May 2024

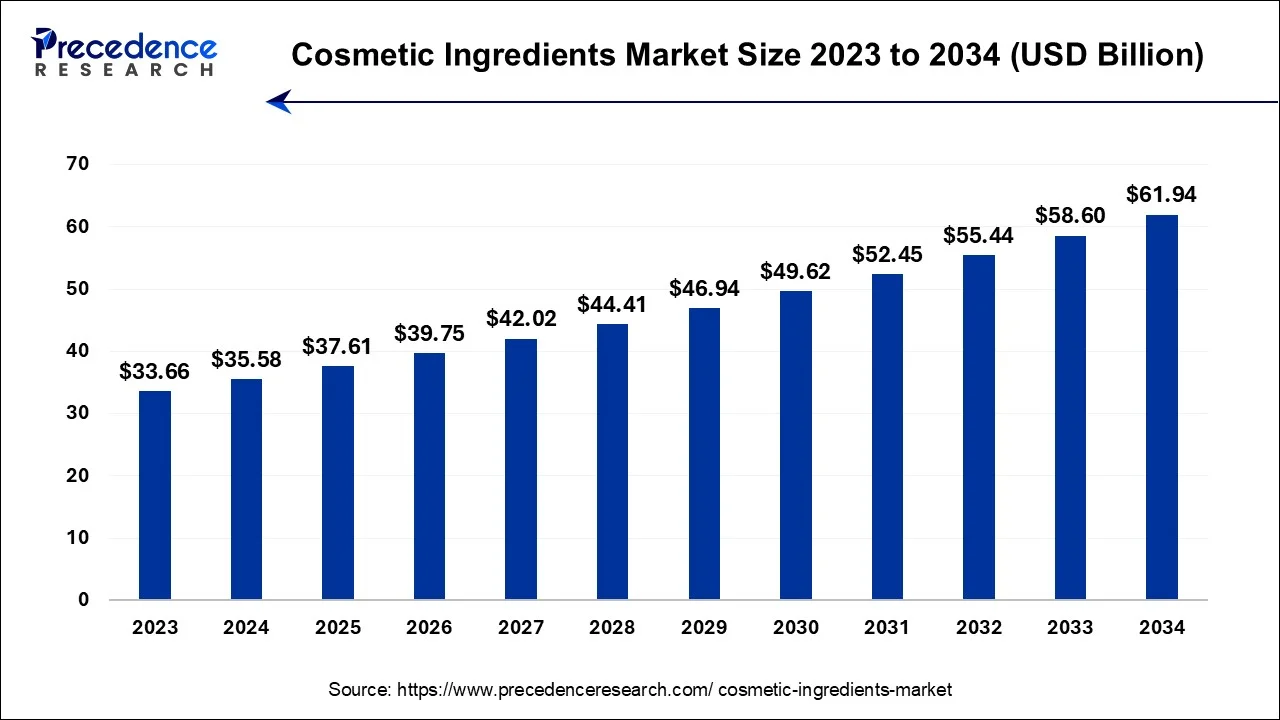

The global cosmetic ingredients market size is estimated at USD 35.58 billion in 2024, grew to USD 37.61 billion in 2025 and is predicted to surpass around USD 61.94 billion by 2034, expanding at a CAGR of 5.70% between 2024 and 2034.

The global cosmetic ingredients market size accounted for USD 35.58 billion in 2024 and is anticipated to reach around USD 61.94 billion by 2034, expanding at a CAGR of 5.70% between 2024 and 2034.

The global cosmetic ingredients market size is estimated at USD 35.58 billion in 2024 and is expected to be worth around USD 61.94 billion by 2034, expanding at a CAGR of 5.82% between 2024 and 2034.

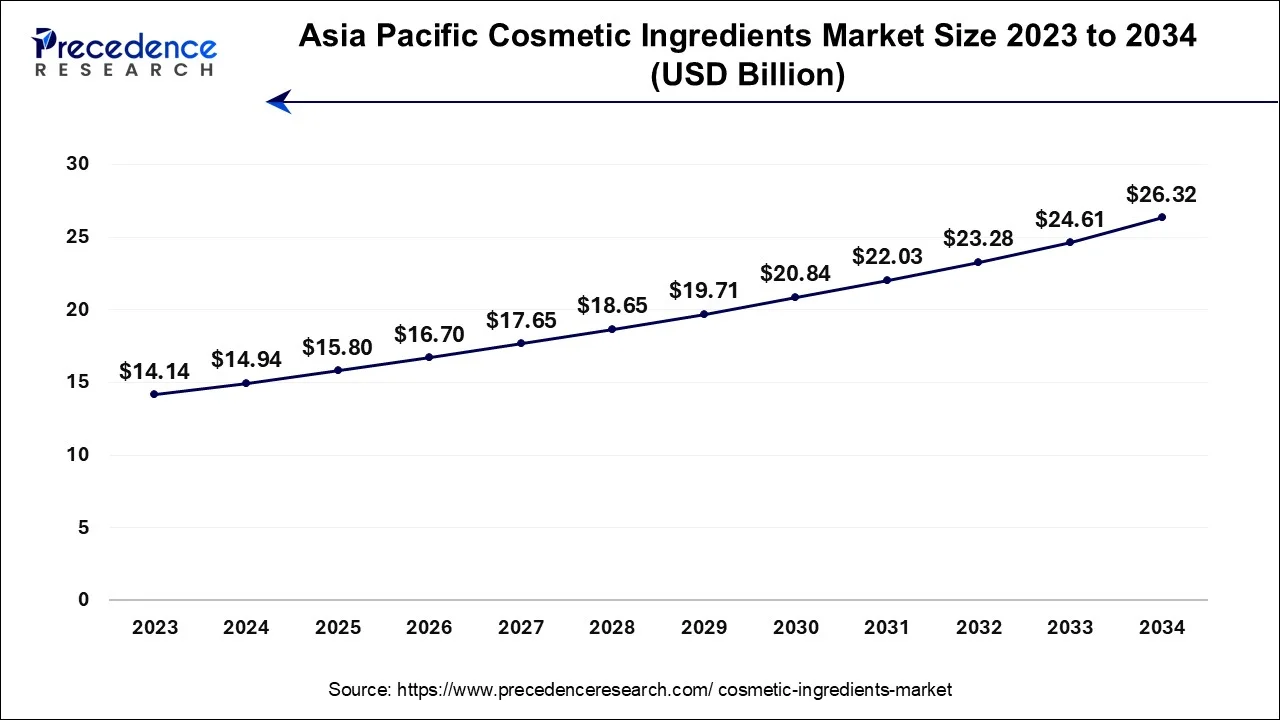

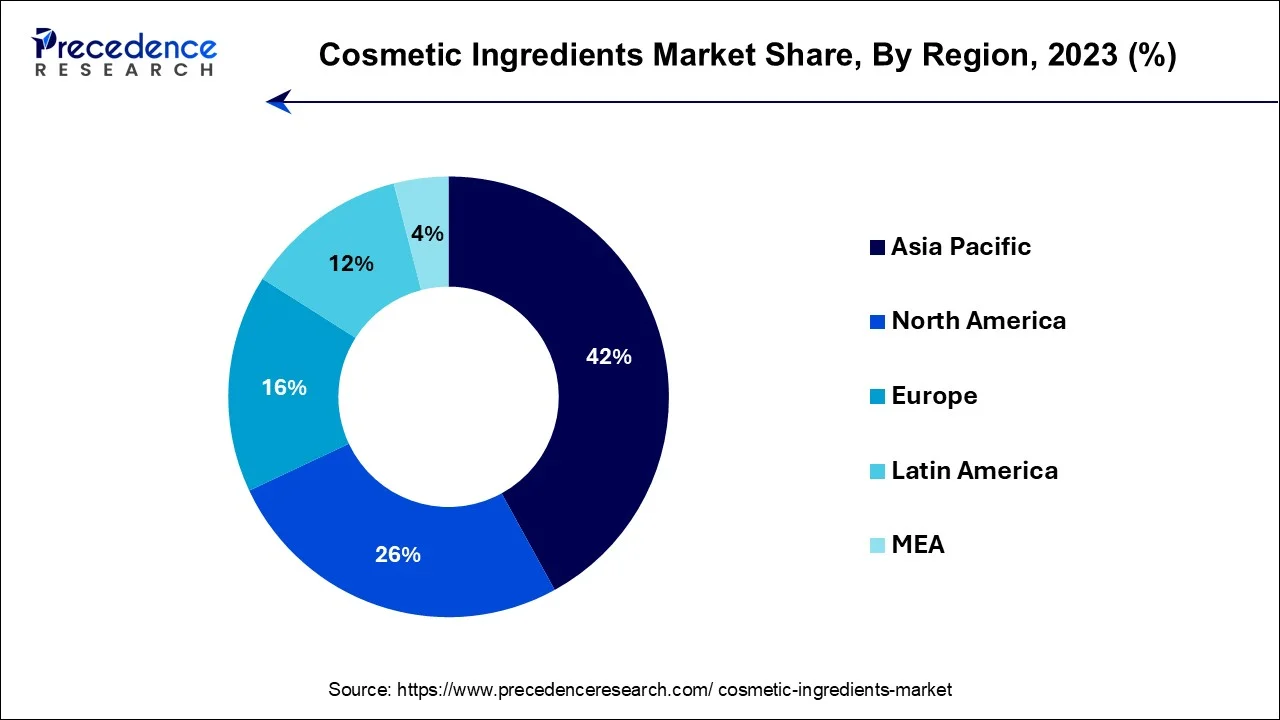

Asia-Pacific has captured the larget share of the cosmetic ingredients market in 2023. The region has seen a considerable increase in the use of beauty care goods, particularly skincare, as a result of the quick change in consumer lifestyle and the rising popularity of natural cosmetics. According to a statement made by L'Oréal, the company's active cosmetic product sales in China increased by 13.4% in Q1 2022 compared to Q1 2021. The demand for cosmetic components serving as emulsifiers and preservatives in the area is being driven by the rising cosmetic product consumption in key Asia-Pacific nations like China, which will boost the market for cosmetic ingredients during the forecast period.

The North America is expected to grow at the fastest rate in thecosmetic ingredients market. Consumers' increased attention to beauty and personal care, particularly among millennials, rising demand for cosmetics like eye and facial make-up, rising incidences of skin problems like acne and hair issues like hair loss, split ends, dandruff, and premature greying, rising demand for herbal or natural cosmetic products, and consumers' high purchasing power are all major drivers of regional market revenue growth.

Cosmetic ingredients are the elements that go into the creation of cosmetic goods like body lotions, eyeliners, lipsticks, moisturizers, and lotions with sunscreen. Water, moisturizers, preservatives, emulsifiers, thickeners, lubricants, pigments, and perfumes are some of the substances used in cosmetics. Ingredients for cosmetics can be created synthetically or obtained from natural sources like items derived from plants. They are utilized to give cosmetic products anti-oxidant, anti-inflammatory, thickening, and moisturizing characteristics. They are additionally employed to improve the texture and appearance of cosmetic goods. Green cosmetics that are beneficial to the environment have been developed as a result of growing awareness of clean-label cosmetic goods. Manufacturers of cosmetic ingredients work hard to develop new products and components while also conducting considerable research and development in order to satisfy consumer demands. Asia Pacific is predicted to have the highest demand for products made with organic components, which will in turn significantly fuel the expansion of the global cosmetics ingredients market over the course of the next five to six years.

Nowadays, customers choose to use fully natural and herbal personal care and cosmetic products because they don't include any dangerous chemicals that could hurt their skin. Major producers and players in the worldwide cosmetic ingredients market have taken notice of the growing demand for herbal cosmetic products and are progressively developing new lines of herbal components, mostly in developed regions like North America and Europe.

| Report Coverage | Details |

| Market Size in 2024 | USD 35.58 Billion |

| Market Size by 2034 | USD 37.61Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.7% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising middle-class population

The market for cosmetic ingredients is expected to benefit greatly from the growing middle class in emerging economies, particularly in the Asia Pacific. According to the European Commission, the global middle class now represents over half of the world's population, growing from 1.8 billion in 2009 to 4 billion by 2021, and is projected to reach 5.3 billion by 2030. This surge in the middle class is expected to drive demand for premium personal care and cosmetic products, fuelling the growth of cosmetic ingredients. Additionally, reports from the World Bank indicate that the Asia Pacific region alone is home to nearly 54% of the global middle class, and the rising disposable incomes in countries like China, India, and Indonesia are leading to increased consumer spending on beauty and personal care products. Furthermore, urbanization trends and a preference for natural, eco-friendly products are likely to further drive the market’s expansion, presenting significant growth opportunities for manufacturers in the coming years.

The synthetic segment is expected to grow at the fastest rate in the cosmetic ingredients market during the forecasting period, due to its availability, low cost and relatively stable in store formulations. They provide manufacturers with stability in the performance of the products and are longer lasting compared to naturally occurring compounds such as, preservatives, emulsifiers, and surfactants. Additionally, the increasing utilization of superior technologies in creating synthetic cosmetic products such as peptide and polymer from laboratory formations is also expected fuel the market.

The surfactants segment held the largest share in the cosmetic ingredients market during the forecasting period, due to their cleaning, foaming, and emulsifying abilities that are used widely in products such as shampoos body washes and facial cleaners. This is mainly due to the increasing consumers’ attention to the dual role of cosmetic products, cleaning and moisturizing. They also point to the growth in consumer awareness of personal hygiene coupled by growth in per capita products consumption in developing countries. Moreover, transition to mild and plant-derived surfactants have risen significantly due to the rising concern for environment friendly and skin-kind ingredients.

The botanical extracts segment is projected to grow at the fastest rate in the market in the coming years, owing to the increasing shift towards natural and organic products. These extracts are obtained from plants and are acidic in nature, and useful for their antioxidant, anti-inflammatory and skin soothing properties. This makes them ideal for products used on problematic, mature or sensitive skin. Furthemore, the Current trends in wellness or ‘clean’ and ‘green beauty’ have prompted manufacturers to include plant actives into their formulations, thus fuelling the segment in the coming years.

The cleansing agents & foamers segment dominated the cosmetic ingredients market, due to the rising demands for skin treatment and personal care products. People turning to skincare routines and washing their faces frequently coupled with increasing preference towards multi-use cleansing products, these ingredients have found a place. The population in urban areas is growing and overall, consumers’ expenditure on personal care products is higher, which in return has created demands for these cleansing agents. Sulfate-free and natural surfactant has become another segment contributing to the industry growth due to increasing consumer concerns for mild products. Additionally, the increasing needs for efficient and mild cleaning agents further boosts the segment.

The moisturizing segment is projected to grow at the fastest rate in the cosmetic ingredients market in the coming years, owing to the growing awareness toward hydration and anti-aging property in the skin care segment. This awareness is specifically expected to be driven among the population in the dryer climate regions of the world hence the need for more moisturizing ingredients. Moreover, the growing trend of product innovation, especially in the development of new products with active ingredients including hyaluronic acid, ceramides and glycerin which are known to have intense moisturizing properties, further propelling the segment.

The oral care segment is projected to grow at the fastest rate in the market during the forecast years, owing to the periodontal diseases have been on the rise, and the general population’s awareness of dental care has expanded. People are getting more conscious about the relation between oral health and general health, creating increased spending on superior oral hygiene products having added benefits such as activated charcoal, probiotics, and natural whitening formulas. Moreover, global companies including Proctor & Gamble and Unilever are also contributing towards facilitating and educating the community about better oral health.

Segments Covered in the Report

By Ingredient Type

By Product Type

By Functionality

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

November 2024

November 2024

October 2024