December 2024

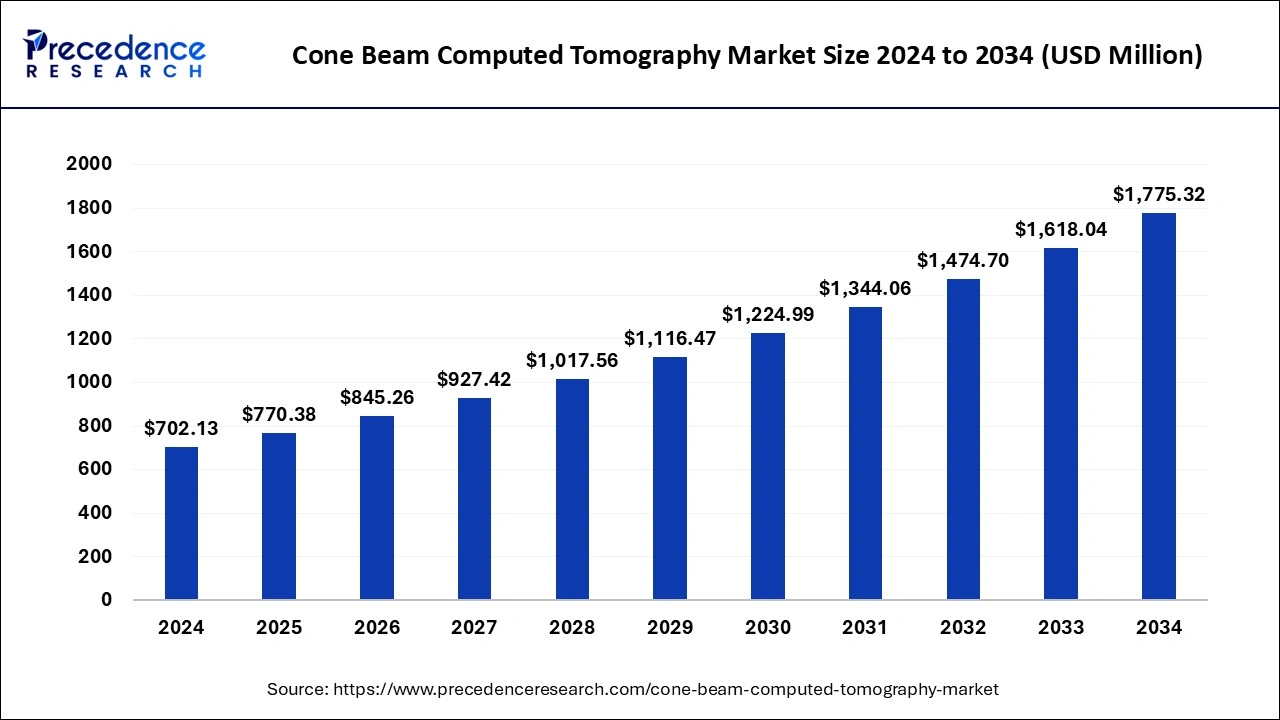

The global cone beam computed tomography market size is calculated at USD 770.38 million in 2025 and is forecasted to reach around USD 1,775.32 million by 2034, accelerating at a CAGR of 9.72% from 2025 to 2034. The North America market size surpassed USD 337.02 million in 2024 and is expanding at a CAGR of 9.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cone beam computed tomography market size was accounted for USD 702.13 million in 2024 and is expected to exceed around USD 1,775.32 million by 2034, growing at a CAGR of 9.72% from 2025 to 2034. The growing demand for cone beam imaging for dental applications is the key factor driving market growth. Also, technological advancements in the field coupled with substantial improvements in healthcare infrastructure can fuel market growth further.

Artificial Intelligence algorithms can detect and process key patterns with remarkable precision in the cone beam computed tomography market. They can also identify abnormalities, decrease human error, and measure bone density. AI ensures reliable and persistent interpretations, which is essential for treatment planning. Furthermore, AI can combine information from cone beam computed tomography scans with data from another patient to create individualized treatment plans.

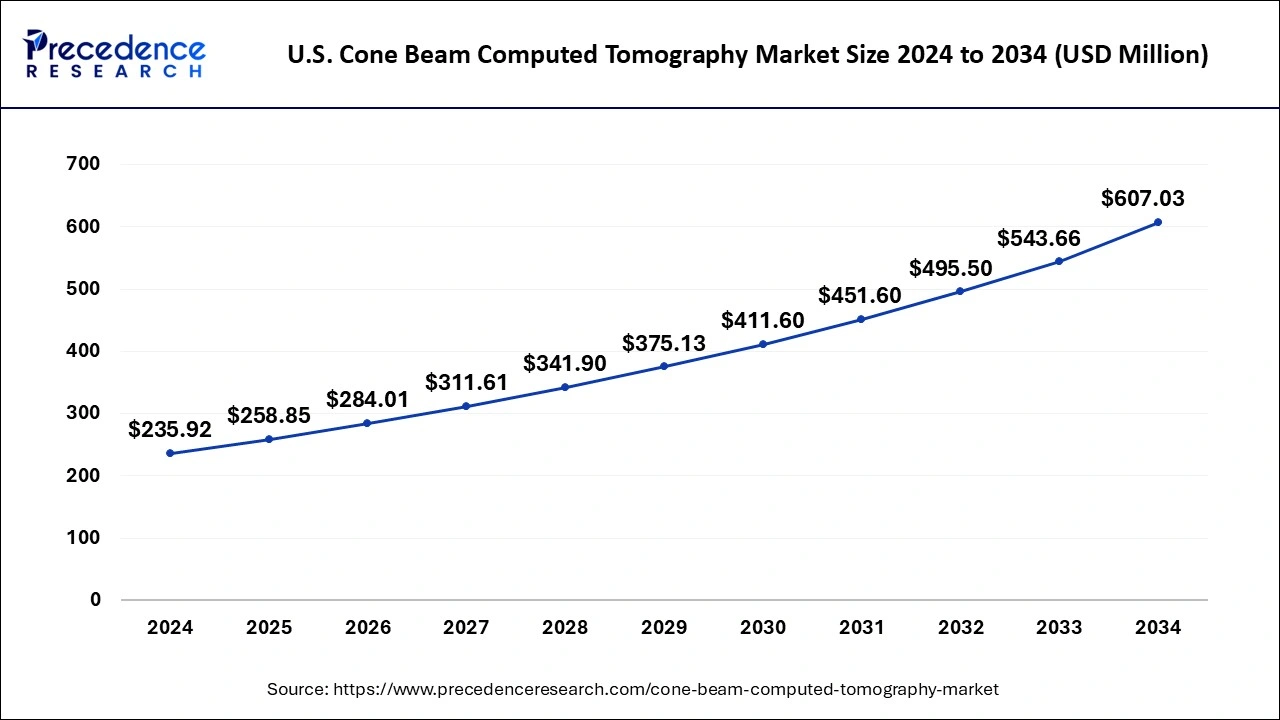

The U.S. cone beam computed tomography market size was exhibited at USD 235.92 million in 2024 and is projected to be worth around USD 607.03 million by 2034, growing at a CAGR of 9.91% from 2025 to 2034.

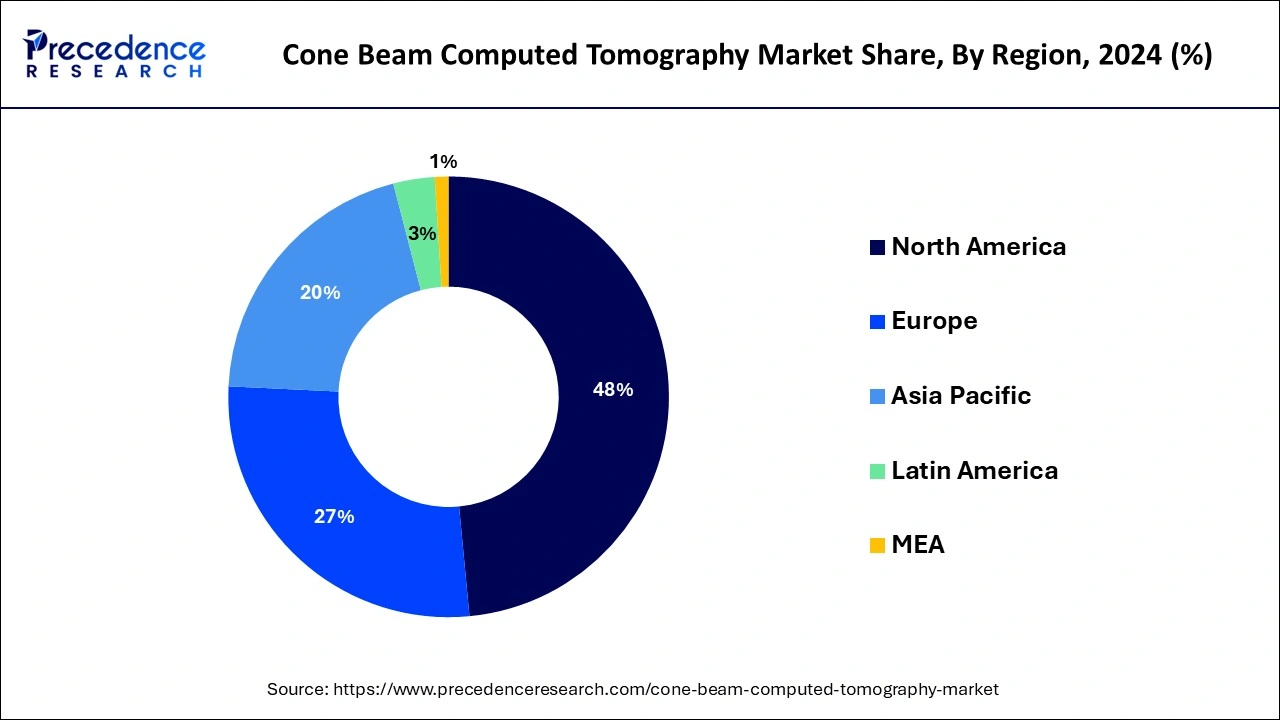

North America dominated the cone beam computed tomography market in 2023. The dominance of the region can be attributed to the growing awareness about the importance of dental care & and oral health. Also, the increasing access of independent clinics along with other R&D activities in imaging techniques is impacting the market growth positively. Furthermore, in North America US led the market owing to the widespread adoption of CBCT technology in dental care and various other applications.

Asia Pacific is expected to show the fastest growth over the studied period. The growth of the region can be credited to the surging number of clinics and improved R&D in healthcare facilities. Furthermore, technological advancements are boosting the development of the healthcare industry. Also, in Asia Pacific, China led the market due to increasing medical tourism and a rising volume of dental care procedures.

Cone Beam computed tomography is a special kind of X-ray technology that offers precise images as compared to conventional 2D imaging methods. The cone beam computed tomography market’s improved imaging technique is important for applications in ear-nose-throat (ENT), dental, and orthopedic diagnostics systems gained significant traction, particularly with their capability to visualize tedious anatomical shapes without any type of invasive procedures. The CBCT systems provide key opportunities for advanced diagnostic procedures.

Instruments and appliances used in the dental industry, exports by country in 2023

| Reporter | Trade Value 1000USD |

| European Union | 1,800,574.13 |

| Germany | 1,607,444.99 |

| United States | 707,598.22 |

| Switzerland | 646,569.34 |

| China | 607,896.71 |

| Report Coverage | Details |

| Market Size by 2024 | USD 702.13 Million |

| Market Size in 2025 | USD 770.38 Million |

| Market Size in 2034 | USD 1,775.32 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.72% |

| Dominating Region | North America |

| Fastest Growing | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Patient Position, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing adoption across medical specialties

The cone beam computed tomography market technology was created for dental applications like implantology, orthodontics, and maxillofacial surgery. Over time, its utility has stretched to other fields, such as orthopedics, otolaryngology, and interventional radiology. In addition, the growing product adoption in interventional radiology for procedures, including ablations and biopsies, is contributing to market expansion.

Limited reimbursement policies

Reimbursement policies for cone beam imaging can be restricted in various regions. This can make these scans more expensive for individuals and also create financial hurdles for medical professionals. Moreover, the concerns regarding data privacy and security may impact t patients' complaints and reliability in CBCT technology. Cone beam imaging produces a high amount of confidential patient data that needs to be kept safe.

Increasing focus on personalized healthcare

The demand for innovative diagnostic imaging technologies like CBCT is fuelled by the growing trends toward personalized healthcare and precision medicine. Healthcare providers can reduce the risks associated with invasive procedures, by using CBCT imaging. Furthermore, this imaging technique can also streamline treatment plans and optimize treatment outcomes based on the unique features of each patient.

The dental implantology segment led the cone beam computed tomography market in 2024. The dominance of the segment can be attributed to the increasing use of CBCT in dental implantology to carry out smooth diagnostic procedures. In dental clinics, CBCT is used to analyze the implant site, understand the bone density and avoid injuries & complications, and perform post-surgical analysis of the receiver site. Additionally, this method is seen as a crucial technique for cross-sectional imaging.

The orthodontics segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the rapid advancements and commercialization in CBCT technology which have propelled affordability and accessibility along with increasing awareness of its numerous clinical benefits. Furthermore, CBCT provides images in many dimensions that are precise for treatment planning.

The seated position segment dominated the cone beam computed tomography market in 2023. The dominance of the segment can be linked to the growing use of seated-position CBCT scans in various dental applications. CBCT scan provides more detailed imaging of teeth than a 2D dental X-ray image. In addition, the 3D imaging technique captures images of bone structures and other soft tissue with keen detail, facilitating precise treatment planning for different procedures.

The supine position segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by increasing recommendations of this position by healthcare professionals during performing procedures like orthodontic surgeries and implant planning. Moreover, this position enables smooth access to the interior structures of the body.

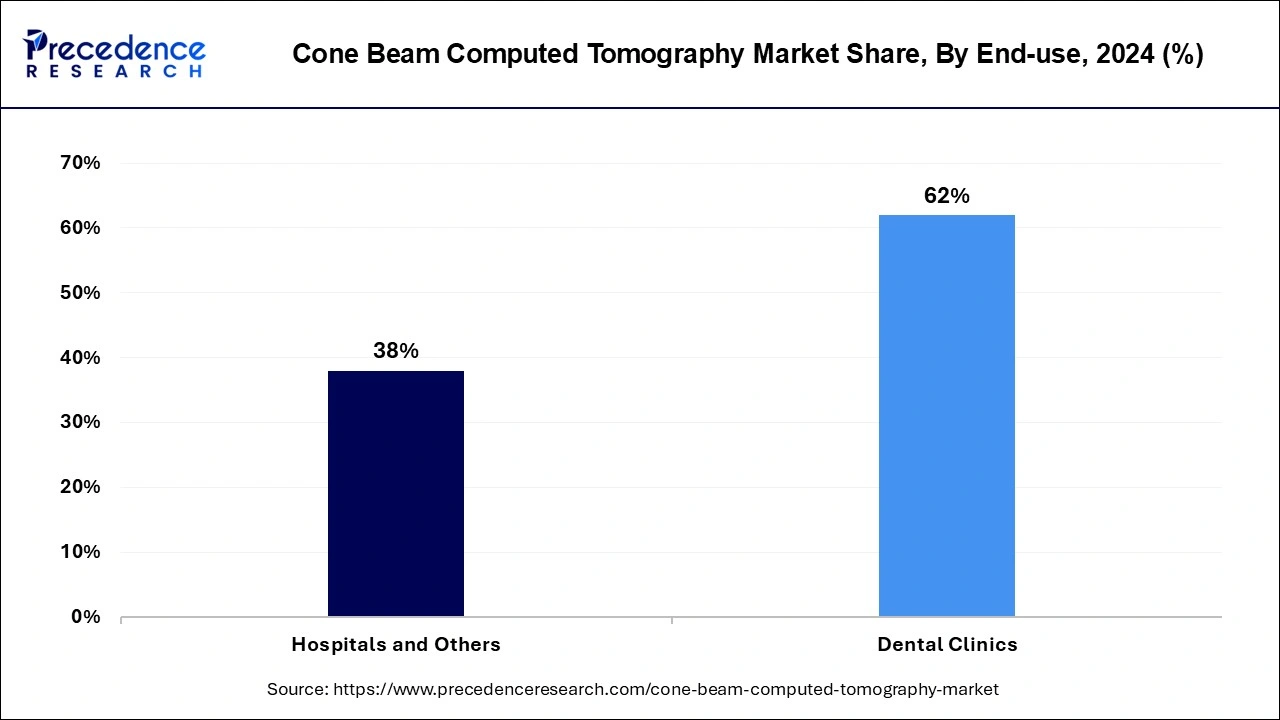

In 2023, the dental clinics segment led the market by holding the largest cone beam computed tomography market share. The growth of the segment is due to the increasing product demand across clinic management systems and hospitals. The growing compliance standards and complexity of healthcare infrastructure necessitate convenient software tools to tackle risks and ensure proper adherence.

The hospital & others segment is estimated to grow at the fastest rate during the projected period. The growth of the segment can be driven by improved infrastructural support offered by these facilities, easier treatment access, and positive reimbursement policies. Furthermore, the surge in personalized medicine and innovations in genomics impact the segment's growth positively.

By Application

By Patient Position

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

March 2025

June 2024