February 2025

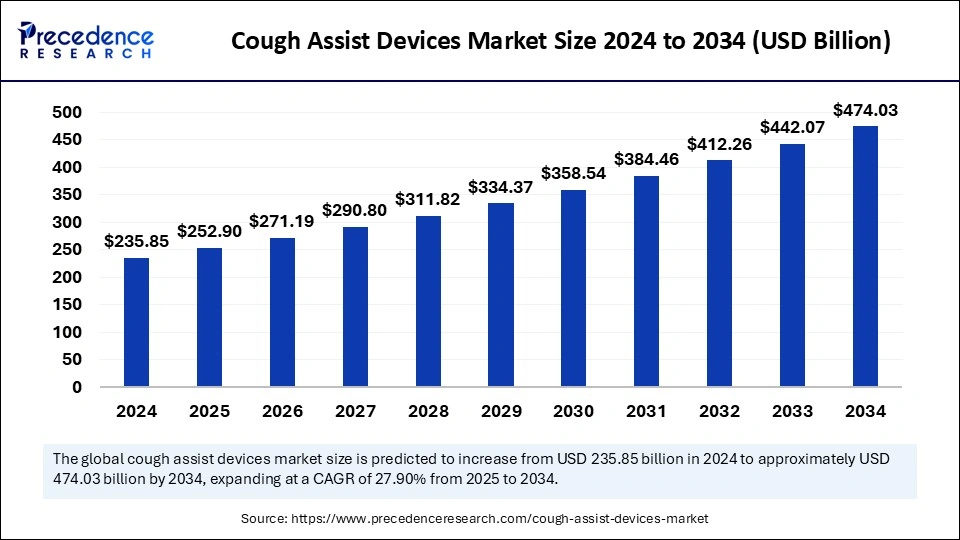

The global cough assist devices market size is calculated at USD 252.90 billion in 2025 and is forecasted to reach around USD 474.03 billion by 2034, accelerating at a CAGR of 7.23% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cough assist devices market size was estimated at USD 235.85 billion in 2024 and is predicted to increase from USD 253.90 billion in 2025 to approximately USD 474.03 billion by 2034, expanding at a CAGR of 7.23% from 2025 to 2034. The increasing prevalence of respiratory and neuromuscular disorders among people of all age groups and the preferences for respiratory therapy or home-based medical care settings drive the expansion of the market.

Artificial intelligence cough tools enable patients to become more aware of their health, and AI helps in cough sound detection and diagnosis. AI-based solutions help to identify characteristics of diseases and their symptoms through cough sounds. They can also identify several respiratory diseases by using cough sounds. AI helps in data analysis and the prediction of results. AI algorithms can identify several diseases, such as asthma, pulmonary edema, pneumonia, TB, etc.

The cough assist devices refer to the equipment used in hospitals and home care settings to give relief to people from respiratory or chest secretions. They are also known as mechanical insufflators or exsufflators, which provide positive airway pressure through a turbine. The air is provided through a mouthpiece and a close-fitting mask. The growing success of the cough assist devices market is driven by the increasing use of these devices among patients with spinal cord injuries or severe fatigue related to lung diseases. The reduced costs associated with hospital visits and increased patient comfort to access medical care in home-based settings accelerate the adoption of these devices in healthcare systems.

The Vest Advanced Pulmonary Experienced (APX) System, launched by Baxter International Inc., is potentially useful in supporting daily therapies for adults and children dealing with chronic lung disorders and retained secretions.

| Report Coverage | Details |

| Market Size by 2034 | USD 474.03 Billion |

| Market Size in 2025 | USD 252.90 Billion |

| Market Size in 2024 | USD 235.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Choice of Delivery, End User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Growing health conditions

The increasing incidence of respiratory diseases and spinal cord injuries causes a rising demand for advanced medical devices in cough assistance, cough detection, and cough diagnosis. The efforts of the WHO and the CDC in the monitoring of several respiratory conditions lead to increased healthcare awareness among the majority of the population. The prevalence of several respiratory illnesses is caused by the seasonal rise of respiratory pathogens, leading to the need for improved patient care with advanced medical equipment.

With the large global population, the global incidence of people living with disability due to spinal cord injuries, including cervical conditions, is increased, which needs effective measures to manage them precisely. Advancements in medical device technologies, such as health acoustic representations (HeAR) like the bioacoustic foundation model, enable researchers to build models that can listen to human sounds and give early signs of diseases.

High costs

The high costs of these medical devices can limit their access to the population. By eliminating the need for hospitalization, patients may face issues in getting proper home-based medical care settings due to the high standards required for maintenance, regulation, etc. The lengthy period for regulatory approvals of medical devices and stringent regulations needed for their maintenance may limit their growth in the market. The limited awareness about the health benefits of these medical equipment can limit their expansive reach in the patient population.

New initiatives and reimbursement policies

Considering the high costs associated with medicines to treat respiratory conditions, companies like AstraZeneca took initiatives for better healthcare accessibility. The expansion of savings programs for patients increases the affordability of medicines used to treat conditions like asthma and chronic obstructive pulmonary disease (COPD). Both uninsured and underinsured people can afford and access related treatments, medicines, and therapies with the help of cost-reduction initiatives by companies.

Favorable reimbursement and insurance coverage in the U.S. boosts the adoption of cough-assist medical devices among the patient population. The susceptibility of the elderly population to impaired lung functions and several kinds of lung infections raises the need for advanced cough detection and diagnosis devices.

The automatic segment dominated the cough assist devices market due to the improved effectiveness, monitoring, data recording capabilities, home care settings, and ease of usage. They offer user-friendly and convenient solutions for people with impaired cough functions, which drives their adoption among the population. The useful features, such as adjustable pressure and timing settings, boost their importance in the market. The adaptability of these products enables healthcare professionals to recommend their uses to meet the specific needs of people.

The manual cough assist device segment is expected to grow at a significant rate in the cough assist devices market during the forecast period due to its importance in treating patients with neuromuscular disorders and spinal cord injuries with weak breathing muscles. The usefulness of these devices in the clearance of high amounts of cough and giving relief to the lungs from maximum air volume drives their demand and need in the market. The use of manual cough assist medical devices and lung volume recruitment (LVR) techniques in managing lung infections and maximum air volumes in lungs boost their increasing adoption in healthcare systems. The implementation of lung volume recruitment techniques such as the LVR bag (breath stacking bag), a breathing machine (ventilator), and the mechanical coughing machine with a mouthpiece or glossopharyngeal breathing (frog breathing) accelerates the segmental growth in the market.

The mouthpiece segment dominated the cough assist devices market due to the simplicity and easy usage of mouthpiece cough assist devices. They enable people to hold the mouthpiece in their mouth and achieve control over their breath during the therapy. The designed features of these devices allow their increased accessibility and availability without the need for masks or external equipment. The other major rationales behind this segmental growth are improved patient comfort, the portability of devices, and better hygienic initiatives.

The face mask segment is expected to grow at the fastest rate in the cough assist devices market over the forecast period due to its potential to clear secretions from the lungs. This non-invasive treatment provides air pressure through a tube and mask interface and raises the increased use of cough assist face masks. The latex-free nature of some face masks and their adaptable use with cough assist units boost their adoption in healthcare. The availability of face masks in various sizes for pediatric and adult patients surges the expansive reach of these products in the market.

The home care settings segment is anticipated to be the fastest-growing in the cough assist devices market during the forecast period due to the preferences for better quality of life, personalized care, decreased risk of infections, and cost-effectiveness. The potential advantages of home care cough assist devices as cost-effective alternatives to hospital-based care drive their importance in the market. People can get comfortable respiratory care by achieving familiarity in their own homes.

The hospital segment dominated the cough assist devices market due to the increased preferences for proper treatment monitoring by healthcare professionals and healthcare facilities available in hospitals. The adaptability of several high-performance medical devices in hospital infrastructure raises the quality of medical treatments in hospitals. The proper maintenance and strict regulations required for medical appliances and related facilities, followed by well-equipped hospital infrastructure, raise the expansion of hospitals in the market. The presence of responsible and accountable medical staff, along with experienced healthcare professionals, causes the increased shift of people toward hospitals for improved patient care.

North America dominated the cough assist devices market due to the rising incidence of chronic respiratory conditions such as cystic fibrosis, chronic obstructive pulmonary disease (COPD), etc. The increased rate of lung infections, difficulties in coughing up, and other health complications raise the need for cough-assist medical devices to deliver improved patient care. The efficiency of these devices in clearing mucus, providing positive airway pressure, and delivering airway clearance drives the growth of the market.

The rising healthcare access and improved affordability of healthcare services surge the adoption of advanced medical devices in hospitals and home-based medical care settings. The presence of well-equipped healthcare infrastructure, the availability of advanced medical technologies, and the accessibility to reimbursement policies boost the shift of people toward healthcare.

Asia Pacific is expected to grow rapidly in the market during the forecast period due to increasing healthcare access, increasing investments in healthcare infrastructure, and economic developments in China and India. The easy accessibility to medical treatments and technologies drives the regional market’s growth significantly.

The major efforts of several leading companies in research and development activities to drive exciting innovations accelerate the growth of the market in this region. The guide, like the PIC/S, offers international standards to promote the elimination of trade barriers, ensure the quality of active ingredients and drug products, and promote equality in licensing decisions.

By Product Type

By Choice of Delivery

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

April 2025

January 2025

January 2025