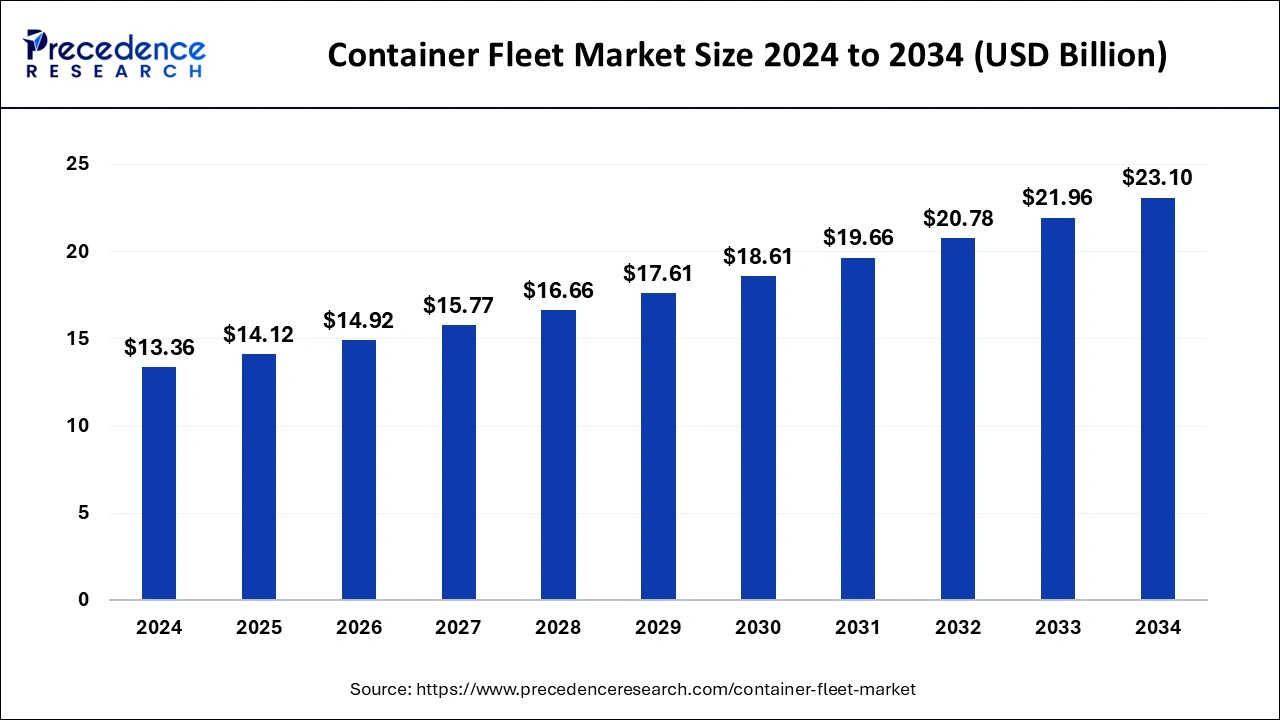

The global container fleet market size is accounted at USD 14.12 billion in 2025 and is forecasted to hit around USD 23.10 billion by 2034, representing a CAGR of 5.63% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global container fleet market size was calculated at USD 13.36 billion in 2024 and is predicted to increase from USD 14.12 billion in 2025 to approximately USD 23.10 billion by 2034, expanding at a CAGR of 5.63% from 2025 to 2034.

A container fleet refers to a collection of standardized containers used for shipping goods by sea. The container fleet plays a crucial role in global trade and allows the efficient movement of goods between producers and consumers worldwide. These containers are generally made of steel, come in standardized sizes, and enable seamless transporting of goods. Container fleet finds various applications in mining and minerals, automotive, oil, gas, and chemicals, food and agriculture, retail, and other industries. The market is experiencing the rising use of fleet management techniques to reduce risk, track the fleet, improve operational productivity, and control expenses.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.63% |

| Market Size in 2025 | USD 14.12 Billion |

| Market Size in 2024 | USD 13.36 Billion |

| Market Size by 2034 | USD 23.10 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid growth in global trade

The expansion of global trade is expected to propel the growth of the container fleet market during the forecast period. The rise in international trade volumes driven by globalization, economic growth, and the robust growth of e-commerce is anticipated to accelerate the demand for containerized shipping services. The rise of trade agreements between different countries, which require reliable shipping solutions to transport goods across borders is also likely to stimulate the growth of container fleet activities. Containerization can standardize cargo transport and enable seamless handling across various modes of transportation. In addition, the tank container industry has grown significantly to the rising global demand for bulk liquid and liquified gas transport.

High cost

The high cost is projected to hamper the growth of the container fleet market. The high capital investment involved with these containers often results in lower export and import activities. The high cost is involved in manufacturing, maintaining, and upgrading shipping containers. In addition, stringent government regulations are likely to limit the expansion of the global container fleet market during the forecast period.

Advancement in technology

The continuous advancements in technology are projected to offer a lucrative opportunity for the growth of the container fleet market during the forecast period. Ensuring containers are in the right place at the right time to meet customer demands and optimizing routes to minimize empty container movements increases the need to deploy advanced technology including GPS tracking, smart IoT sensors, and data analytics, which has significantly assisted in effective management of container fleets, and facilitating firms to track containers in real-time, improving safety, predict maintenance needs, and optimize routes.

The dry containers segment accounted for the dominating share in the container fleet market in 2024. Dry container is a freight container that is enclosed and weatherproof, with a rigid roof, side walls, and floor. It is well suited for the transport of a large variation of cargoes. Dry containers facilitate the transportation of a wide range of dry cargo which includes electronics, textiles, and manufactured goods. Dry containers are most commonly used to transport different types of dry goods and they are packed in cartons, cases, bags, boxes, bales, pallets, and others.

The reefer containers segment is expected to witness a significant share during the forecast period. Reefer containers are ideal and are used for goods that require to be temperature-controlled during shipping. Reefer containers are equipped with an advanced refrigeration unit that is connected to the power supply on board the ship. All standard reefer containers are built to maintain a temperature between +25° C and -25° C for chilled and frozen cargo. Fresh fruits and vegetables, milk and dairy products, meat, fish (frozen or fresh), pharmaceuticals, juice, chocolate, and others are most commonly transported in refrigerated containers. They are engineered to maintain the humidity, temperature, and atmosphere of the container at a constant value during the whole transit period. Such factors boost the segment’s growth.

The oil and gas segment held the largest share of the container fleet market in 2024 owing to the increasing applications of the oil and gas industry. Containers are extensively used for transporting oil and gases across cross border. Specialized tank containers are used for transporting expensive chemicals, liquid petroleum products, and gases safely across different regions. On the other hand, the food segment is expected to grow fastest during the forecast period. Containers are employed for transporting perishable and non-perishable food products such as vegetables, fruits, meat, poultry, seafood, grains, beverages, packaged goods, and dairy products. Reefer containers are best suited for transporting food products as it is designed to maintain consistent temperature and humidity levels to preserve the freshness and quality of food products throughout the journey.

Asia Pacific held the dominant share of the container fleet market in 2024. The region is observed to witness prolific growth during the forecast period. Factors such as rapid infrastructure development at ports, increasing demand for cargo transportation, globalization of supply chains, stringent rules and reforms of government associations about shipment procedures, the introduction of larger vessels and mega container ships, technological innovation, high demand for intermodal transportation, and economic growth in emerging markets are expected to contribute towards the growth of the market in the region.

The rise in refrigerated cargo containers is anticipated to boost the growth of the container fleet market in the region due to the increasing demand for transporting fruits, meat, medicines, and fresh vegetables, as well as maintaining their temperature to reduce the risk of damage. Additionally, the rising industrial activities have enhanced significant operations across retail, oil and chemicals, automobile, agriculture, mining, and other industries, which has propelled the demand for the container fleet.

North America is observed to expand at a rapid pace during the forecast period. The growth of the region is attributed to the rise in global trade, increasing investment in infrastructure development, rapid urbanization, adoption of advanced technology, an increase in intermodal freight transportation, and growing demand for refrigerated sea transportation. The United States and Canada are the economic powerhouses of the region. The rising activities of the automotive and oil and gas sectors usually have a high dependency on containerized transportation for facilitating smooth international and domestic trade.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client