August 2024

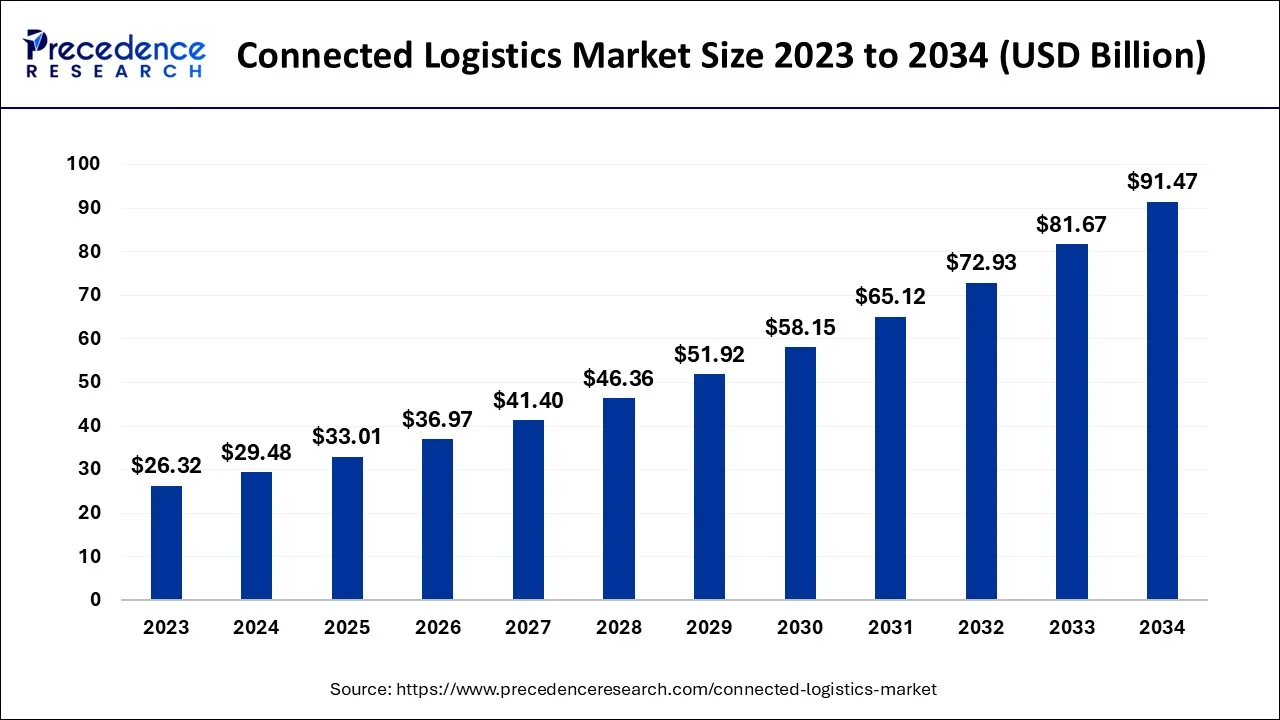

The global connected logistics market size accounted for USD 29.48 billion in 2024, grew to USD 33.01 billion in 2025 and is predicted to surpass around USD 91.47 billion by 2034, representing a healthy CAGR of 11.99% between 2024 and 2034

The global connected logistics market size is exhibited at USD 29.48 billion in 2024 and is predicted to surpass around USD 91.47 billion by 2034, growing at a CAGR of 11.99% from 2024 to 2034.

Connected logistics have changed the way logistical operations are carried out so that they are more focused on the customer's needs by sharing data, information, and facts with supply chain partners. In order to increase the productivity of logistics operations, connected logistics makes use of a network of interconnected communication systems, cloud platforms, and Internet of Things (IoT) technologies. It can also be characterised as a set of connected devices that logistics service providers use to get a better understanding of order processing, financial transactions, shipping, and other logistical processes like warehousing, transportation, and other value-added logistics services. Some of the factors driving the market's growth include the expanding use of online shopping among consumers and the advancement of technology. The demand for these solutions is being driven by the expanding availability of linked logistics systems with high interoperability, security, and accessibility characteristics.

The demand for connected logistics products and solutions is being driven by the need to lower the cost of shipping and storage services. Intelligent transportation systems are expected to become much more necessary. The target market is expected to benefit financially from the improved adoption of logistics 4.0 and ongoing efforts to enhance autonomous logistics trucks during the forecast period. One of the key factors influencing the growth of the target market is the decreasing cost of loT sensors and connected logistics hardware. However, the logistics industry's growing security and safety concerns have some limits on how far the market can grow. A competitive market, rising customer demands, and a lack of standardisation in the logistics sector are just a few of the challenges the connected logistics sector faces. However, due to the need for better integration, increased process efficiency, real-time reporting, more visibility, and improved communications, the logistics sector is increasingly adopting cutting-edge technologies. As more new cars are fitted with fleet telematics, a technology made possible by cellular IoT connectivity that gives fleet management, and operators access to data from the numerous onboard sensors, there is undeniable potential for connected logistics.

Even though cellular Internet of Things connections are rapidly growing, their full potential has yet to be realised. Through the networking of people and things, the Internet of Things improves safety, preparedness for emergencies, and route planning. Logistics companies require IoT location & route management solutions that enable real-time position tracking in order to manage transportation visibility. According to a report released by LM Ericsson in 2021, the number of IoT connections in the transportation sector alone is expected to rise from 100 million in 2020 to 292 million in 2030 as linked devices gather more data and support growth with analytics solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 29.48 Billion |

| Market Size by 2034 | USD 91.47 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.99% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Application, By Transportation Mode, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Some of the factors propelling the global connected logistics market include the rising use of cloud-based technology, as well as logistics 4.0, Bluetooth 5, and IoT, increasing demand for logistic operational effectiveness, and the widespread adoption of smart devices. The development of the internet of things (IoT) and other related technologies has led to a massive expansion in the logistics and transportation sector. Additionally, technological development has led to the creation of more accessible, clever, and improved communication tools. These devices are being used across industries, particularly in logistics and transportation, to enhance operational efficiency through good data exchange. In addition, the introduction of internet connectivity and the advancement of contemporary communication technology have led to new logistical solutions that improve the overall effectiveness of transportation services, warehouse management, and end delivery.

Connected logistics, which enables end users and logistic providers to adjust their supply chains to reduce delays and cancellations, increases the need for on-time & real-time tracking logistics services. Due to significant advancements in IoT and related technology, logistics companies are now offering linked logistics apps to track and monitor the entire supply chain in real-time using sensors & connected devices anywhere and at any time.

The market is divided into hardware, solutions, and services based on components. In 2023, the hardware segment dominated the market, and it is predicted that it will continue to do so while growing at the fastest CAGR possible. The market is further divided based on the hardware into RFID tags, sensors, communication tools, tracking tools, and others. The sensors category is anticipated to gain a sizable market share due to the rising demand for asset tracking. Furthermore, connected sensing technology based on the Internet of Things (IoT) helps to maintain temperature stability and reduce food waste while improving supply chain visibility. It is anticipated that the software segment will grow at a significant CAGR during the forecast period.

The workload planning, tracking, receiving, and inventory storage are just a few of the warehouse processes that the warehouse management software automates and optimises. Owners of cargo ships, aircraft, trucks, and other transport vehicles all over the world can take advantage of the fleet management software's extensive selection of vehicle management features. Fixed assets, inventory tools, and other significant physical assets are tracked through asset tracking and management. Data management and analytics provide solutions for enhancing and monitoring the performance of end-to-end logistics.

The services segment is expected to grow at the fastest CAGR through the forecast period. The increased demand for managed services in connected logistics is the main factor driving the market's continued growth. The main players are involved in offering services like managed services, consulting, integration and deployment, support, and maintenance. Consulting services offer advisory services that support shipping vendors by providing specialised and knowledgeable solutions.

The inventory tracking sector is anticipated to hold the largest share of the connected logistics market globally in 2023. The advantages of IoT-powered, connected inventory tracking solutions, including total visibility into inventory movement, improved accuracy, and decreased error-prone manual operations via automated scanning of inbound and outbound items, are anticipated to drive segment growth. Because it is possible to develop user-friendly web dashboards that combine various stages of supply chain management into a single app, the end-to-end delivery tracking segment is anticipated to grow at the highest CAGR during the forecast period.

In 2023, the roadways segment dominated the market in terms of transportation modes. Through the forecast period, it is expected to grow at the fastest CAGR. This is due to the growing demand for road-based transportation for long-distance retail goods delivery, particularly for the last mile. This transportation method also has a large carrying capacity, which makes it a popular option for logistics. The expansion of this market segment is also being aided by the increasing efforts made by governments around the world to promote road travel. For instance, the Indian government has implemented a national logistics policy to ease business operations and lower transportation costs. In order to cut down on fuel consumption, which is thought to be the factor that has the greatest impact on freight transport costs, the government is building a highway network from the port area to the remote site of the nation as part of this initiative.

Throughout the forecast period, the railway segment is anticipated to expand at a sizable CAGR. This method of transportation benefits intrinsically from less frictional resistance, which makes it possible to attach a heavier load to wagons or carriages. Additionally, the expansion of government programs to support rail freight is anticipated to support segment growth. For instance, the Rail Program was started by the U.S. Department of Transportation, and the government intends to increase the number of freight rail routes under this program.

Retail & e-commerce, automotive, aerospace & defence, healthcare, energy, electronics & semiconductors, and others are the market segments based on vertical. In 2023, the retail and e-commerce sectors dominated the market. The retail industry uses connected logistics solutions to meet rising business demands. IoT solutions help related logistics increase reliability, which aligns with the interests of the retail and e-commerce sectors.

Over the forecast period, it is anticipated that the automotive segment will gain a sizable market share. The automotive industry's connected logistics solutions offer real-time infographics based on the location of the vehicle, the state of the cargo, and the driver's actions. For the automotive industry, leading market participants provide specialized solutions. For instance, Alibaba Cloud offers reliable automotive management and monitoring solutions for vehicle manufacturers and goods owners to facilitate smooth, accurate vehicle monitoring.

In 2023, North America dominated the global market. The presence of a highly developed infrastructure in terms of rail and road connectivity can be attributed to the area's growth. Additionally, essential players in the sector enable the region to lead the world market in revenue contribution during the anticipated period. Modern infrastructure makes it possible for technologies to be implemented more quickly. Because of the development of new technologies, rising working capital, and the explosive growth of the e-commerce industry, the U.S. is predicted to maintain its lead over the forecast period.

Over the forecast period, the CAGR for the Asia-Pacific region is anticipated to be the fastest. In terms of investment and growth, the Asia Pacific is anticipated to have a more rapid economic growth rate than other regions and become the centre of all logistical activity. Furthermore, over the forecast period, regional growth is anticipated to be fueled by rising transportation technological advancements and investment in megacity projects. The target market is expanding quickly due to the region's booming manufacturing and e-commerce sectors. The two biggest markets in the area are China and India.

Segments Covered in the Report

By Component

By Application

By Transportation Mode

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

August 2024

January 2025