January 2025

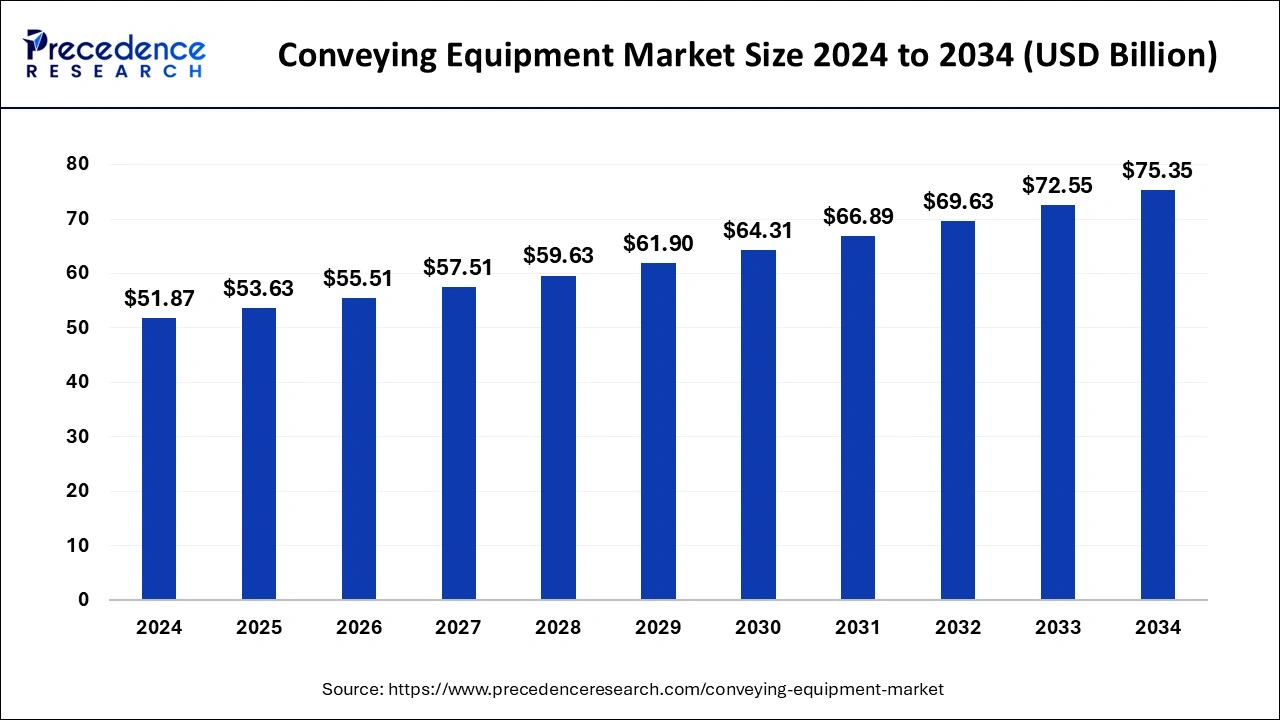

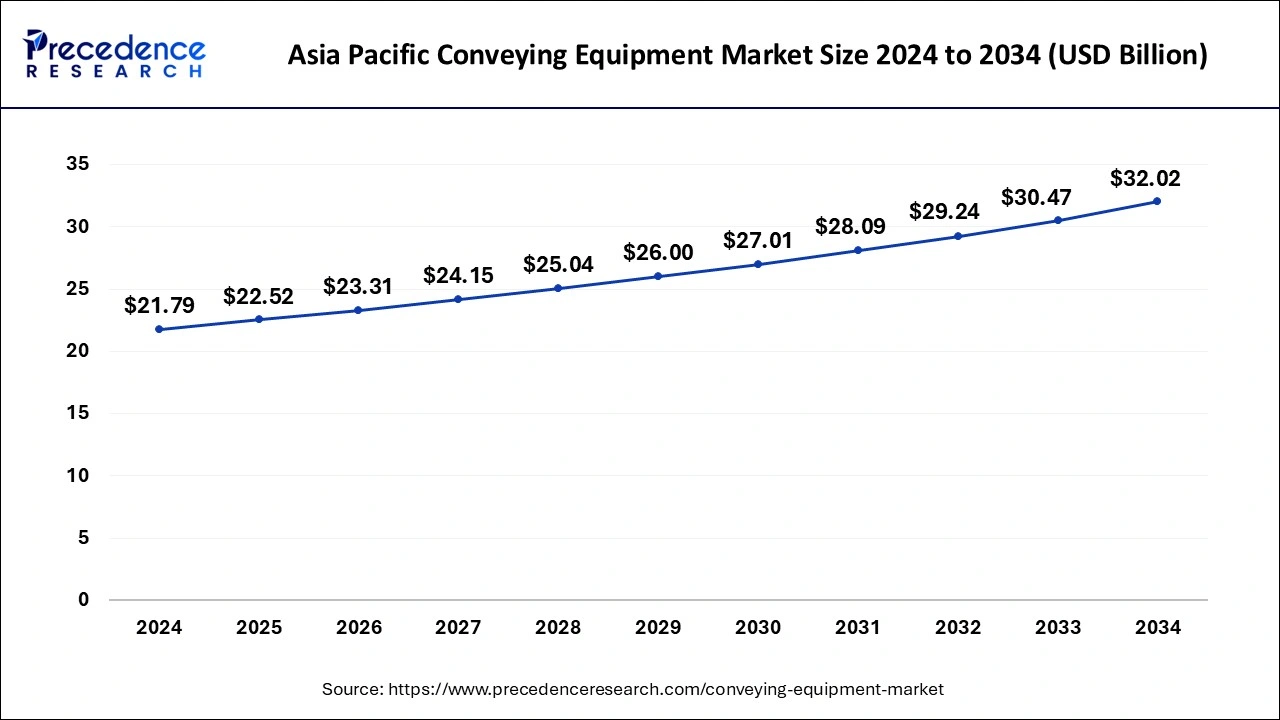

The global conveying equipment market size is evaluated at USD 53.63 billion in 2025 and is forecasted to hit around USD 75.35 billion by 2034, growing at a CAGR of 3.80% from 2025 to 2034. The Asia Pacific market size was accounted at USD 21.79 billion in 2024 and is expanding at a CAGR of 3.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global conveying equipment market size accounted for USD 51.87 billion in 2024 and is predicted to increase from USD 53.63 billion in 2025 to approximately USD 75.35 billion by 2034, expanding at a CAGR of 3.80% from 2025 to 2034.

The Asia Pacific conveying equipment market size was evaluated at USD 21.79 billion in 2024 and is projected to be worth around USD 32.02 billion by 2034, growing at a CAGR of 3.92% from 2025 to 2034.

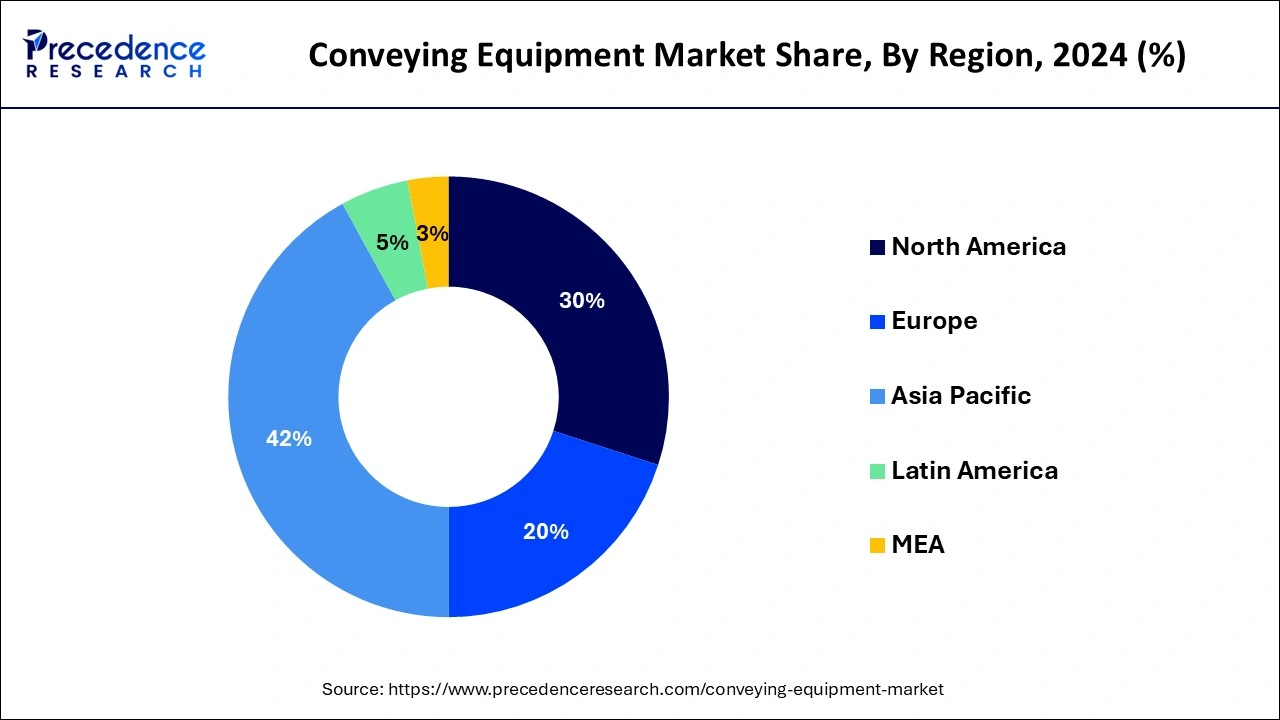

Asia-Pacific holds a 42% share in the conveying equipment market due to robust industrialization, burgeoning manufacturing activities, and the rapid expansion of e-commerce. Countries like China and India witness substantial demand for conveying systems across diverse industries, including automotive, electronics, and logistics. The region's economic growth, infrastructure development, and the adoption of advanced technologies contribute to the dominance of Asia-Pacific in the global conveying equipment market, attracting significant investments and fueling market expansion.

North America is poised for swift growth in the conveying equipment market due to a robust manufacturing sector, increased adoption of automation, and a surge in e-commerce activities. The region's emphasis on technological advancements, coupled with the need for efficient material handling in industries such as automotive and logistics, is driving market expansion. Additionally, the focus on sustainability and compliance with stringent safety standards further fuels the demand for advanced conveying solutions, positioning North America as a key growth hub for the industry.

Meanwhile, Europe is experiencing notable growth in the conveying equipment market due to several factors. The region's robust industrial sector, driven by automotive, pharmaceuticals, and logistics, is investing in advanced material handling solutions to enhance efficiency. Additionally, stringent regulations promoting workplace safety and sustainability are encouraging the adoption of modern conveying systems. The rise of e-commerce and the need for streamlined supply chain processes further contribute to the increased demand for conveying equipment in Europe, positioning the region as a significant market for innovative and efficient material handling solutions.

Conveying equipment is a diverse set of specialized machinery designed to efficiently move materials within industrial settings. This equipment includes conveyor belts, rollers, screw conveyors, pneumatic systems, and bucket elevators, all aimed at automating the smooth transfer of goods or raw materials. In sectors like manufacturing, mining, agriculture, and logistics, conveying equipment is widely embraced for its ability to minimize manual labor, enhance safety, and optimize operational processes. Businesses enjoy increased efficiency, reduced risk of material damage, and improved overall organization thanks to these systems. Essentially, conveying equipment stands as a crucial element in modern industries, fostering heightened productivity and a more streamlined approach to handling materials.

| Report Coverage | Details |

| Market Size in 2025 | USD 53.63 Billion |

| Market Size by 2034 | USD 75.35 Billion |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global manufacturing growth

Global manufacturing growth significantly propels the demand for the conveying equipment market as industries expand and modernize their production processes. The surge in manufacturing activities across diverse sectors, including automotive, electronics, and consumer goods, necessitates efficient material handling solutions. Conveying equipment, such as conveyor belts, rollers, and automated systems, becomes integral to seamlessly transporting raw materials and finished products within manufacturing facilities. With heightened production levels worldwide, industries seek to optimize operational workflows and reduce manual labor.

The adoption of Conveying Equipment enhances productivity, minimizes downtime, and contributes to overall cost-efficiency. As global manufacturing experiences an upswing, the conveying equipment market witnesses increased demand, driven by the essential role these systems play in streamlining supply chains, ensuring timely production, and meeting the dynamic needs of a growing industrial landscape.

Space constraints

Space constraints present a notable restraint on the market demand for conveying equipment, particularly in industries where available floor space is limited. Manufacturing and warehouse facilities often grapple with spatial challenges, hindering the installation and expansion of conveyor systems. The need to optimize operational layouts and accommodate other essential machinery can limit the feasibility of integrating conveying equipment seamlessly. Businesses operating in confined spaces may find it challenging to deploy conveyor belts or automated systems without disrupting existing workflows or sacrificing valuable floor area.

Furthermore, the space limitations pose obstacles to scalability, restricting the capacity for businesses to expand their conveying infrastructure as production volumes increase. The demand for conveying equipment is thus influenced by the adaptability of systems to spatial constraints, with compact and flexible designs becoming increasingly crucial for industries seeking efficient material handling solutions within confined working environments. Overcoming these challenges requires innovative solutions that maximize the utility of available space while maintaining the integrity and efficiency of conveying processes.

Customization for diverse industries

The trend towards customization in conveying equipment is creating significant opportunities in the market by addressing the unique needs of diverse industries. Different sectors, such as pharmaceuticals, food and beverage, and automotive, have distinct requirements when it comes to material handling. Conveying equipment manufacturers can seize this opportunity by developing tailored solutions that cater to industry-specific challenges.

For example, the pharmaceutical industry may demand conveyor systems with stringent hygiene features, while the automotive sector may require heavy-duty conveyors for transporting large components. Customization allows companies to offer specialized solutions that enhance operational efficiency and meet compliance standards within specific industries.

Furthermore, the ability to adapt conveying systems to the varying spatial constraints and workflows of different industries positions manufacturers as valuable partners. Tailored conveyor solutions not only improve overall productivity but also contribute to cost-effectiveness by addressing the specific demands of each sector. As industries continue to seek optimized and efficient material handling processes, the trend towards customization presents a strategic avenue for conveying equipment providers to differentiate themselves and foster long-term partnerships across diverse markets.

The belt segment generated over 25% of the market share in 2024. In the conveying equipment market, the belt segment refers to conveyors that utilize a continuous loop of material, typically made of rubber or fabric, to transport goods. Belt conveyors are versatile and widely used across various industries for their ability to handle a diverse range of materials. The trend in the belt segment involves the integration of advanced technologies, such as sensors and automation, to enhance efficiency and enable real-time monitoring. This results in increased demand for smart belt conveyors, offering improved control and adaptability in material handling processes.

The roller segment is anticipated to expand at a significant CAGR of 5.12% during the projected period. The roller segment in the conveying equipment market refers to systems that utilize rollers to facilitate the movement of goods along a designated path. These rollers, typically mounted on frames, allow for smooth and controlled material transport. A notable trend in this segment is the increasing adoption of precision-engineered rollers for enhanced durability and efficiency. Industries are opting for advanced roller conveyors to reduce friction, improve load-bearing capacities, and ensure reliable performance, contributing to the overall growth and evolution of the conveying equipment market.

According to the product, the unit handling has held 47% market share in 2024. The unit handling segment in the conveying equipment market involves the transportation of individual items or loads, such as boxes, totes, or cartons. This segment is characterized by solutions like conveyor belts, rollers, and automated systems designed for precise and controlled handling of discrete units. A notable trend in unit handling is the increasing integration of advanced technologies like RFID tracking and automation to enhance accuracy and efficiency in sorting, distribution, and order fulfillment processes, meeting the growing demand for precision and speed in logistics and e-commerce operations.

The bulk handling equipment segment is anticipated to expand fastest over the projected period. The bulk handling equipment segment in the conveying equipment market encompasses machinery designed for the efficient transportation of large quantities of materials, such as grains, minerals, and aggregates. Key trends in this segment include the growing demand for robust and high-capacity conveyor systems to handle bulk materials in industries like mining, agriculture, and construction. Advancements in technology, such as improved conveyor belt materials and enhanced automation for precise material handling, are shaping the evolution of bulk handling equipment in response to industry requirements for increased efficiency and reduced operational costs.

The warehouse and distribution segment has hold a 24% market share in 2024. In the conveying equipment market. The exponential growth of e-commerce and the evolving landscape of supply chain dynamics have thrust warehouse and distribution into the limelight. As consumer expectations for faster deliveries and seamless logistics rise, the need for efficient conveying solutions becomes paramount, positioning this segment as a linchpin in meeting industry demands.

The automotive segment is anticipated to expand fastest over the projected period. In the conveying equipment market, the automotive segment involves the use of conveyor systems to streamline material handling within automotive manufacturing facilities. These systems efficiently transport components, parts, and assemblies along production lines, contributing to increased automation and productivity. A notable trend in the automotive sector is the integration of advanced conveying technologies, such as automated guided vehicles (AGVs) and robotic systems, to enhance precision, speed, and flexibility in assembly processes, reflecting the industry's continuous pursuit of efficiency and innovation.

By Type

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

August 2024