September 2024

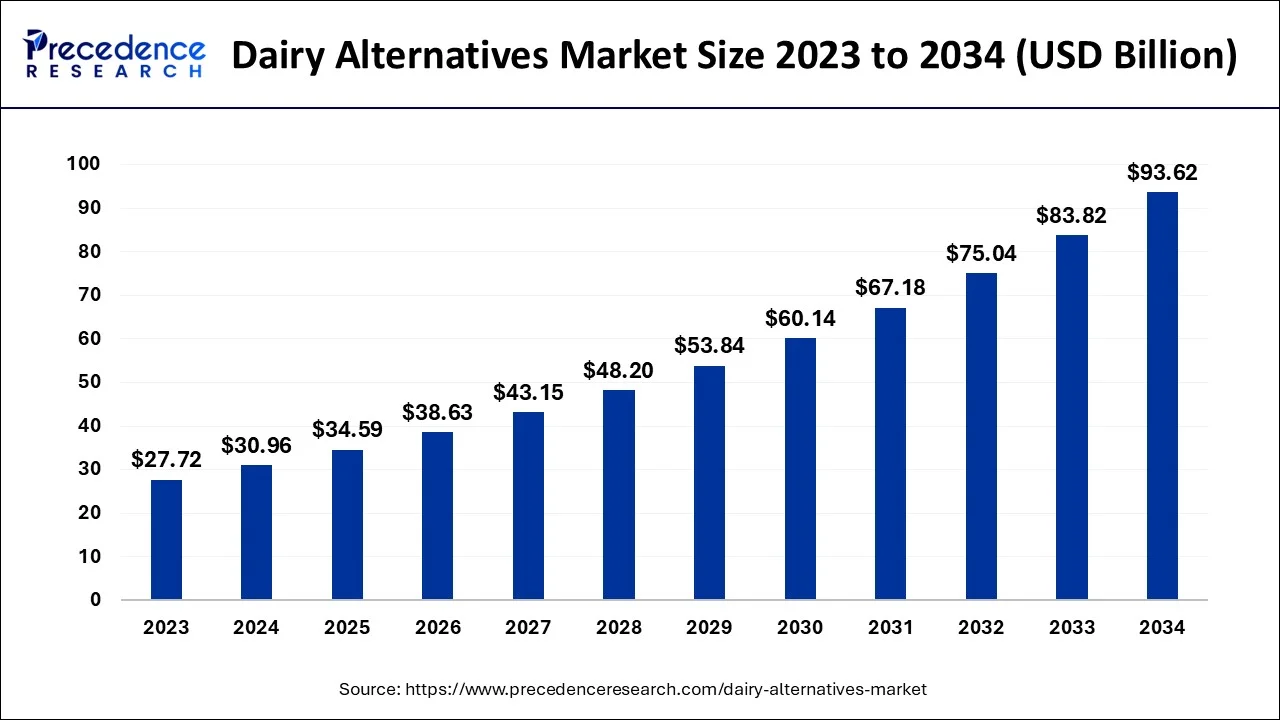

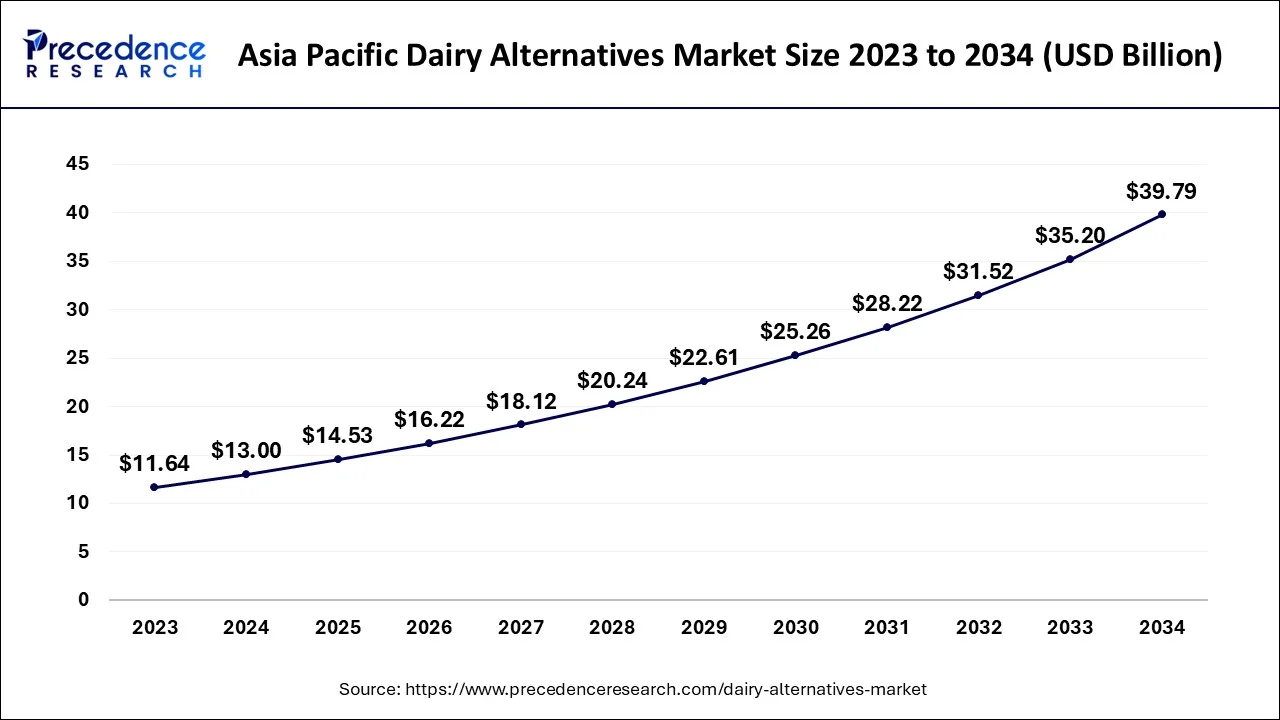

The global dairy alternatives market size accounted for USD 34.59 billion in 2025 and is predicted to surpass around USD 93.62 billion by 2034, representing a healthy CAGR of 11.70% between 2025 and 2034. The Asia Pacific dairy alternatives market size accounted for USD 14.53 billion in 2025 and is expanding at a CAGR of 11.82% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dairy alternatives market size was accounted at USD 30.96 billion in 2024 and is anticipated to reach around USD 93.62 billion by 2034, growing at a CAGR of 11.70% from 2025 to 2034.

The Asia Pacific dairy alternatives market size was evaluated at USD 13.00 billion in 2024 and is predicted to be worth around USD 39.79 billion by 2034, rising at a CAGR of 11.82% from 2025 to 2034.

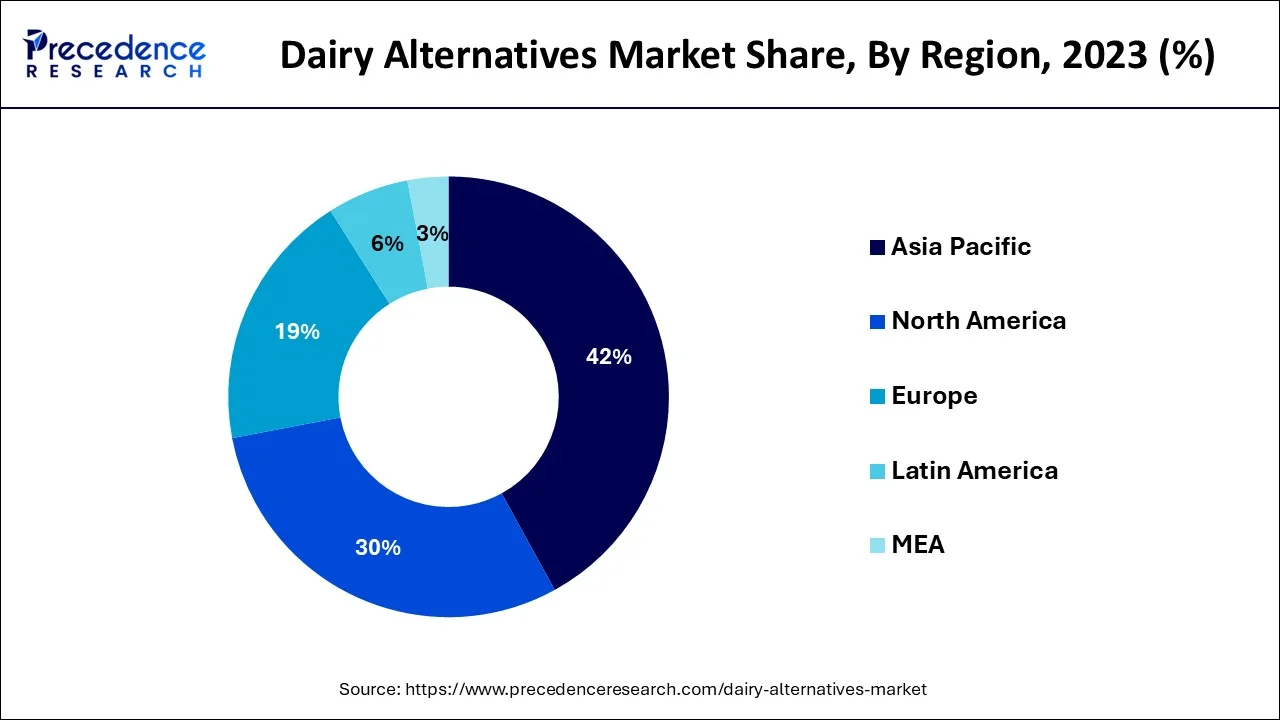

Why Asia-Pacific held highest market share?

Why North America region reach significant share in the dairy alternatives market?

Why Europe region is growing faster?

Dairy alternatives are foods and beverages that can replace dairy products. These products are made with plant-based milk that resembles dairy milk in texture and taste, and contains fewer calories, fat, and sugar than regular milk. Plant-based milk is derived from plant sources such as soybeans, coconuts, almonds, peas, and cashews. Soy milk, rice milk, and almond milk are some of the most popular alternatives to milk worldwide. Cheese, butter, ice cream, and yogurt, among other products, can be made from plant-based milk.

Globally, the health benefits of dairy alternatives have led to their widespread adoption in many applications. In addition, the functional properties presented by dairy-free products contribute to improved texture, resistance to fatigue, stress, aging and many other problems. The market is on the rise and is in high demand due to changing consumer eating habits and changing food trends. Increasing cases of milk allergy and lactose intolerance are expected to drive demand for milk alternatives during the forecast period. Dairy alternatives are considered healthy due to the presence of several essential vitamins and minerals. They're also low in fat, cholesterol, and lactose-free. Therefore, these food products are especially suitable for consumers with lactose intolerance. As a result, many food and beverage products use dairy alternatives to attract a growing number of customers who opt for plant-based alternatives and dairy alternatives.

This is expected to contribute to the growth of the market as fitness savvy consumers increase globally. Changing lifestyles, increasing health awareness, increasing number of lactose allergy cases and growing application areas is also a crucial factor driving the growth of the market.

The food and beverage sector has faced unexpected challenges due to the COVID-19 pandemic. Various government-imposed restrictions in the countries such as lockdowns and production shutdowns severely disrupted global supply chains in 2022. Lack of raw materials and shortage of labor force hindered the production of many small varieties and large-scale products as well as small scale food and beverage manufacturers. However, healthcare and wellness trends have changed dramatically due to the COVID-19 pandemic as people become more and more concerned about their health and immunity, which has created a need for large for herbal products of plants. Health and wellness are the main drivers for the adoption of alternative or plant-based proteins, which has driven the growth of the dairy alternativess market.

In addition, in 2023, manufacturers are allowed to operate at full capacity, which helps them close the gap between supply and demand. This factor is expected to give the dairy alternativess market players plenty of opportunities during the forecast period. As a result, the COVID-19 pandemic has had a mixed effect on the milk substitutes market, and in the long run, it is expected to open up significant opportunities.

The vegan population has increased significantly in recent years. People are shifting their focus to a vegan diet, due to growing health concerns. Many nutritionists and health professionals recommend switching to a vegetarian diet to reduce the risk of chronic health problems, such as obesity, heart disease, high blood pressure, high blood pressure, and digestive disorders. According to Google Trends, vegan was one of the top 5 most searched terms on Google in 2019 in the UK and globally. As a result, the growing trend of veganism and vegetarianism is driving the growth of the market for plant-based products. The nutritional benefits such as lower cholesterol levels, improved heart health and diabetes control from plant-based dairy alternatives have increased their intake. Soybean sourced milk is consumed as a vital source of protein, omega-3 fatty acids, and fiber. Plant based milk alternatives to dairy products tend to contain fewer calories, less fat, more water. Some plant based products are fortified with vitamins and other nutrients. These nutritional benefits are contributing to the growth of the milk substitutes market.

The growing popularity of dairy alternatives as dietary supplements among the young population to maintain healthy lifestyle goals will drive demand for these products. The high consumption of dietary supplements to regulate body weight as well as the increase in obesity in adults will positively affect the dairy alternative market. In addition, the increasing use of coconut and soy-enriched products by professional athletes and fitness enthusiasts as a substitute for whey protein will boost the market share of dairy alternative products. The rapid shift of health cautious consumers to western diets in many developing countries, including Argentina, China, India, and Russia is one of the important factors contributing the growth of the dairy alternatives market. The vegan diet is mainly based on dairy products such as milk, cheese, and butter. Furthermore, benefits such as low sugar content, low calorie content and presence of water in dairy alternatives are driving its demand globally.

| Report Coverage | Details |

| Market Size in 2024 | USD 30.96 Billion |

| Market Size in 2025 | USD 34.59 Billion |

| Market Size by 2034 | USD 93.62 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.70% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Product, Type, Formulation, Distribution Channel, Distribution Channel, Geography |

Based on source, the market is segmented into almond, soy, coconut, oat and others. Soybean segment holds the largest market share; however, the almond segment is becoming an important segment. Almonds have a nutty flavor and can be consumed by vegans, consumers with lactose intolerance and those allergic to soy milk. Almond products are rich in fat, fiber and protein, which explain their popularity among consumers.

In addition, almonds are also rich in B vitamins, which increase the body's basal metabolic rate, allowing it to burn fat and calories more efficiently. Growing demand for almond milk alternatives due to these nutritional benefits is contributing to the growth of the segment. Soy milk is expected to gain popularity in the United States among older consumers and women because it contains isoflavones, which are believed to reduce the risk of heart disease and breast cancer. Soy also contains phytoestrogens, which act similarly to estrogen, a female hormone. Drinking soy milk is popular as an alternative therapy among women to increase estrogen levels, which is expected to drive the market further. Almond milk is becoming increasingly popular among health-conscious young people who follow diets, such as the ketogenic and vegan diets. Almond milk is a rich substitute for dairy products due to its high fat, fiber and protein content, and is expected to be adopted by consumers widely. Additionally, almond milk helps regulate blood pressure and provides additional benefits for the skin, kidneys, and heart. It is increasingly being consumed in food as a means of preventing related diseases.

On the basis of product, the dairy alternativess market is segmented into food (milk, ice cream, yogurt, cheese and others) and beverages. The milk segment holds the largest market share; however, the yogurt segment is expected to achieve the highest CAGR during the forecast period. Vegan yogurt is a healthy creamy food that helps vegans and people with lactose intolerance meet their nutritional needs without depending on dairy products. It is enriched with nutrients such as important vitamins, minerals, amino acids and lipids, which help reduce inflammation and boost metabolism. Vegetarian yogurts are currently in high demand due to the growing vegan trend and easy availability of yogurts in various flavors such as vanilla, strawberry, raspberry, strawberry blend and others.

Growing demand for cheese products made with dairy alternatives, such as soy and almond cream cheese, sour cream and regular cheese, is expected to drive demand for dairy alternativess during the forecast period. Lactose-intolerant and dairy-allergic consumers are turning to almond and soy cheeses, which are leading the market. Growing health and wellness awareness, hectic lifestyle and growing demand for vegan products by millennial spurred the consumption of dairy-free beverages. Dairy alternatives such as almond milk, soy milk, oat milk and others are widely used in beverages to increase texture and creaminess.

On the basis of distribution channel, the market is segmented into supermarkets & hypermarkets, online retailers, convenience stores, and others. The supermarket and hypermarket segment is the largest market segment. Supermarkets & hypermarkets offer a wide range of food products, groceries, beverages, and wide variety of household items. Products of different brands are available at reasonable prices at these stores, allowing shoppers to quickly find the right product. Moreover, supermarkets usually offer huge discounts, and variety of options for payments. Manufacturers of milk substitutes often prefer to sell their products in supermarkets and hypermarkets due to the high traffic to these stores.

Convenience stores often offer lower discounts than hypermarkets, supermarkets, and online stores due to low volumes from manufacturers or suppliers. Also, convenience stores mainly focus on everyday items, so the limited availability of shelf sizes makes it impossible for them to hold a large stock of dairy alternatives. Due to the limited availability of milk substitute brands in convenience stores, consumers mainly prefer other distribution channels, so this is expected to hold back the growth of this segment in the forecast period. However, convenience stores provide better traction for raw milk, as consumers generally prefer it for everyday use.

By Source

By Product

By Formulation

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

June 2025

January 2025

January 2025