January 2025

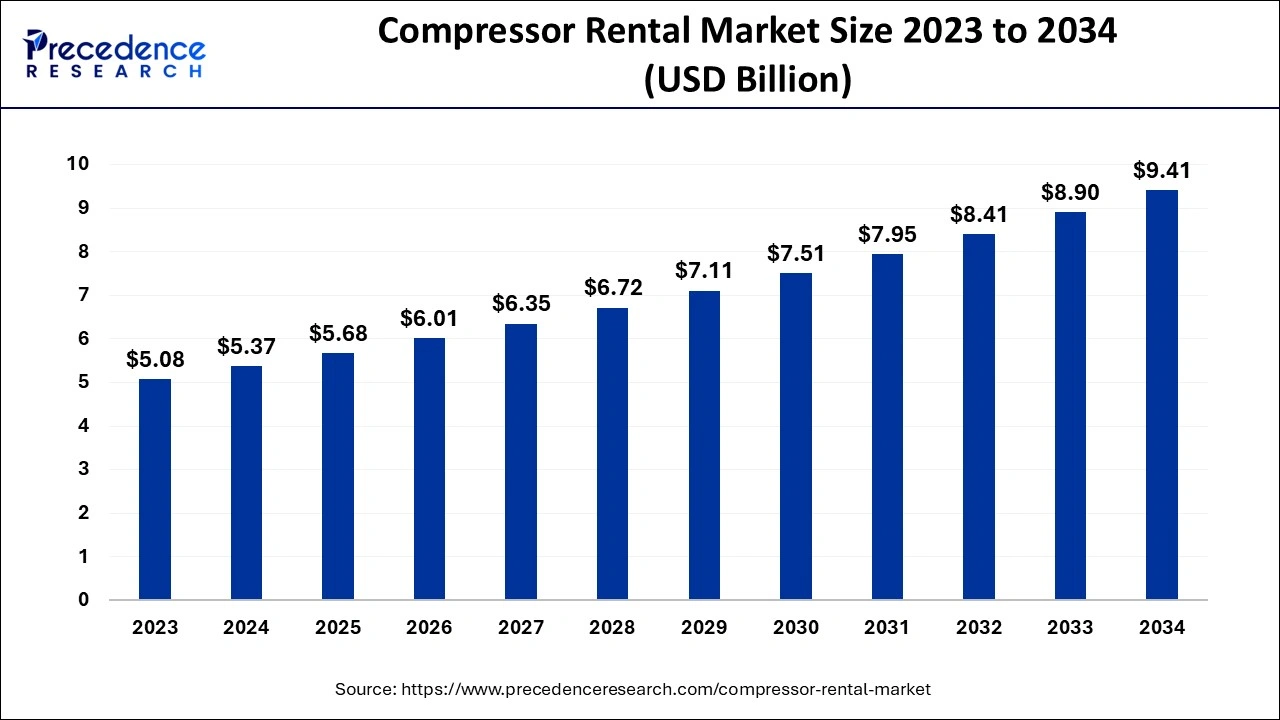

The global compressor rental market size accounted for USD 5.37 billion in 2024, grew to USD 5.68 billion in 2025 and is projected to surpass around USD 9.41 billion by 2034, representing a CAGR of 5.76% between 2024 and 2034. The Asia Pacific compressor rental market size is evaluated at USD 2.96 billion in 2024 and is expected to grow at a CAGR of 5.75% during the forecast year.

The global compressor rental market size is calculated at USD 5.37 billion in 2024 and is predicted to reach around USD 9.41 billion by 2034, expanding at a CAGR of 5.76% from 2024 to 2034. The compressor rental market is accelerating because of increasing demand in construction, oil and gas, and manufacturing segments. Market growth stimulators include development in technology, availability of low-cost models of renting equipment as well as rising concerns for the environment.

The compressor rental market with the use of artificial intelligence (AI) helps improve the efficiency of a compressed air system. It can also bring and enhance the Industrial Internet of Things (IoT). It makes improvements in compressed air systems and their efficiency. This is done by monitoring the status of compressed air equipment with real-time condition data, and by employing AI to run diagnostics on this data. This makes it possible to achieve the required energy efficiency and increase the amount of operating time. There are also other aspects of AI compressors. These are operational excellence-based technological solutions aimed at enhancing performance quality and overall profitability. The AI service can be specially tailored for business requirements.

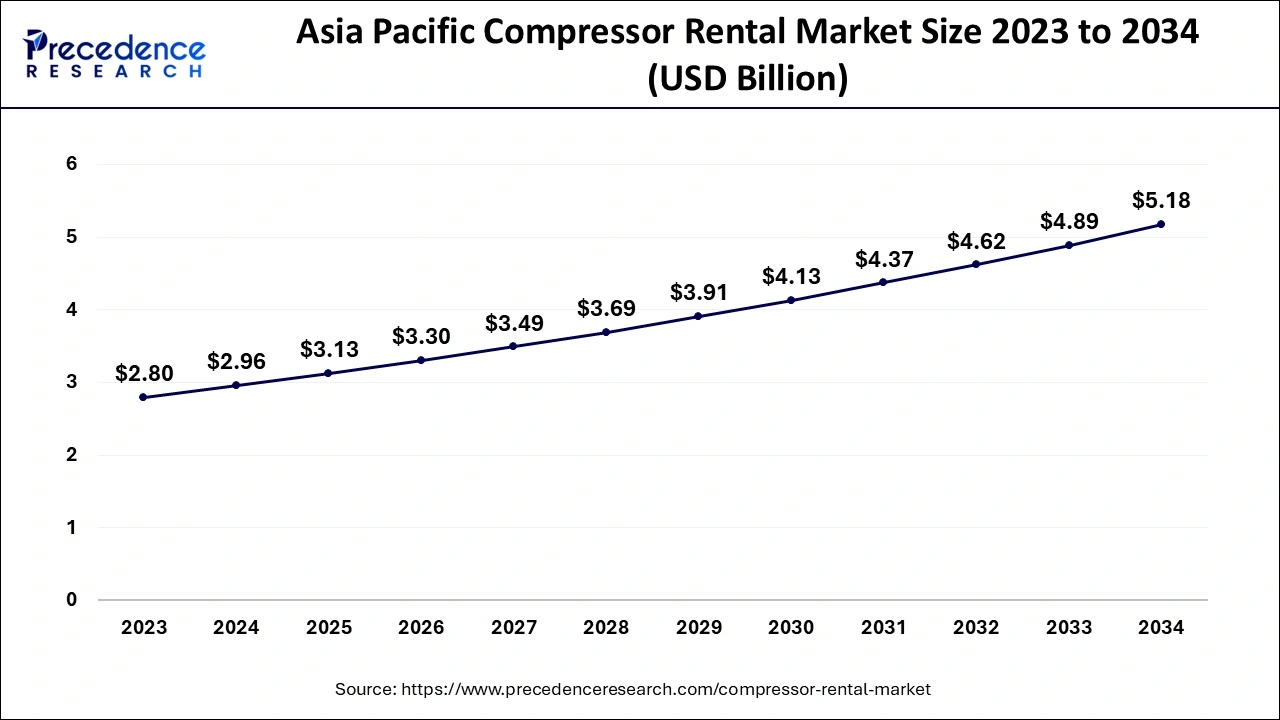

The Asia Pacific compressor rental market size is evaluated at USD 2.96 billion in 2024 and is projected to be worth around USD 5.18 billion by 2034, growing at a CAGR of 5.75% from 2024 to 2034.

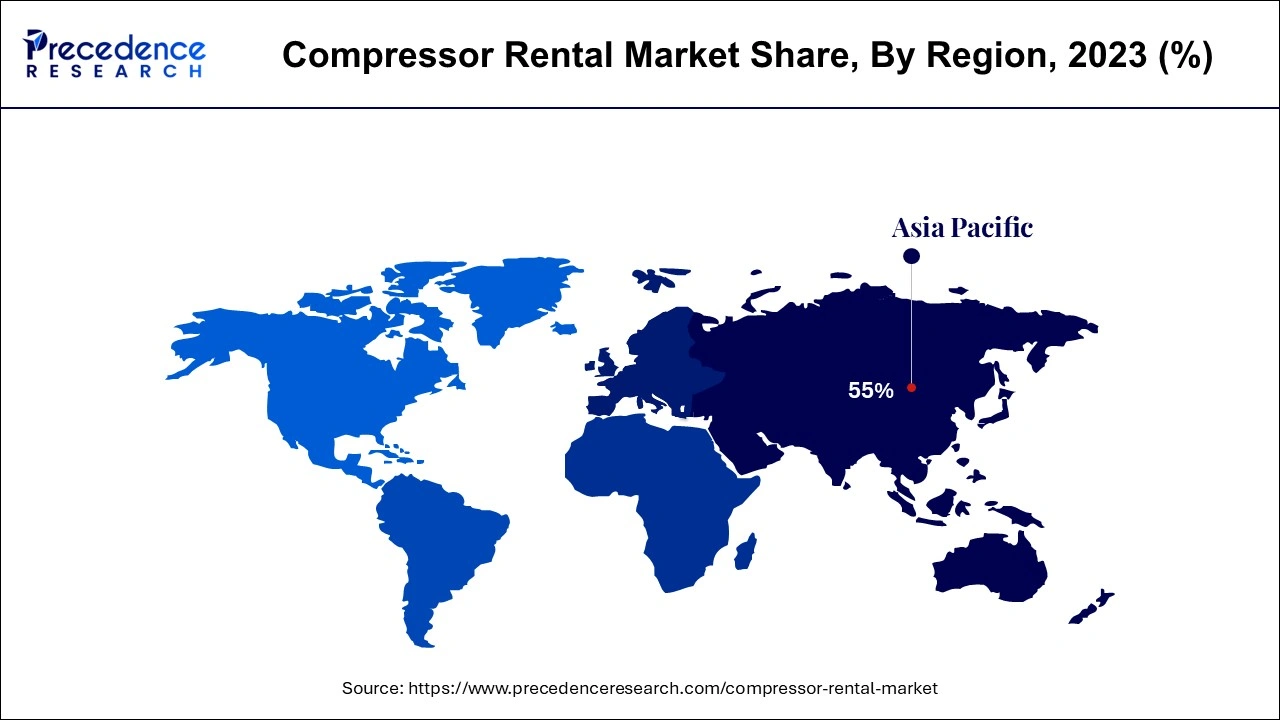

Asia Pacific led the compressor rental market in 2023. Due to industrialization, infrastructure construction, and urbanization, Asian countries, China, Japan, and India, have experienced growth in various sectors, including manufacturing, construction & mining, all requiring compressed air solutions. The rental compressors are considered both environmentally friendly and cost-efficient, which contributes to the regional market development. China has continued to be the largest market for compressor rental because of the sustained expansion of the country's chemical and mining industries.

North America is observed to grow at the fastest rate in the compressor rental market during the forecast period. In North America, there is a growing need for rental compressors due to increased economic incomes, improved construction projects, and the increasing use of flexible and portable air compressors in different industries. There is also a shift in demand towards energy-efficient and environmentally friendly compressor systems, as well as the regulatory drive to increase overall sustainability and reduce running costs. The upstream sector of the oil and gas industry is comparatively very large and experiencing rapid growth in the United States. As a result, there is exponential growth in investment in the exploration and production of hydrocarbon successively.

Compressor rental is the process of hiring or leasing an air compressor, either for a week, month, and year or for any other agreed duration. Compressor rentals are found in construction sites, mining companies, the oil and gas industry, manufacturing businesses, and chemical industries. A compressor is a mechanical tool that can help to raise air pressure. The reasons for strong growth in the recent period have been attributed to compressor rental due to lower operating costs and the availability of customized compressors.

Increasing demand for modified rental air solutions for addressing various needs of the industry is also seen as a significant factor for the growth in this compressor rental market with the increasing usage of customized air compressor rental systems in sectors like medical and construction besides the oil and gas industries. Compressed air rental services are characterized by the complete supply of large and small compressors. There are various advantages of renting industrial air compressors, which include saving on capital expenditure, maintenance cost, storage space, and probably flexibility depending on their usage needs.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.41 Billion |

| Market Size in 2024 | USD 5.37 Billion |

| Market Size in 2025 | USD 5.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.76% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | End-use Industry, Compressor Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Cost Effectiveness and flexibility

Renting an air compressor is considered to be a financially reasonable and flexible decision for industrial processes. Renting an air compressor allows businesses to expand and adapt and does not require investment. The need for flexible and budget-efficient solutions in various industries is growing. Producers and users, including construction firms, manufacturing industries, and oil and gas sectors, require air compression systems. The compressor rental market services allow businesses to utilize the services of a compressor for certain tasks or at certain times when demand is high, but the business cannot afford to make a huge capital investment in a new compressor. This flexibility makes it possible for the companies to utilize their resources optimally.

Rising infrastructure development and investment

The compressor rental market can be borrowed in developing economies because infrastructure development concerns and construction projects are on the rise. Air compressors are required for construction tasks, including pneumatics tools, concrete spraying, and sandblasting. The enhancements in the business of infrastructural development and construction, especially in the growing economies, play a significant role in the demand for compressor rental. Rapid urbanization and industrialization are increasing the demand for compressed air in applications such as construction equipment and manufacturing. As these markets persist in diversifying and growing, the requirement for compressor rentals will consequently grow.

High initial costs

The compressor rental market has several restraints which can limit the growth and profitability of the market. Capital investment is involved in procuring the industrial standard compression unit. This high initial investment may pose a challenge to small rental firms and hinders the rapid expansion of most company’s needs. There are constant annual maintenance and usage costs similar to skilled labor involved with compressor maintenance and operating parts, as well as frequent services. Increasing stringent laws on emissions and noise levels may force companies to source sustainable vehicles to rent, thereby increasing their operating expenses.

Environmental preservation and efficiency on energy utilization

The growing concern for sustainable energy all across the world. The latest products that offer energy efficiency and reduction in carbon footprint are another favorable driver of market growth. Rising environmental standards and stricter regulations across the globe also favor the further development of the compressor rental market. There are usually efficient compressor designs in the rental facilities that are comfortable and energy-compliant. With growing consciousness regarding sustainability among the worldwide tender providers of equipment, the presence of green compressor rental solutions has emerged.

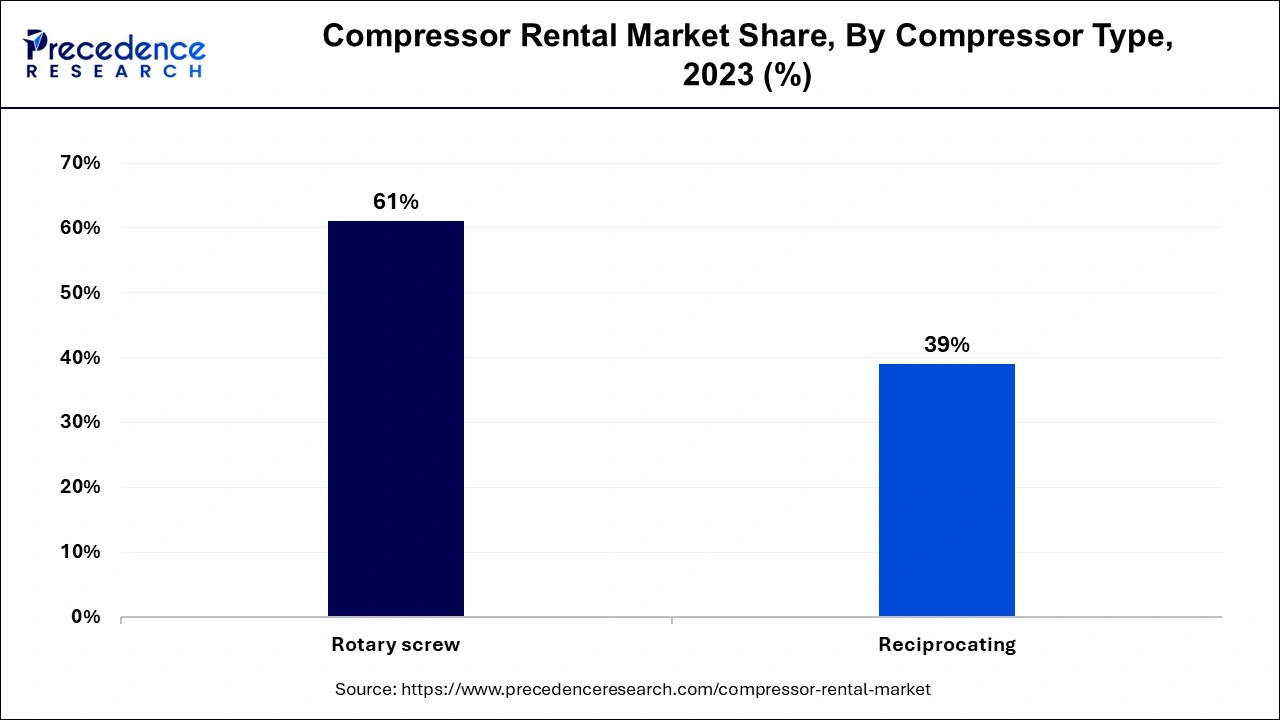

The rotary screw segment held the largest share of the compressor rental market in 2023. Rotary screw compressors are widely used because they are portable, easy to install & transport, cost-effective, and versatile in application. Furthermore, they hardly require much attention and can be operated always because the reliability of the machine is high while its size is small and its operational capabilities are immense. Rotary screw compressor design gives enhanced performance and dependability of compressed air delivery in a steady consistency, which is increasing the market growth. Furthermore, oil-free rotary screw compressors are crucial in industries such as pharmaceutical and food production industries where the quality of air.

The reciprocating segment is expected to grow at the fastest rate in the compressor rental market over the forecast period. A reciprocating compressor is an apparatus that raises the pressure of a gas succeeding the lessening of its volume; commonly referred to as a piston compressor. The working basics of a reciprocating air compressor involve pulling gas into the inlet and then moving the gas forward in a cavity chamber that is relatively smaller. Reciprocating compressors are used in applications that occasionally need compressed air and up to moderate levels of CFM, such as small industries such as welding, manufacturing, automobile, etc. They are also useful when there is variability in the required amount of air and are switched on or off as necessary.

The construction industry was the largest segment of the compressor rental market in 2023. The construction is the largest application area, and rotary screw compressors are the preferred type of machinery in construction applications. The construction industry, in general, is expected to rise internationally due to infrastructural growth, changing skyline of cities, and improvement in living and business properties together with industrial parks. Apart from construction uses such as pneumatic tools and equipment, concrete spraying, and material handling, among others, the need for compressed air has been a big usurp in demand for rented compressors.

According to the United States Census Bureau, during the 1st quarter of the year 2023, the number of construction establishments was more than 919,000. This industry provides people with working opportunities and payments for USD 8 million people and carries out construction structures production for nearly USD 2.1 trillion yearly. The construction industry also greatly contributes to the manufacturing sector, mining, and a host of service industries.

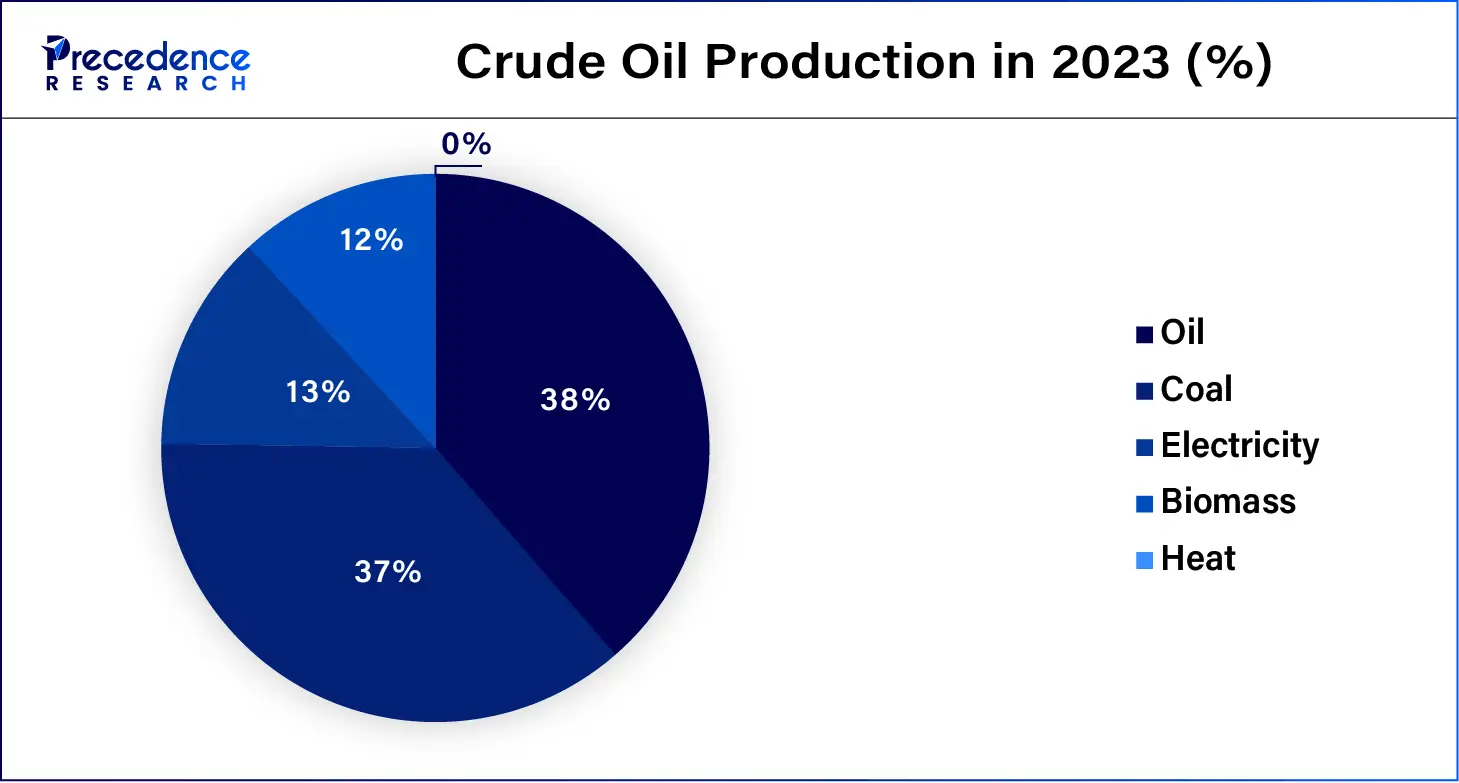

The oil and gas segment is expected to witness significant growth in the compressor rental market during the forecast period. Air compressors are very popular and are used in most oil and gas industries. They are durable, effective, and compatible for use with most air tools and other related accessories. This is because industries involved in drilling, pipeline maintenance, and even offshore operations largely depend on compressed air. The uptrend is due to an increase in exploration & production in conventional and unconventional oil and gas reserves, driving the demand for compressor rentals. The oil and gas industry requires advanced compressor technologies to help reduce emissions standards and improve effectiveness. Applications of air compressors include well drilling, maintenance of pipelines, and refineries, among others.

By End-use Industry

By Compressor Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

January 2025

September 2024