May 2024

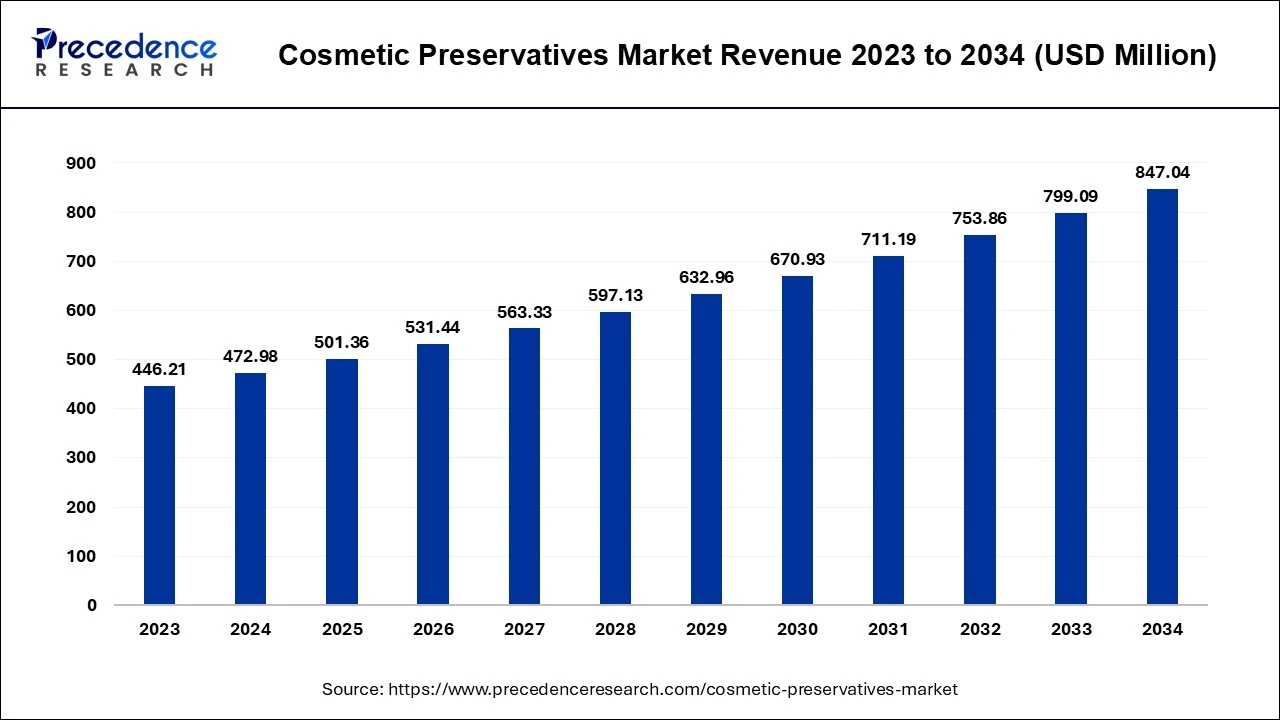

The global cosmetic preservatives market size accounted for USD 472.98 million in 2024, grew to USD 501.36 million in 2025 and is predicted to surpass around USD 847.04 million by 2034, representing a healthy CAGR of 6% between 2024 and 2034.

The global cosmetic preservatives market size is exhibited at USD 472.98 million in 2024 and is predicted to surpass around USD 847.04 million by 2034, growing at a CAGR of 6% from 2024 to 2034.

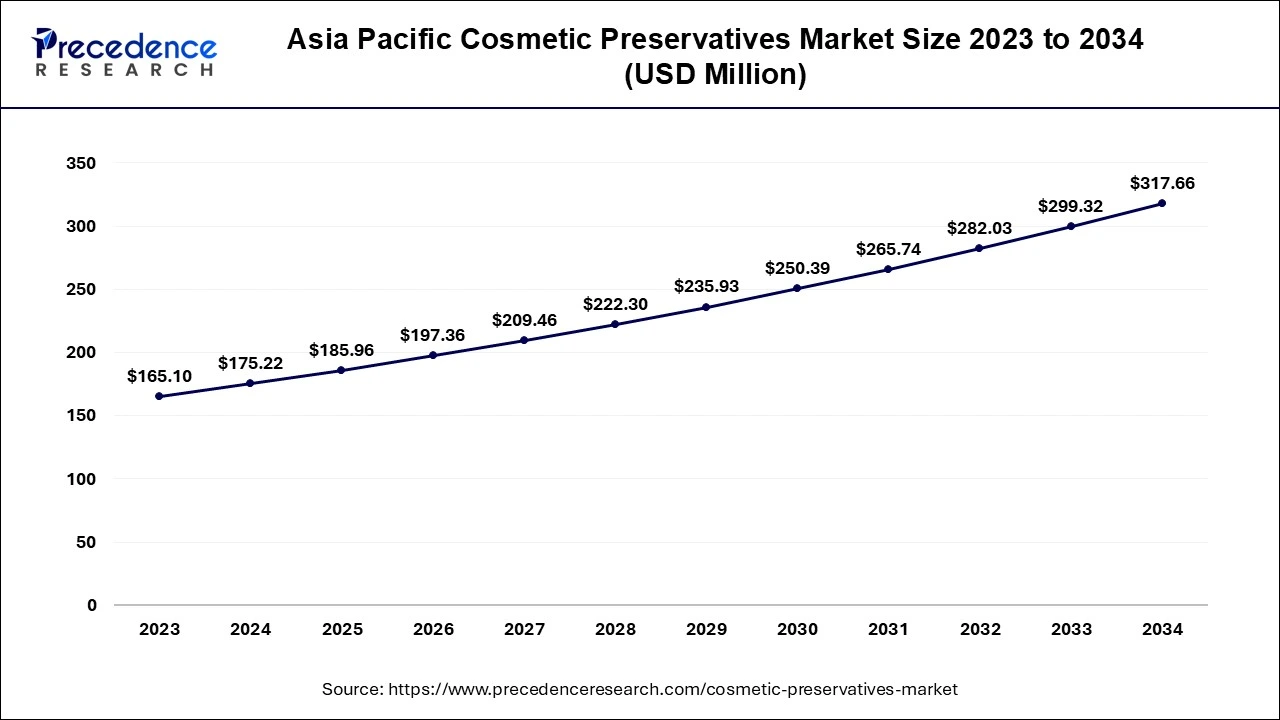

The Asia Pacific cosmetic preservatives market size is estimated at USD 175.22 million in 2024 and is expected to be worth around USD 317.66 million by 2034, rising at a CAGR of 6.13% from 2024 to 2034.

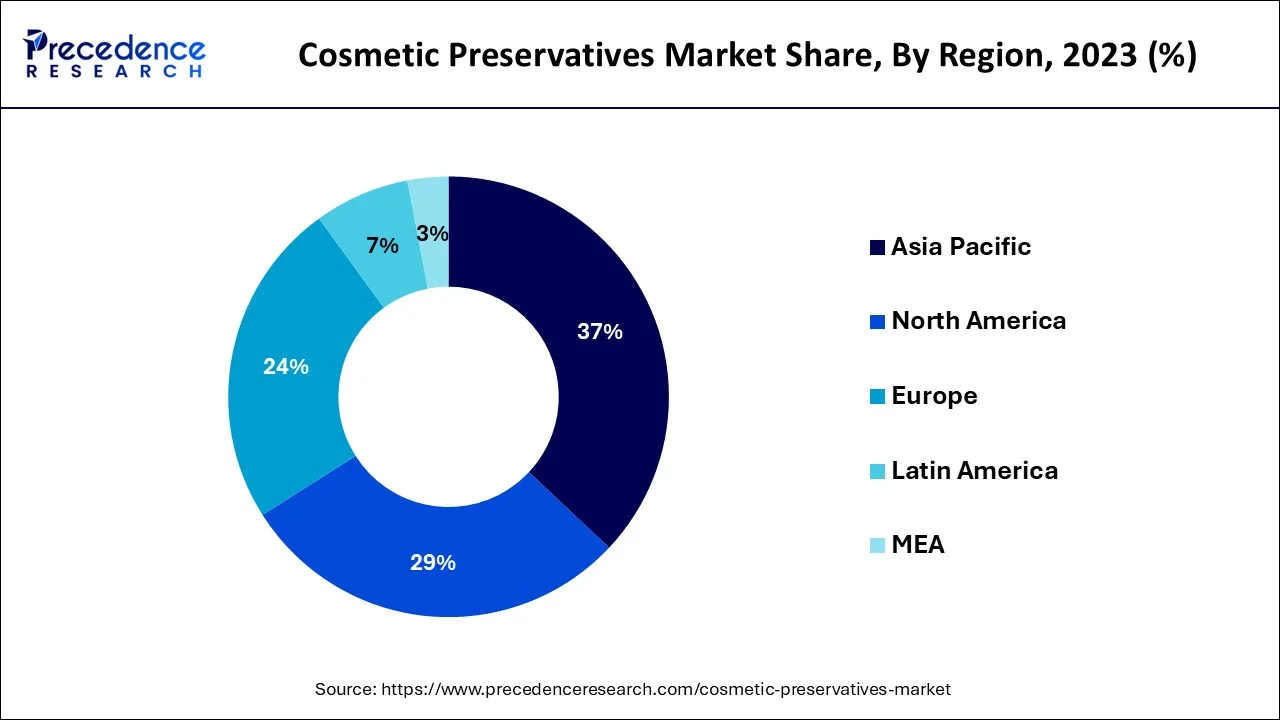

On the basis of geography, Asia-Pacific has held a market share of more than 37% in 2023, the Asia Pacific market was the industry leader in terms of cosmetic preservatives. Growing consumer demand for cosmetics and rising public awareness of personal hygiene and cleanliness are anticipated to drive market expansion in this area. According to projections, China and India will expand rapidly, followed by other South East Asian nations. The growing popularity of Gen X and millennial customers in China, Japan, and India has led to an increase in the market for cosmetic preservatives. Additionally, a lot of cosmetic businesses are adopting high-end chemicals for cosmetic preservation, which is predicted to boost market share. As living standards and views regarding the dermatological aspect of skincare evolve, there will likely be an increase in demand for premium cosmetic components. The aging of the population, the trend toward luxury cosmetics, and the rapid development in demand for high-quality products are all expected to have a significant impact on market share.

Up to 2033, the Europe market might see positive growth. Europe is anticipated to have the second-largest market share. Europe's market is fueled by nations like Germany, the UK, France, Italy, and Spain. Due to the rising production of high-end beauty items, Germany is predicted to expand at the greatest CAGR throughout the projection period.

A synthetic or natural component called a cosmetic preservative is added to personal care products to prevent unneeded chemical changes and deterioration brought on by microbial development. Preservatives are an ingredient in many cosmetic goods, including hair smoothing treatments, color cosmetics, scents, lipsticks, shampoos, conditioners, lotions, and anti-aging products. The rising cost of personal care products is what primarily drives the global market for cosmetic preservatives. Advanced preservatives have been included as a result of the rising demand for multipurpose and high-end cosmetics, supporting the expansion of the cosmetic preservatives market. Cosmetic Preservatives are becoming more popular and consumers are becoming more aware of them, which might increase product demand. The accessibility of both natural and artificial preservatives encourages the expansion of the sector.

The key drivers of the continued growth of the market for cosmetic preservatives include urbanization in developing economies and an increase in the number of working women in nations like China, India, and Korea. The variables that contribute to the advancement of society and urbanites' desire for an affluent lifestyle are crucial to the market's expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 472.98 Million |

| Market Size by 2034 | USD USD 847.04 Million |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Strict legal requirements to restrict the use of ingredients

Increase in the female working population

Increase in purchasing of consumers

The risk associated with synthetic ingredients

Male-specific cosmetics are receiving more attention

On the basis of product, the phenol derivatives segment is expected to have the largest market share in the coming years period, this segment has dominated the market in the past with the maximum share in terms of revenue and it will continue to grow well in the coming years.

The category for phenol derivatives is anticipated to see the greatest CAGR throughout the forecast period. The increasing usage of phenol derivatives, notably phenoxyethanol, in the manufacture of cosmetics including skin-lightening creams and lotions, hair coloring solutions, and sunscreens is one of the aspects that may be credited to the segment's rise. Since many years ago, phenol derivatives have been utilized in cosmetic goods and are efficient against a variety of microorganisms.

On the basis of application, the conditioners & shampoos segment is expected to have the largest market share in the coming years period, the segment has dominated the market and it will continue to grow well in terms of revenue. It is advised to employ either natural or synthetic preservatives in the formulation of shampoos and conditioners due to their high water and oxygen content. The market for cosmetic preservatives is being driven by the growing popularity of organic and natural shampoos and conditioners, which is why this market segment is growing.

The facemasks, sunscreens, scrubs & lotions are expected to grow at a significant rate during the forecast period. This application category is expected to develop as people become more aware of the damage that ultraviolet rays do to the skin. Due to increased public knowledge of the effects and harm that the sun may do to exposed skin, sunscreen use is on the rise. The part highlights benefits, such as the fact that sunscreen products' main objective is to prevent or reduce skin damage caused by UV and solar radiation. Skin cancer and actinic aging are two examples of these impacts. Moisturization and a decrease in UV-induced melanin production on exposed skin are secondary advantages. Today's sun care formulator must create solutions that are both elegantly designed to encourage consumer compliance and cost-effectively designed to be accessible in challenging economic times, all while meeting strict SPF and UVA protection criteria.

In February 2022– To develop its personalized personal care product technology, BASF is heavily reinvesting in its strategic partner B2B Cosmetics. The Engage system, which offers consumers freshly manufactured, customized cosmetics, has continued to be developed by BASF and B2B Cosmetics. Users may create custom personal care items using Image technology.

By Product

By Application

By Raw Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

August 2023

November 2024

October 2024