February 2025

Compression Therapy Market (By Product: Compression Pumps, Compression Stockings, Compression Bandages, Compression Tape; By Technology: Static Compression Therapy, Dynamic Compression Therapy) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

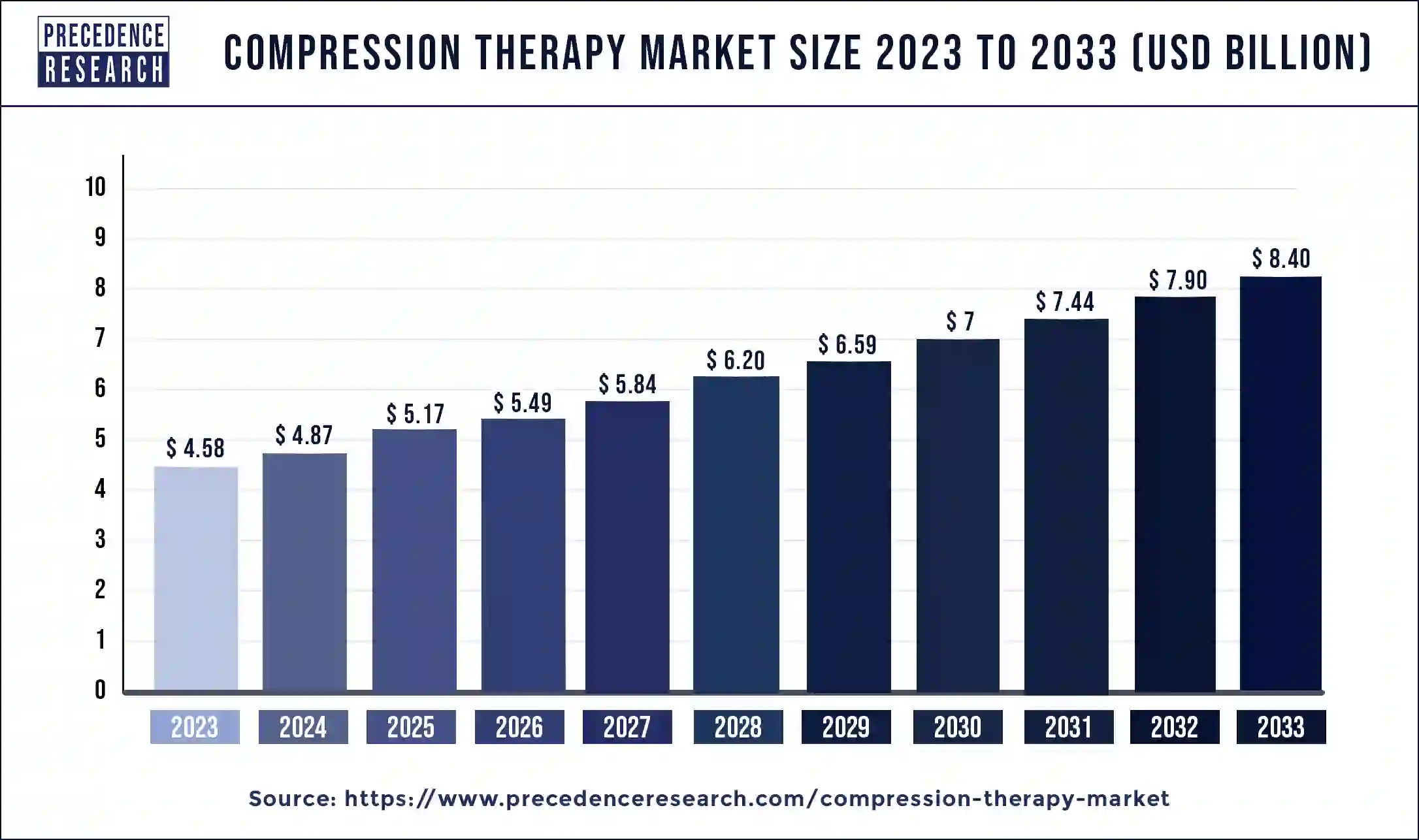

The global compression therapy market size reached USD 4.58 billion in 2023 and is estimated to hit around USD 8.40 billion by 2033 with a CAGR of 6.25% from 2024 to 2033.

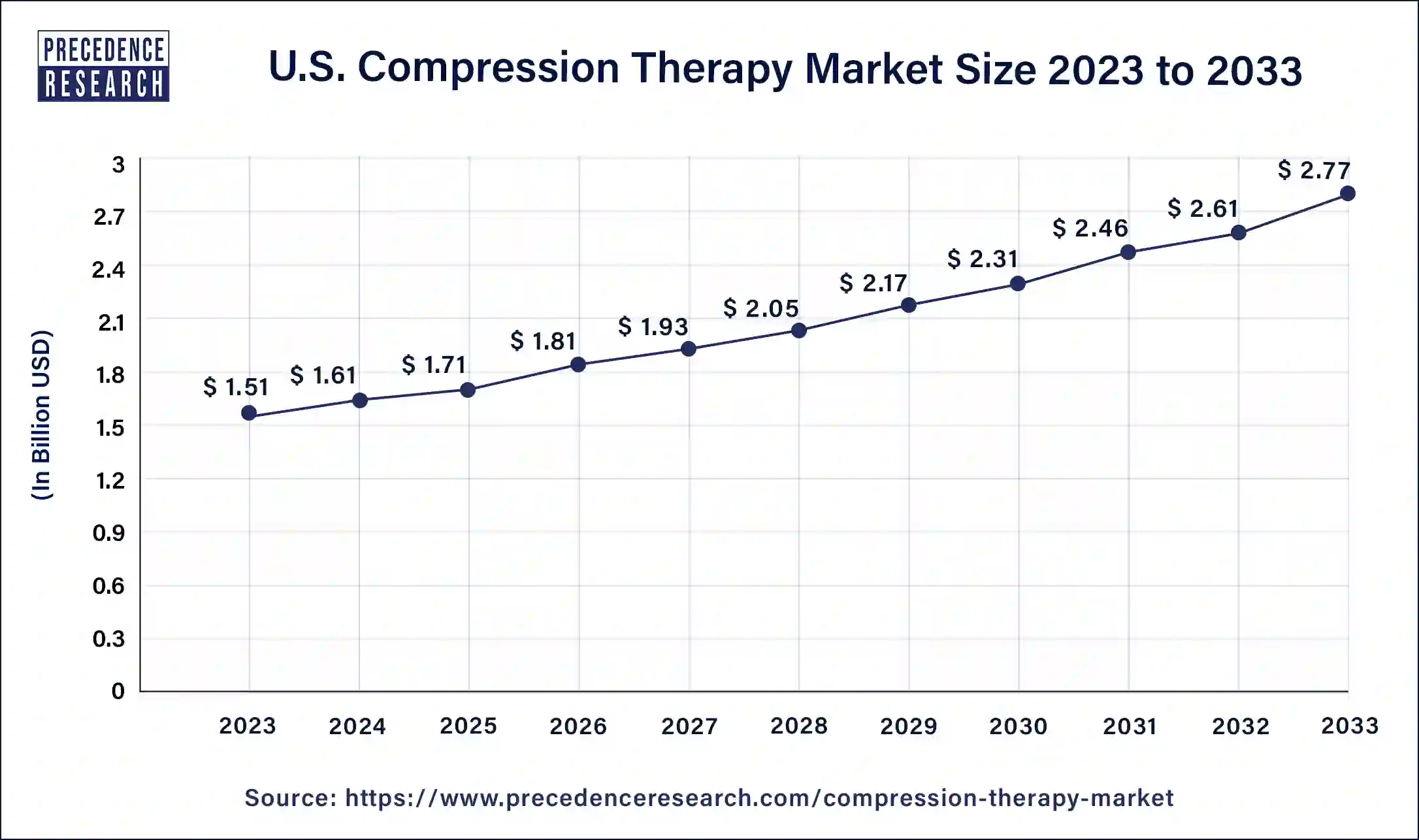

The U.S. compression therapy market size was estimated at USD 1.51 billion in 2023 and is anticipated to reach around USD 2.77 billion by 2033, poised to grow at a CAGR of 6.33% from 2024 to 2033.

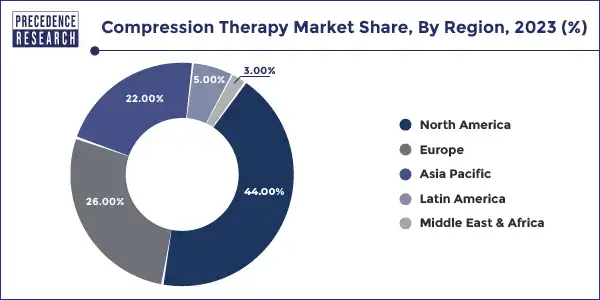

North America held the largest market share of 44% in 2023 The region is observed to sustain its position in the upcoming years. The growth of the North American region is attributed to the sophisticated healthcare infrastructure, rising investments in research and development activities and rising awareness of the significance of compression therapy.

Moreover, the rising healthcare expenditure, rising, geriatric population, growing healthcare awareness, and rising prevalence of chronic disorders such as deep vein thrombosis (DVT), lymphedema, peripheral artery disease (PAD), and chronic venous disease (CVD) also promote the expansion of the market in the region.

Chronic Venous Disease (CVD) refers to the medical conditions related to or caused by veins that become diseased or abnormal. According to the report published by the National Institutes of Health (NIH) in April 2023, Varicose veins afflict more than 25 million people in the United States, and more than 6 million harbors severe venous disease, making CVD a prevalent health condition. The most common signs of CVD are telangiectases, reticular veins, varicose veins, and venous ulcerations.

In North America, the United States is observed to remain as the largest contributor to the compression therapy market due to the presence of major compression therapy product manufacturers, favorable government reimbursement policies, and increasing awareness regarding early diagnosis of venous ulcers, arthritis, and others. Moreover, the rising number of road accidents and sports injuries has resulted in the increasing adoption of compression therapy for the healing of injuries. Furthermore, companies are engaged in strategic approaches such as partnership or collaboration, acquisitions, mergers, and product launches.

Asia Pacific is expected to witness the fastest growth in the compression therapy market during the forecast period. The growth of the region is attributed to the increasing investment in the healthcare infrastructure and, robust focus on wellness resulting in rising product adoption, an increase in the number of road accidents, an increasing burden of chronic vein disorders (CVD) adult population, increasing sport injuries, rising innovation in product development, and growing geriatric and obesity population. In addition, the market has witnessed the sales of compression therapy products growing through e-commerce. Online pharmacies are leveraging on offering doorstep delivery and discounts which are quite appealing to the end-users.

Compression Therapy Market Overview

The compression therapy market services associated with effective treatment to help improve blood flow in your lower legs. Such services are often associated with varicose veins and compression products and devices that provide relief to the patient. This therapy uses the technique of controlled pressure to increase blood flow in the legs which in turn helps to improve blood flow to the heart, support veins, and reduce swelling in the lower extremities.

Compression therapy involves the use of socks, stockings, and bandages which are specially designed to provide compression on legs, ankles, and feet as well as support veins to increase blood circulation in the legs. Compression therapy can treat swelling and when there is more than enough or extra fluid in the legs, compression assists the body to absorb it.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.25% |

| Global Market Size in 2023 | USD 4.58 Billion |

| Global Market Size by 2033 | USD 8.40 Billion |

| U.S. Market Size in 2023 | USD 1.51 Billion |

| U.S. Market Size by 2033 | USD 2.77 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: The increasing burden of sports injuries and accidents

The rising number of sports injuries and accidents is expected to fuel the growth of the compression therapy market during the forecast period. Compression therapy is increasingly becoming popular due to the rising cases of sports injuries and traffic accidents. Sports injuries and road accident victims often suffer from mild to severe injuries. Compression therapy assists in supporting veins and improves blood circulation in the legs.

In addition, football has reported the highest number of injuries, at over 1.5 million each year. 40 percent of all football injuries are sprains and strains. In addition, the increasing demand for Compression therapy is driven by the rising cases of road accidents. Such supportive factors are contributing to the market’s growth during the forecast period.

Restraint: Lack of awareness

The lack of awareness is anticipated to restrain the compression therapy market's expansion during the forecast period. Less awareness of compression therapy among people as well as regarding the benefits of compression therapy particularly in underdeveloped countries. In addition, the availability of alternative therapies may result in restricting the expansion of the market.

Opportunity: Increasing demand for advanced therapies and new product launches

The rapidly rising demand for advanced therapies along with the new product launches is projected to offer a lucrative opportunity for the growth of the compression therapy market during the forecast period. Several key market players are constantly investing in innovating advanced therapies and technologies for managing the treatment of venous diseases. The use of compression therapy can help to improve the quality of life and it is also an effective form of treatment for various medical conditions such as improving blood flow, reducing swelling in the legs, lessening the risk of blood clots, aiding in healing leg ulcers, and effective treatment for varicose veins. Additionally, the rise in new product launches is projected to create significant opportunities for the market’s growth during the forecast period.

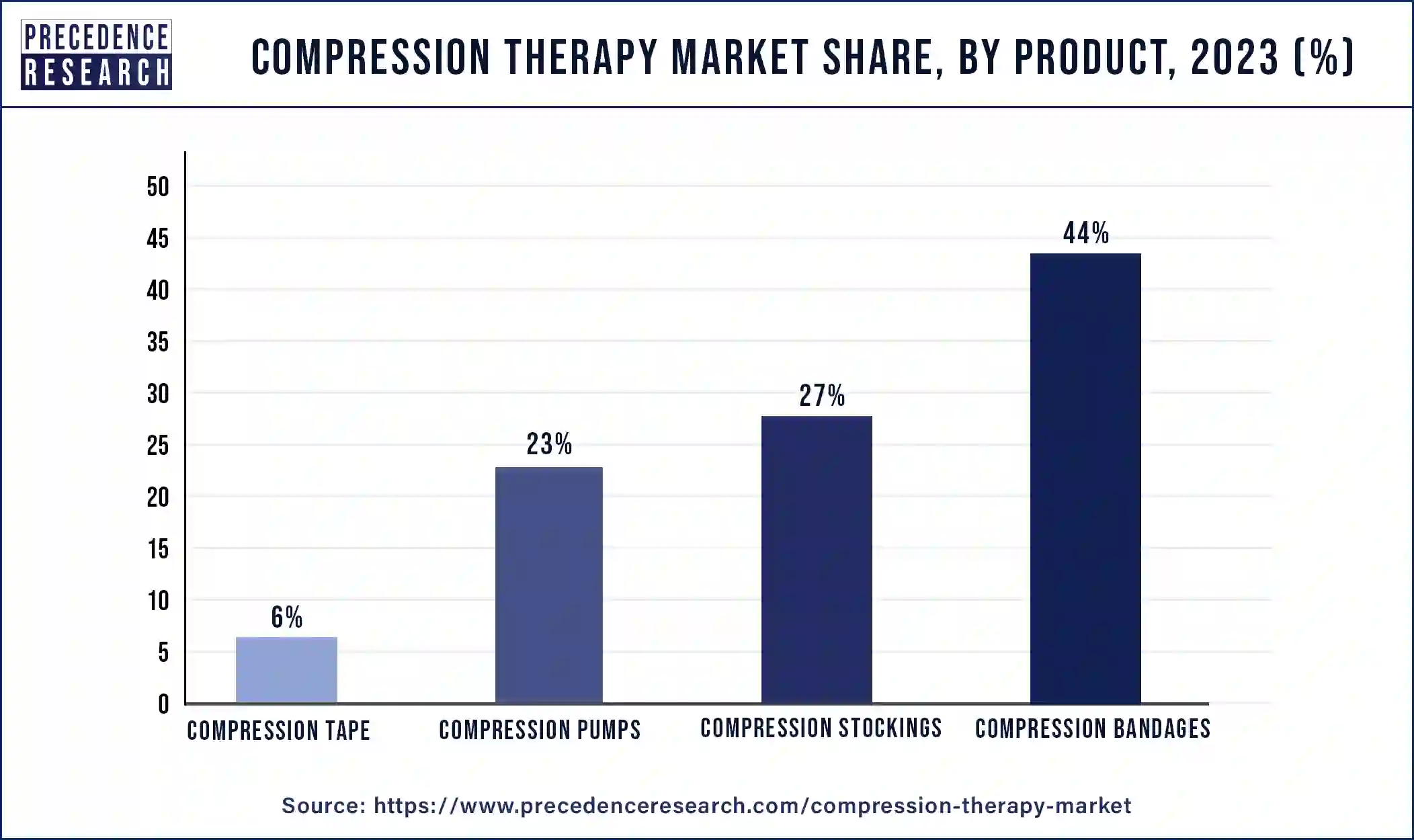

The compression bandages segment accounted for the dominating segment in the compression therapy market share of 44% in 2023 owing to the increasing adoption for treatment of Edema, Chronic Venous Insufficiency (CVI), and Deep Vein Thrombosis (DVT). Compression bandages are mainly classified into types elastic and inelastic. Compression bandages are extensively used for the treatment of venous diseases as well as to prevent their re-occurrence during compression therapy. Compression bandages can be wrapped around a sprain or strain. The gentle pressure of the bandage helps to reduce swelling in the injured area. The aforementioned factors will accelerate the segment's growth.

The compression pumps segment is observed to witness a significant rate of growth in the compression therapy market over the forecast period. The segment is growing due to the increasing cases of lymphedema and other venous disorders. Compression pumps are advanced, user-friendly, and have adjustable pressure settings to cater to specific patient needs as per the severity of the disorder. Thereby, boosting the growth in the market.

The static technology segment held the largest share of the compression therapy market in 2023, the segment is expected to sustain the position throughout the forecast period. Static technology has convenience and user-friendly attributes. The benefits associated with static technology help in treating edema and sports-related injuries to alleviate pain. Static technology is highly preferred by physicians for treating deep vein thrombosis, lymphedema, and chronic venous insufficiency (CVI).

The dynamic technology segment is expected to grow at a significant rate in the compression therapy market during the forecast period. The growth of the segment is driven by improvements in technology. Dynamic compression therapy helps to improve performance and reduce muscle recovery time. Smart features provide real-time feedback and facilitate personalized treatment facilities, and resulting in better patient results. The rising acceptance of sophisticated healthcare solutions is projected to accelerate the segment’s growth.

Segments Covered in the Report

By Product

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

February 2025

January 2025