December 2024

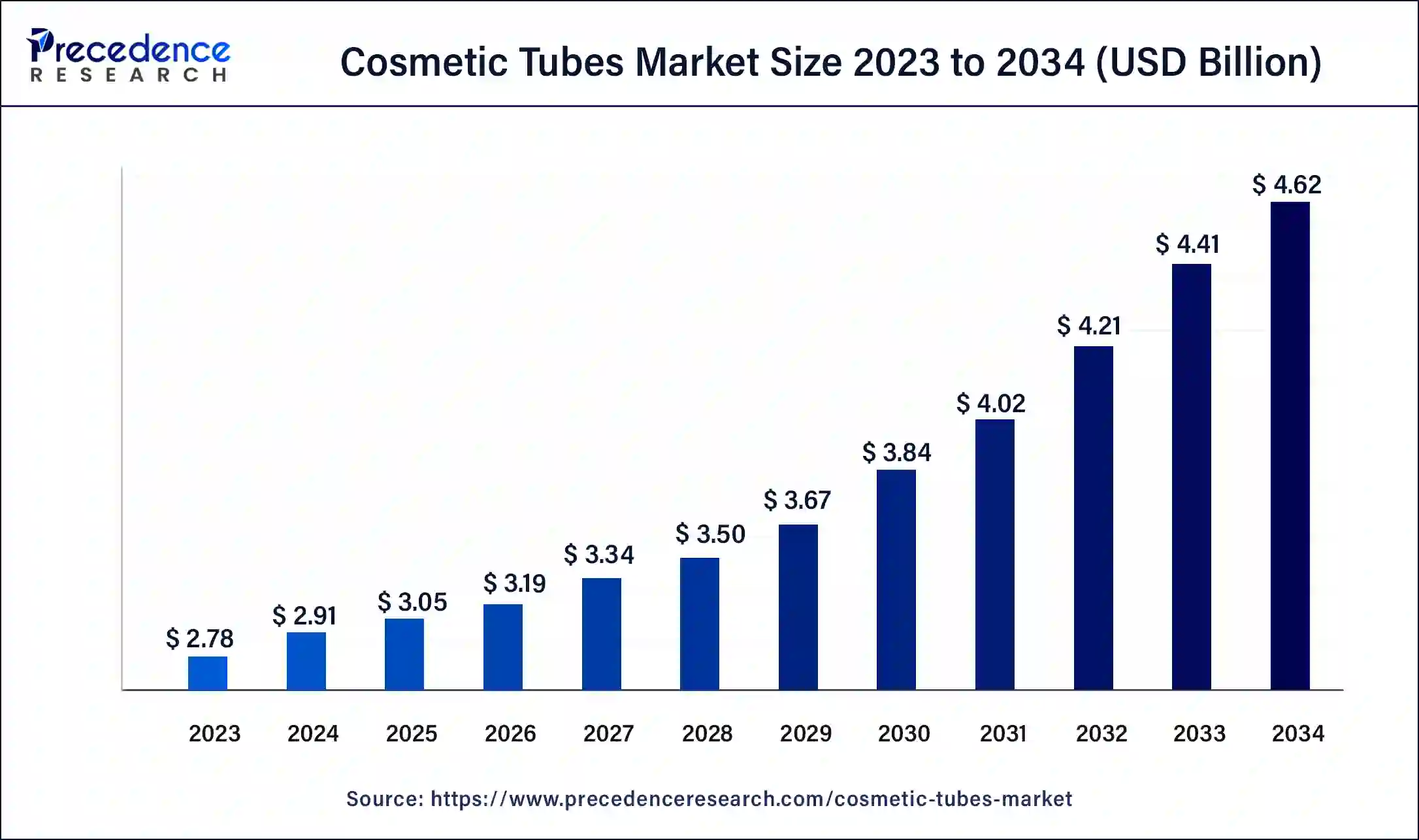

The global cosmetic tubes market size surpassed USD 2.78 billion in 2023 and is estimated to increase from USD 2.91 billion in 2024 to approximately USD 4.62 billion by 2034. It is projected to grow at a CAGR of 4.73% from 2024 to 2034.

The global cosmetic tubes market size is projected to be worth around USD 4.62 billion by 2034 from USD 2.91 billion in 2024, at a CAGR of 4.73% from 2024 to 2034. The cosmetic tubes market is driven by the growing number of individuals with busy lifestyles who seek convenient and portable beauty products.

Cosmetic tubes are a vital component of branding. Customizable labels, colors, and patterns enable businesses to stand out from the competition in the market and draw customers in with eye-catching packaging. Cosmetic items are adequately protected by tubes, which keep them out of the light and keep their shelf life longer. They also keep the product's efficacy intact. The market for cosmetic tubes is expanding due to growing consumer awareness of skincare and grooming, innovation in packaging technologies, and rising demand for personal care and beauty goods. Due to this expansion, Companies can diversify their product lines and take up new market niches.

Albéa's sustainable cosmetic tubes: Cutting-edge solution

By 2025, Albea pledges to have its packaging recyclable or reused. In 2022, it brought in a total of $1.4 billion. In October 2022, Albéa's EcoFusion Top tube won a German Packaging Award in the "durability" category. It was also given a Gold Award, which goes to the winner with the most creative solution. Every year, about 8 billion tubes are made. All the plastic packaging produced by the Albéa Group will be recyclable or reused by 2025. This will be accomplished by making the tube lighter and making items more recyclable to lessen its operation's carbon footprint.

Since Topialyse's packaging comprises polyethylene (PE), it may already be recycled alongside high-density PE bottles in the current systems. Albéa's primary task was to create the EcoFusion, which roughly lowered the overall weight by 55% compared to a traditional tube while considering the product's whole life cycle, including the material, process, and recycling. Apart from its distinct technical attributes, the tube's manufacturing method was completely redesigned to achieve maximum sustainability. This tremendous revolution in the production of plastic tubes has resulted in several machine investments and adjustments, as well as a significant reduction in CO2 emissions.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.62 Billion |

| Market Size in 2023 | USD 2.78 Billion |

| Market Size in 2024 | USD 2.91 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.73% |

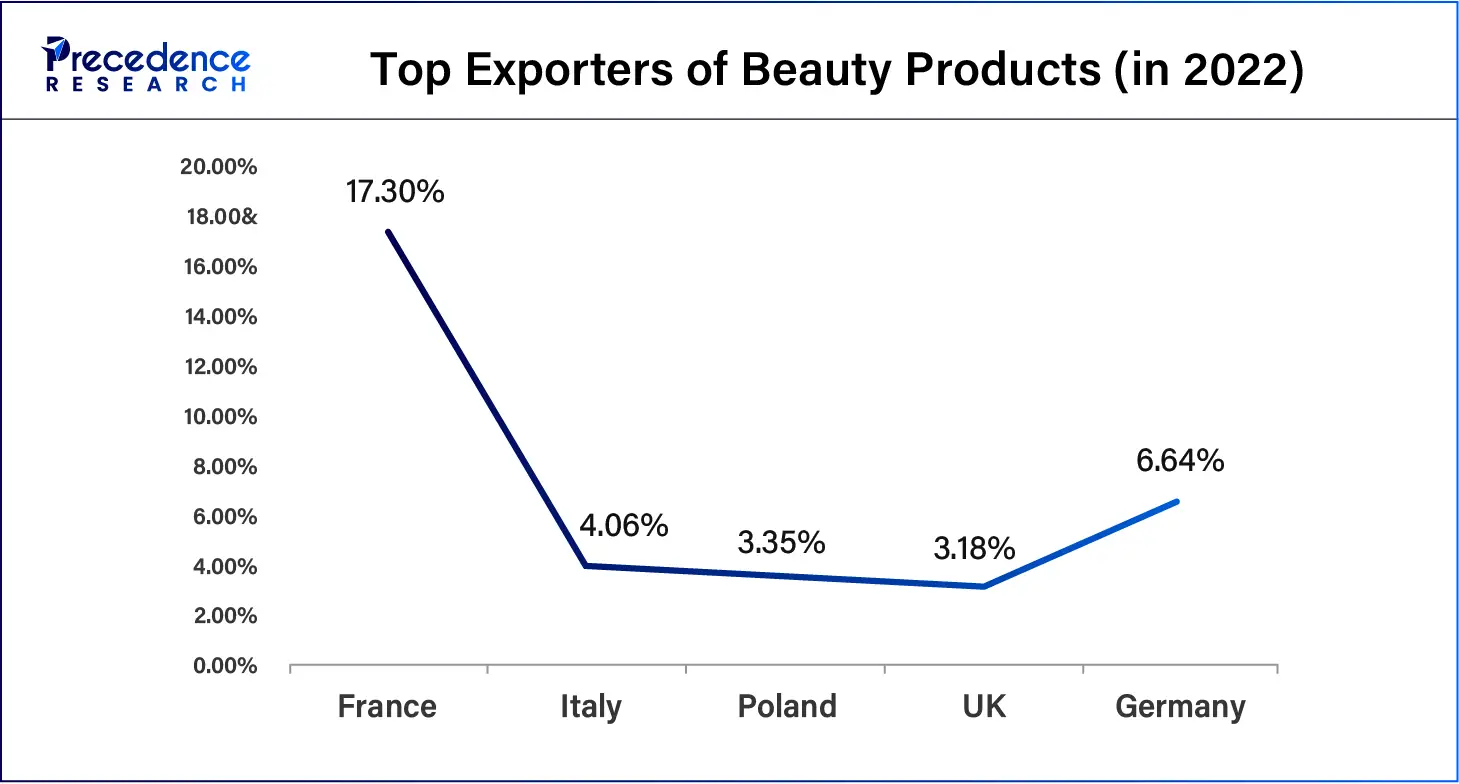

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Application, Type, Applicator, Capacity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for personal care products

Demand for cosmetics and other personal care items grows as individuals become more aware of personal cleanliness and grooming. Consumers' increasing investment in these products drives the need for packaging solutions that can efficiently store and protect high-quality, diversified personal care goods. Cosmetic tubes are preferred because they are practical, simple, and can preserve the product's integrity. Differentiating your brand is essential in a crowded market.

Cosmetic tubes allow customization of shape, size, color, and printing. To stand out in a congested market, brands are investing more and more in distinctive packaging designs. Because of this trend, innovative and personalized cosmetic tubes that improve brand identity and appeal are in high demand.

Supply chain disruptions

Plastics, metals, and glass are the primary materials used to make cosmetic tubes; these materials require specific raw resources, such as polymers, aluminum, or glass. Shortages can occur due to disruptions in the supply of materials brought on by trade restrictions, natural disasters, or geopolitical unrest. This would delay manufacturing and raise expenses. Inventory shortages can result from disruptions, as producers and retailers might not have enough merchandise to satisfy customer demand. This may impact sales and customer happiness. Manufacturers of cosmetic tubes may need to reconsider their long-term plans in case of persistent disruptions. This may involve making investments in alternative materials or local production.

Rising trend towards personalized and premium cosmetic products

The emergence of bespoke and high-end items presents a chance for tube design innovation. Cosmetic tubes can be made more functional by adding features like airless pumps, accurate dispensing mechanisms, and multi-chamber tubes, which also help maintain the integrity of premium formulations. Cosmetic tubes that can hold a variety of formulations and fulfill a range of product needs are seeing new prospects due to the emergence of personalized beauty solutions, including custom-blended skincare and makeup products.

The plastic segment dominated the cosmetic tubes market in 2023. In comparison to comparable materials like glass or metal, plastic is much less expensive. Plastic appeals to producers and consumers because of its relatively low mass production cost, made possible by its efficient manufacturing methods and lower raw ingredients cost. Despite environmental criticism, plastics have come a long way in developing reusable and biodegradable materials. Sustainable methods, such as using recycled materials and creating eco-friendly packaging solutions, are being adopted by many cosmetic tube makers. Addressing environmental concerns is being aided by this move toward more sustainable choices.

The aluminum segment shows a significant growth in the cosmetic tubes market during the forecast period. Since aluminum is strong and impact-resistant, handling and transit of the product doesn't compromise its integrity. Aluminum tubes' flexibility makes squeezing and dispensing the product simple, enhancing user ease. Businesses are collaborating and forging strategic alliances to improve their product offerings and increase their market reach. Many firms are concentrating on sustainability efforts, such as switching to aluminum packaging, to meet their CSR objectives.

The skin care segment dominated the cosmetic tubes market in 2023. The value of skincare is becoming more widely recognized among consumers as personal hygiene, well-being, and health become more important. The demand for skincare products, which are frequently housed in cosmetic tubes, has increased due to increased knowledge. These goods include moisturizers, sunscreens, serums, anti-aging creams, and acne treatments. Skincare companies often introduce limited-edition or personalized goods, and tubes provide specialized packaging options based on client preferences, promotions, or seasonal themes.

The hair care segment is observed to be the fastest growing in the cosmetic tubes market during the forecast period. As consumers become more aware of the health of their hair, there is a growing need for a variety of hair care products, such as shampoos, conditioners, hair oils, serums, and hair masks. This increased consciousness necessitates creative and practical packaging options like makeup tubes. Manufacturers are investing in environmentally friendly packaging solutions in response to growing consumer demand for eco-friendly products. In the hair care market, biodegradable and recyclable tubes are becoming more popular because they appeal to customers who care about the environment.

The squeeze tubes segment dominated the cosmetic tubes market in 2023. Squeeze tubes are incredibly convenient because they let users distribute exact amounts of product with little effort. Because of the tube's flexibility, users may effortlessly regulate the cosmetic product's flow, which minimizes waste and guarantees a more practical application procedure. In response to consumer demand for more environmentally friendly products, many squeeze tubes are now constructed from recyclable materials or have refillable designs. As brands increasingly prioritize ecologically responsible packaging solutions, this sustainability component has further cemented their place in the market.

The collapsible tubes segment shows a notable growth in the cosmetic tubes market during the forecast period. Collapsible tubes are frequently composed of recyclable, lightweight aluminum. This aligns with consumers' and regulators' rising demand for environmentally friendly packaging options. Collapsible tubes are being designed with new dispensing technologies like tamper-evident seals and airless pumps, which offer enhanced security and performance.

The pumps segment is observed to be the fastest growing in the cosmetic tubes market during the forecast period. Pump dispensers provide customers with a more practical and easy-to-use method of dispensing goods than squeeze tubes. They save waste and mess by enabling exact control over the quantity of materials supplied. With the increasing customization available in modern pump systems, various dispensing rates can be achieved to accommodate varying product viscosities. Pumps work well with a wide range of cosmetic products, including serums and lotions, because of their flexibility.

The nozzles segment is expected to witness a significant growth in the cosmetic tubes market during the forecast period. Customers favor more exact product applications made possible by nozzles on cosmetic tubes, especially in skincare, haircare, and personal care. Nozzle applicators, for example, are helpful for products like hair serums, eye creams, and spot treatments because they allow users to apply the product directly to a targeted region, reducing waste and increasing product efficacy.

Nozzles are becoming more ecologically friendly in design as the cosmetics industry focuses more on sustainability. In line with consumers' rising demand for environmentally friendly packaging options, this involves utilizing recyclable materials and designs that minimize product waste.

The 50 to 100 ml segment dominated the cosmetic tubes market in 2023. The 50 to 100 ml size range strikes the ideal mix of being big enough to hold enough produce and tiny to be portable. Customers find these tubes convenient to pack in purses, travel kits, or gym bags, which makes them perfect for busy lifestyles. Producing smaller tubes, which frequently require less packaging material per unit, allows manufacturers to maximize material consumption. The significance of eco-friendly practices is growing as more and more organizations and consumers value them.

Europe held a significant share in the cosmetic tubes market in 2023. Europe can produce innovative goods with a focus on quality and precision. Numerous producers of cosmetic tubes, including laminated, aluminum, and plastic tubes, are derived in the area. These producers are renowned for their capacity to satisfy the exact standards of quality demanded by the cosmetics sector. The demand for cosmetic tubes has also grown due to the expansion of e-commerce in Europe. There is an increasing need for robust, portable, and lightweight packaging as more people buy cosmetic items online. Cosmetic tubes are an excellent choice for online sales because they are simple to use and include protective features.

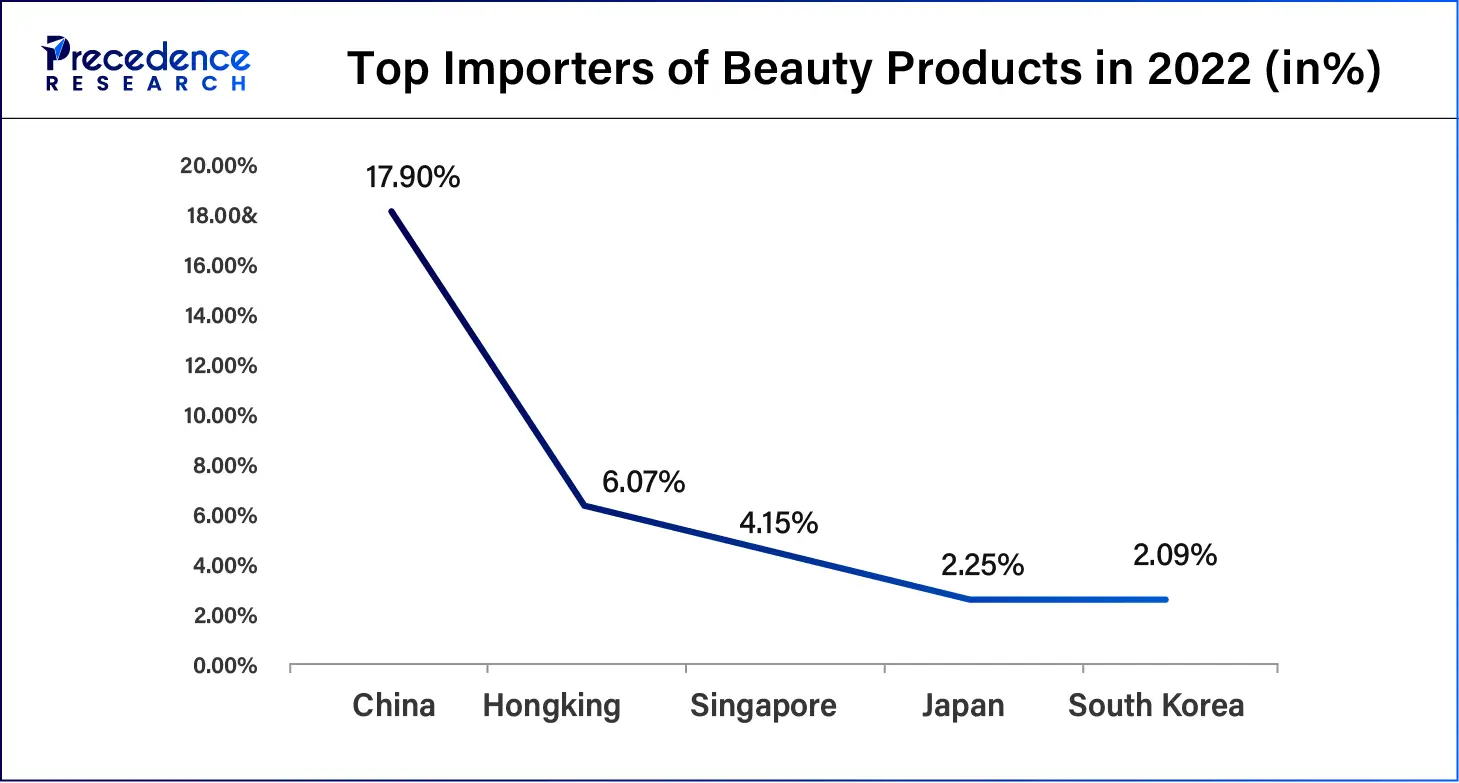

Asia-Pacific is observed to be the fastest growing in the cosmetic tubes market during the forecast period. Increasingly, people have more disposable income due to the rapid economic expansion of nations like China, India, and Southeast Asia. Because of this, customers can now spend more on cosmetics and personal care items, increasing the need for packaging solutions like cosmetic tubes. As their diversity grows, a wide range of tube packaging is required for cosmetic items, including skin care creams, lotions, foundations, and serums. This tendency helps the cosmetic tube industry as producers look for novel ways to set their products apart.

Segments Covered in the Report

By Material

By Application

By Type

By Applicator

By Capacity

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

August 2024