February 2025

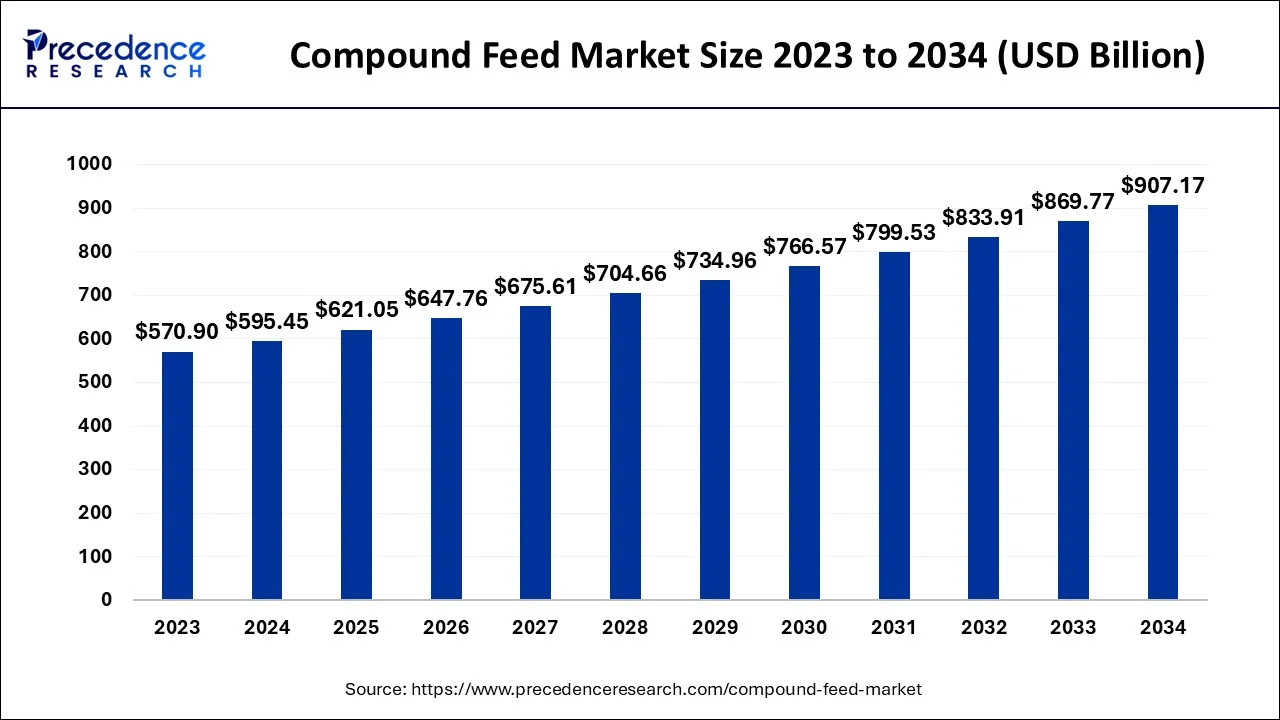

The global compound feed market size accounted for USD 595.45 billion in 2024, grew to USD 621.05 billion in 2025 and is predicted to surpass around USD 907.17 billion by 2034, representing a healthy CAGR of 4.30% between 2024 and 2034.

The global compound feed market size is estimated at USD 595.45 billion in 2024 and is anticipated to reach around USD 907.17 billion by 2034, expanding at a CAGR of 4.30% from 2024 to 2034.

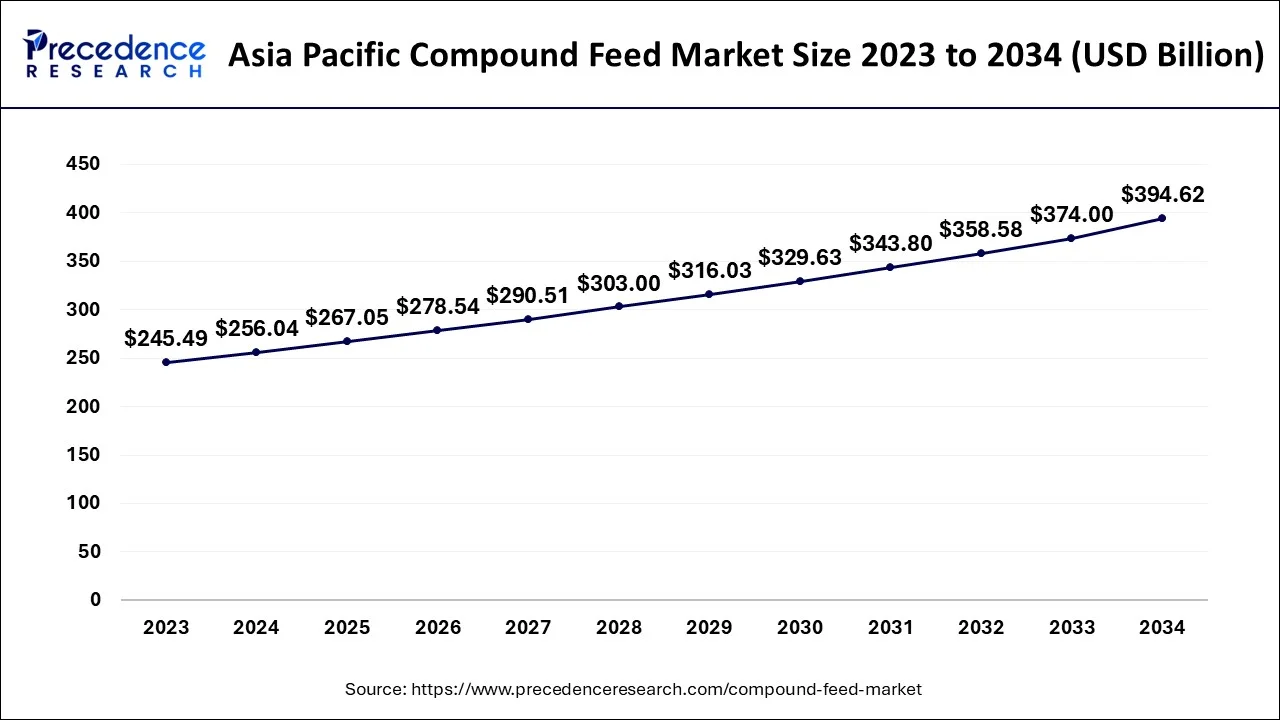

The Asia Pacific compound feed market size is evaluated at USD 256.04 billion in 2024 and is predicted to be worth around USD 394.62 billion by 2034, rising at a CAGR of 4.41% from 2024 to 2034.

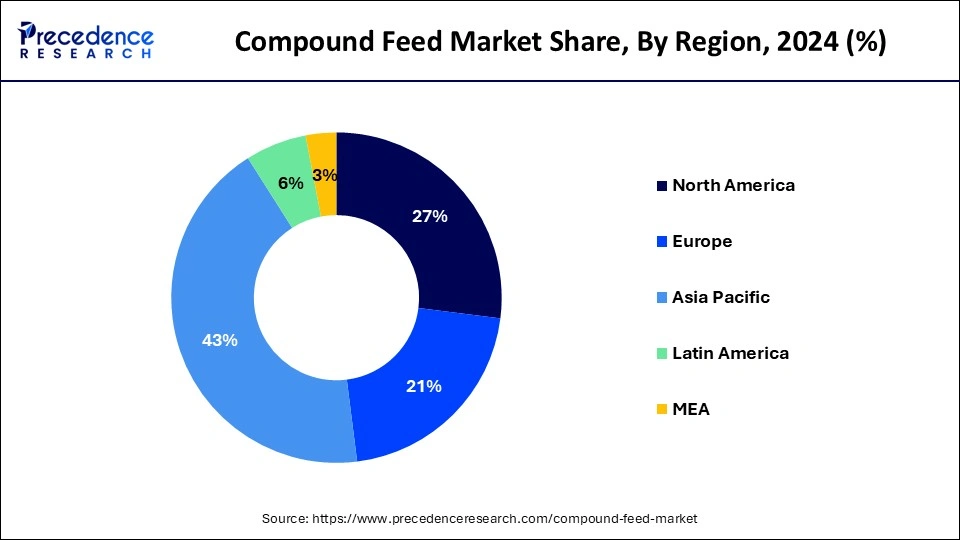

On the basis of geography, the Asia Pacific region is expected to be the largest market during the forecast period. As there is a growth in the income of the people and an increased demand for meat consumption the market in this region is expected to grow well. Many countries belonging to the Asia Pacific region have a maximum consumption of compound feed.

The North American region and the European region are also expected to grow well during the forecast period. As the demand for poultry as well as cattle is growing in the North American region the market will grow well during the forecast period. As there is a growth in the production of meat due to an increase in the demand for these products the compound feed market in the developed nations is also expected to grow well in the coming years. In Africa and the Middle East region the demand for compound feed will continue to grow due to a growing demand for animal products.

In order to obtain meat, poultry, animals are being reared on a larger scale across many countries. Compound feed it's a product which is used for feeding the farm animals which happens to be a mix of animal products and plant products. The compound feed has all the essential nutrients for the healthy growth of these animals. In order to have healthy animals for deriving various products there is a growing focus of manufacturers in providing a better feed to these farm animals. Due to these improved efforts there shall be an increased production through livestock which would also be economical. In many nations across the globe there is a growing demand for dairy products as well as meat and in order to meet the growing demand of the market the manufacturers are focusing on providing a nutritious compound feed to the animals. There are many stringent government policies in most of the developed nations which hampers the growth of the compound feed market.

Apart from the policies there is also an increase in the cost of raw material used in the production of this feed which shall also be one factor that will hamper the growth of the market in the coming years period there are many other natural changes in the weather which may have a larger effect all these animals and the production of the food. As there is a growing focus on providing nutritive food at affordable costs major manufacturers are working in order to provide both. When there is a demand for animal products the prices of the byproducts also grows during that phase. There are many rules associated with the field which make it mandatory to have at least a few raw materials.

During the pandemic the livestock market was affected to a great extent. The compound feed market was also affected. As there was a complete shutdown of various industries the manufacturing units of the compound feed were also closed. As there were restrictions on movement and also the supply chain there was a shortage of raw material. The supply of compound feed to different nations had also stopped due to restrictions on import and export activities. As the demand for poultry and meat had dropped during the pandemic the market saw a negative phase.

Compound feed market affects the environment there's a growing focus on reducing the cost associated with this feed. The manufacturers are adopting ways that will be helpful in reducing the impact on the environment. The production of raw material also affects the final product. There is a growing concern among the consumers regarding the production of raw materials as it affects the market. As there is a growing demand for high protein diets in many nations across the globe the market is expected to grow well during the forecast period. Consumers across the developed as well as the developing economies seek animal based proteins as compared to the plant based proteins which will drive the market growth in the coming years.

In order to meet the demand of the livestock products there is a growing demand for the production of livestock. In many nations livestock business happens to be a livelihood for the farmers. There is a growth in the demand for animal based products due to a major shift in the food eating habits add increased purchasing power. In the developed nations the consumption of milk is high as compared to the developing nations. There is a growth in the consumption of dairy products in the United States as compared to the recent years. The market for meat, poultry and dairy products is expected to have a good growth in the coming years. The demand for these products in the Asia Pacific region is less as compared to the other developed nations. In order to have healthy animals farmers are adopting ways that will help in improving the quality of compound feed. This market is also expected to grow as it happens to be the only source of income for many farmers in rural areas.

Growing awareness among the consumers regarding the good quality of food products and safer food products derived from the animal origin will create a demand for a quality feed. As the amount of land used for the livestock production is less the market will grow well during the forecast period. There is a growth in animal husbandry due to a growing demand for animal products. As there's an increase in the number of restaurants and food chains across the globe which happens to be an organized sector there shall be a growing demand for this product in the coming years. There's an increased adoption of technology in order to overcome the issue of the quantity of land available for animal husbandry. There is an increase in the industrialization there has been a development in the management of livestock.

Growing awareness regarding the use of technologies and modern ways of fielding the market is expected to grow well in the coming years. The growing demand for better quality of compound feed as it is extremely useful in meeting the daily requirements of the animals in terms of the correct nutrients required.

| Report Coverage | Details |

| Market Size by 2024 | USD 595.45 Billion |

| Market Size by 2034 | USD 907.17 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.30% |

| Asia Pacific Market Share in 2023 | 43% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Ingredients, Source, Form, Livestock, Supplement, Geography |

Depending upon the ingredients, the cereals segment is expected to have a larger market share and the cakes and the meals segment will have the second place in the market during the forecast period. This segment has had the second largest market share in the recent years. Cakes are made by using the residues which are left from the oil seeds during the process of oil extraction. This compound feed market segment is expected to have the largest market share due to its nutrient content.

Cakes and meals produced from the residues of the oilseeds have the largest amount of nitrogen which accounts to 95% add since the cakes are made from oil seeds they happen to be rich in the protein content. These cakes are also high in vitamin B. Compared to all the other segments this segment will have a good market share due to its nutritive value and its ease of storage. The serial segment is expected to grow in the coming years as it has a good nutritional value and it is also available easily throughout the globe. The sources of cereal feed are corn rice and wheat. Barley oats as well as Millet are the other forms of cereal which are also used in the feed.

By form, the pellet form is expected to have the largest market share. The pellet segment has dominated the market in the past. Pellet which is derived from many different plants sources or animal sources as are largely used.

Followed by the pallet segment the crumble segment is also expected to have a good compound annual growth rate during the forecast period. By crushing the pellet the obtained consistency is fed to animals in order to increase the production. Many different types of ingredients are used in order to make this type of feed.

By livestock, the poultry segment is expected to have a largest revenue share in 2023. If there is an increase in the rearing of poultry animals across many nations the market is expected to grow in the coming year period growing demand for Turkey as well as chicken will drive the growth of this segment. As poultry happens to be a great source of protein available at an affordable cost the market is expected to grow in the coming years. Due to the health benefits associated with the consumption of white meat as compared to the red meat there is a greater demand for the poultry segment.

Followed by the poultry segment, the swine segment is also expected to grow well in many nations across the globe. There has been an increase in the export of pork products to many Asia Pacific regions due to a growing demand for these products.

By source, the plant based segment is expected to have a larger market share in the coming years. This segment happens to be an affordable option and the nutrient content of the feed derived from the use of plant based sources is at par the animal sources. Easy availability of these products and increasing environmental concerns will drive the market growth during the forecast period. In the European region there is a growing demand for compound feed and the crop production is used in the manufacturing.

By Ingredients

By Source

By Form

By Livestock

By Supplement

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

June 2024