September 2024

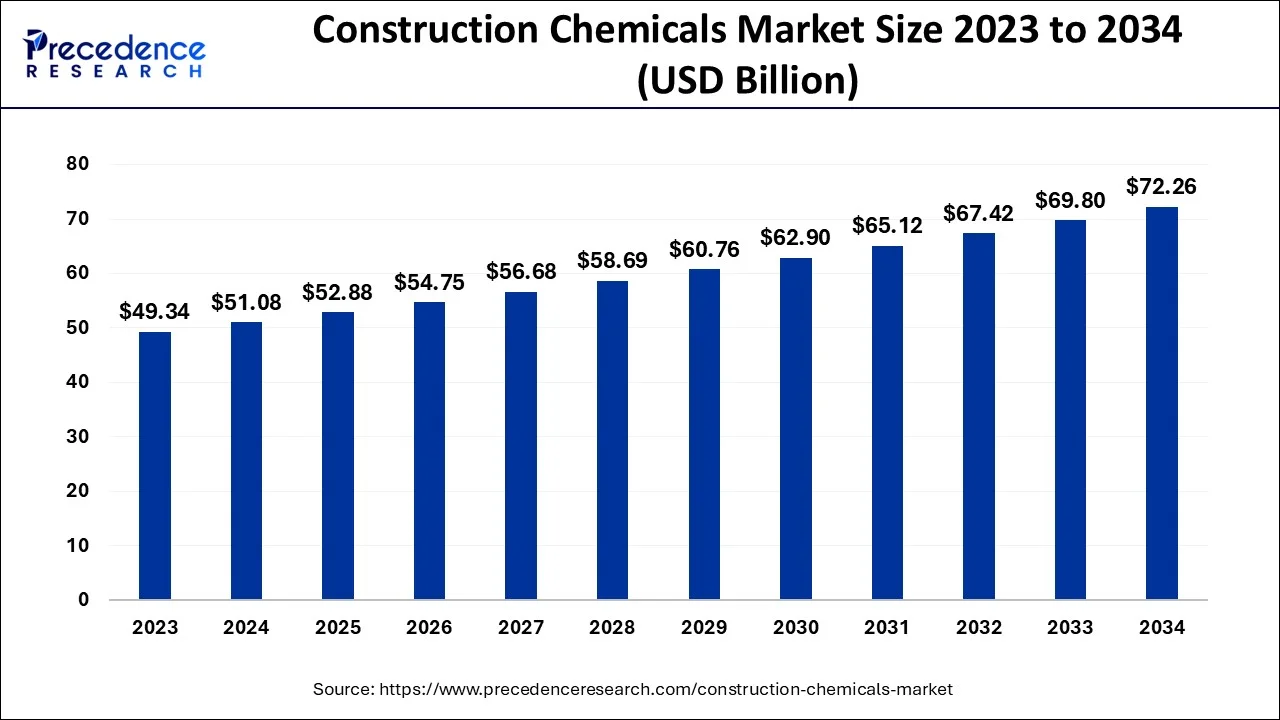

The global construction chemicals market size accounted for USD 51.08 billion in 2024, grew to USD 52.88 billion in 2025 and is predicted to surpass around USD 72.26 billion by 2034, representing a healthy CAGR of 3.53% between 2024 and 2034.

The global construction chemicals market size is estimated at USD 51.08 billion in 2024 and is anticipated to reach around USD 72.26 billion by 2034, expanding at a CAGR of 3.53% from 2024 to 2034.

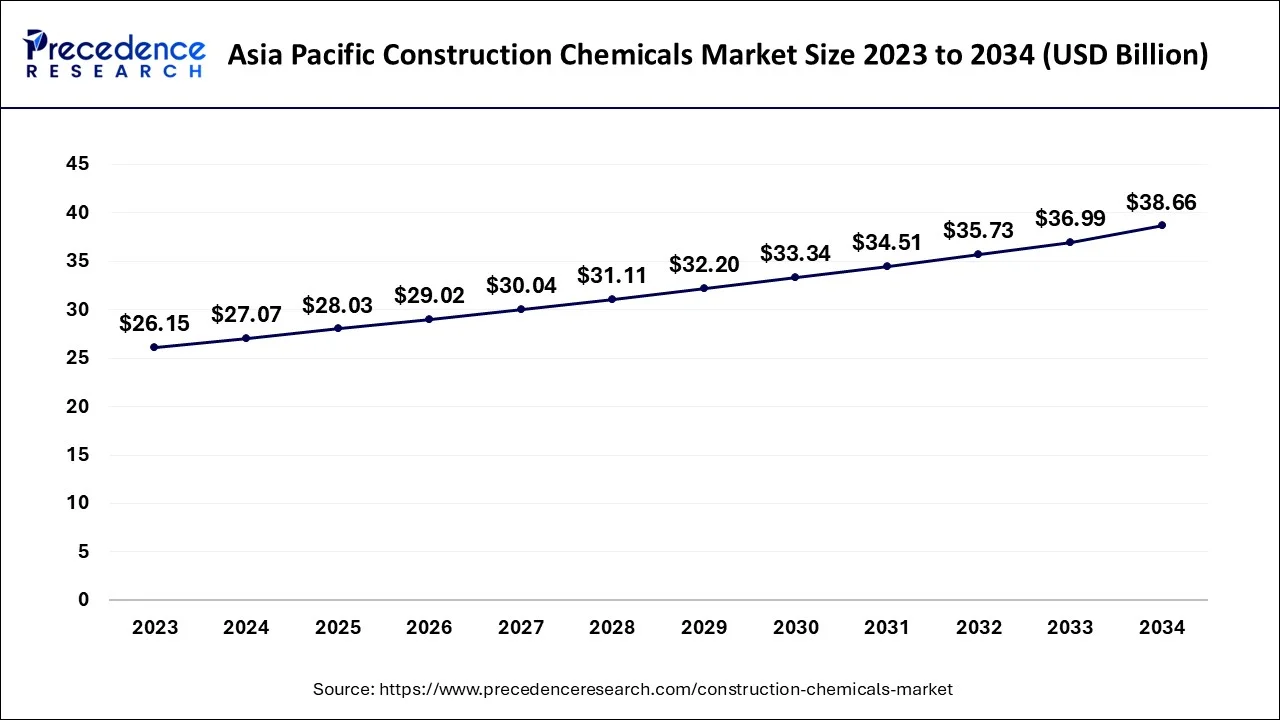

The Asia Pacific construction chemicals market size is estimated at USD 27.07 billion in 2024 and is expected to be worth around USD 38.66 billion by 2034, rising at a CAGR of 3.62% from 2024 to 2034.

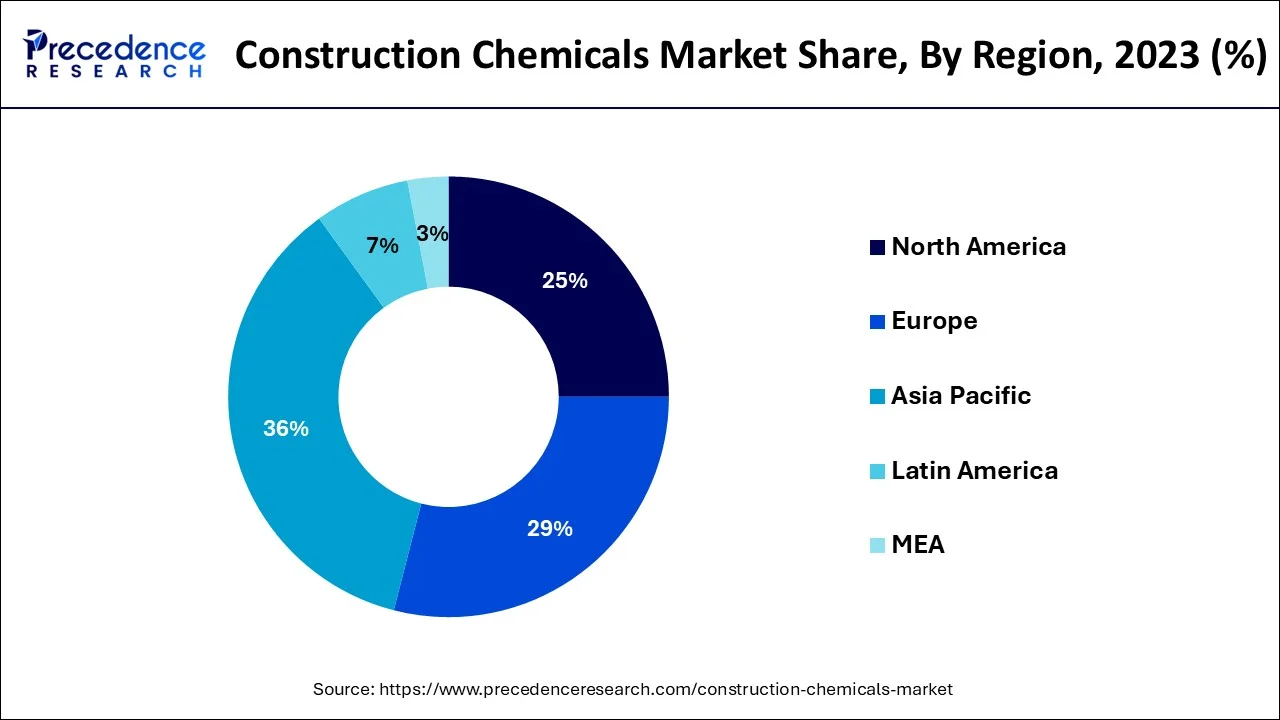

On the basis of geography, Asia-Pacific accounted for the majority of revenue share in 2023. Due to the region's rapid growth in building and government incentives to support the infrastructure sector, Asia-Pacific currently holds a monopoly on the market for construction chemicals. Additionally, the region's market growth has been helped by a thriving residential sector brought on by the region's expanding middle class. Due to the increased demand for luxury homes, the expansion of construction projects, and the best acceptance of product development in the construction sector, particularly in Asian nations like India, China, and Southeast Asia, the region has experienced significant growth. The demand for building chemicals is ultimately fueled by the fact that Asian nations like China and India have one of the greatest rates of urbanization in the entire world.

On the other hand, North America is anticipated to experience profitable growth from 2024 to 2034 as a result of the region's rising economy and strong market fundamentals for commercial real estate projects. The market for construction chemicals in this area may also grow as a result of the rising population and upcoming development projects.

Construction chemicals are chemical substances that are mixed with cement, concrete, or other building materials during construction to hold them all together. The project will be more sustainable, and the building materials will be of higher quality. Chemical compounds called construction chemicals are utilized in construction projects. They are primarily employed to speed up the procedure and provide the buildings with greater sustainability and strength. Construction chemicals are used in various building materials to improve workability, and performance, provide functionality, and preserve the fundamental or bespoke aspects of a structure during construction. The most important component of any chemical enterprise is these compounds. The environments of the entire construction sector have changed as a result of construction chemicals. Their use has increased building material quality, and as a result, they are widely used in construction projects to provide sustainability.

Cities all throughout the world are adopting programs aimed at enhancing infrastructure. More than two-thirds of the world's population is expected to reside in urban regions by 2050. The majority of these rapid increases would be seen in underdeveloped nations. In addition, areas like Africa and Asia are predicted to have the quickest rates of urban growth because they are still relatively less urbanized than other areas. By 2050, it is anticipated that Africa's urban population would increase from 40% to 56%, while Asia's urban population will increase from approximately 48% to 64%.

The demand for premix admixtures before they are employed in construction is increasing, which is driving growth in the building chemicals sector. Additionally, the diminished infrastructure durability brought on by greater rainstorms and wetted winters has led to an increase in the demand for high-quality building chemicals.

| Report Coverage | Details |

| Market Size in 2024 | USD 51.08 Billion |

| Market Size by 2034 | USD 72.26 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.53% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

On the basis of type, the concrete admixtures segment is expected to have the largest market share in 2023. In construction, cement is frequently employed as a binding agent. Concrete is made by mixing cement in precisely measured amounts with sand, water, and crushed rock. The characteristics of concrete are then enhanced by the addition of concrete admixtures. They offer advantages including a low cement-water ratio, accelerated setting time, reduced segregation, and increased permeability. The rising utilization of concrete admixtures, which is driving the expansion of the construction chemicals market, is a result of the expanding building industries in China, India, the United Kingdom, and Germany.

Chemicals used in waterproofing are intended to prevent water ingress. As a maintenance and preventative waterproofing element, waterproofing chemicals are added to concrete during the construction phase. The reconstruction of the damaged structural components is known as repair and rehabilitation. This substance consists of rust removers, anti-corrosion treatments, and epoxy-based repair mortars.

On the basis of application, the non-residential segment is expected to have the largest market share in 2023. The expansion of infrastructure development resulted in a predominance in the non-residential sector. The demand for highways, tunnels, dams, and bridges is hastening market expansion. The demand for more expensive, higher-quality public buildings is also being fueled by a high population rate and growing disposable economies, which is boosting the global market for construction chemicals.

The residential market is incredibly fragmented, and rising urbanization has led a significant portion of consumers to move into metropolitan areas. This market's expansion is anticipated to be fueled by shifting lifestyles, fast urbanization, rising living standards, and a rising desire for attractive residential constructions.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

November 2024

November 2024