February 2025

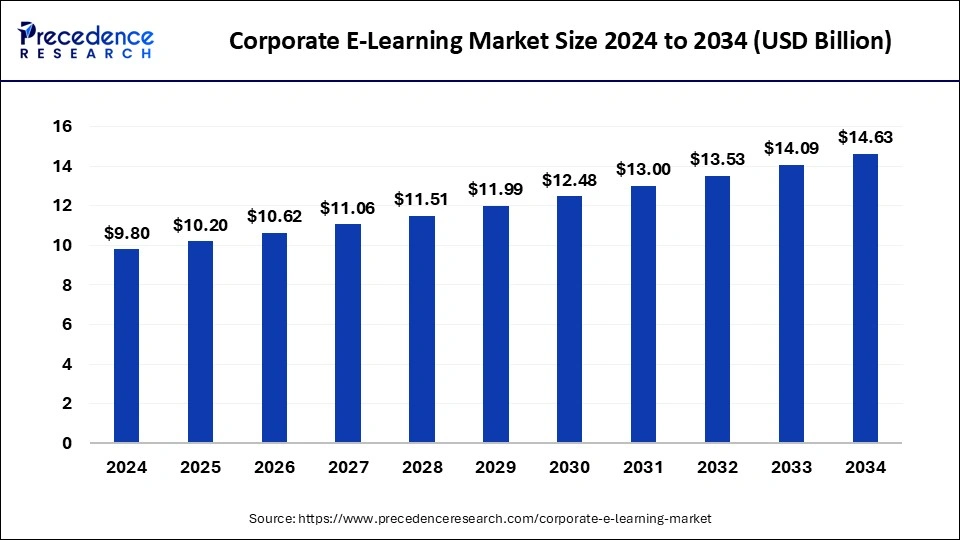

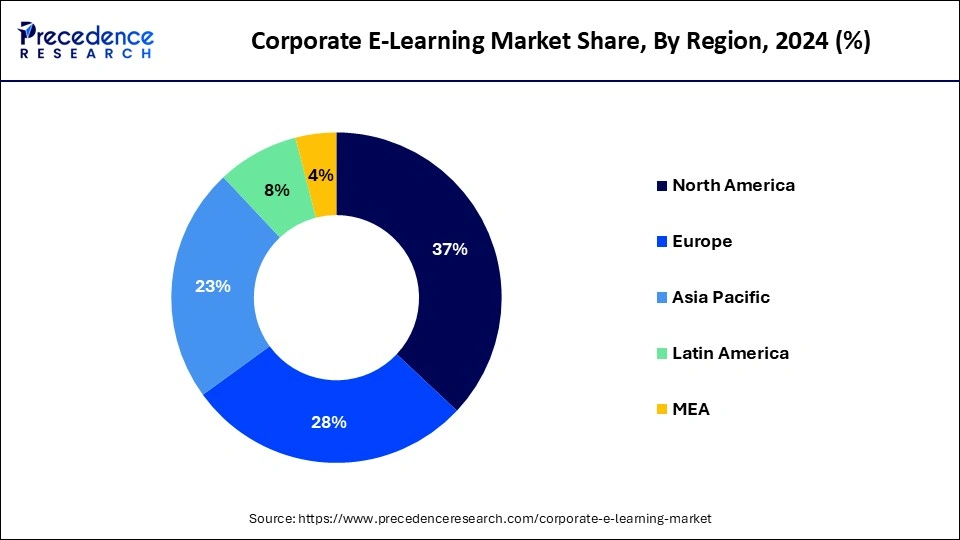

The global corporate e-learning market size is calculated at USD 10.20 billion in 2025 and is forecasted to reach around USD 14.63 billion by 2034, accelerating at a CAGR of 4.09% from 2025 to 2034. The North America corporate e-learning market size surpassed USD 3.63 billion in 2024 and is expanding at a CAGR of 4.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global corporate e-learning market size was estimated at USD 9.80 billion in 2024 and is predicted to increase from USD 10.20 billion in 2025 to approximately USD 14.63 billion by 2034, expanding at a CAGR of 4.09% from 2025 to 2034. The expenses of travel, lodging, and printed materials that come with traditional classroom training are decreased with e-learning.

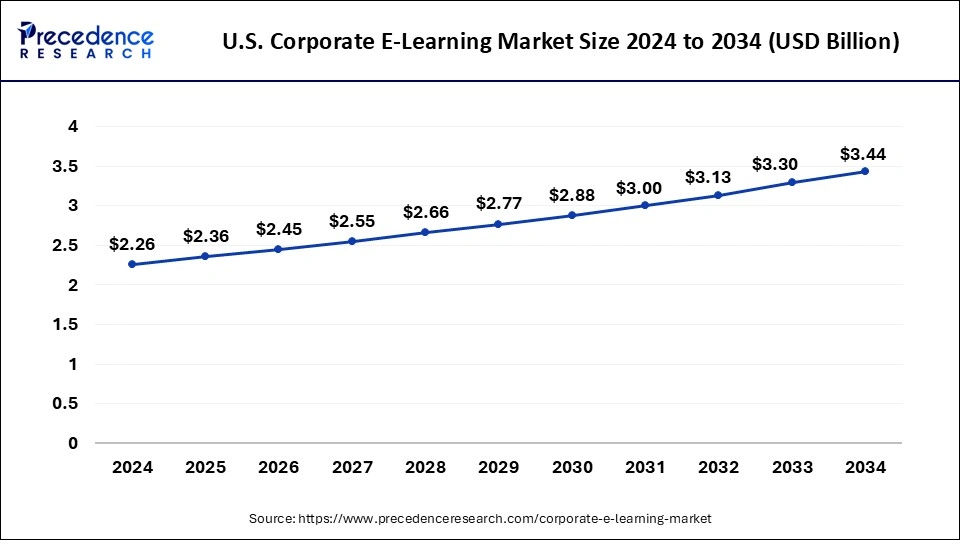

The U.S. corporate e-learning market size was estimated at USD 2.26 billion in 2024 and is predicted to be worth around USD 3.44 billion by 2034, at a CAGR of 4.29% from 2025 to 2034.

North America held the largest share of the corporate e-learning market in 2024. The COVID-19 epidemic has hastened the transition towards remote employment, which has raised demand for online training programs. Many businesses are implementing eLearning platforms to give their remote workers access to ongoing training and possibilities for upskilling. E-learning is more affordable than traditional classroom-based training when it comes to travel costs, venue rents, and teacher fees. Companies can also reduce their printing expenses because most course materials are provided electronically. Adaptive learning technologies, which tailor the learning experience to each learner's requirements and preferences, are frequently included in e-learning systems. This personalization increases interest and strengthens retention of the information. The corporate e-learning market provides programs that are easily scalable to meet changing training needs or a workforce that grows.

Europe is expected to host the fastest-growing corporate e-learning market during the forecast period. The corporate e-learning market in Europe is considerable and has been expanding steadily. As digital learning technologies have become more widely used, the market has grown to meet the varied needs of companies in many sectors of the economy. The COVID-19 pandemic hastened the industry's embrace of online learning platforms. With the rise in popularity of remote work, businesses started using eLearning platforms to provide their remote workers with training and upskilling. Even after the pandemic, this shift toward online education is predicted to continue. Businesses are looking more and more for eLearning solutions that are particular to them and their workforce requirements. Adaptive learning technology, data analytics, and personalized learning pathways are essential for providing training programs that work.

Businesses are using eLearning solutions to train their staff simply and effectively as workplaces become more digital. The COVID-19 epidemic has expedited this trend by compelling numerous firms to implement remote work and virtual training techniques. Conventional training approaches may be costly and time-consuming. With corporate eLearning, businesses may reduce costs associated with travel, lodging, and teacher fees. It's a more economical option.

A lot of e-learning platforms use AI and machine learning algorithms to customize each employee's learning experience based on their unique learning preferences and styles. Employees are under increasing pressure to continuously upskill and reskill in order to be competitive in the job market due to the rapid improvements in technology. Businesses can provide training programs that are specifically designed to meet the needs of their employees, thanks to corporate e-learning.

Enhancing employee engagement and retention through the integration of gamification features and microlearning modules into eLearning courses can contribute to a more pleasurable and productive learning process. Companies may effectively monitor and track employee development, provide reports, and evaluate the efficacy of training programs by integrating eLearning platforms with Learning Management Systems (LMS).

| Report Coverage | Details |

| Market Size in 2025 | USD 10.20 Billion |

| Market Size by 2034 | USD 14.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.09% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Delivery Mode, Industry Vertical, Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid content updates

The business environment is ever-changing due to the frequent emergence of new technology, laws, and consumer trends. E-learning materials must be updated often in order to provide staff members with the most recent information. Knowledge and skills are becoming less relevant as industries change and technology advances. Information that was current six months ago might not be so now. This drives the growth in the corporate e-learning market.

In the corporate e-learning market, quick updates guarantee that students have access to up-to-date knowledge. Learners' feedback can point out places in the content that are unclear or lacking. Quick updates make it possible to quickly resolve these problems and enhance the learning process as a whole. Use agile approaches to generate content so that it may be updated quickly in response to feedback or changing requirements.

Cultural and language barriers

The linguistic competency of employees from different cultural origins may differ in the training materials. This may have an impact on how well they understand and interact with the material. Making sure translations are accurate and suitable for the target culture is essential when translating e-learning materials into other languages. Inaccurate translations of content might cause misconceptions and reduce the efficacy of the services of the corporate e-learning market.

Cultural conventions, values, and communication techniques vary widely. In order to prevent unintentionally offending or alienating students, e-learning materials should be culturally sensitive. Corporate e-learning initiatives can have to abide by regional laws and customs regarding company operations. Producing training materials that are effective requires an understanding of these subtleties in the corporate e-learning market.

Integration with learning management systems (LMS)

In the corporate e-learning market, LMS platforms function as a single point of contact for managing user accounts, progress monitoring, reporting, and e-learning content. Corporate training departments can simplify their operations and centralize all training-related tasks by integrating with an LMS. Data from e-learning modules is automatically collected within the LMS for analysis and reporting needs, thanks to integration.

In the corporate e-learning market, employee training is subject to stringent compliance and regulatory obligations in many businesses. Organizations may manage employee completion of required training, make sure that training materials are current, and create audit trails to prove compliance by integrating with an LMS. With the powerful tracking and reporting features that LMS platforms offer, businesses can keep an eye on student progress, evaluate the success of their training initiatives, and produce compliance reports.

The self-paced learning segment led the corporate e-learning market in 2024. Employees can access training materials at any time, allowing them to fit learning around their personal and professional schedules. This is known as self-paced learning. This flexibility is especially helpful for remote workers or personnel with hectic schedules. Organizations may find self-paced learning to be more affordable than traditional instructor-led instruction. After the e-learning material is created, as many employees as needed can access it without paying more for facilities or trainers. Because self-paced learning systems are so highly scalable, they can be used by businesses of all sizes. Self-paced online learning can meet the demands of every worker in an organization, no matter how big or small.

The blended learning segment is expected to grow rapidly in the corporate e-learning market during the forecast period. Because blended learning combines the advantages of online and traditional face-to-face training, it has grown in popularity in the corporate e-learning sector. Employees can access course materials and take part in training sessions at their own pace and convenience with blended learning, which is particularly helpful for working professionals. Businesses can customize the combination of online and offline elements to fit their unique training requirements, adding virtual classrooms, interactive web modules, and practical workshops as needed. Businesses may simply scale training programs with blended learning to meet the needs of an expanding workforce without having to make major resource or logistical changes.

The healthcare segment dominated the corporate e-learning market in 2024. As part of their overall strategy for talent retention, productivity development, and cost reduction connected to healthcare expenses, many firms are investing in employee wellness initiatives. Corporate e-learning modules are frequently used in sectors like manufacturing and construction that have inherent health and safety hazards to guarantee compliance with laws and best practices. Employee education regarding the healthcare benefits provided by their employer can also be accomplished through the use of e-learning platforms. This could involve providing guidance on navigating healthcare networks, explaining various insurance coverage options, and offering advice on how to get the most out of their benefits. Topics, including medication management, nutritional recommendations, and methods for leading a healthy lifestyle, may be included in modules.

The information technology (IT) segment is expected to witness the fastest growth in the corporate e-learning market during the forecast period. Technology is essential to creating e-learning systems that meet the unique requirements of corporate training. This entails developing user-friendly interfaces, including different learning management system (LMS) functionalities, guaranteeing cross-platform interoperability, and putting strong security measures in place. IT makes it possible to handle e-learning content effectively, which includes developing, arranging, storing, and updating course materials. Content distribution networks (CDNs), content repositories, version control systems, and content authoring tools could all be involved in this. IT makes it possible to tailor e-learning experiences to the preferences, skill levels, and learning styles of specific learners. Using data analytics, adaptive learning algorithms dynamically modify exams, course material, and pace to maximize learning results for every student.

The small and medium enterprises segment held a significant share of the corporate e-learning market in 2024. Compared to larger organizations, SMEs frequently have budgetary restraints. Employee training can be done more affordably using e-learning than with costly in-person sessions or engaging outside trainers. Platforms for e-learning provide flexibility in terms of training materials accessible at any time and from any location. For SMEs who may have personnel dispersed across multiple sites or working remotely, this is very helpful. SMEs must constantly upskill their staff in order to remain competitive in today's quickly evolving business environment. Numerous courses spanning a range of talents, from technical skills to soft skills like communication and leadership, are available on e-learning platforms.

The large enterprises segment is expected to show the fastest growth in the corporate e-learning market during the forecast period. Because of their size and complexity, they frequently have considerable training needs, necessitating scalable solutions to onboard new hires, upskill current staff, and guarantee compliance across departments and locations. Tailored e-learning solutions are typically necessary for large organizations in order to conform to their unique corporate culture, policies, and training goals. Innovation in content production services and e-learning platforms is fueled by this demand. As a result, they might spend money on producing engaging, high-quality e-learning materials or collaborate with e-learning providers to design unique courses. E-learning platforms from large businesses are usually integrated with HR systems already in place for easier management, reporting, and employee performance tracking.

By Delivery Mode

By Industry Vertical

By Size

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

July 2024

July 2024