August 2024

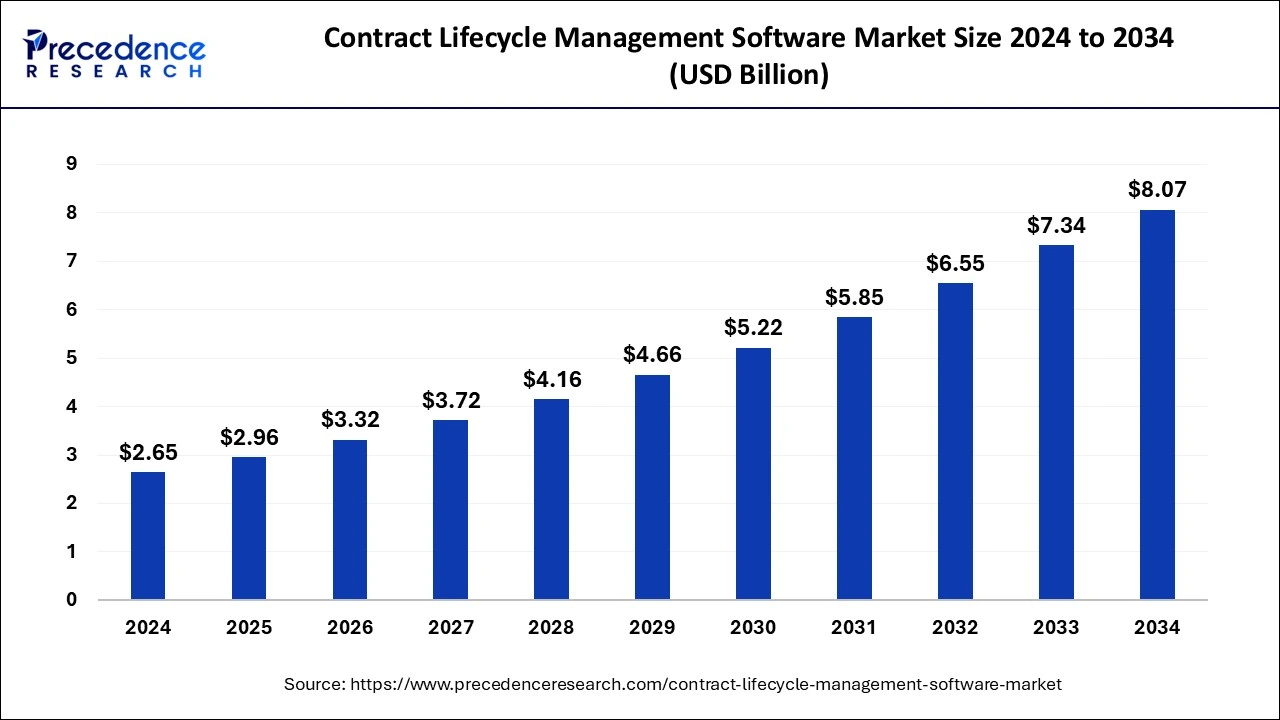

The global contract lifecycle management software market size is calculated at USD 2.96 billion in 2025 and is forecasted to reach around USD 8.07 billion by 2034, accelerating at a CAGR of 11.78% from 2025 to 2034. The North America contract lifecycle management software market size surpassed USD 1.06 billion in 2024 and is expanding at a CAGR of 11.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global contract lifecycle management software market size accounted for USD 2.65 billion in 2024 and is anticipated to reach around USD 8.07 billion by 2034, expanding at a CAGR of 11.78% from 2025 to 2034.

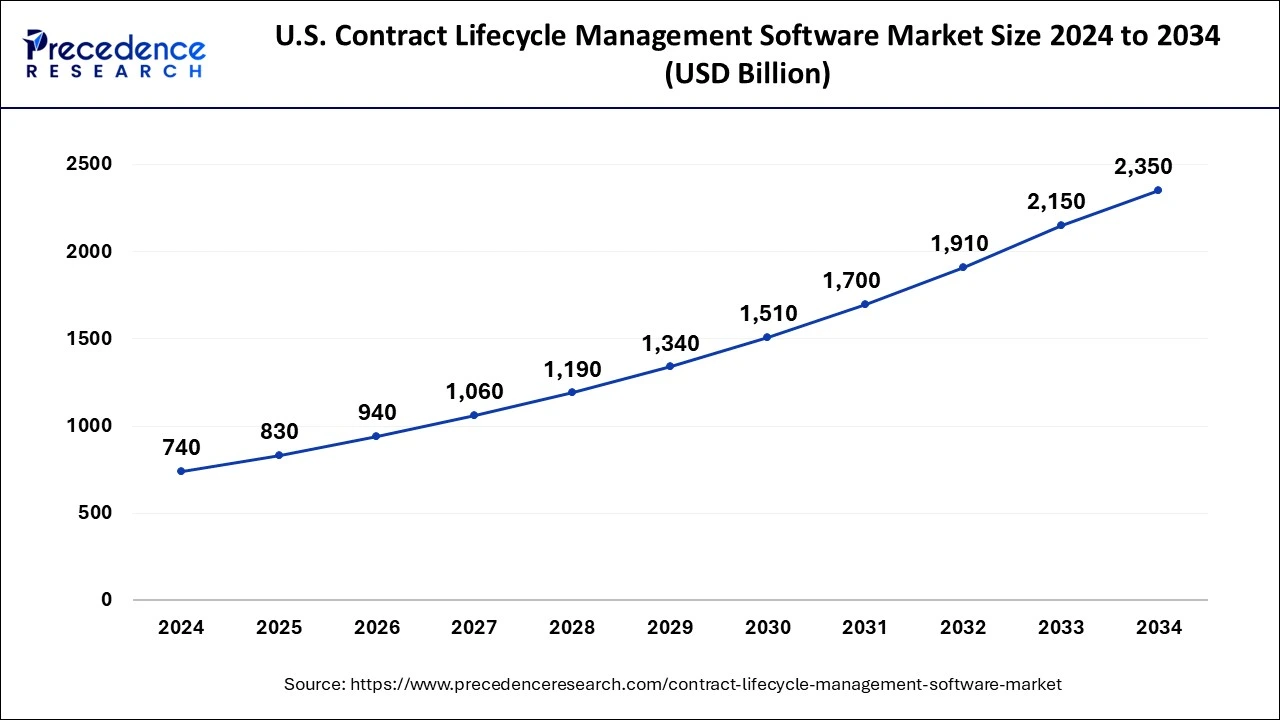

The U.S. contract lifecycle management software market size surpassed USD 740 million in 2024 and is expected to be worth around USD 2,350 million by 2034, growing at a CAGR of 12.25% from 2025 to 2034.

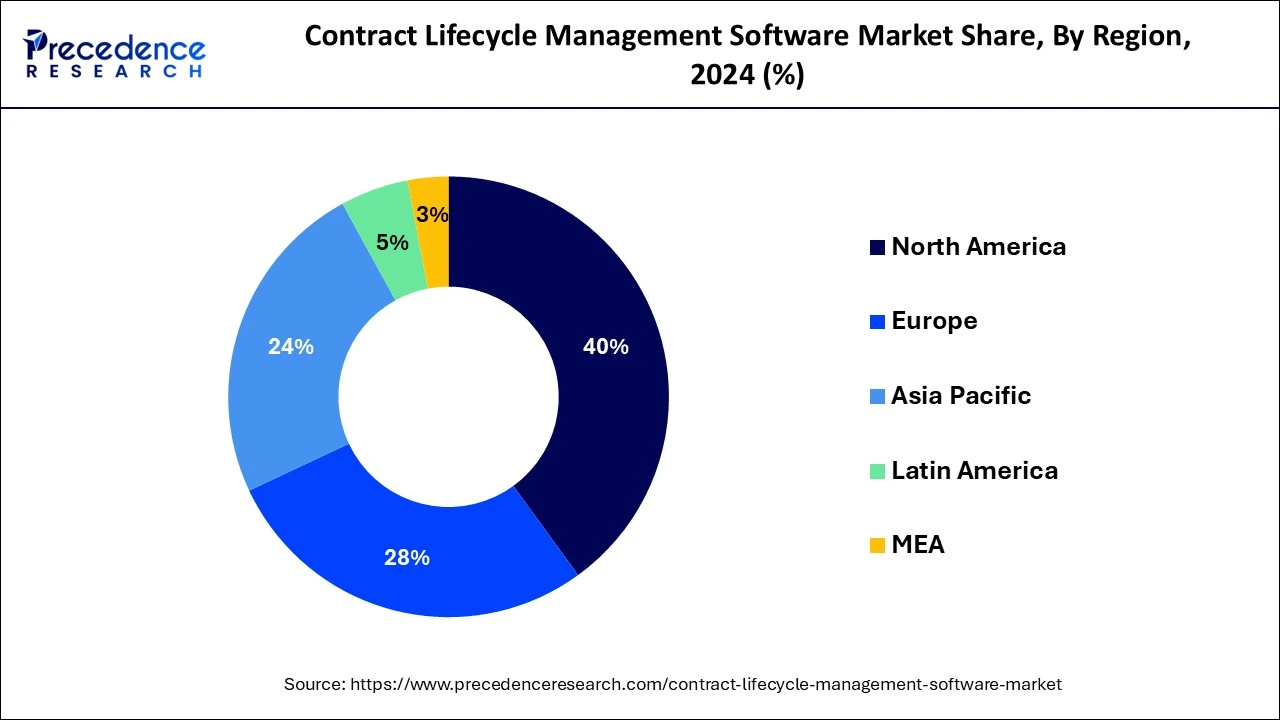

In 2023, the market for contract management software is mostly driven by North America in 2024. One of the main factors influencing the expansion of the North American market is the existence of prominent players in the region, including Coupa, Apttus, Docusign, Icertis, Zycus, etc. Players in the contractual management system industry in this area make significant R&D investments. For instance, Coupa invested almost 62 million USD, or 23.7% of its annual revenue, in research & development in 2018. Additionally, the BFSI, IT, and healthcare sectors in North America are well established, which gives a big opportunity for such providers of contract management solutions.

Organizations in North America are required to keep a systematic record of their contracts. These firms can increase the openness of their construction contracts by putting in place clear policies and employing simple technologies. Additionally, supportive laws like the Healthcare Insurance Protection & Accounting Act (HIPAA) encourage the use of contractual software solutions in the area.

Nearly 25% of the market for contracts is devoted to contract lifecycle management. Every part of a contract is managed and tracked for compliance, performance, and other success criteria using agreement lifecycle management. A contract is managed through each stage of its lifecycle via a contract lifecycle management solution. Due to the rising adoptive parents of cloud-based agreement management solutions, enterprise agreement lifecycle management applications, contract automation systems, and cloud-based agreement revision control applications, among many others, the demand for service agreement lifecycle management remedies is anticipated to experience a significant increase during the forecast period.

All procedures connected to a contractual agreement's life cycle are included in contract lifecycle management. Keeping organized throughout the whole contract lifecycle is made possible by regulations, audits, and analyses of contracts. Additionally, effective document management systems and responsibility and risk and compliance solutions assist any firm to save time and money. With the growing demand for cloud-based contractual lifecycle management systems for better security, limitless data storage, and accessibility to this data stored from wherever the market for contractual lifecycle management is gradually expanding. Additionally, the suppliers of contract lifecycle management offer a range of business services such as legally binding contract administration, contractual analytics, and CLM technology that enable users to streamline the procedure and meet client expectations.

One of the main causes influencing the adoption of CLM technology to reduce risks, create a stronger framework for compliance management, and improve customer experience is the growing complexity of corporate operations. Furthermore, self-service contract writing, management of templates and pre-approved alternate provisions, and real-time cooperation for a quicker contract turnaround are all benefits of cloud-based CLM software, which is rapidly gaining popularity in small and medium-sized businesses. To facilitate and manage contract talks, secure attachments, and emails and lower compliance risk through automated contract approval processes, it also provides configuration management and comparison capabilities.

In addition, the integration of artificial intelligence (AI), IoT, computer vision, and voice control capabilities offer high efficiency and accuracy while removing the risks connected to contract expiration. This is expected to present attractive growth prospects to major market players within the industry, especially given the growing emphasis of many organizations on large-scale cooperation to handle frequent changes in their industries.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.78 % |

| Market Size in 2024 | USD 2.65 Billion |

| Market Size in 2025 | USD 2.96 Billion |

| Market Size by 2035 | USD 8.07Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Type, Organization Size, Business Function, and Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Any company can have its reputation damaged by CLM errors - There are numerous options available in the present day for contract management software. Of course, there isn't a "one size fits all" CLM option for every agency or company. Customers, business associates, and appropriate authorities all want businesses to handle contracts carefully and responsibly. Institutions like government entities are now held to a stricter standard than ever before whenever it comes to agreements. Any business or organization can have its reputation damaged by even minor CLM mistakes. Contract performance must be monitored over time since contracts may perform poorly or get stale. Any CLM process should provide specialized contractual reporting based on predetermined criteria. You and your organization might benefit from being able to generate contract reports depending on factors like transaction fees, business regions, or even the durations of renewal terms.

Automate structured and planned processes - large companies are increasingly utilizing contractual lifecycle management because it allows them to manage planned and specified processes. Additionally, it appears that major organizations engage in more collaborations and other operations annually than do small and medium-sized companies. The implementation model predicts that the market for on-premise agreement lifecycle management might well grow rapidly through 2033 due to the inherent advantages of the model, including the ability to handle everything internally, control placed above a white safety and backup systems, delivered an exceptional adherence, and avoid yearly advertising costs.

For reference, CLM software enables lawyers to locate similar contracts in the library that may be visually viewed in Microsoft Word, PowerPoint, and Excel formats. This shortens the evaluation process and makes it possible for businesses to find systemic flaws. This software enables firms to enforce compliance with laws put in place by governmental bodies and also delivers transparency and efficiency in reporting procedures and management controls. The need for this solution is also being fueled by the development of cloud-based CLM technology across a variety of industries since it offers a user-friendly interface, seamless interaction with well-known CLM systems, supports dynamic process approvals, and substantially lowers total costs.

Additionally, it aids businesses in minimizing infrastructure expenditures associated with contract administration. Rapid globalization has made it imperative to take a collective approach when managing projects & joint ventures since it improves contract visibility for all parties involved. Because of this, businesses are starting extensive collaborations to deal with ongoing changes in their industries, which is anticipated to have a favorable impact on the CLM market.

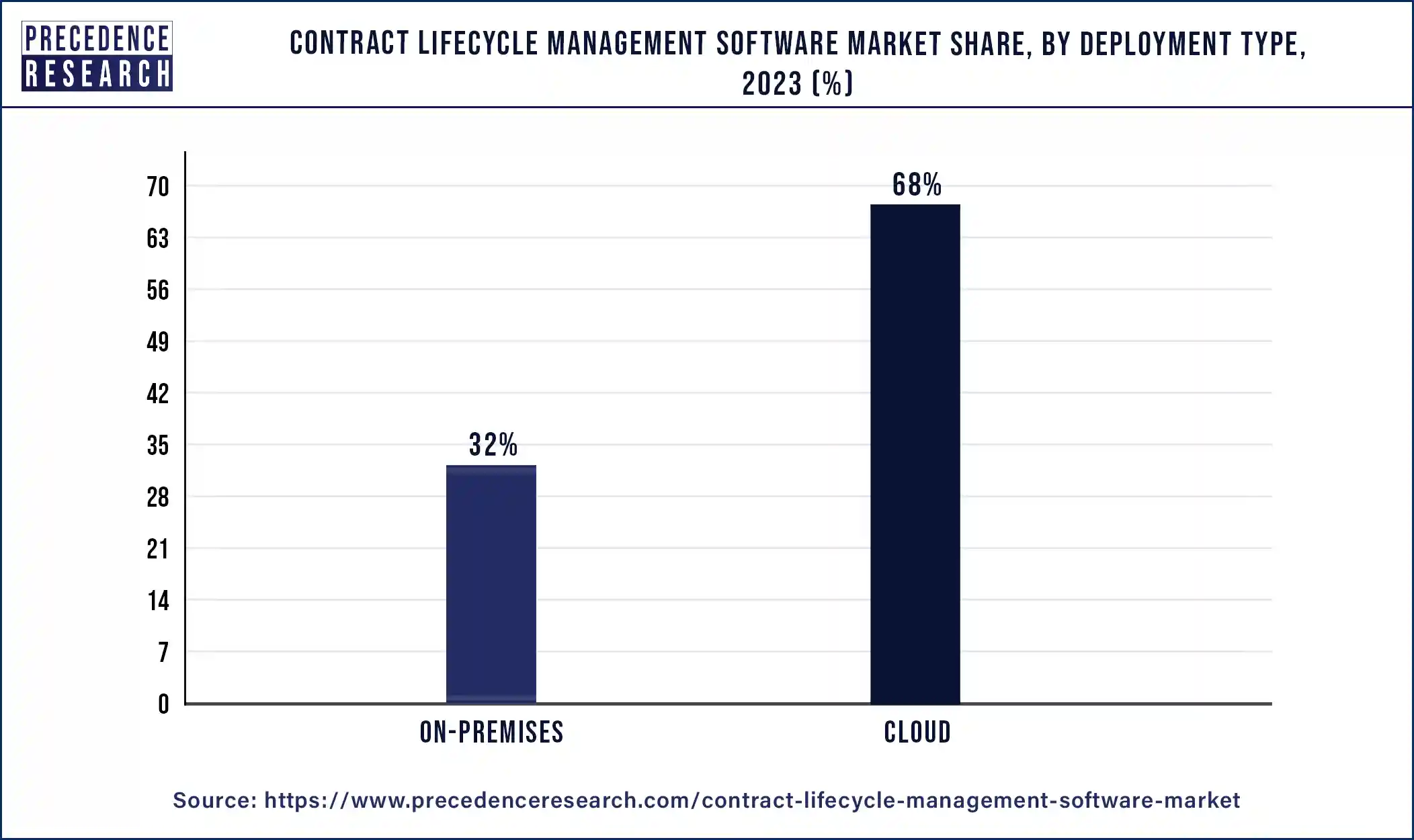

In 2024, the cloud-based market category held the most market share. The license and subscription sector will continue to rule the worldwide contractual lifecycle management software industry in 2023 based on CLM offerings.

The small and medium-sized segment is anticipated to hold the largest market share depending on enterprise size. In terms of region, North America controlled most of the share of the market in 2024.

Small and medium-sized businesses are defined as those with fewer than 1,000 employees. These businesses must maximize production while minimizing costs because they have a tight budget to manage their contracts. To optimize their agreements, these businesses need a solution that is both affordable and effective. Compared to huge corporations, SMEs manage a smaller number of contracts. As a result, there is a dearth of aggressive contract management because contracts can be delayed with little to no cost. SMEs can supervise the contracts manually and save money on software expenditures if there are only a few contracts.

The number of new agreements will increase over time, while the conditions of current contracts will change or they will close out. And this is the point at which the risks connected to an SME's contracts begin to quickly increase. For small and medium-sized businesses, the use of contract management solutions is anticipated to increase managing risk, reduce administrative costs, lower the cost of complying, and produce positive business outcomes.

Hospitals manage a huge number of contracts, each of which is subject to a different set of compliance requirements and performance criteria. Hospitals that employ smart contract management systems streamline their processes, saving time and reducing the possibility of missing any crucial tasks. Software for managing contracts has significantly advanced technologically over the years. In terms of patient personal confidentiality and security, the most recent contract administration software on the market complies fully with HIPAA as well as other international regulations. This is encouraging hospitals to use contract management systems.

One of the primary areas for cutting healthcare expenses is the efficient handling of important contract agreements, patient information, and databases with minimal human labor. Furthermore, it is more crucial than ever for healthcare businesses to handle their contracts and papers efficiently and productive efficient and productive manner due to unforeseen costs associated with errors & denials, fines related to data breaches, and lawsuits.

Recent Developments

By Component

By Deployment Type

By Organization Size

By Business Function

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

January 2025

August 2024