January 2025

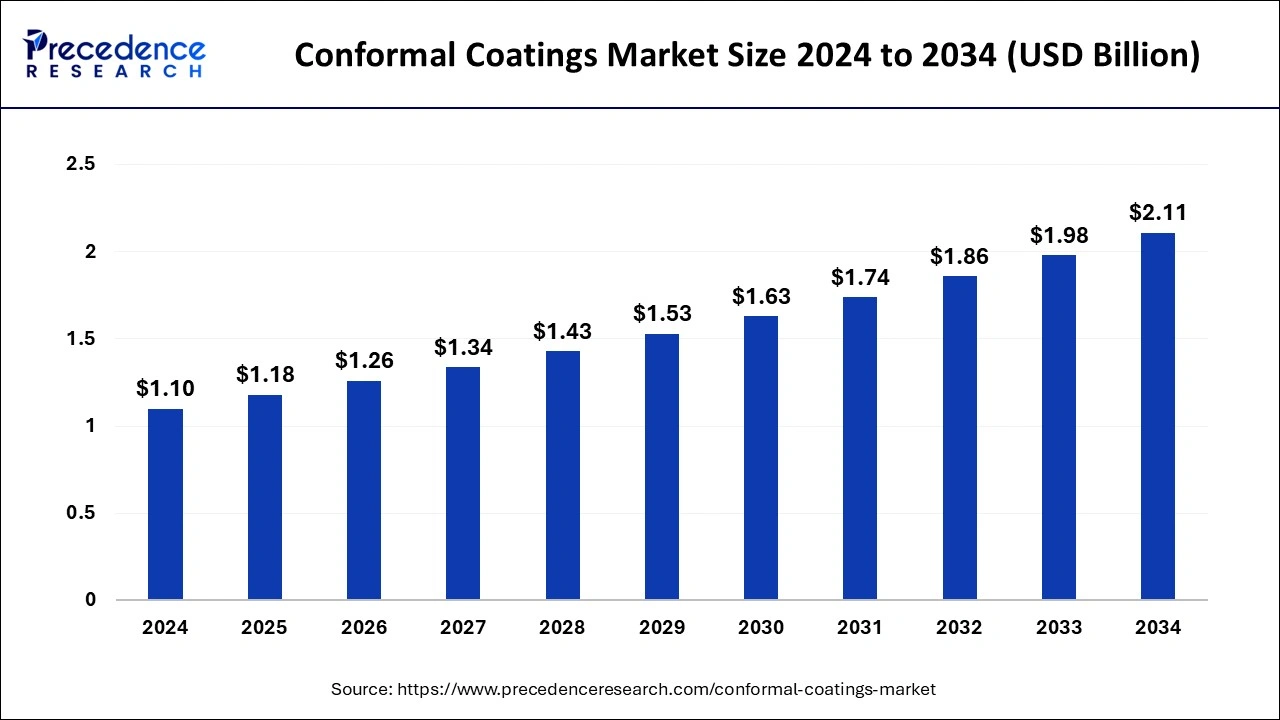

The global conformal coatings market size was USD 1.1 billion in 2024, calculated at USD 1.18 billion in 2025 and is expected to reach around USD 2.11 billion by 2034, expanding at a CAGR of 6.73% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global conformal coatings market size accounted for USD 1.10 billion in 2024 and is expected to reach around USD 2.11 billion by 2034, expanding at a CAGR of 6.73% from 2025 to 2034. The market is witnessing significant growth due to the rising demand for advanced coating solutions from various industries and the increasing advancements in coating technologies.

Artificial intelligence (AI) is transforming the landscape of many industries, including paints and coatings. The detection of air bubbles in coatings is an important part of the manufacturing process. However, AI technologies can monitor various tasks in manufacturing processes and identify flaws, thereby enhancing the quality of conformal coatings. In addition, integrating AI technologies in the manufacturing processes of conformal coatings helps improve speed and accuracy by automating various tasks. This, in turn, enhances operational efficiency and production output.

AI also helps maintain the consistency and quality of coatings by detecting anomalies, helping manufacturers save resources, and solving issues before the final stages of production. AI technologies further help researchers develop new coating formulations by analyzing the properties of various materials. This leads to the development of advanced coatings.

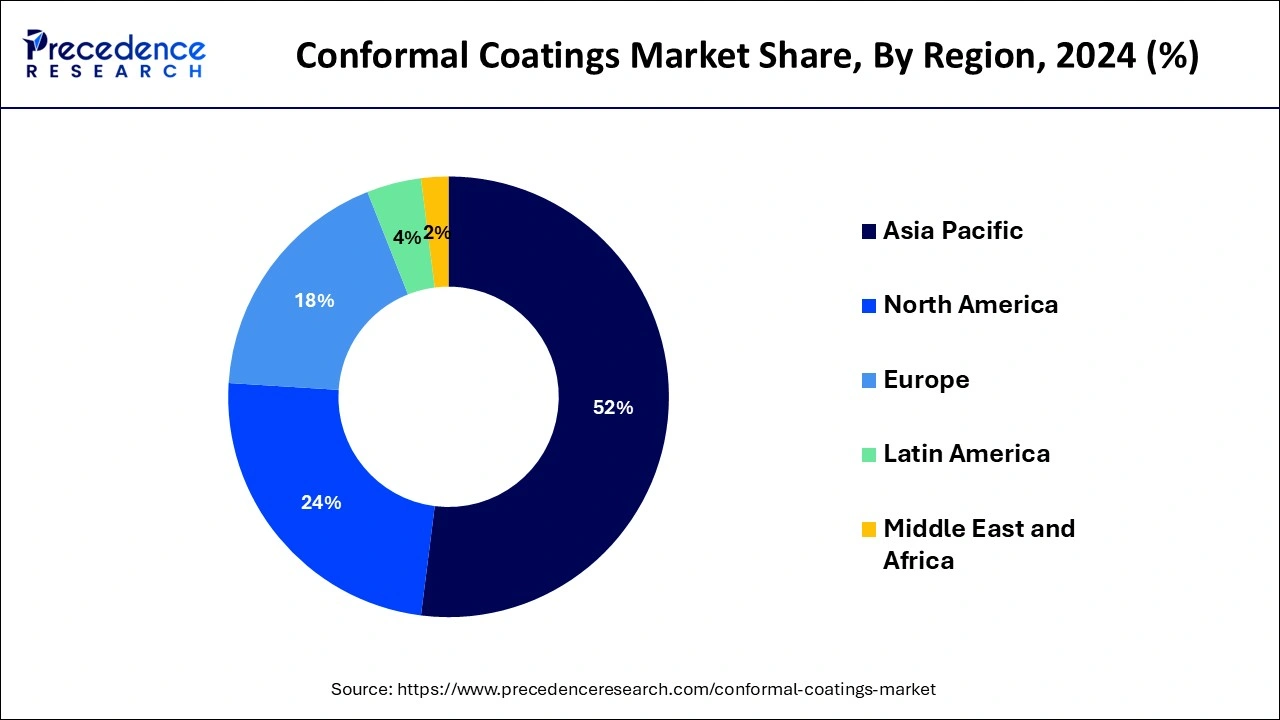

The Asia Pacific conformal coatings market size was estimated at USD 572 million in 2024 and is predicted to be worth around USD 1,097 million by 2034, at a CAGR of 6.75% from 2025 to 2034.

Due to the rising popularity of advanced applications that need conformal coatings and the region's expanding number of printed circuit board (PCB) producers, the Asia-Pacific region is anticipated to dominate the conformal coatings market. Asian nations with substantial manufacturing sectors include China, India, South Korea, and others. These sectors include consumer electronics, telecommunications, automotive, and medical devices.

Increased access to affordable raw materials in nations such as India and China led to the provision of raw materials for companies within the global electronic manufacturing sector, consequently lowering the cost of the final product. Moreover, China's aviation sector has grown significantly over the past years, partly because of the country's increasing involvement in the global commercial aircraft market and the supply chains of the biggest aerospace companies in the world. This factor has boosted the need for conformal coatings in the Asia Pacific area in the aerospace sector.

The rise of the market in India is also attributed to the expansion of the production of consumer electronics, including smartphones and other white goods. The nation's expanding electronics market is anticipated to offer significant growth opportunities for market participants. India is a significant consumer of consumer electronics and has a sizable manufacturing and industrial environment. For instance, according to the report, sales of 5G smartphones increased by 74% in 2022, with Samsung leading in the sales of these devices with a 23% share compared to Xiaomi's 21% share of the entire smartphone business.

Asia Pacific is estimated as firmest budding regional market on account of huge spending in the electronics industry in China, Taiwan, South Korea and Japan that generate enormous product demand. Besides, rapid progress of the consumer electronics and automotive manufacturing industry in India is expected to fuel product demand in the region.

Europe and North America are growth marketplaces only next to Asia pacific due to high defense outlay in U.S and impending security threats. North American defense sectors stances to achieve with it being a foremost end use industry. Further, enormous growth in the U.S. is endorsed to a deep-rooted aerospace, electronics, automotive, and defense industry. Crucial companies in this region are adopting strategies such as collaboration, acquisition to attain advantage in market dynamics across the value chain.

Conformal coating is a polymer-based material coating applied in a thin layer over a printed circuit board (PCB) or other electronic components. Conformal coatings are made from various polymers, like silicone, urethane, epoxy, and acrylic. The surface of the printed circuit board can be uneven, and these coatings stick to the surface and form an insulating layer between different electronic components. These coatings also help in keeping the PCB protected from external elements like temperature, humidity, airborne contaminants, and dust. The stability and insulation provided by these coatings make them suitable for electronic applications. The rising demand for consumer electronics is boosting the growth of the conformal coatings market. These coatings are also used across various industries, such as healthcare, consumer electronics, automotive, aerospace, and defense, for various purposes.

| Report Highlights | Details |

| Market Size in 2024 | USD 1.10 Billion |

| Market Size by 2034 | USD 2.11 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.73% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Operation Method, Technology, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Rising Demand from the Aerospace Industry

The aerospace industry heavily relies on advanced electronic systems to improve aircraft performance. There is a heightened adoption of conformal coatings in the aerospace industry to protect critical aerospace components from moisture, extreme temperatures, and corrosive substances. These coatings improve the reliability and durability of electronic equipment used in aircraft, significantly improving performance and endurance in difficult situations.

Rising Conformal Coating Failure Mechanisms and Rework:

Failures of conformal coatings are always the result of either improper substance choice or improper process design. The correct application technique and conformal covering substance must be chosen. The usual issue that may arise when dispensing and fixing conformal finishes is a failure mechanism in conformal coating processing. Moreover, delamination, cracking, capillary flow, de-wetting, and other factors are the most typical sources of reworking and flaws. For instance, acrylic finishes are comparatively simple to remove with chemical solvents. On the contrary, epoxy and perylene covering are difficult to get off.

Rise in the Demand for Medical Equipment:

Several nations have experienced lockdowns because of the pandemic, forcing the closure of several manufacturing facilities. The pandemic has led to a rise in demand for medical and food packaging, while other sectors, including automotive and consumer electronics, have seen downfalls. Medical equipment and device makers are functioning to their total capacity as a result of this rising demand. Due to their effectiveness in preventing exterior chemical attacks and deterioration of electrical devices, conformally coated PCBs are used for medical uses. With healthcare facilities battling the pandemic, there is a huge demand for medical equipment and devices. As a result, there is a high demand for the machinery needed to make this equipment, which opens up lucrative opportunities for the makers of conformal coatings.

Diverse kinds of resin materials are usually utilized to formulate conformal coatings including epoxy, acrylic, silicone, polyurethane, parylene, and fluoropolymer. Among all, acrylic is predicted to record fastest growth with highest CAGR during prediction period. This progress of this material is credit to its enhanced characteristics including stress-free application, moisture resistance, and exclusion for reworking that create them favored selection for acceptance in end-use sector.

During the anticipated years, parylene coating is anticipated to grow sustainably. Many extensively used bio-medical implanted devices have been demonstrated to utilize parylene. Parylene has traditionally been useful in medical applications, strengthening and protecting a variety of equipment and systems, such as stents, elastomeric seals, mandrels, catheters, ocular implants and cochlear, and electrosurgical instruments. In addition to robotic laparoscopic devices, medical PCBs and sensors, orthopedic hardware, cochlear implants, implantable cardiac defibrillator, and pacemakers, these coatings are also employed in these devices since they are frequently used in minimally invasive and cardiovascular surgeries. For instance, as per the data, nearly 13 million laparoscopic surgeries are carried out annually worldwide. Over the subsequent years, it is predicted that these numbers will increase. Hence, there is an increase in demand for these implantable devices.

Epoxy conformal coatings own dielectric properties and are extremely resistant to solvents that are appropriate for uses in electronic devices PCBs. Further, these type of coatings are resistant and rigid to abrasion that’s why they are employed in the production of circuit boards and home appliance. Conformal coatings based on silicon have been making a mark in the marketplace with significant rate of progresses. These coatings have inferior environmental footmark and offer greater reliability. Silicon based coatings are pricier than anticipated however it their price is projected to drop to price of common conformal coatings with progressions in material expertise.

It is crucial to provide long-term protection against bodily fluids, enzymes, proteins, and lipids anytime implantable devices come into contact with the human body. To shield them from chemicals, moisture, and other potentially hazardous things, biomedical surfaces often need to be coated. Perylene is particularly effective at blocking the transfer of pollutants from the body to the substrate and from the substrate to the body because it does not out-gas.

The spray coating segment dominated the market with the largest share in 2023. This is mainly due to its increased adoption in applications that require uniform coating. The spray method is faster than other methods. Its ability to coat hard-to-reach areas and complex shapes makes it increasingly preferable. Moreover, the spray method reduces material waste.

Global conformal coatings generate revenue by demand from different end-use sectors such as automotive, consumer electronics, medical, industrial machinery & equipment, aerospace, marine, and defense among others. The consumer electronics end-use sector is probable to inflate at a speedy rate during coming years as it is a prominent user of conformal coatings. Upsurge in automotive production and intensification in requirement for automotive with innovative features are anticipated to surge the sale of conformal coatings throughout the estimate period. Need for rigid and flexible PCBs are huge in the automotive sector across globe.

PCBs are necessary to operate everyday consumer goods, including smartphones, laptops, etc. Since manufacturers are making smaller, more technologically complex smartphones and laptops, PCBs are used in all devices. To keep the cost of the finished product low, PCBs are also inexpensive when utilized for consumer electronics. To safeguard the electronic assembly during its operational life, a conformal coating is a protective nonconductive dielectric layer that is put onto the surface of the printed circuit boards (PCB) assembly.

Conformal coatings are needed to defend PCBs that are utilized in digital displays, engines, radar, mirror controls and power relay timing systems. As per statistics stated by European Automobile Manufacturers’ Association, the motor vehicles production was greater than 80 million in 2017. Requirement for automobiles with cutting-edge facilities has been increasing significantly across the world which requires PCB for functioning. This, in turn, is expected to lift the sale for conformal coatings in the automotive sector greatly.

Consumer goods like communication equipment, computers, and home appliances frequently use coated PCBs. For instance, the United States computer shipments totaled 17.8 million units in the third quarter of 2022. As people consistently returned to their offices, desktop sales growth in the US increased by 33%, and tablet sales growth remained strong at 5%. Thus, the consumer electronics segment is predicted to expand significantly during the anticipated time frame.

By Product

By Operation Method

By End-User

By Technology

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025