Condom Market (By Material Type: Latex Condoms, Non-latex Condoms; By Product: Male Condoms, Female Condoms; By Distribution Channel: Supermarkets, Drug Stores, Online Store) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

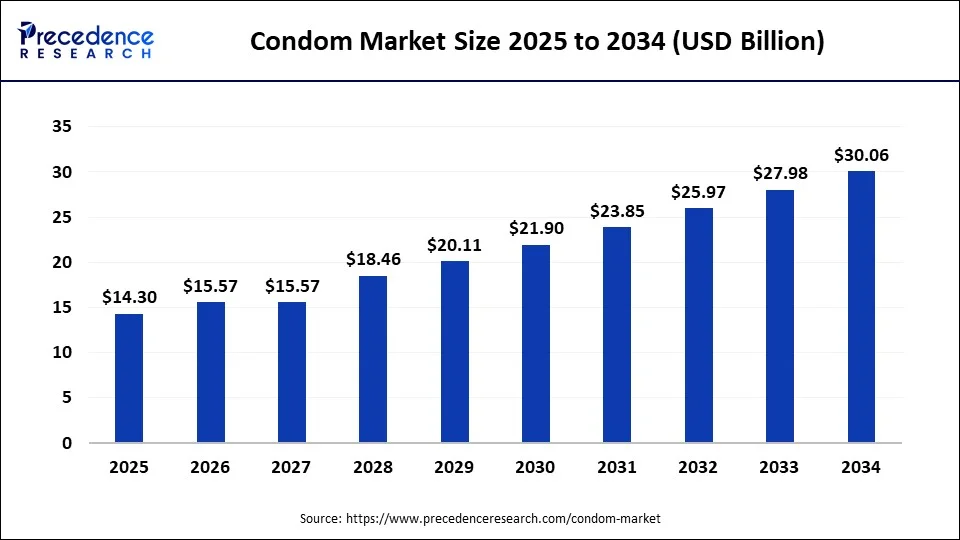

The global condom market size is estimated at USD 13.13 billion in 2024 and is expected to reach around USD 30.06 billion by 2034, growing at a CAGR of 8.6% from 2024 to 2034. The rising prevalence of sexually transmitted Infections (STIs) across the globe is expected to boost the growth of the condom market.

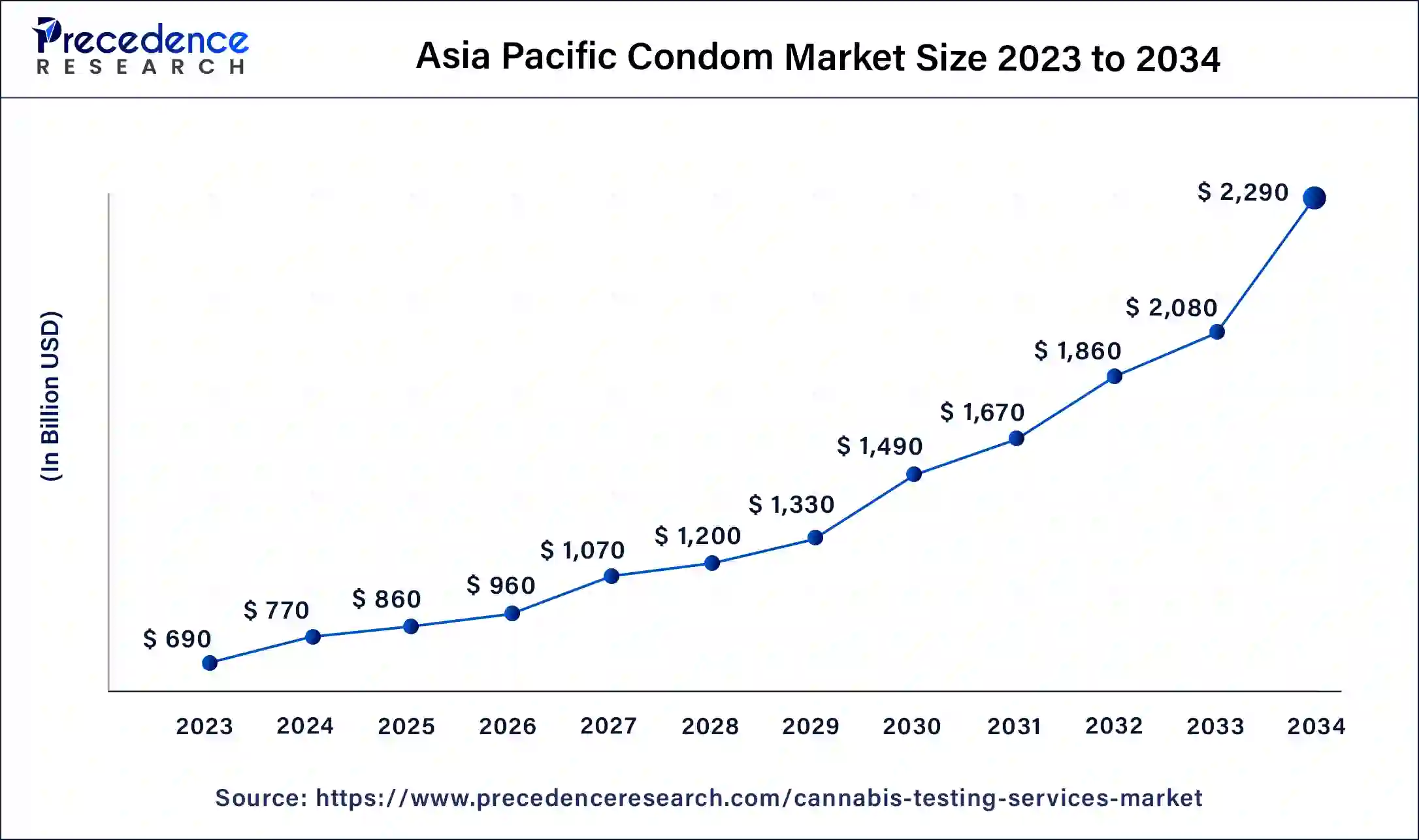

The Asia Pacific condom market size was valued at USD 6.27 billion in 2023 and is predicted to be worth around USD 15.63 billion by 2034, growing at a CAGR of 9% from 2024 to 2034.

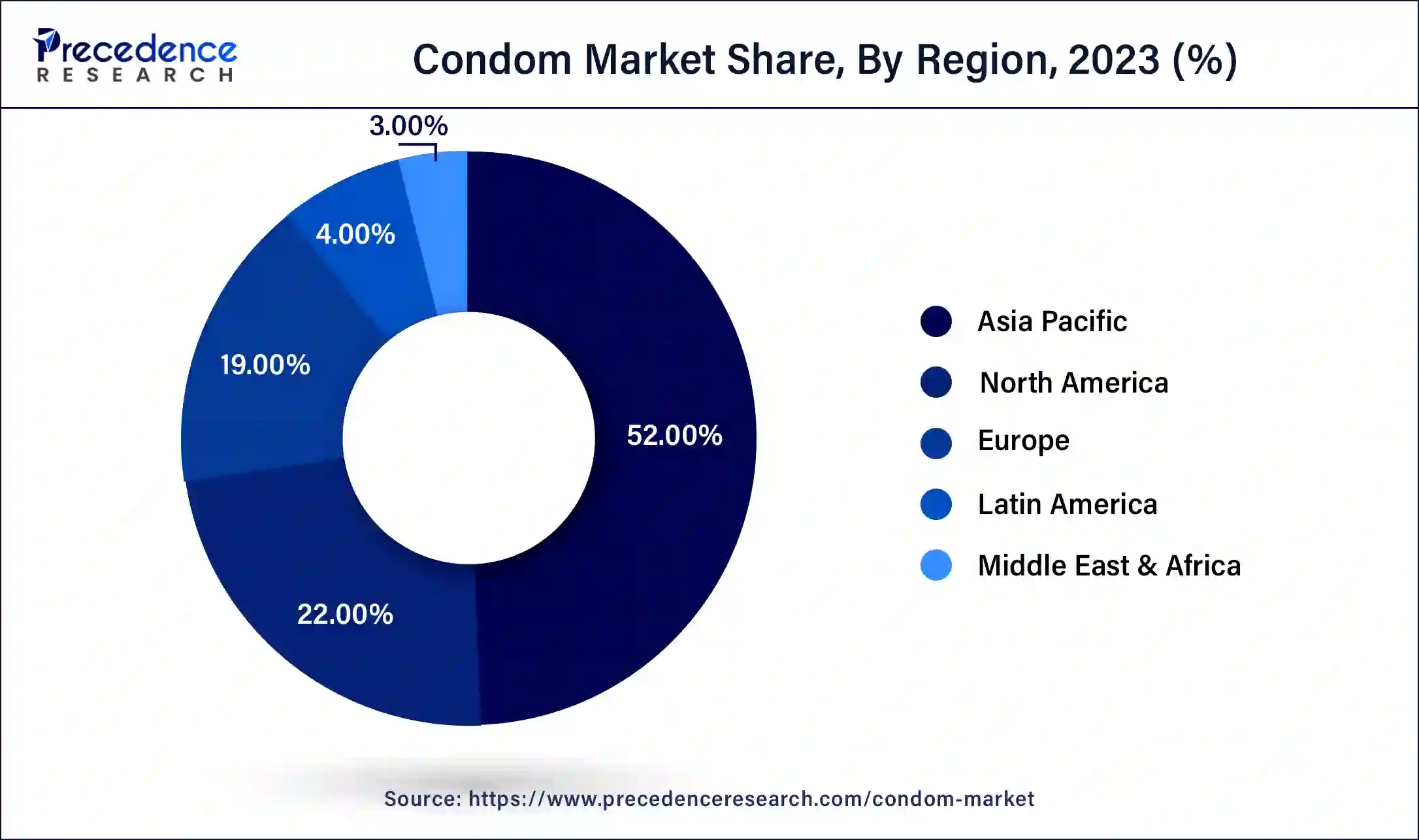

Asia Pacific holds over 52% share of the global condom market, which is expected to maintain its dominance during the forecast period. The market’s growth is driven by several factors, such as rising awareness about safe sex practices and government initiatives promoting the use of condoms. India and China are the largest marketplaces for condoms in Asia Pacific, followed by Japan, Vietnam, and South Korea.

The rising government focuses on boosting the utilization of condoms to control the population rise. The increasing spread of sexually transmitted diseases in India is propelling the growth of the condom market in the country.

In August 2022, the Odisha state government, India, announced to offer of a free kit with contraceptives and condoms for newlywed couples in the state. The welcoming step was taken under the central government’s Mission Parivar Vikas (family development) initiative. The state government believes in strengthening the family planning program with this initiative. Moreover, one of the major programs implemented by the Indian government is the National AIDS Control Program (NACP).

The program aims to prevent the spread of HIV and other STIs by promoting safe sex practices, including the use of condoms. Overall, the Indian government has been actively promoting the use of condoms as a means of preventing STIs and unintended pregnancy.

Being the second largest marketplace, Europe is anticipated to register a significant increase in the condom market during the forecast period. One of the primary drivers of the European condom market is the growing awareness about safe sex practices and the importance of preventing sexually transmitted infections (STIs) and unintended pregnancy. This has led to increased demand for condoms among consumers, particularly among young adults. The rising number of sex workers (both male and female) is another major factor in the growth of the condom market in Europe.

Additionally, some European countries have taken steps to increase awareness about safe sex practices and reduce the stigma associated with condom use. In the Netherlands, the government has implemented a comprehensive sex education program that emphasizes the importance of using condoms and other forms of contraception.

The North American condom market is also witnessing a shift towards innovative and value-added products such as flavored and textured condoms. This trend is expected to continue to drive the growth of the market in the coming years. However, the North American condom market is facing stiff competition from other forms of contraception, such as oral contraceptives and long-acting reversible contraceptives (LARCs). This is expected to pose a challenge to the market's growth in the coming years.

A condom is a contraceptive device made of latex, polyurethane, or other materials worn to prevent the exchange of bodily fluids, such as semen and vaginal secretions, and reduce the risk of sexually transmitted infections (STIs) and unintended pregnancy.

By considering the rising prevalence of sexually transmitted infections and the increasing involvement of the younger generation in unsafe intercourses, many governmental bodies, administrations, and even non-governmental organizations have started focusing on spreading awareness about the use of condoms. This is one of the most significant factors for benefiting the market players by boosting the demand for condoms.

According to a report published by the World Health Organization (WHO), in 2022, more than 1 million sexually transmitted infections will be acquired in just one day worldwide. In March 2023, Delaware County, a country in Pennsylvania, launched a program called ‘Doing Delco Safely’ to curb the spread of diseases caused by unsafe intercourse. Delaware County has decided to offer or directly mail a set of ten condoms to its residents as per their request. The program also allows residents to choose from various male and female condoms.

The program was launched after observing a sudden rise in STDs over the past several years. Delaware County reported 2,937 new cases of sexually transmitted diseases in 2022, which is a rise of 6% from 2021. Condoms are expected to remain a popular and effective method of contraception, mainly as they offer protection against sexually transmitted infections in addition to pregnancy prevention; this fact highlights a noticeable growth of the global condom market.

Considering the rising concerns of overpopulation and disease spread, governments across the world are investing efforts to boost the utilization of condoms. Governments' initiatives aim to promote safe sex practices and increase access to contraceptives such as condoms. This is helping to drive demand for condoms and contribute to the growth of the condom market.

In December 2022, French president announced the new health measure ‘small revolution in prevention’, under this, youngsters between 18-25 will be able to get free access to condoms in France. In 2021 and 2022, France experienced a 30% increase in sexually transmitted infections (STIs). Along with this, the France government has made all contraceptives free for women.

Many companies involved in the condom market are focusing on marketing, branding and expanding businesses with new product launches along with innovative ideas to boost sales and awareness about the importance of condoms, this is another major factor to fuel the growth of the condom market.

In September 2022, Mankind Pharma’s new condom brand Epic condoms announced the launch of a new campaign ‘Make Love Epic’, while announcing the premium range of epic condoms in the global market. The new campaign aims to make customers aware of the new brand to target a consumer base in India.

Overall, the growing awareness about safe sex practices, government initiatives, rising focus on sex education by education institutions, and availability of diverse product ranges are the major drivers for the growth of the condom market.

| Report Coverage | Details |

| Market Size in 2023 | USD 12.06 Billion |

| Market Size in 2024 | USD 13.13 Billion |

| Market Size by 2034 | USD 30.06 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.6% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material Type, Product, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising awareness about family planning

Condoms are used as a contraceptive method, providing a safe and effective way for individuals to prevent unwanted pregnancies. As more people become aware of the importance of family planning, the demand for condoms is expected to increase. Along with their effectiveness, condoms are considered one of the most affordable methods of preventing unintended or unwanted pregnancies.

Moreover, governments and organizations that promote family planning may also provide education and resources on the benefits of condom use. This can help to increase awareness about the importance of using condoms to prevent both unintended pregnancies and the spread of sexually transmitted infections (STIs). In turn, this can help to drive demand for condoms and increase their accessibility to those who need them.

Availability of alternative contraceptive methods

The availability and popularity of alternative contraceptive products can potentially impact the growth of the condom market, as many people may choose to use these alternatives instead of condoms. Hormonal contraceptives such as birth control pills, patches, injections, and vaginal rings are popular alternatives to condoms. IUDs are small, T-shaped devices that are inserted into the uterus to prevent pregnancy, and they work by preventing fertilization and implantation of a fertilized egg. As IUDs are long-lasting and highly effective, they are increasingly popular as an alternative to condoms. Moreover, sterilization's high degree and permanence also make it a better alternative to condoms.

Rising development of sustainable condoms

Traditional condoms are made from latex or polyurethane, which are not biodegradable and can take hundreds of years to decompose. Sustainable condoms, on the other hand, are made from natural materials such as organic components, sustainably sourced rubber, and plant-based materials that are biodegradable and compostable.

As consumers become more aware of the environmental impact of their purchasing decisions, there is a growing demand for sustainable and eco-friendly products. This trend is likely to continue in the condom market as more people seek out products that align with their values.

In March 2023, Branmover, a Swiss company, launched a sustainable FeelGood condom range. This new condom range is 100% vegan and made with green electricity. The company stated that the new vegan and sustainable condoms are made with 100% FSC-certified rubber latex, and the box used for packaging is also made with 100% recycled paper.

Overall, the development of sustainable condoms has the potential to drive growth in the condom market by appealing to a growing segment of environmentally conscious consumers and spurring innovation in the industry.

Covid-19 Impacts:

The Covid-19 pandemic has shown massive adverse effects on the global economy and all major industries. Similarly, it has affected the growth of the worldwide condom market due to the interrupted supply chain and store closure. However, the condom market also experienced a slightly increased demand, which mildly improved the market’s revenue.

The Covid-19 pandemic has disrupted supply chains, leading to shortages of condoms in some areas. This is due to restrictions on the movement of goods, factory shutdowns, and decreased production. With the pandemic leading to lockdowns and reduced social interactions, there has been a decrease in demand for condoms in the initial phase.

However, the demand for condoms increased with rising online sales as people have been staying at home, there has been an increase in online sales of condoms. The global condom market is experiencing noticeable growth with increased online sales even after the pandemic.

According to the latest survey done in 2022 by Swiggy in India, Mumbai witnessed a maximum order for condoms online in India for the year 2021. The same survey stated that Mumbai ordered condoms 570 times more in the last twelve months.

Overall, the Covid-19 pandemic has had mixed impacts on the global condom market, with both positive and negative effects.

The latex material segment for condoms dominated the market in 2022; the segment is expected to maintain its dominance during the forecast period. Latex material is considered highly durable and effective. Additionally, latex condoms are compatible with water-based lubricants, which are widely available and safe for use. Moreover, the comfort and softness of latex have boosted the utilization of latex material in condoms.

The non-latex material segment is growing at a noticeable CAGR due to the wide range of materials. Non-latex condoms are available in various materials, including polyisoprene, polyurethane, and lambskin. Along with this, non-latex material is ideal for people with latex allergies.

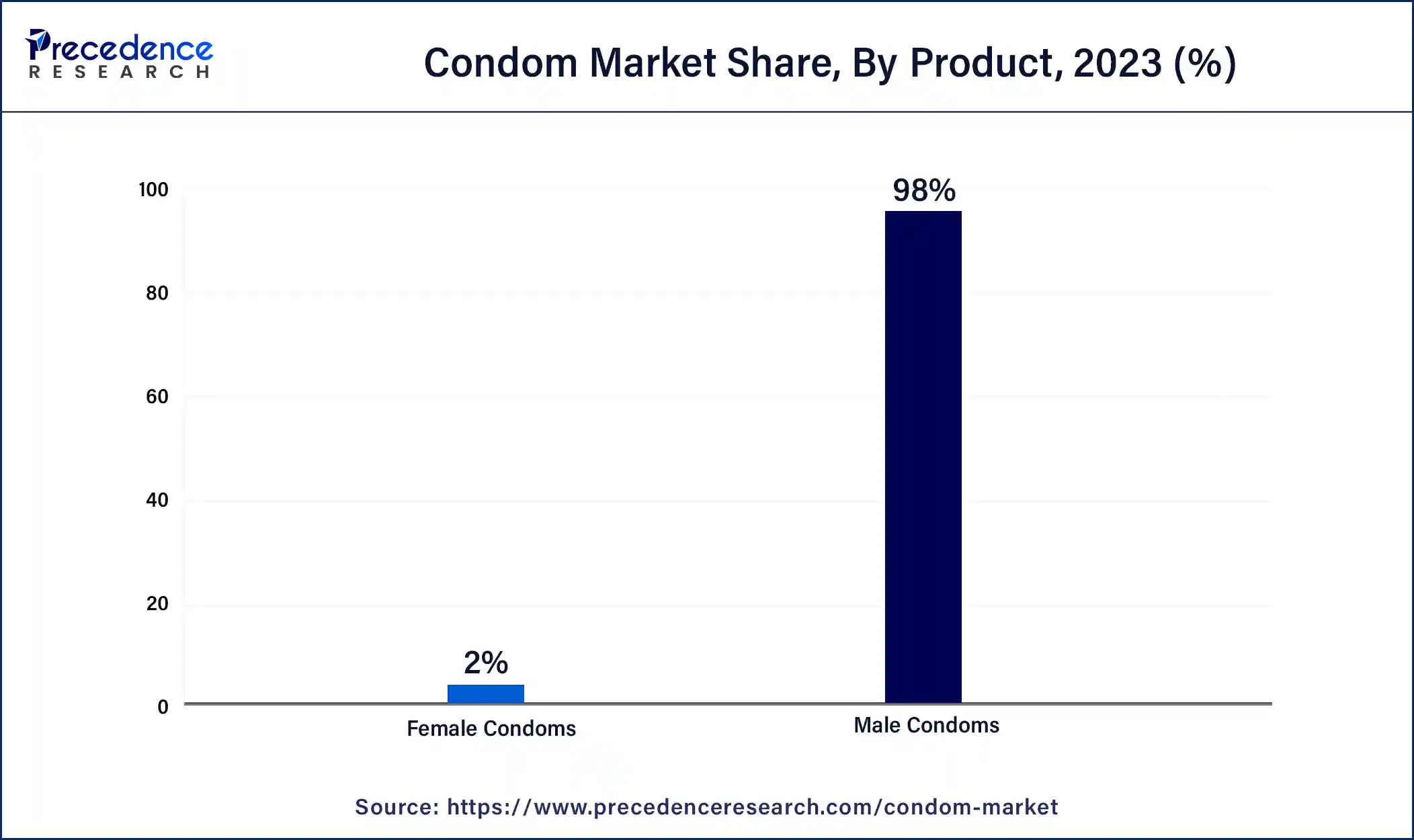

The male condom segment dominated the market, accounting for over 98% of the total share. Male condoms are still considered a highly effective measure to prevent the penetration of fluids and reduce the risk of STIs. Moreover, the presence of focused manufacturers, low cost, and negligible side effects of male condoms supplement the segment’s growth.

The female condom segment is expected to register the fastest growth owing to the rising production of female condoms by prominent manufacturers. Moreover, the comfort and protection offered by female condoms present a noticeable growth for the segment during the forecast period.

In January 2021, a leading hygiene and wellness brand, Pee Safe, announced the launch of its first condom range for women. With the launch of this range of female condoms, the company aims to challenge the stereotypes around contraceptive usage.

The drugstore segment dominates the global condom market. Drug stores typically have a wide variety of condoms available, including different sizes, shapes, and brands; the convenience of buying preferrable contraceptive products with maintained privacy is the primary factor for the growth of the distribution channel segment. Condoms sold in drug stores are often competitively priced, which can make them more affordable for consumers. The affordability of products in drug stores is held as another factor that drives the segment’s growth.

At the same time, the online store segment is predicted to register the fastest growth during the forecast period, and the lockdown period during the Covid-19 pandemic boosted the sales of condoms through online stores. The availability of a wide range of condoms on all possible e-commerce websites, along with offers and promotional discounts for consumers, is driving the growth of the online store segment. Moreover, convenience, privacy, selection, and discreet packaging offered in online shopping on contraceptive products are fueling the segment’s growth.

Segments Covered in the Report:

By Material Type

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client