July 2024

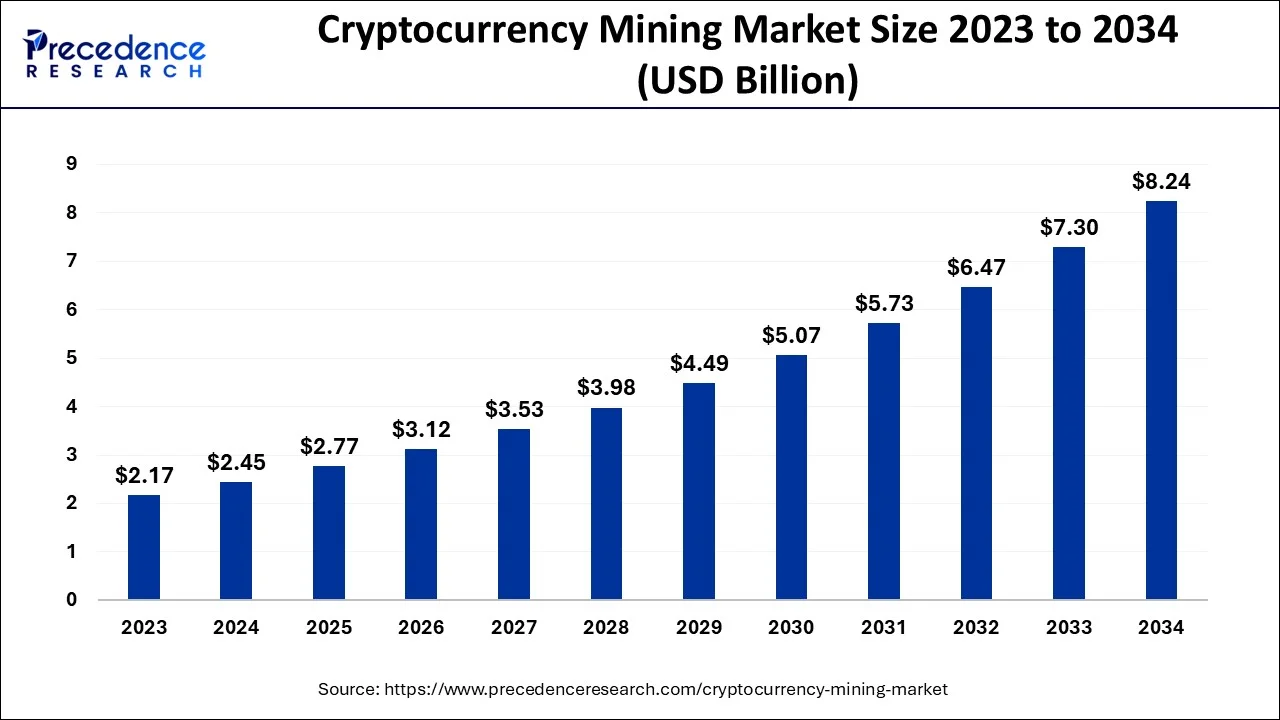

The global cryptocurrency mining market size accounted for USD 2.45 billion in 2024 and is anticipated to reach around USD 8.24 billion by 2034, growing at a CAGR of 12.90% between 2024 and 2034.

Bitcoin and numerous other cryptocurrencies service the mining progression to produce a new exchange and validate fresh transactions. Bitcoin operates on a distributed network or decentralized computer network that keeps track of cryptocurrency. New bitcoins are generated or mined when machines on the system authenticate and process the transaction. The transaction is processed by these computer networks, or miners, in return for a Bitcoin reward.

The industry is expanding primarily because of the development of distributed ledger technologies and an increase in electronic venture capital investment. Digital currency is now being used by developing nations as a means of financial transactions. Additionally, blockchain technology is frequently used in conjunction with virtual currency to provide decentralized and managed related capital. Blockchain technology enables quick decentralization.

Transactions that are efficient, safe, and transparent. For instance, the Singapore-based Qtum Chains Association and Amazon Web Services Chinese collaborated in October 2018 to implement decentralized applications on the AWS cloud. This partnership aims to make it simpler and more effective for AWS users to create and distribute contracts using Amazon Machine Images (AMI). Such actions taken by market participants are anticipated to aid in the expansion of the industry.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.45 Billion |

| Market Size by 2034 | USD 8.24 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.90% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Offering, By Process, By Type and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Distributed database technology's transparency: Difficulties with a lack of transparency and when transactions occur without the awareness of stakeholders, particularly in Asian nations where numerous instances of unauthorized or fraudulent activities, such as the withdrawal of scheduled costs, are regularly seen.

Customers may lose a significant amount of money as a result of this, which could be brought on by human error, mechanical fault, or manipulation of data even during the transaction process. Additionally, financial firms typically do not acknowledge their mistakes. The public is dissatisfied with the present money system because of its lack of transparency.

Demand for virtual currency is driven by regional instability and a focus on financial crisis mitigation: Financial catastrophe is a significant problem that affects financial services and the financial industry. The economy is hampered by economic uncertainty since the price of the currency declines. For example, the 2008 Lehman Brothers crisis, which had an impact on the country's economy, was a huge issue for India's ICICI bank.

The financial crisis has had little impact on Bitcoins and other cryptocurrencies because of their uniformly balanced worth. In places with shaky economic systems, cryptocurrencies are a preferable option in times of financial instability, which is increasingly a key market-driving driver.

Growing bitcoin usage to experience exploding demand in the crypto market: Growing capital investment, increased visibility, and favorable rules are all contributing to the industry's expansion. The market worth of digital cash is also rising as a result of mature bitcoin dollar amount and the ability to pay rewards for transactions. People's propensity for digital money is evident in developing nations like the U.S., Japan, Europe, and many others. This trend is anticipated to support the development of the cryptocurrency industry in the next few years.

Worries about privacy, security, and control: Peer-to-peer & transfer transactions free from conformity get the capacity to be transformed and revolutionized by cryptocurrencies; however, end users must overcome some obstacles relating to security, confidentiality, and control to take advantage of bitcoin. Because cryptocurrency activities are stored in bitcoin, a decentralized public database, hackers have a huge attack surface to obtain sensitive data.

It is possible that duplicating the file will make it simpler for attackers to access the public ledger if it is employed to store private information about contracts or payment details. if a compromised key. Both a distributed system and a hub-spoke architecture can use to retrieve the data.

Significant growth prospects in developed and emerging markets: For businesses operating in the cryptocurrency sector, emerging markets (like China, India, China, Brazil, and developed nations (like the US, German, and Japan are anticipated to have considerable growth prospects. For example, Brazilian cryptocurrency businesses signed a rule of personality in 2020 intending to legitimize and accelerate the acceptance of digital currencies in the nation. The agreement was signed on behalf of the nation's organization of cryptocurrency businesses, Abcripto.

The agreement's goal is to create operating procedures and compliance requirements that all participants must follow. Several well-known bitcoin companies from the nation have signed the code, including Bitcoin Market, Foxbit, Ripio, and Nolvadex.

In 2023, hardware will support the largest cryptocurrency industry. The idea behind cryptocurrencies is to decentralize transaction oversight. Miners, who are often users, verify the transactions conducted by other users as part of the transaction control process. High computer power is required in this procedure for the system to authenticate the transaction. Hash codes are generated as part of the validation procedure to secure the transaction.

A miner needs extremely efficient and powerful equipment to create a cryptographic hash. In those other terms, miners must produce as frequent patterns as they can to obtain fresh blocks & solve those. Mining pays out for the miners. Minings come in a variety of forms and dimensions. According to the type of processor used, the bitcoin hardware market has been divided into four categories: GPUs, ASICS, CPUs, and FPGAs. A trading engine is a limited service that exchanges technology employs to connect offerings and swaps with futures of digital currencies. Digital wallets are once again classified as self-hosted or custodian wallets based on the patient's authority over the secret key security feature.

In 2023 the mining segment generated more than 76% of the revenue share. For the creation, transmission, and confirmation of cryptocurrency transactions, mining is a crucial operation. It guarantees the currency's steady, safe, and secure transmission from a payment to the receiver. Cryptocurrencies operate on a peer-to-peer network and therefore are decentralized, in contrast to fiat money, in which a central authority oversees & regulates all activities.

Bitcoin has gained a lot of market traction as a virtual currency. Among the most popular digital currencies, based on a report from Deutsche Bank AG that was released in 2017, is bitcoin, which will continue to rule the market for the foreseeable future. Another well-liked cryptocurrency in that marketplace is ether, which can be utilized for trading, forming decentralized applications, and developing distributed applications. at the store. It is anticipated that ether would grow slowly.

Similarly, to that, debentures are verified using ripple. The network created by ripple creates creditor-debtor relationships and current accounts that are accessible to any network user. Although Litecoin shares the same good job as Bitcoin, it holds the advantage of being four times quicker than Bitcoin, which would be expected to dominate the market in the next years. Monitor, Dogecoin, and Dash are only a few examples of additional cryptocurrencies that significantly contribute to market expansion.

The biggest market share was taken by trading. The chapter focuses on cryptocurrency trading platforms like Coinrule, Cryptohopper, Pionex, and Bitsgap. Retail and e-commerce businesses have begun to accept bitcoins as a method of money. For example, in September 2019, every German location of the fast-food giant Burger King welcomed bitcoin because of its online purchases and delivery. It is predicted that cross-border remittances will be impacted by the adoption of virtual currency in digital payment. The banking firm is focusing on the blockchain, which is predicted to dominate the market in the years to come.

In 2023, North America accounted for the largest portion of the worldwide market since most of that region considered bitcoins more like a tax-related means of exchange than a form of money. Many wealthy nations continue to prioritize using electronic currency, even though the state does not have any legal restrictions on it. The marketplace is growing as a result of customers' and merchants' acceptance of electronic money.

Furthermore, the North American market is dominated by the prevalence of mining bitcoin and also the existence of a plurality of prominent firms. APAC will experience the highest CAGR concerning value growth in the forthcoming years. Because of its low electricity prices and abundance of huge mining enterprises, China has the greatest market of all the APAC nations.

Segments Covered in the Report

By Offering

By Process

By Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024