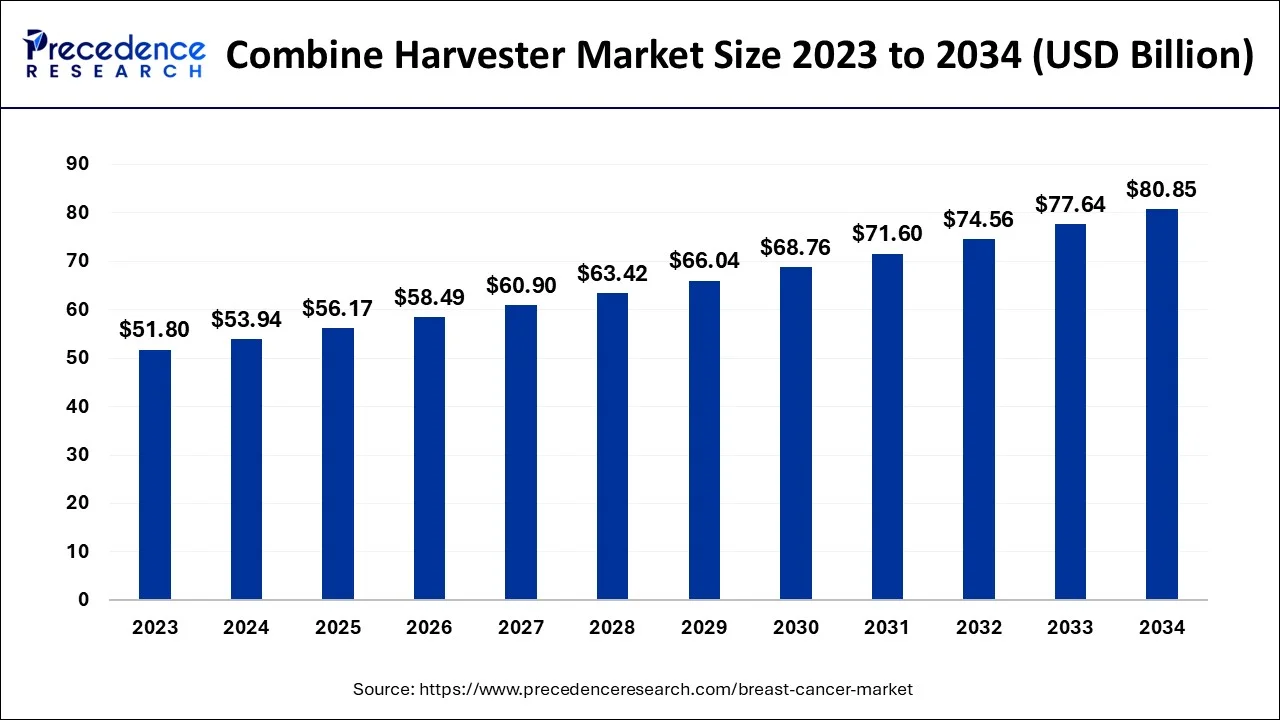

The global combine harvester market size accounted for USD 53.94 billion in 2024, grew to USD 56.17 billion in 2025 and is projected to surpass around USD 80.85 billion by 2034, representing a healthy CAGR of 4.13% between 2024 and 2034.

The global combine harvester market size is estimated at USD 53.94 billion in 2024 and is anticipated to reach around USD 80.85 billion by 2034, expanding at a CAGR of 4.13% between 2024 and 2034.

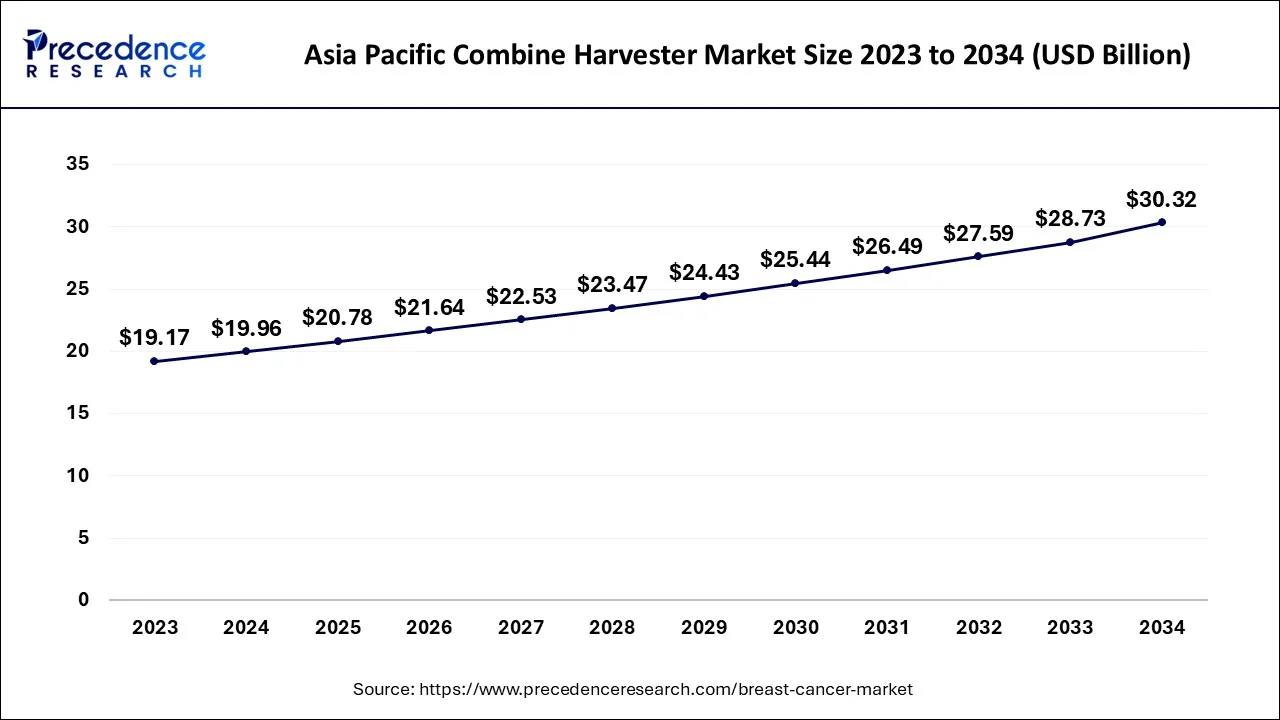

The asia pacific combine harvester market size accounted for USD 19.96 billion in 2024 and is expected to be worth around USD 30.32 billion by 2034, growing at a CAGR of 4.26% between 2024 and 2034.

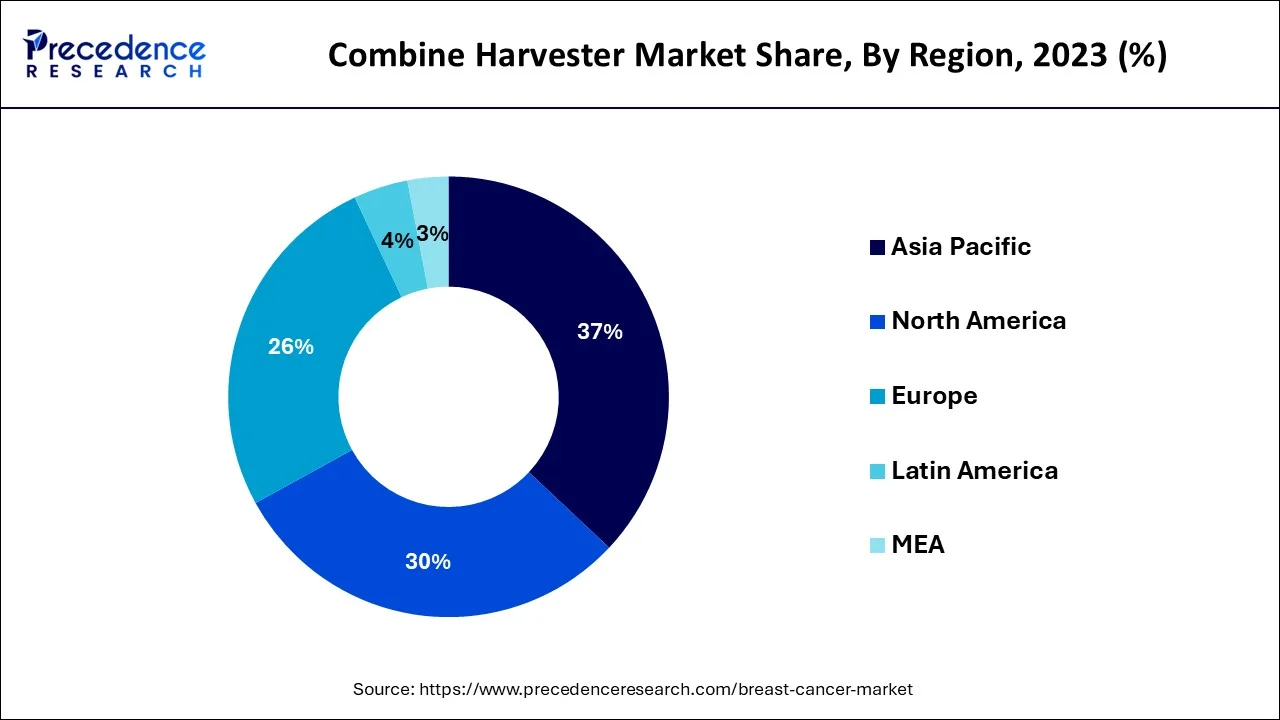

The Asia Pacific region is seeing a transition from manual to mechanized farming due to growing urbanization. Throughout the course of the forecast timeframe, the region's industry for agricultural machinery is anticipated to grow at a CAGR of 4.4%.

Market expansion is being fueled by extensive agricultural activity, increased acceptance of cutting-edge techniques in the area, government backing, and Due to the planned renewal of combined harvester stock within those regions, the industries in Europe and North America are expected to experience positive potential growth within the second quarter of the forecast timeframe. Due to developing agricultural technology over course of the projection year, it is expected that the Indian market would offer more chances.

Powerful equipment called a combine harvest was made to convenient energy for various grain harvests. threshing, A combination harvester combines the three separate harvesting processes of threshing, reaping, and winnowing into such a single procedure. This is the most economically advantageous labor-saving innovation of the modern world, resulting in a decrease in manpower in agriculture. In India, relative to other crop kinds, cereals and grains are frequently harvested with agricultural machinery. Farmers prefer self-propelled combination harvesters over harvesters placed on tractors because of their great efficiency. Equipment for combine harvesters is utilized in many agricultural operations, including reaping & threshing. A lot of time and money required for these tasks will be reduced with the usage of combined harvester equipment.

A versatile technology, the combines harvester is employed to efficiently harvest a range of crops. It stands out for having flexible suspensions and broad tires having deep, open grooves. Enhanced agricultural automation is among the key reasons propelling the India Combined Harvester Industry's expansion. Precision farming reduces post-harvest wastage, reduces agricultural production expenses, and ultimately boosts crop productivity and farm profitability. It also reduces labor and time. Instruments that are usually attributed, to animals, and machines have all increased steadily.

The market is expanding due to the pro-machinery credit policies of the federal government as well as other organizations, as well as the ability to boost farm output. An Indian government was enticing farmers to use technological innovations that would boost output. The need for combined harvesters would rise as people become more aware of new technologies and as farmers get more knowledgeable about production methods. This will help the sector keep its upward trajectory steady. Government initiatives, including those that offer incentives for purchasing equipment, also contribute to this growth. Farms are often small in scale, which prohibits the employment of large machinery there. This significantly reduces the requirement for combined harvester equipment.

The demand for combination harvester machinery is also anticipated to be severely constrained by their high maintenance and cost requirements. Because there was an excess of labor, labor prices were cheap, and machine expenses were high, the usage of combine harvesters had traditionally been restricted. Nevertheless, rural job programs like MGNREGA have improved the situation for combination harvesters in India. Beyond providing a social security net, the Gandhi National Rural Job Guarantee Act also protects the right to employment. Indian farmers now find it more cost-effective to use a machine for chopping and thrashing due to a shortage of labor with rising costs of labor.

| Report Coverage | Details |

| Market Size in 2024 | USD 53.94 Billion |

| Market Size by 2034 | USD 80.85 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.13% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Mechanism, By Power, By Class, By Grain Tank Size, and By Crop Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

A growing need for cutting-edge modern farm equipment

Support from the government for agricultural technology

Self-propelled vehicles held the majority of the market in 2023, and throughout the forecast timeframe, they are anticipated to grow at the fastest CAGR. Wheeled extractors are fantastic for fields with rough soil. They represent the standard type that is popular in India and Bangladesh. Since of their great efficiency and low maintenance issues, self-propelled combination harvesters are expanding. In tiny farm fields, vehicles and agricultural machinery are frequently preferred range sizes from 1-10 acres.

The market was led by hydraulic agricultural machinery in 2022, but over the projected timeframe, hybrid combined harvesters are anticipated to grow at the fastest rate. The header serves as the primary control panel for the tractor. The hydraulic drivetrain of a header has a direct effect on both the machine's performance overall and the gearbox system's layout. Benefits of hydraulic management include a high density of power and small volume. Nevertheless, hybrid combination extractors may harvest the produce without no wastage and in a shorter time, especially on fields with evergreen trunks or moist areas.

Modern combine harvesters frequently have a diesel engine to operate all of the equipment's operational components and to move the machine forward when in use. The share of the market of agricultural machinery with 150–300 horsepower will grow at the highest CAGR, per the Astute Analytica analysis, although those with fewer horsepower would hold the majority of the market. Additionally, favorable for such a diesel car sector could be the increased accessibility of a large number of state-of-the-art diesel engine farming equipment.

While the classes 5-6 (9-12 kg/s) category is anticipated to experience the maximum CAGR of 4% and over a projected timeframe, the classes 3-4 (5-8 kg/s) sector held the largest share of the market throughout 2022. The quality and speed of performing a variety of actions determine the efficiency (output) of a harvesting machine. Although small tractors are much more maneuverable in smaller fields, wider engines were best adapted for large disciplines with light soil texture. Wider machines cannot operate in tiny paddy fields, discouraging their use by small proprietors. Due to the abundance of little farming plots in India and Bangladesh mini combine extractors has recently grown in favor in South Asia.

It is anticipated that the 250-350 bu category will grow at the greatest CAGR throughout the projected period and have the largest market share in 20232. The growing demand for smaller tractors is responsible for the 250 bu sector's good future growth.

With a market share of around 37% in 2023, the wheat category dominated. The category is anticipated to develop as a result of the persistently increasing demands for grains and the persistently rising emphasis on improving its productivity relative to certain other crops. To order to meet the growing demand from Southeast Asia, in addition to Europe, Western Asia, with Northern Africa, India, the 2 exporters of wheat within the globe, is concentrating on mechanizing the agriculture industry more broadly. Due to the growing demand for the wheat harvesting process within the Asia Pacific, imports from Ukrainian have already been hindered since Russia's intervention in Feb 2022.

By Type

By Mechanism

By Power

By Class

By Grain Tank Size

By Crop Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client