August 2024

Connected Cars Market (By Technology: 3G, 4G/LTE, 5G; By Connectivity Solution: Integrated, Embedded, Tethered; By Service: Driver Assistance, Safety, Entertainment, Well-being Vehicle Management, Mobility Management; By End Use: OEM, Aftermarket) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

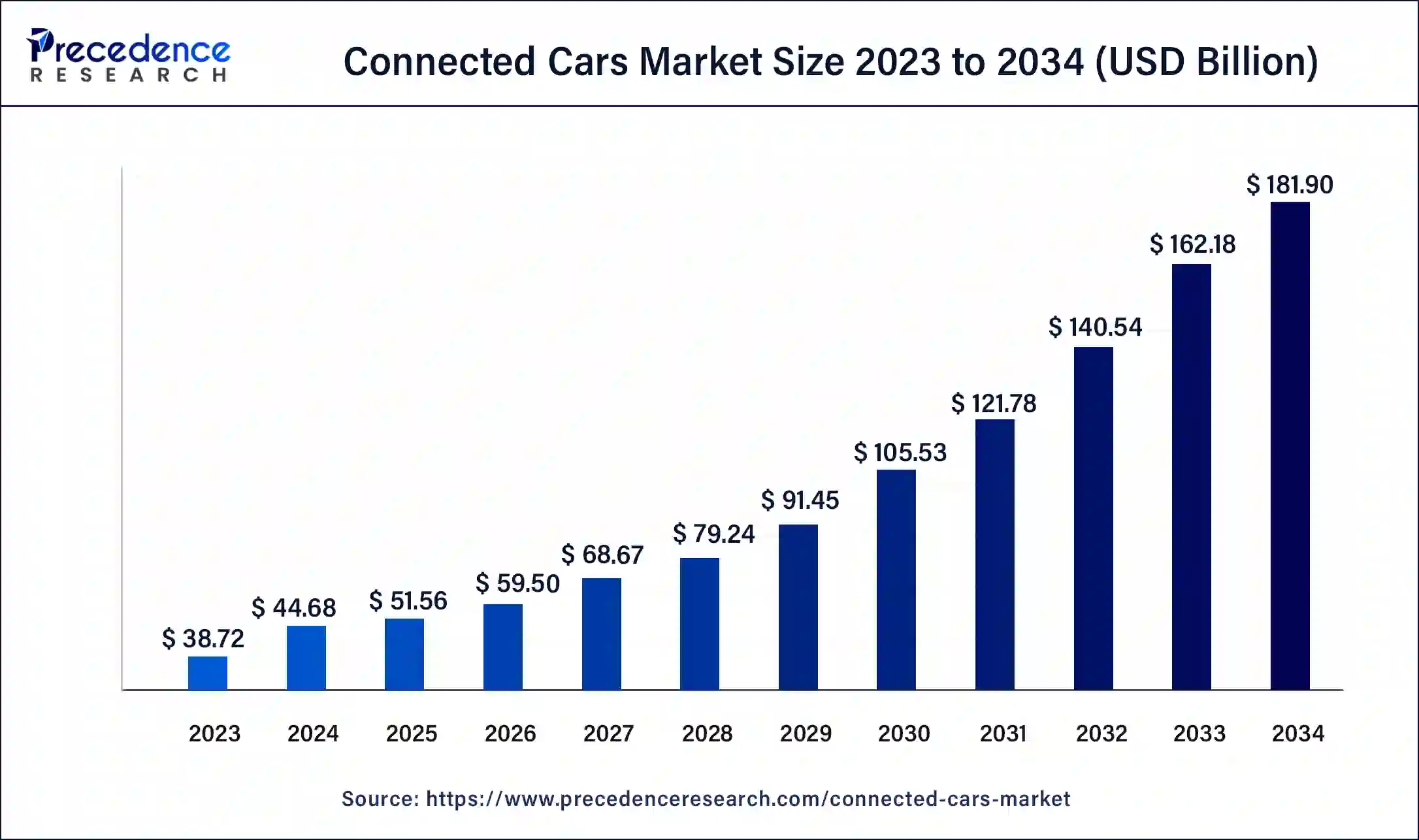

The global connected cars market size is estimated at USD 44.68 billion in 2024 and it is expected to reach around USD 181.90 billion by 2034, growing at a CAGR of 15.1% between 2024 and 2034.

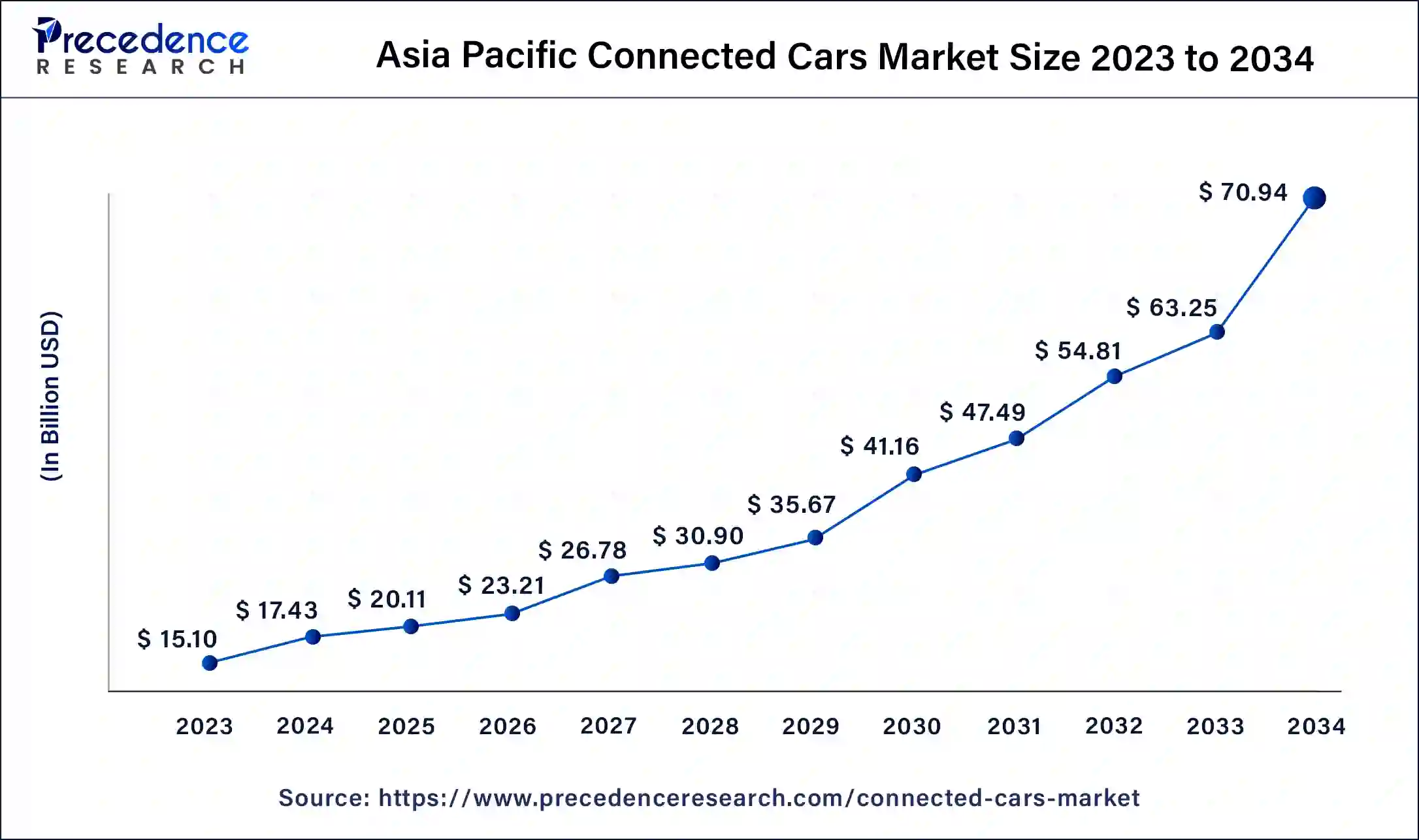

The Asia Pacific connected cars market size was valued at USD 15.10 billion in 2023 and is expected to be worth USD 70.94 billion by 2034, growing at a CAGR of 16% from 2024 to 2034.

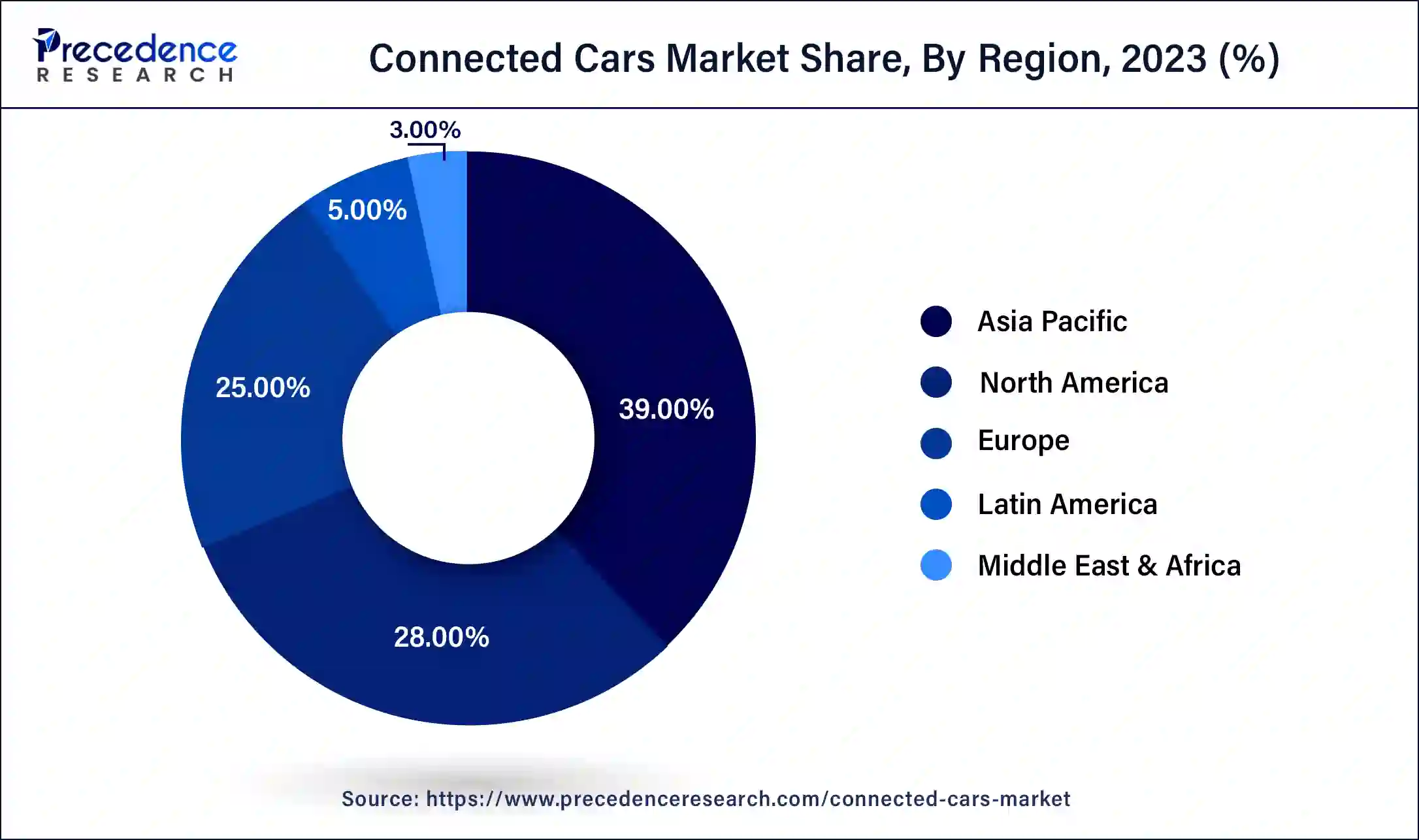

North America contributed the notable revenue in 2023. It is anticipated that the connected cars market in North America would experience significant growth as a result of the development of the connected car network. Important telecommunications companies are also making investments in the creation of connected car capabilities. The growth of connected car services in North America has been facilitated by increased vehicle production and sales. In order to provide better and more effective service, connected service providers have made significant breakthroughs, leading to the expansion of the regional market.

The second-largest region is Europe. The countries of the UK, Germany, France, Russia, Italy, and the rest of Europe make up Europe. Investment firms provide cash to top connected car developers to encourage the use of cybersecurity in these vehicles. This is done to convey data safely. To enhance the driving experience, important automakers are now introducing new autonomous, connected cars. The connected car market in Europe has grown as a result of developments made by Europe's leading corporations to provide better and more effective connected car services. Also, the introduction of advanced technologies like ADAS has made it possible for automakers to provide linked services in vehicles, resulting in the expansion of the European market.

Third, in size is the Asia-Pacific. China, Japan, India, South Korea, and the other Asian countries make up Asia-Pacific. A large number of automakers with operations in the Asia-Pacific area have created connected services, which will ultimately aid in the growth of the connected car industry in the region. Due to the cooperation of well-known connected vehicle companies and the rollout of 5G networks for connected cars, the market for connected cars is expected to grow tremendously. The development of sophisticated wireless platforms by wireless service providers for connected vehicles is another initiative that is expected to aid in the growth of the Asia-Pacific connected car industry.

Connected cars enable connectivity while providing performance, comfort, safety, and security in addition to strong network technology. The driver is able to converse in real-time by connecting to online networks in this manner. The rise in consumer demand for connectivity solutions, the surge in the need for continual connectivity, the rise in dependency on technology, and the rise in tech literacy among the populace are the main factors propelling the expansion of the global market for connected automobiles.

Machine-to-machine (M2M) communication platforms are among the connectivity solutions that automakers and service providers have developed throughout time. Its M2M functionality in a car allows two connected cars to communicate with one another. The car includes a lot of sensors and processors that provide the driver with accurate and current information.

The market is expected to grow as a result of technological advancements, higher auto production, and rising customer demand for luxury and comfort in vehicles. Also, it is anticipated that issues like the expansion of international auto rules and the high maintenance costs of contemporary suspension systems will impede the development of the connected cars sector. Nonetheless, it is projected that the industry will have a higher chance of expanding as a result of the development of enhanced suspension systems and the rise in demand for lightweight suspension systems.

The priority for automakers now is to include connectivity options in their vehicles. Modern automobiles feature a variety of connectivity options, many of which depend on an internet connection to work. In a car, connectivity can be supplied by embedded, integrated, or tethered connectivity solutions. The driver and other passengers who ride in the car can access the internet via one of these connectivity options.

With a smartphone, modem, or networking device, an in-car hotspot can be established to give Internet access to all of the gadgets inside the car. As a result, the market for connected cars is expanding due to the rising trend of connectivity solutions.

Another significant development in this market is the increased deployment of cybersecurity solutions in-car safety systems. Data has recently emerged as a crucial element in the automotive sector. The infotainment system of the automobile is linked with the user's smartphone in connected vehicles.

The user's data may include bank and medical information, which could be subject to getting hacked. To stop data from being stolen, IT behemoths like Google and Apple are creating automobile cybersecurity apps. These apps are very user-friendly, keep an eye on the security of the car, and alert the owner if a stranger logs in using other devices. For instance, DENSO and Dellfer entered into a joint development agreement to create the cybersecurity product ZeroDayGaurd 1.0 for the automotive industry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 15.1% |

| Market Size in 2023 | USD 38.72 Billion |

| Market Size in 2024 | USD 44.68 Billion |

| Market Size by 2034 | USD 181.90 Billion |

| Largest Market | North America |

| Second Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Connectivity Solution, Service, End Use, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in trend of connectivity solution to drive the global connected car market

The idea of connectivity has changed throughout time as a result of smartphones. When travelling, people want to stay connected to the outside world. Automobile manufacturers incorporate connectivity options in their vehicles to boost sales now that connectivity is a necessity. Customers anticipate that their cars will fulfil similar functions to those of personal computers and cellphones.

The incorporation of connectivity technology has been given top emphasis by automakers. Several networking technologies used in modern cars nowadays require internet access in order to function properly. Connection systems that are embedded, integrated, or tethered can enable connectivity in a vehicle. Internet access for the driver and passengers of the car is one connectivity solution. An in-car hotspot can be created using a smartphone, modem, or networking device to provide Internet connectivity to any devices within the car. As a result, the market for connected cars is growing due to the popularity of connectivity solutions.

Lack of uninterrupted & seamless internet connectivity

Keeping the consumer connected to the outside world is the primary goal of connected cars. Even when travelling, people require constant access to the internet. Customers anticipate that their cars will perform duties like to those of their computers or smartphones. Due to its inability to provide a seamless Internet connection, intermittent connectivity may serve as a barrier for the connected automobile market. This is primarily because service providers' networks are inconsistent and vary depending on the region.

Opportunity:

Intelligent transportation system to provide opportunities for the global connected car market

The data interchange between the vehicle and the driver is one of the many innovative aftermarket technologies that connected automobiles offer as part of their safety features. To increase vehicle efficiency, save fuel and maintenance costs, strengthen security and safety measures, and improve the entire driving experience for the driver, safety blends telecommunications and automobile technology. Another element of connected cars that assists the driver in choosing the best route to their destination is the driver assistance system. Also, it delivers notifications about parking availability and traffic congestion. With the help of these connected car features, intelligent transportation systems can improve the driving experience.

The market is divided into 4 categories based on technology: 3G, 4G-LTE, satellite, and 5G. Throughout the projected period, it is anticipated that the 5G sector would dominate the market. For improved communication between connected automobiles and external devices, some telecommunications firms are creating sophisticated 5G networks. The 5G Automobile Association claims that a seamless 5G network can prevent more than 60% of traffic accidents. For instance, by investing more than USD 1.5 billion, South Korea and the EU have teamed up to create a 5G network for regional initiatives. This should reduce the increasing number of traffic accidents.

Over the projected period, the satellite segment is anticipated to develop at the fastest rate. Only urban regions with mobile towers are supported by cellular and Wi-Fi networks for connected cars. The network is entirely cut off once the car departs the mobile tower's perimeter, which could be extremely problematic for the people inside connected vehicles. To solve this issue and provide continuous connectivity, numerous automobile OEMs, satellite operators, and mobile operators concentrate on creating hybrid satellite-terrestrial networks. Thus, it is anticipated that the connected automobile industry would be driven by the rising demand for satellite and 5G networks.

The market is divided into embedded, tethered, and integrated systems depending on the type of connectivity solution. During the course of the projected period, the integrated segment is anticipated to rule the market. These technologies are more affordable than embedded and tethered systems and offer limitless data sharing options. Leading OEMs from all over the world have teamed up with other important businesses to create cutting-edge integrated solutions for connected vehicles that provide users with seamless communication. For instance, Ford and Geotab collaborated to provide a telematics solution for Ford automobiles.

The embedded market segment is anticipated to hold the second-largest share. Government regulations, cloud services, and cost-optimization of service plans are all anticipated to support its dominant position in the market.

The driver assistance sector is predicted to dominate the market during the projection period, according to market forecasts. Technology-advanced features that improve the safety of the car include adaptive cruise control, lane keep assist, 360-degree cameras, park assist, etc. Globally, numerous governments have established strict safety standards for automakers. For instance, the Indian automotive sector approved the BS-VI specification in April 2020, which mandates the installation of reverse parking sensors in all vehicle categories.

The market's second-largest category is of mobility management. With the help of this system, the driver may travel the shortest distance while using the least amount of fuel. Also, it provides crucial details about hazardous weather and road conditions.

The market is divided into OEM and aftermarket segments based on the sales channel. The OEM market segment commands the biggest market share globally. Over the projection period, it is projected that rising technology advancements such as unbroken connectivity, cybersecurity, and the development of driverless vehicles linked with highly secure software will support OEMs' supremacy. An additional factor boosting the growth of the OEM industry is the expansion of partnerships with important players to create high-quality and affordable components.

Segments Covered in the Report

By Technology

By Connectivity Solution

By Service

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

November 2024

October 2024

March 2025