January 2025

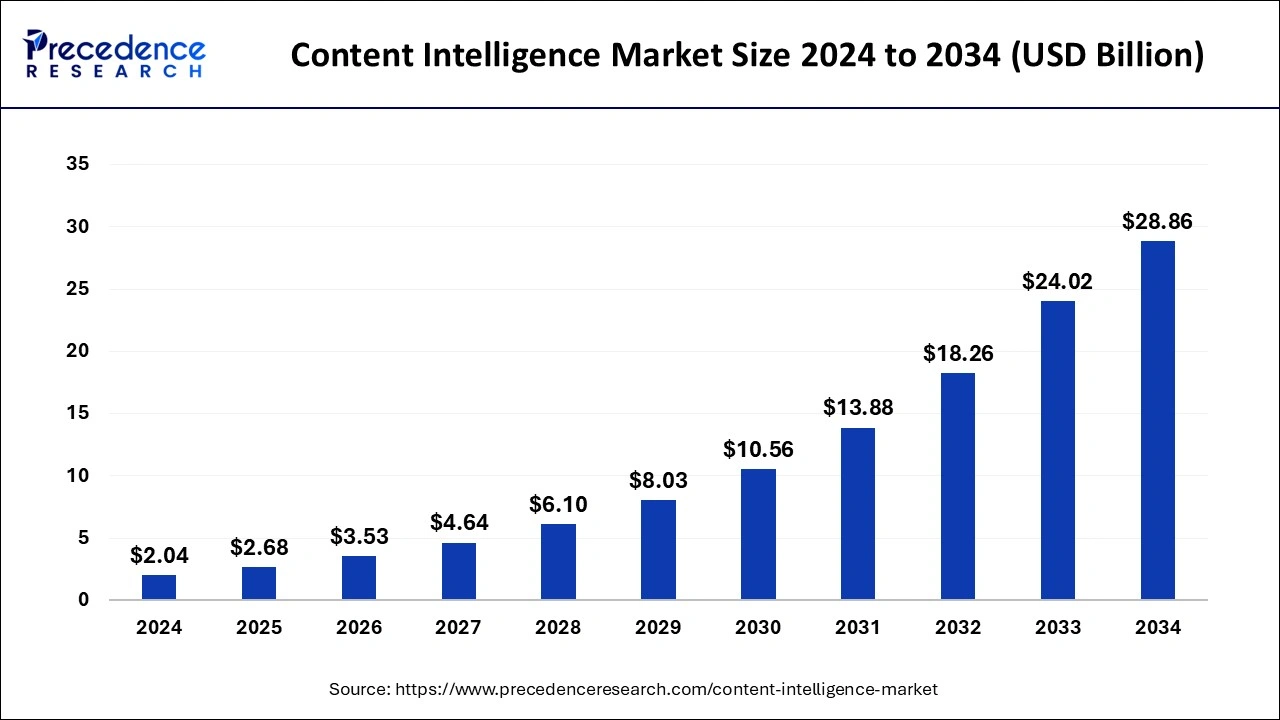

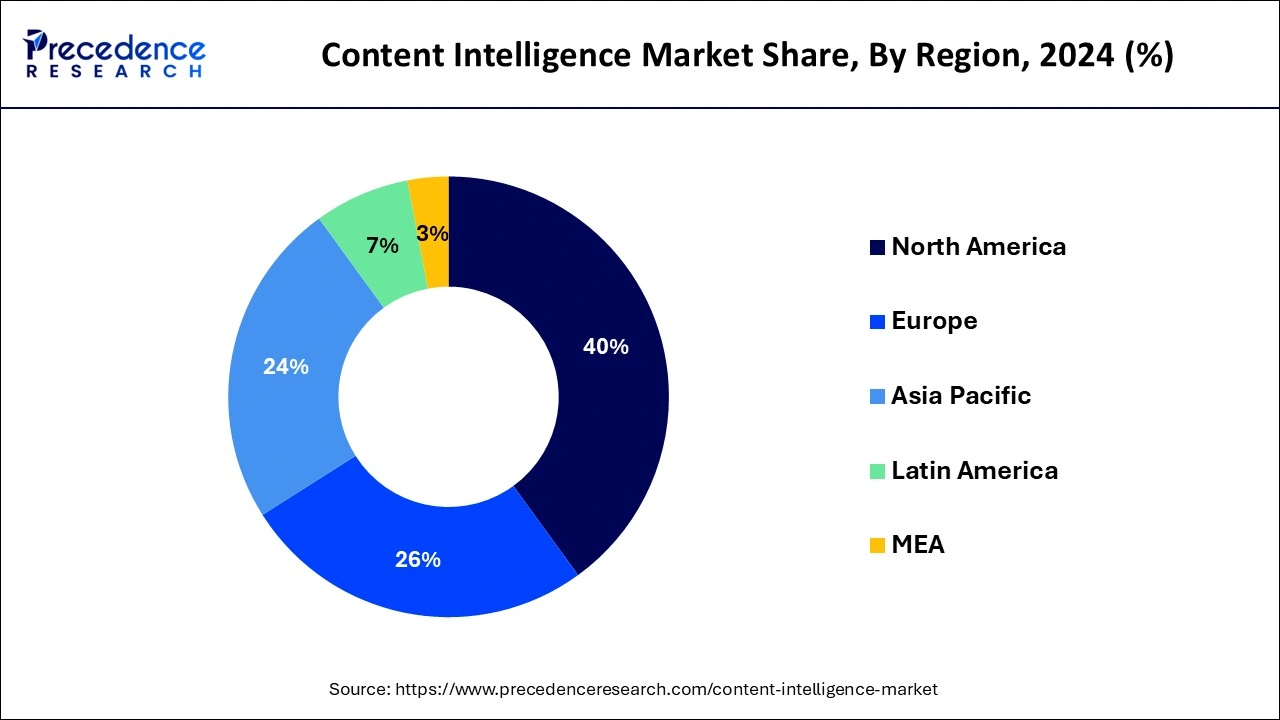

The global content intelligence market size is calculated at USD 2.68 billion in 2025 and is forecasted to reach around USD 28.86 billion by 2034, accelerating at a CAGR of ccc% from 2025 to 2034. The North America content intelligence market size surpassed USD 820 million in 2024 and is expanding at a CAGR of 30.37% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global content intelligence market size was estimated at USD 2.04 billion in 2024 and is predicted to increase from USD 2.68 billion in 2025 to approximately USD 28.86 billion by 2034, expanding at a CAGR of 30.34% from 2025 to 2034.

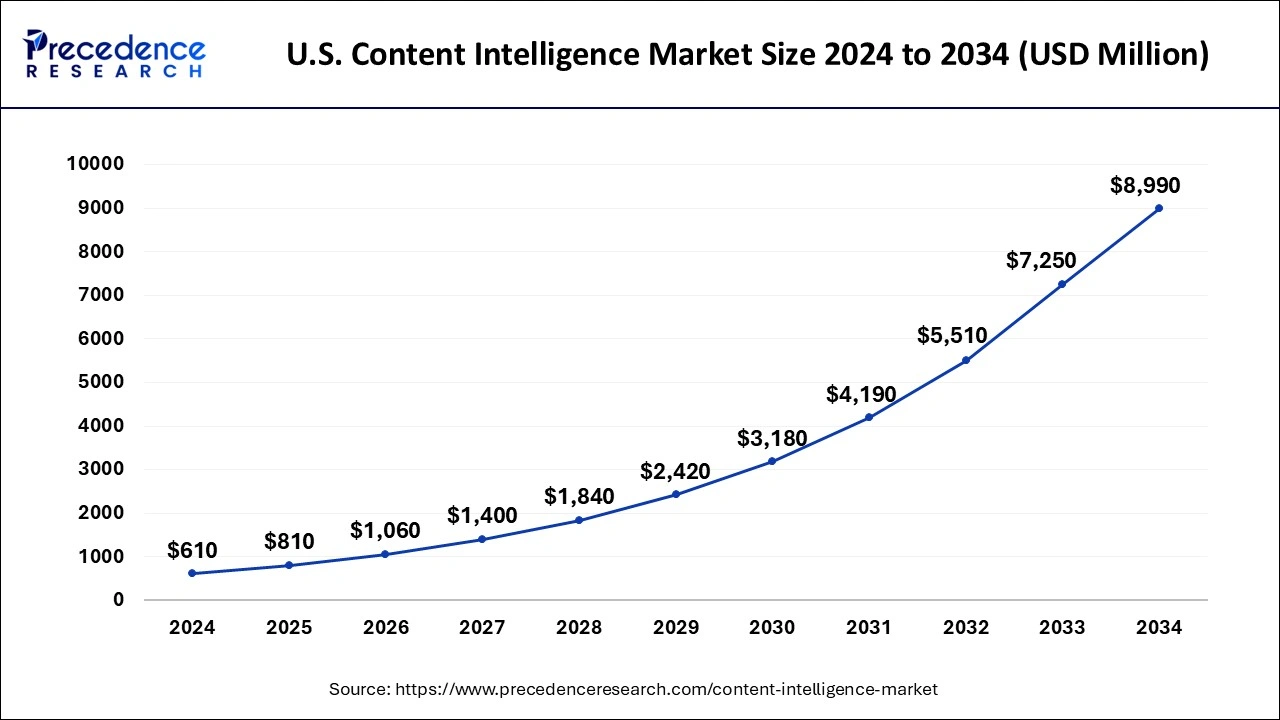

The U.S. content intelligence market size was estimated at USD 610 million in 2024 and is projected to surpass around USD 8,990 million by 2034 at a CAGR of 30.87% from 2025 to 2034.

North America has held the major market share of 40% in 2024, due to several factors. The region boasts a mature digital infrastructure, widespread adoption of advanced technologies, and a large base of tech-savvy consumers. Moreover, North American businesses prioritize innovation and invest heavily in data analytics and AI solutions, driving the demand for content intelligence tools. Additionally, the presence of key market players and a thriving startup ecosystem contribute to North America's dominance in the content intelligence market.

Asia-Pacific is witnessing rapid growth in the content intelligence market due to several factors. Increasing internet penetration and smartphone adoption have expanded the digital footprint, leading to a surge in online content consumption. Additionally, rising demand for personalized digital experiences and advancements in artificial intelligence and data analytics are driving the adoption of content intelligence solutions. Furthermore, the region's burgeoning e-commerce sector and evolving regulatory landscape present significant opportunities for content intelligence providers, fostering further growth in the market.

Meanwhile, Europe is witnessing significant growth in the content intelligence market due to several factors. The region's businesses are increasingly adopting digital transformation strategies, driving the demand for content intelligence solutions to optimize their online presence and engage with customers effectively. Moreover, stringent data privacy regulations, such as GDPR, have led companies to invest in compliant content intelligence tools. Additionally, the rise of e-commerce and the increasing focus on personalized customer experiences are further fueling the adoption of content intelligence technologies across Europe.

Content intelligence refers to the technology and processes used to gather insights and understanding from digital content. It involves analyzing data from various content sources such as websites, social media, and documents to derive valuable insights. This includes understanding audience preferences, identifying trends, and optimizing content for better engagement and effectiveness. Through content intelligence, businesses can make informed decisions about their content strategy, ensuring that the content they produce resonates with their target audience and achieves their goals. By leveraging data analytics, artificial intelligence, and natural language processing, content intelligence helps organizations create more personalized and relevant content, ultimately driving better results and enhancing the overall customer experience.

Content Intelligence Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 30.34% |

| Market Size in 2025 | USD 2.68 Billion |

| Market Size by 2034 | USD 28.86 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for personalized content experiences

The rising demand for personalized content experiences is a major driver fueling the growth of the content intelligence market. People today expect content tailored to their specific interests and preferences, whether they are browsing social media, shopping online, or consuming news articles. This demand for personalized content has surged as consumers seek more relevant and engaging experiences. Content intelligence helps businesses meet this demand by providing insights into audience behavior, preferences, and demographics.

By analyzing data from various sources, such as website interactions, social media engagement, and past purchasing behavior, content intelligence enables organizations to create and deliver personalized content at scale. This not only enhances customer satisfaction but also improves engagement and conversion rates. As businesses recognize the value of delivering personalized content experiences, the demand for content intelligence solutions continues to grow, driving innovation and investment in the content intelligence market.

Difficulty in accurately measuring ROI and demonstrating value

The difficulty in accurately measuring ROI and demonstrating value poses a significant restraint on the demand for content intelligence solutions. Businesses need to justify their investments in content intelligence by showing tangible returns, such as increased market, improved customer engagement, or cost savings. However, accurately quantifying the impact of content intelligence on these metrics can be challenging. Without clear evidence of the value generated by content intelligence, businesses may hesitate to invest in these solutions or allocate limited resources to their implementation and maintenance. This uncertainty can hinder the widespread adoption of content intelligence across industries, slowing down market growth.

Additionally, the inability to demonstrate ROI may lead to skepticism among stakeholders, further dampening demand for content intelligence tools. Therefore, addressing the challenge of measuring and proving the value of content intelligence is crucial for overcoming this restraint and driving broader adoption in the market.

Offering subscription-based and scalable content intelligence solutions

Offering subscription-based and scalable content intelligence solutions presents significant opportunities in the market. Subscription-based models allow businesses to access content intelligence tools without large upfront costs, making them more accessible to organizations of all sizes, including small and medium-sized enterprises (SMEs) and startups. This flexibility encourages wider adoption of content intelligence solutions across various industries, driving market growth. Scalable solutions enable businesses to adjust their usage and capabilities according to their evolving needs, ensuring efficient resource allocation and cost-effectiveness.

This scalability appeals to enterprises experiencing fluctuating content volumes or those looking to expand their content operations. By offering subscription-based and scalable options, content intelligence providers can attract a broader customer base and establish long-term relationships, leading to increased market share and market. Moreover, this approach fosters innovation as providers strive to continually improve their offerings to meet the diverse needs of their subscribers.

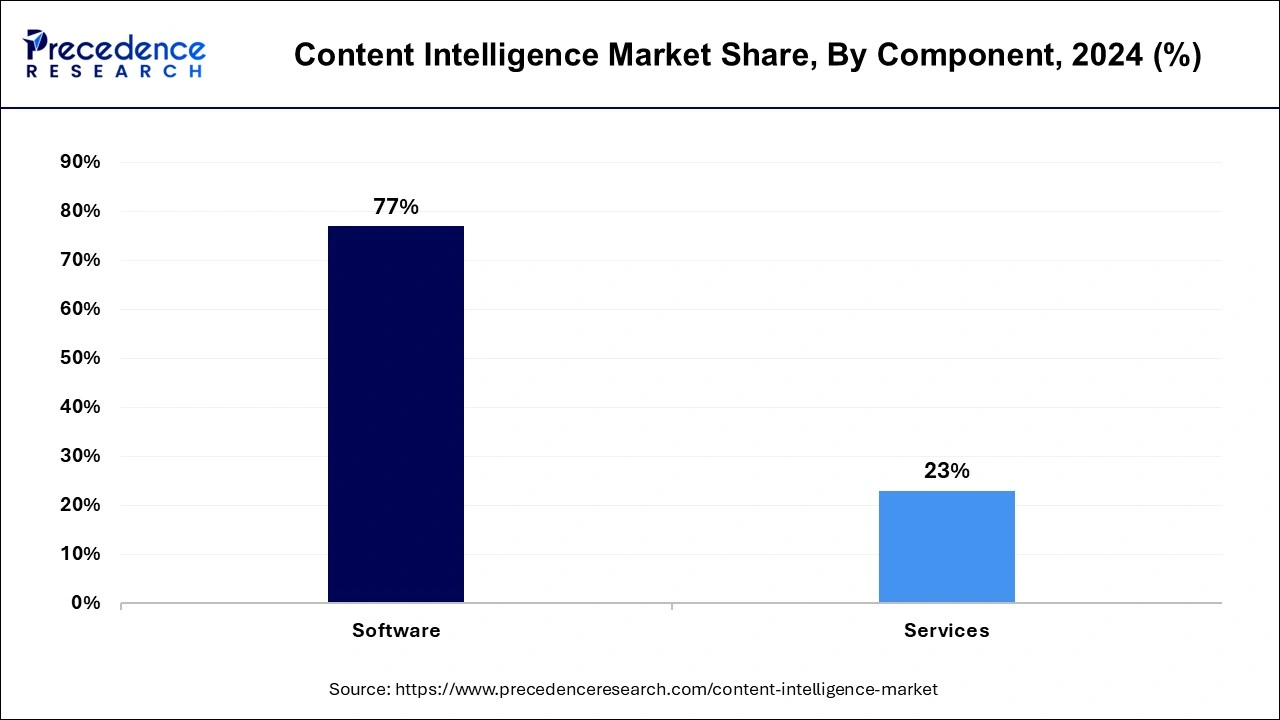

The software segment has held the largest market share of 77% in 2024. In the content intelligence market, the software segment encompasses the various applications and platforms used for analyzing and extracting insights from digital content. This includes content management systems, data analytics tools, artificial intelligence algorithms, and natural language processing software. Trends in this segment involve the integration of advanced AI and machine learning capabilities to automate content analysis, enhance personalization, and improve content optimization. Additionally, there is a focus on developing user-friendly interfaces and scalable solutions to cater to the diverse needs of businesses across industries.

The service segment is anticipated to witness rapid growth at a significant CAGR during the projected period. The service segment in the content intelligence market encompasses a range of offerings aimed at supporting the implementation, integration, and maintenance of content intelligence solutions. Services may include consulting, training, support, and managed services. Trends in this segment include a growing demand for consulting services to develop content intelligence strategies, as well as increased interest in managed services for ongoing support and optimization. Providers are also focusing on offering specialized training programs to enhance user proficiency and maximize the value of content intelligence investments.

The large enterprises segment held a 70% market share in 2024. Large enterprises, typically characterized by extensive resources and complex content ecosystems, form a significant segment in the content intelligence market. Trends indicate a growing focus on integrating content intelligence solutions into large-scale operations to optimize content creation, distribution, and engagement strategies. These enterprises seek comprehensive and scalable content intelligence platforms capable of handling vast amounts of data and providing actionable insights to enhance customer experiences and drive business growth.

The SMEs segment is anticipated to witness rapid growth over the projected period. Small and Medium-sized Enterprises (SMEs) typically comprise businesses with fewer than 250 employees. In the content intelligence market, SMEs are increasingly adopting scalable and cost-effective solutions, such as subscription-based models. These businesses often have limited resources and budgets but recognize the importance of leveraging data insights for content optimization. As a result, content intelligence providers are tailoring their offerings to cater to the specific needs and constraints of SMEs, driving growth in this segment.

The media & entertainment segment has held a 24% market share in 2024. In the content intelligence market, the media and entertainment segment focuses on providing insights and analytics tailored to the needs of media companies, broadcasters, and entertainment platforms. This segment analyzes audience behavior, content preferences, and engagement metrics to optimize content creation, distribution, and monetization strategies. Trends in this segment include the adoption of AI-driven content recommendation systems, personalized content experiences, real-time audience insights, and the integration of content intelligence tools into digital platforms to enhance viewer engagement and satisfaction.

The retail and consumer goods segment is anticipated to witness rapid growth over the projected period. In the content intelligence market, the retail and consumer goods segment refer to businesses operating in the retail industry and manufacturing consumer goods. This segment focuses on analyzing consumer behavior, preferences, and market trends to optimize content strategies. Trends in this segment include personalized product recommendations, targeted advertising, and real-time inventory management. Retailers are leveraging content intelligence to enhance customer experiences, drive sales, and stay competitive in the dynamic retail landscape.

By Component

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

July 2024

March 2025