July 2024

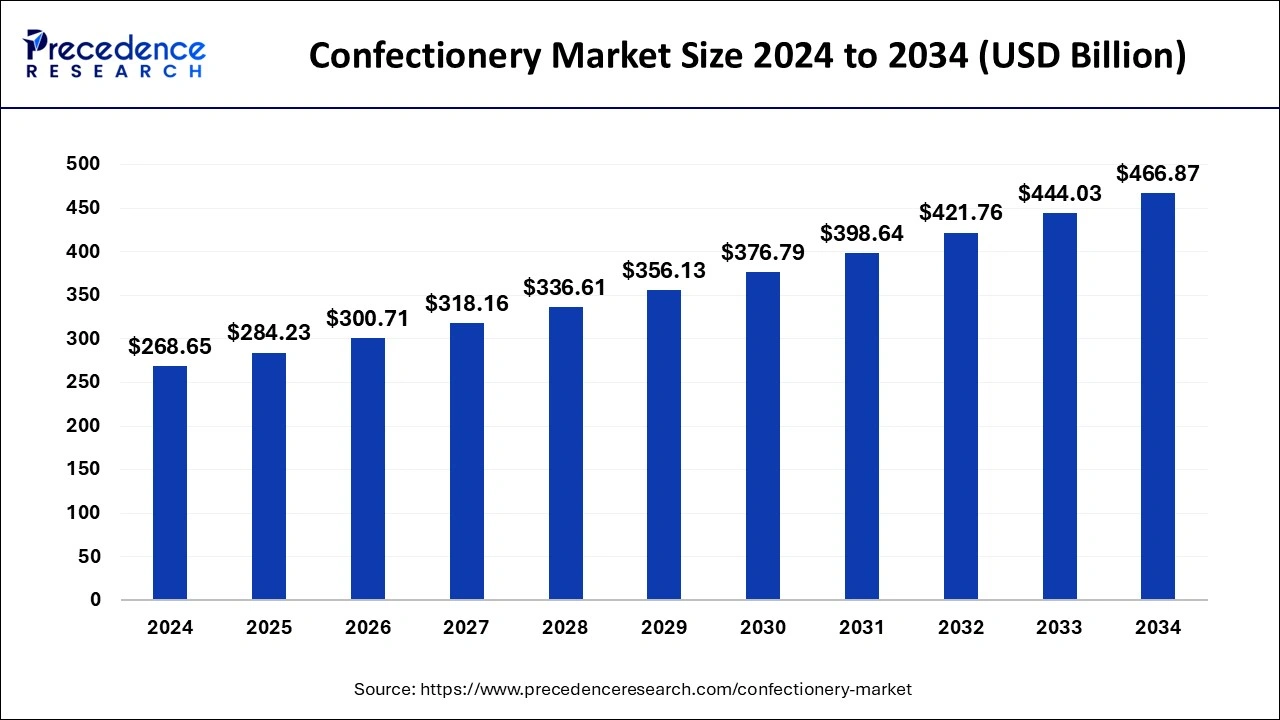

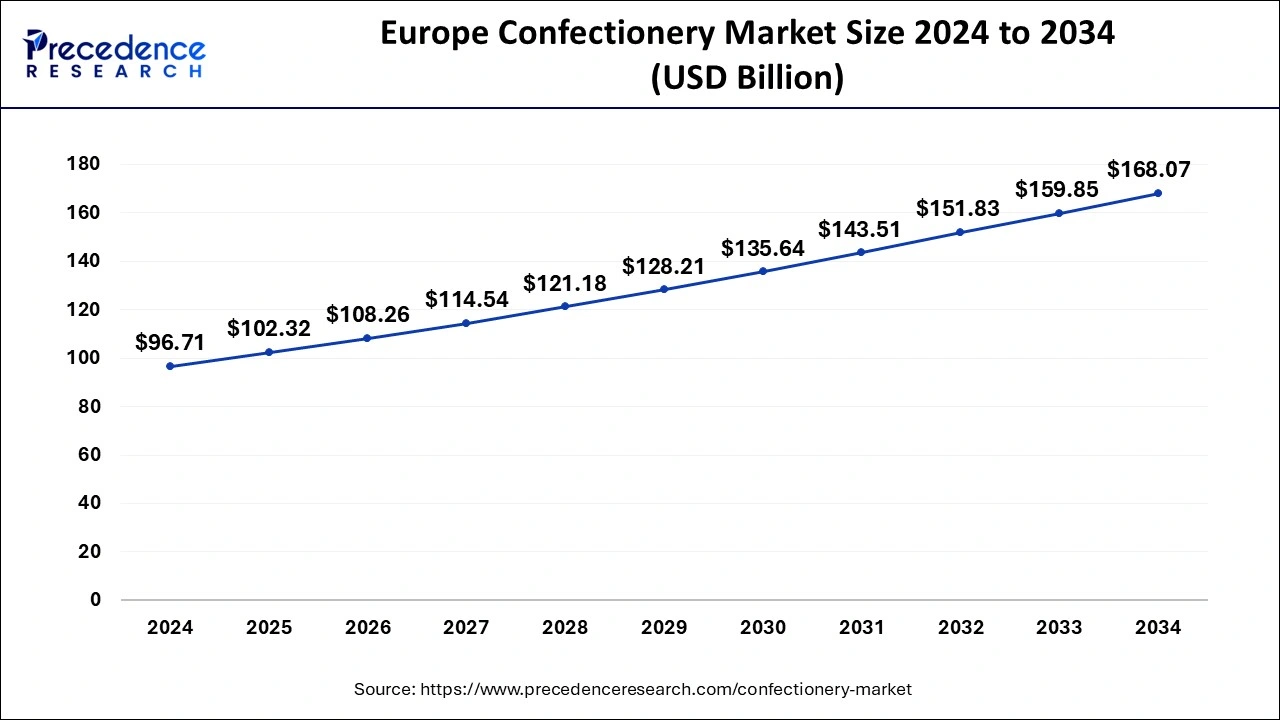

The global confectionery market size is estimated at USD 284.23 billion in 2025 and is anticipated to reach around USD 466.87 billion by 2034, expanding at a CAGR of 5.68% from 2025 to 2034. The Europe confectionery market size was valued at USD 102.32 billion in 2025 and is expanding at a CAGR of 6% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global confectionery market size accounted for USD 268.65 billion in 2024 and is predicted to reach around USD 466.87 billion by 2034, growing at a CAGR of 5.68% from 2025 to 2034.

The Europe confectionery market size was valued at USD 96.71 billion in 2024 and is estimated to reach around USD 168.07 billion by 2034, at a CAGR of 6% from 2025 to 2034.

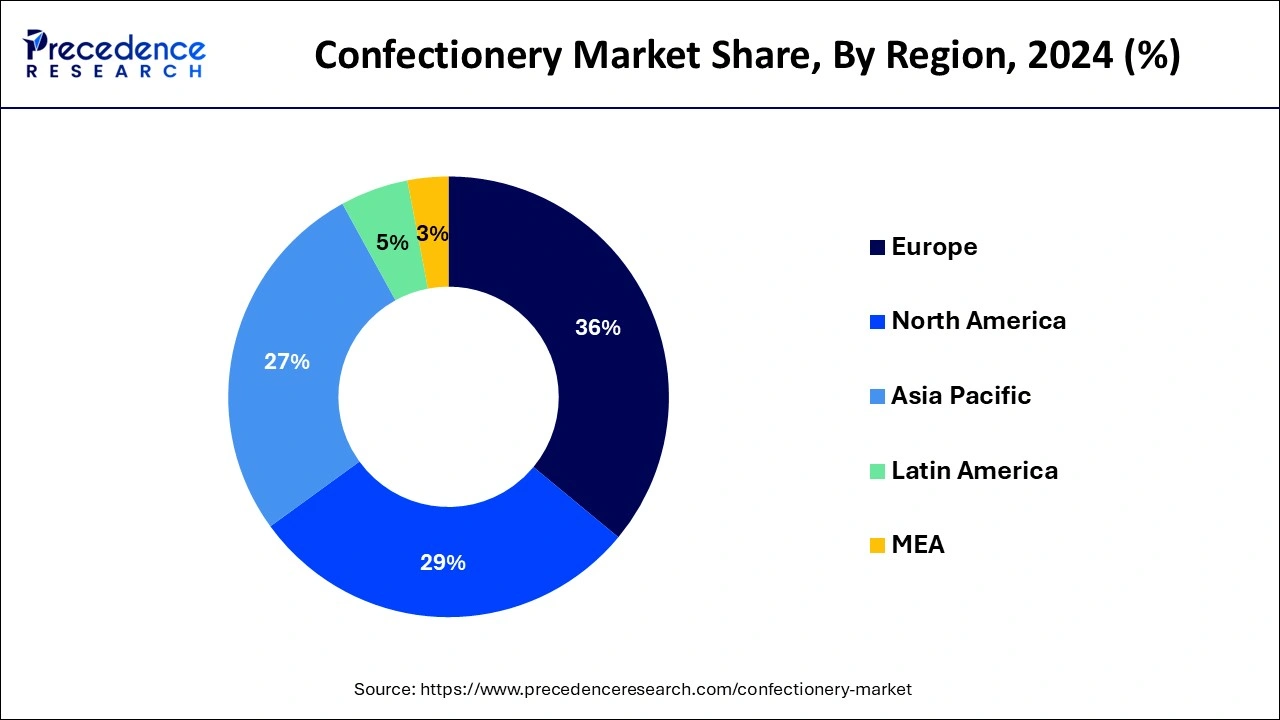

Based on the region, Europe dominated the global confectionery market with the highest revenue share in 2024 and is expected to sustain its significance throughout the forecast period. This is attributed to the highest per capita consumption of confectioneries in majority of the European countries such as Switzerland, Sweden, France, Italy, and Netherlands. Further, the growing consumer awareness regarding the side-effects of chemically produced raw materials like cocoa liquor used for making chocolates have exponentially boosted the demand for the organic chocolates in the region. The growing demand for the organic chocolate among the population is expected to be the major driver of the confectionery market in Europe during the forecast period.

On the other hand, Asia Pacific is estimated to be the fastest-growing confectionery market during the forecast period. The presence of huge youth population, rising disposable income, changing consumer lifestyle, demand for the premium products among the young population, and rising investments in the region by the major market players are the various important factors that are expected to foster the market growth across the region.

The various confectionery products such as chocolates, gums, chews, jellies, toffies, caramel, nougat, and sweets are enormously popular among the global population ranging from kids to old age people. The constantly evolving consumer taste and preferences have encouraged the manufacturers to indulge in the production of new and innovative confectioneries. Introduction of functional ingredients, innovative fillings, and exotic flavors in the various confectioneries like chocolates and sweets have significantly driven the global confectionery market in the past. Various marketing and promotional strategies of the key market players have a key role in the increased consumption and sales of the various confectioneries. For instance, Dairy Milk repositioned itself as a gifting product. As a result, Dairy Milk became a trending gifting product in India. Further, the consumption of confectioneries is not only limited to the kids. The aggressive marketing strategies by the players targeted the adult and geriatric population in order to expand their business.

The growing trend of sugar-free, growing consumption of on-the-go snacks, and impulse buying of confectioneries are the major boosters of the confectionery market. The rising prevalence of obesity and diabetes among the children, and adults have significantly encouraged the confectionery manufacturers to opt for sugar substitutes that can provide the taste of sugar with low or no impact of the blood glucose levels. This is a major factor that is expected to be the driving force of the confectionery market during the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 268.65 Billion |

| Market Size in 2025 | USD 284.23 Billion |

| Market Size by 2034 | USD 466.87 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.68% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | Europe |

| Segments Covered | Type, Age Group, Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The chocolate segment led the global confectionery market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. Chocolate is the most common and popular confectionery across the globe. The growing rising disposable income, craving for chocolate among the all age groups, and easy availability of various chocolates like dark chocolate, white chocolate, nut-based, and fruit-based chocolates are the important factors driving the demand for the chocolates globally.

On the other hand, the sugar confectionery is estimated to be the most opportunistic market due to the rising adoption of low-calorie sugar substitutes in various sugar confectioneries. The taste bud satisfying feature of the sugar confectioneries coupled with the low or no negative impact on health is driving the sugar confectionery segment across the globe.

By distribution channel, the supermarkets & hypermarkets segment led the global confectionery market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. The supermarkets & hypermarkets offers discounted prices on popular brands and has high penetration in the developed markets like U.S., Germany, UK, France, Canada, Italy. This segment accounted for over 35% of the market share in 2023 and is estimated to remain the leading segment throughout the forecast period.

On the other hand, online stores is expected to be the most opportunistic segment during the forecast period. This is attributed to the rapid growth and popularity of online groceries and food delivery platforms across the globe.

The adult segment led the global confectionery market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is mainly attributed to the increased consumption of different confectioneries among the millennials. The improved packaging, introduction of innovative flavors, and personalized services offered by the confectioners are the major driving force of this segment.

On the other hand, the geriatric segment is expected to grow rapidly during the forecast period. The population of the world is getting older. Therefore, the consumption habits of people is expected to boost the consumption of sugar-free confectioneries, thereby propelling the segment growth in the forthcoming years.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved services. Moreover, they are also focusing on maintaining competitive pricing.

In January 2020, The Hershey Company launched its new chocolate bars in India to mark its presence in the most attractive market in the Asia Pacific region.

In November 2020, Mars Incorporated launched its premium chocolate, Galaxy Kenzin five variants, in the Middle East countries.

These major developments by the key players serves the constantly changing tastes and preference of the modern day consumers and exponentially contributes towards the market growth across the globe.

By Type

By Distribution Channel

By Age Group

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024