October 2023

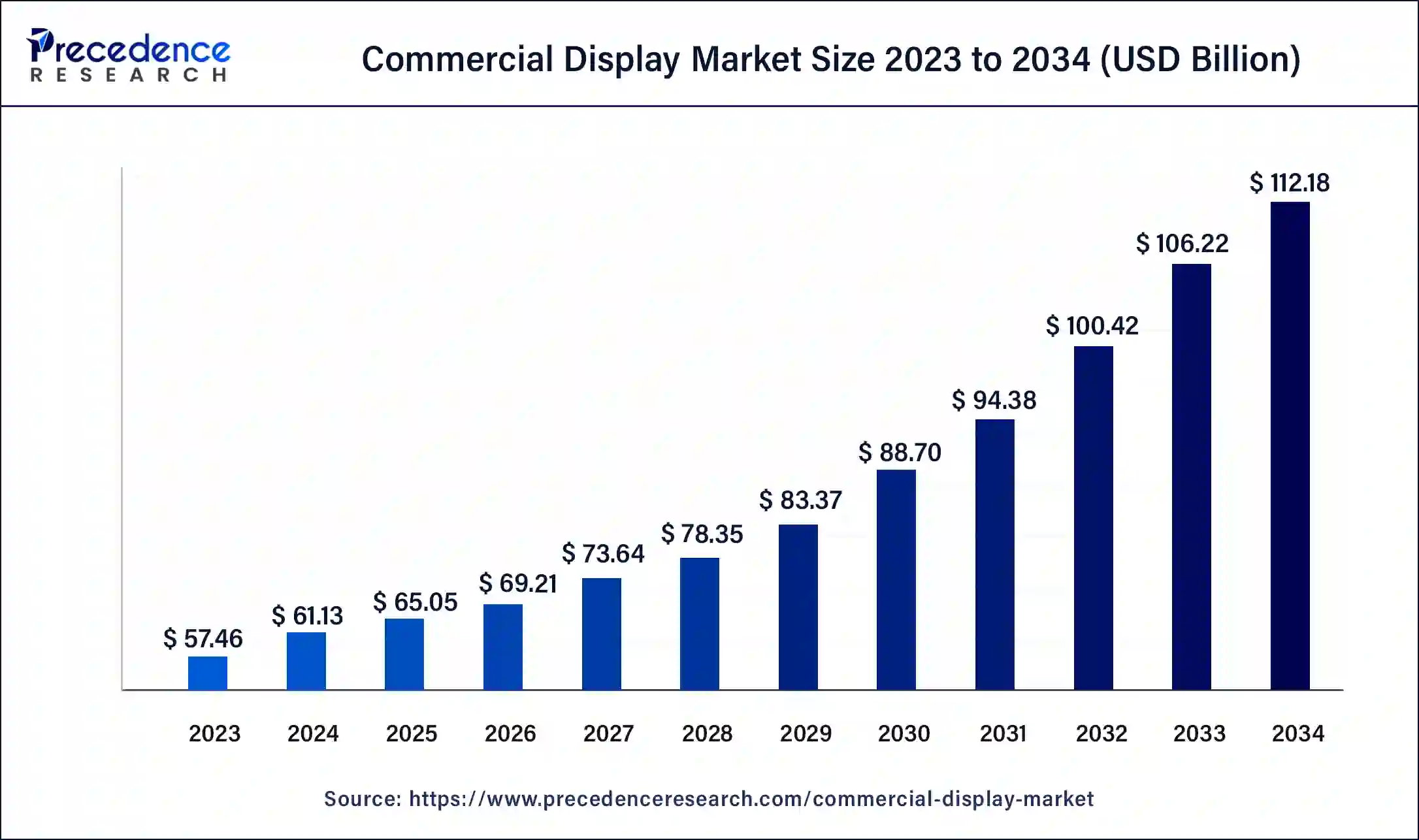

The global commercial display market size was USD 57.46 billion in 2023, estimated at USD 61.13 billion in 2024 and is anticipated to reach around USD 112.18 billion by 2034, expanding at a CAGR of 6% from 2024 to 2034.

The global commercial display market size accounted for USD 61.13 billion in 2024 and is predicted to reach around USD 112.18 billion by 2034, growing at a CAGR of 6% from 2024 to 2034.

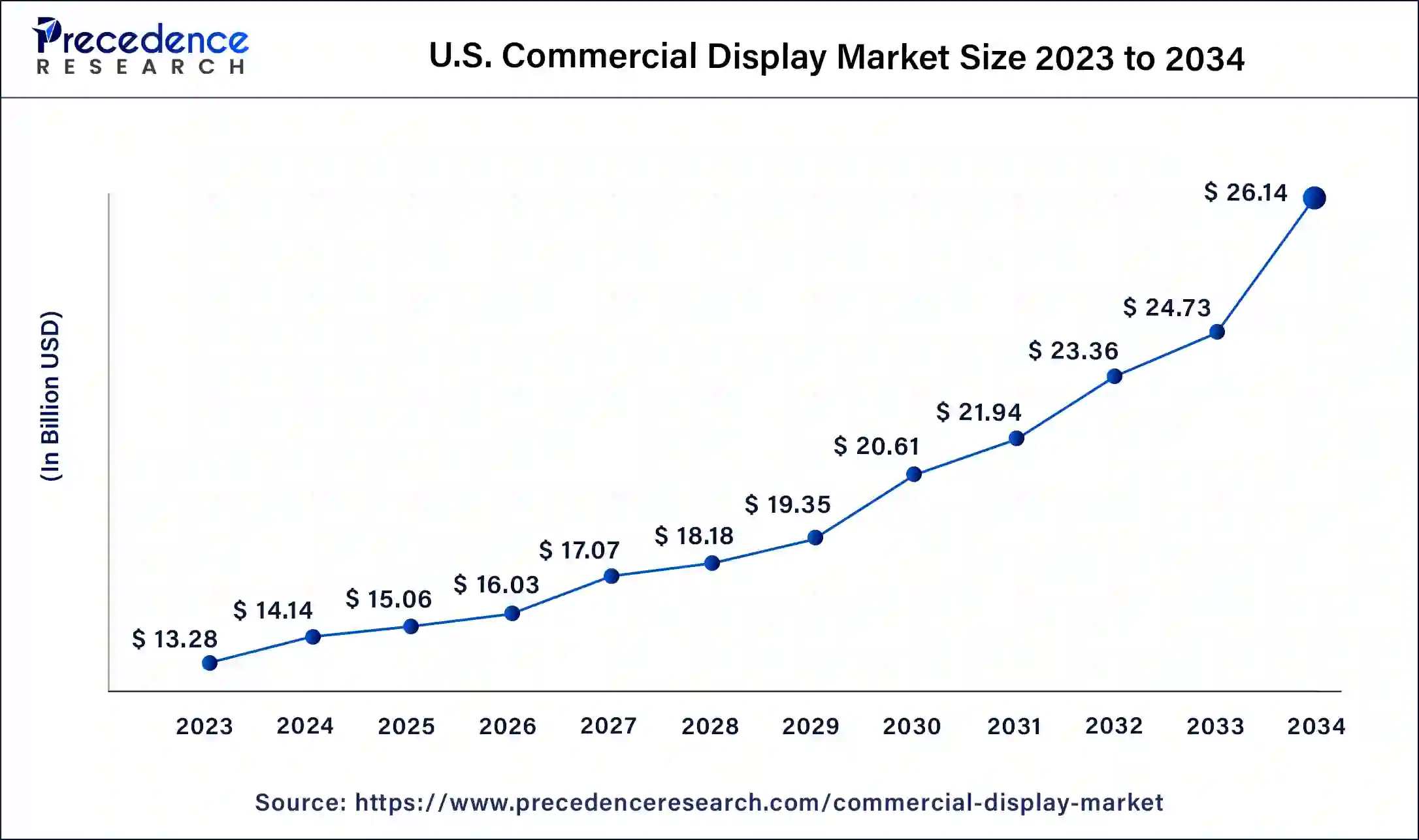

The U.S. commercial display market reached USD 12.47 billion in 2023 and is projected to be worth USD 26.14 billion by 2034, at a CAGR of 6.33% between 2024 to 2034.

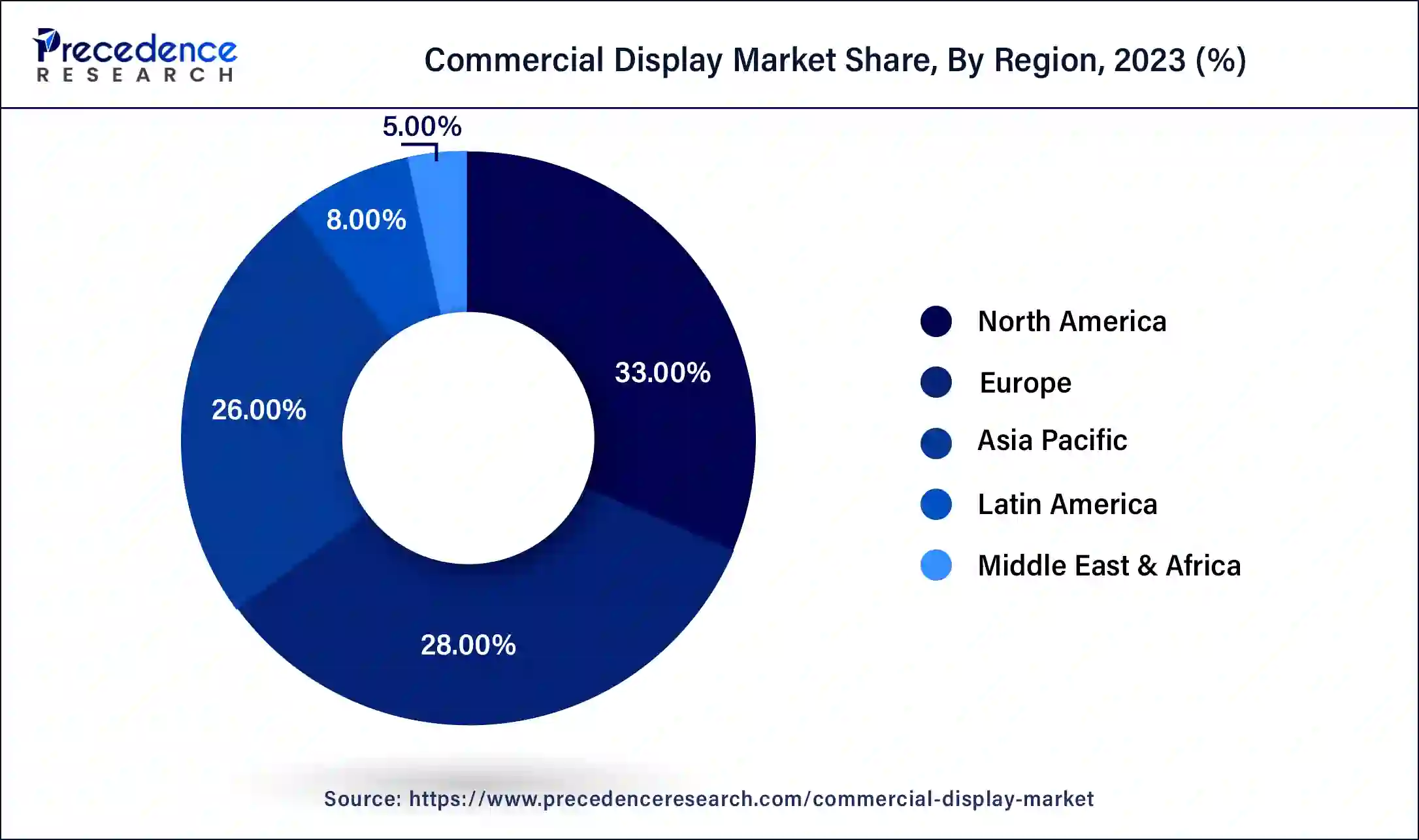

Based on region, North America dominated the global commercial display market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is characterized by the increased penetration of supermarkets/hypermarket, hotels, restaurants, shopping malls, and other commercial units that has significantly contributed towards the growth of the global commercial display market. Further, increased adoption rate of the digital technologies for the advertisement and promotional activities of products and service in North America has led towards the dominance of this region in the global market.

Asia Pacific is estimated to be the most opportunistic segment during the forecast period. The rapid industrialization and rapid urbanization coupled with the rising penetration of numerous commercial units in the region is expected to boost the adoption of the commercial displays in the region in the forthcoming years.

The increasing demand for the digital signage across the healthcare and transportation sectors is expected to drive the growth of the global commercial display market. Rapid industrialization and rapid urbanization, rising government expenditure on the development of infrastructure, and changing lifestyle of the consumers is fostering the growth of the commercial display market across the globe. Furthermore, the rising adoption of digital technologies by the market players for the advertisement of products and services for making a strong impact on the customers mind is major driving force propelling the demand for the commercial displays. Moreover, rising integration of technologies such as AI and machine learning in the commercial displays is fueling the market growth across the globe. The introduction of 4K and 8K displays is ramping up the production of ultra-HD advertising content, which is significantly contributing towards the market growth. Further, the energy efficiency factor is becoming an important aspect of the sustainable business, hence the demand for the energy efficient commercial displays is rising rapidly across the globe.

Further, the increasing demand for the commercial displays across wide range of sectors such as retail, entertainment, hospitality, corporate, banking, and education is driving the growth of the commercial display market. Technological advancements in the development of software in order to increase target audience engagement tracking and engagement, and management of content has fostered the market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 112.18 Billion |

| Market Size in 2023 | USD 57.46 Billion |

| Market Size in 2024 | USD 61.13 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Display Type, Component,Technology,Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the product, the digital signage segment accounted largest revenue share in 2023 and is expected to remain its dominance in near future. This is attributed to the increased adoption of digital signage in the retail sector like supermarkets and shopping malls across the globe. The rising number of commercial complexes like shopping malls and rising penetration of supermarkets in the developing regions is expected to further drive the growth of this segment. The segment is also estimated to be the fastest-growing segment during the forecast period. The rising adoption of the micro and mini-LED in the commercial grade TVs is expected to drive the growth of this segment in the forthcoming years.

Based on the display type, the flat panel segment dominated the global commercial display market in 2023, in terms of revenue. This is due to the extensive utilization of the flat panels by the end-use sectors in the past years. Moreover, low cost and easy availability are the major factors that resulted in the huge adoption of this panel. The immense popularity of the digital posters, video walls, TVs and monitors has significantly contributed towards the growth of this segment in the past.

On the other hand, curved panel is estimated to be the most opportunistic segment during the forecast period. Curved panels are now being widely adopted in the TVs, monitors, and smartphones. The increasing adoption of curved panels across the various end-use sectors is expected to drive the growth of this segment in the upcoming years.

Based on the component, the hardware segment dominated the global commercial display market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is due to the availability of high cost hardware and wider range of hardware components such as displays, cables, accessories, and other equipment.

On the other hand, the software is estimated to be the fastest-growing segment during the forecast period. This is mainly due to the rising technological advancements and upgradations in the software in order to develop effective software that can efficiently manage contents in the commercial displays.

Based on the technology, the LCD segment accounted highest revenue share in 2023. The LCD has been widely accepted technology across the globe in the past few decades, which led to its dominance in the market. The banking and corporate sectors extensively uses the LCD technologies. Further, the low cost of production associated with the LCDs is a significant driver of the segment.

On the other hand, the LED segment is expected to be the fastest-growing segment during the forecast period. This can be attributed to the technological advancements and rising popularity of the QLEDs and OLEDs is fueling the growth of the segment. These LED technologies are known for its energy efficiency. Moreover, the emergence of micro and mini-LED is expected to further drive the market in the foreseeable future.

Based on the application, the retail segment hit largest market share in 2023. This can be attributed to the increased adoption of the commercial displays in the retail sectors like shopping malls, supermarkets, and hypermarkets. The huge number of footfall in the shopping malls and other retail units makes it a huge segment for the application of the commercial displays.

On the other hand, the hospitality is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising penetration of quick service restaurants, motels, bars, and cafes across the globe. The restaurants, cafes, and bars requires huge number of display units to display their offers and menus. Hence, the rising number of such foodservice units is boosting the growth of this segment.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

Segments Covered in the Report

By Product

By Display Type

By Component

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

December 2024

August 2024

January 2025