August 2024

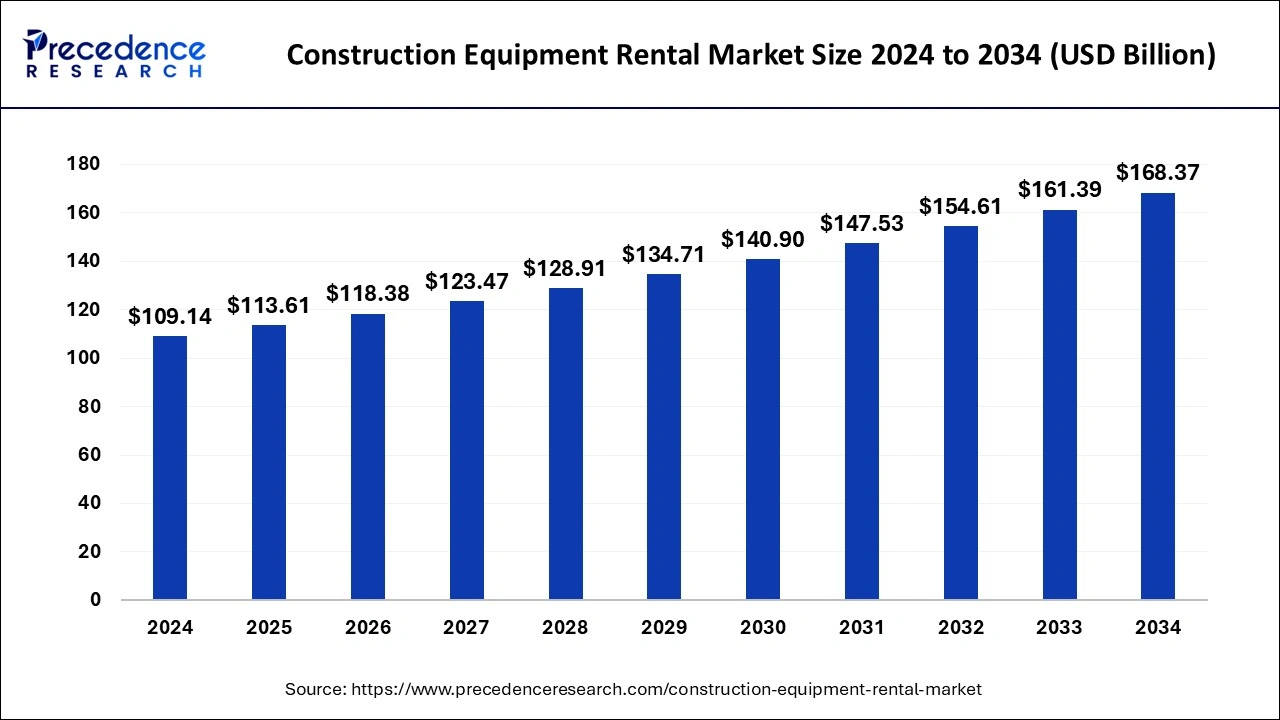

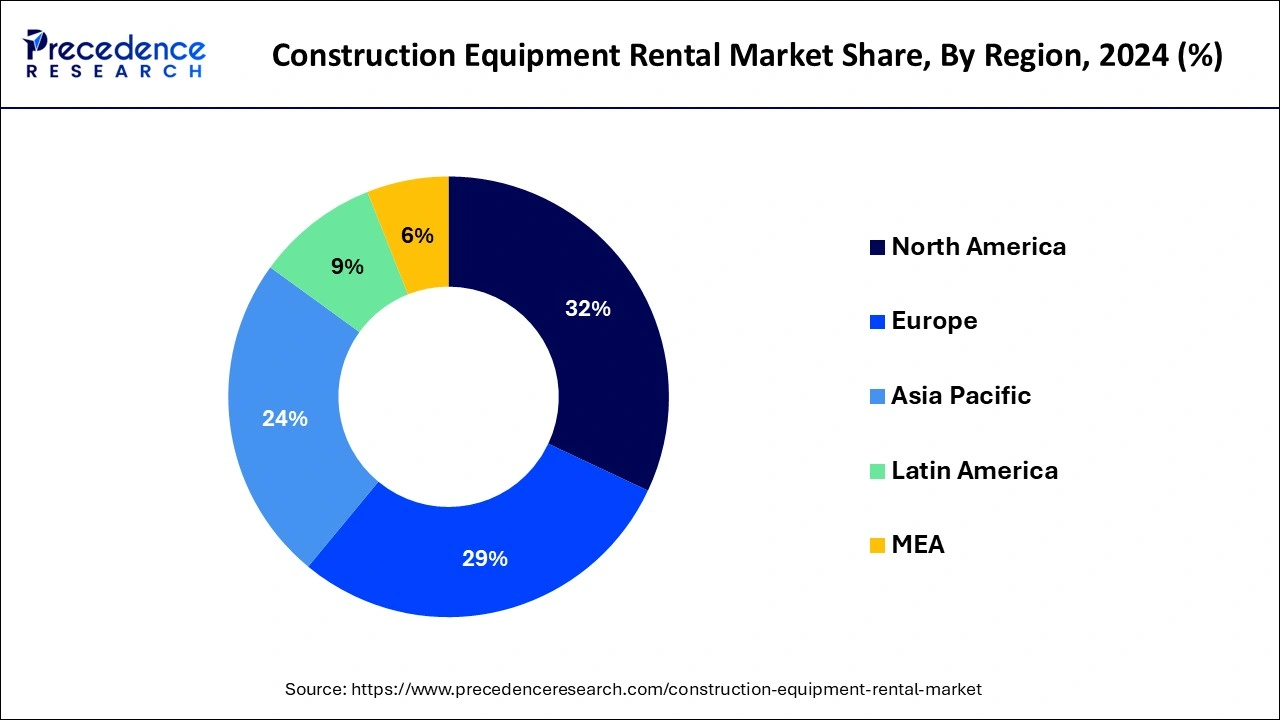

The global construction equipment rental market size is calculated at USD 113.61 billion in 2025 and is forecasted to reach around USD 168.37 billion by 2034, accelerating at a CAGR of 4.43% from 2025 to 2034. The North America construction equipment rental market size surpassed USD 34.92 billion in 2024 and is expanding at a CAGR of 4.59% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global construction equipment rental market size was valued at USD 109.14 billion in 2024 and anticipated reach around USD 168.37 billion by 2034, groeing at a CAGR of around 4.43% from 2025 to 2034.

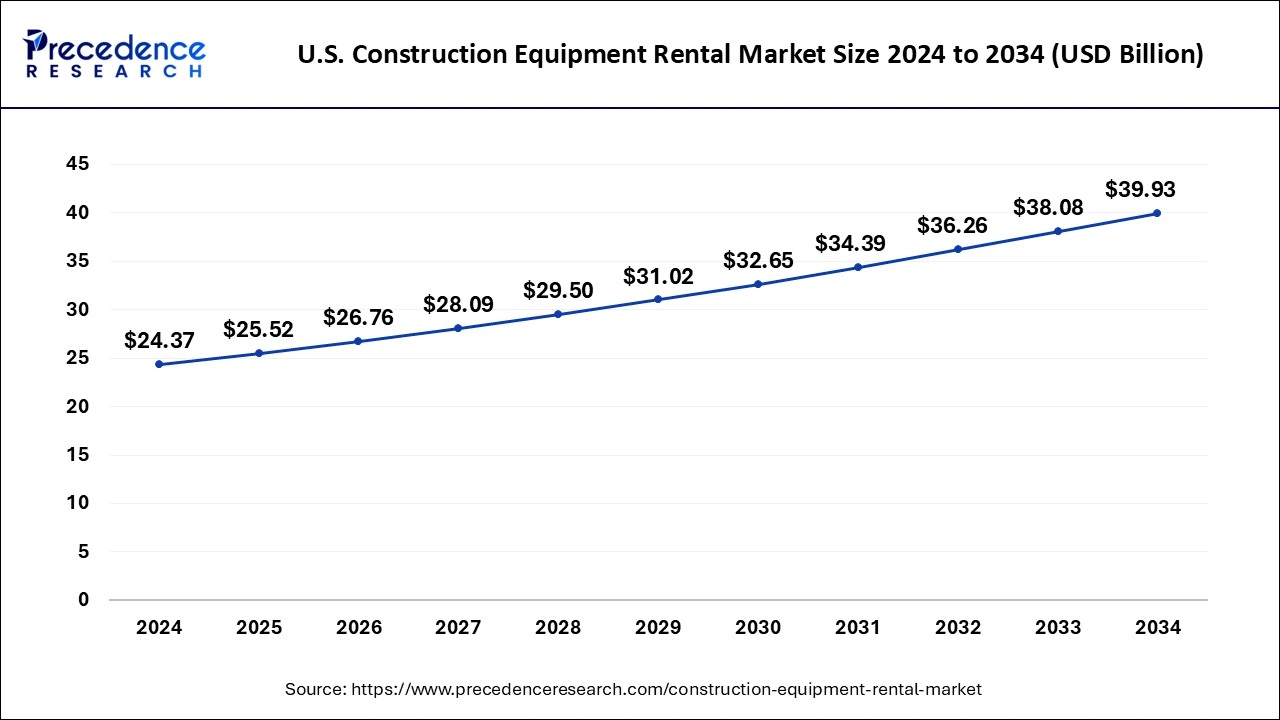

The U.S. construction equipment rental market size was estimated at USD 24.37 billion in 2024 and is predicted to be worth around USD 39.93 billion by 2034, at a CAGR of 5.06% from 2025 to 2034.

North America holds the largest share in Construction Equipment Rental Market. For many construction enterprises, renting construction equipment can be more economical than buying new machinery outright. They can now access a large variety of equipment without having to worry about upkeep, storage, or depreciation. Renting offers flexibility, making it simple for businesses to scale their equipment requirements in accordance with project specifications. This is especially helpful for smaller businesses or those with varying workloads. Typically, rental businesses provide support and maintenance services to keep equipment in working order and reduce downtime for building projects. North America has a competitive rental market with several providers providing a variety of equipment alternatives. Competitive pricing and better client services are frequently the results of this competition.

Constant improvements in the infrastructure industry along with a diverse range of cutting-edge construction equipment in rental fleets are anticipated to spur the demand for the construction equipment rentals services across the globe. Corporations in the construction equipment rental market are skillful in identifying consumers and accordingly reposition construction equipment to diverse locations to control swelling requirement from real estate sector in residential and commercial areas. Furthermore, stringent guidelines, cumulative ownership price and financial restraints are some of the important motives stimulating the growth of global construction equipment rental market. On the other hand, unstable fuel prices and spending of delivering and picking up machinery, specifically if the contractor is working in inaccessible areas may impede demand in the construction equipment rental market during years to come.

Technological progressions in heavy machinery and automotive industry have carried out numerous new-fangled features in the construction equipment rental market. Construction equipment manufacturers are strongly concentrating on integrating cutting-edge safety features including 360-degree camera visual, lift assist, and supplementary work lights and also striving to offer systems that increase operational productivity and need minor maintenance. Nevertheless, these features come at a great cost, which is not reasonable to numerous small contractors and builders. Due to these factors, professionals are more inclined towards rental construction machinery.

| Report Highlights | Details |

| Market Size in 2025 | USD 113.61 Billion |

| Market Size by 2034 | USD 168.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.43% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Access to latest technology

Telematics systems, which enable remote monitoring of usage, fuel consumption, maintenance schedules, and even location tracking, are being integrated by numerous rental firms into their equipment. Construction projects are using automation technology like drones, self-driving cars, and GPS-guided machinery more and more. These elements are being offered by rental firms as equipment to increase productivity, safety, and accuracy on construction sites. Manufacturers of equipment are producing lighter, more robust, and energy-efficient machinery by utilizing improved materials and production procedures. Rental equipment is being equipped with predictive maintenance algorithms to foresee and stop malfunctions before they happen. Rental companies can reduce downtime and repair costs by scheduling maintenance proactively and monitoring equipment health in real-time.

Restraint:

Maintenance and Downtime

In the market for renting construction equipment, maintenance and downtime are vital factors. Reducing downtime is crucial for rental companies to increase revenue and satisfy clients. Preventive maintenance procedures are generally used by rental firms to ensure that their equipment remains in optimal condition. In order to spot such problems early on and resolve them before they become more serious and result in downtime, routine inspections, service, and repairs are planned. Breakdowns can still happen even with precautions taken. For rental companies to react swiftly to equipment issues, they must have effective mechanisms in place. This entails having knowledgeable personnel on hand for on-site repairs or quickly delivering replacement equipment to reduce interference with the client's project.

Opportunity:

Service Offerings and Value-added Solutions

In order to guarantee that the equipment is in top operating condition throughout the duration of the rental, rental companies frequently provide maintenance services. This can involve routine examinations, fixes, and replacements as necessary. To guarantee the equipment operates safely and effectively, several construction equipment rental businesses offer their clients training courses. Online resources, user manuals, and on-site instruction are a few examples of this. Remote monitoring of usage, performance, and maintenance requirements is made possible by the integration of telematics and other technologies into rental equipment. Since sustainability is becoming more and more important, rental companies might provide eco-friendly equipment or adopt eco-friendly procedures like fuel efficiency optimization and emissions monitoring.

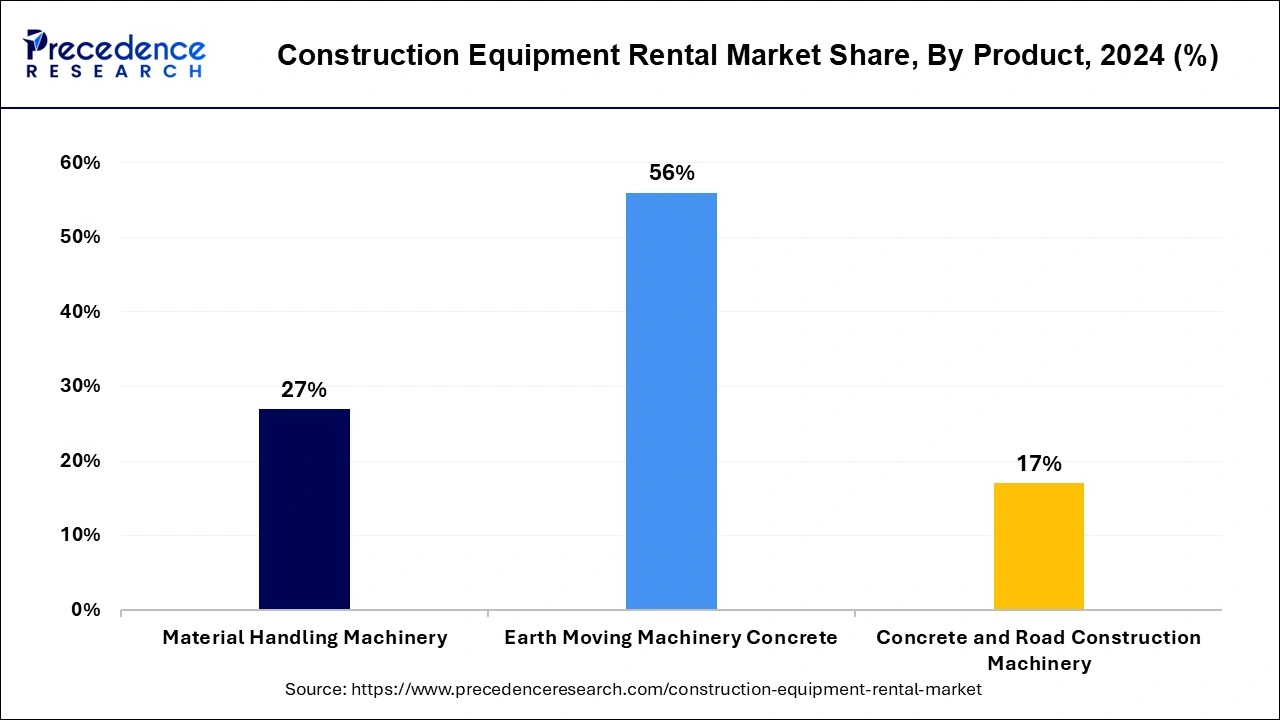

Global construction equipment rental market can be classified on the basis of product into material handling machinery, earthmoving machinery, and concrete and road construction machinery. Out of these different products contributing in market growth, earthmoving machinery led the global construction equipment rental market in 2023. Nevertheless, the concrete and road construction machinery segment is also projected to display the utmost growth rate during the assessment period. The earthmoving machinery including excavators experiences huge demand across the globe due to its widespread application scope in mining, agriculture and construction industries. Other equipment in this category includes mini excavators, backhoe loaders, crawler excavators, and skid-steer loaders that also possess eye-catching market potential. These provide high load capability and engine power, which allow them to operate competently in harsh circumstances.

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

February 2025

January 2025