April 2025

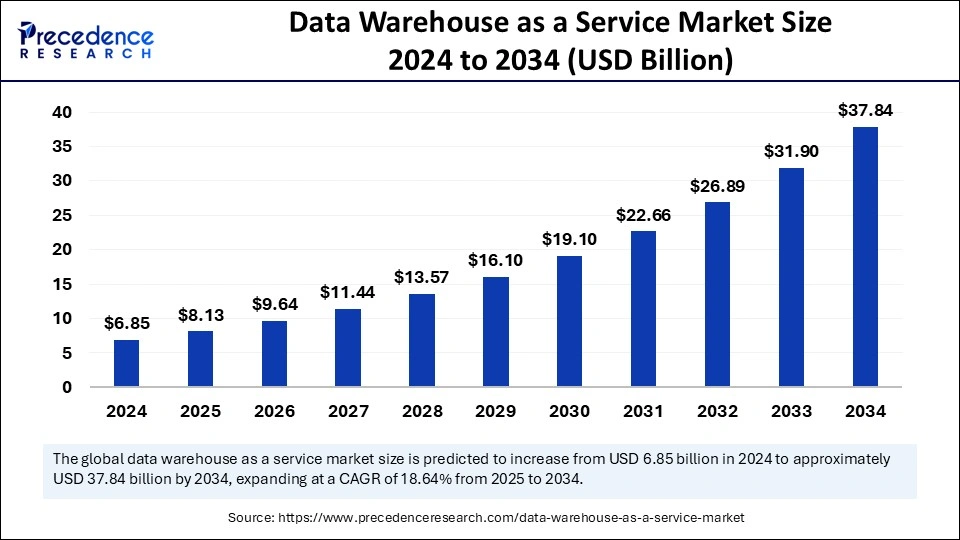

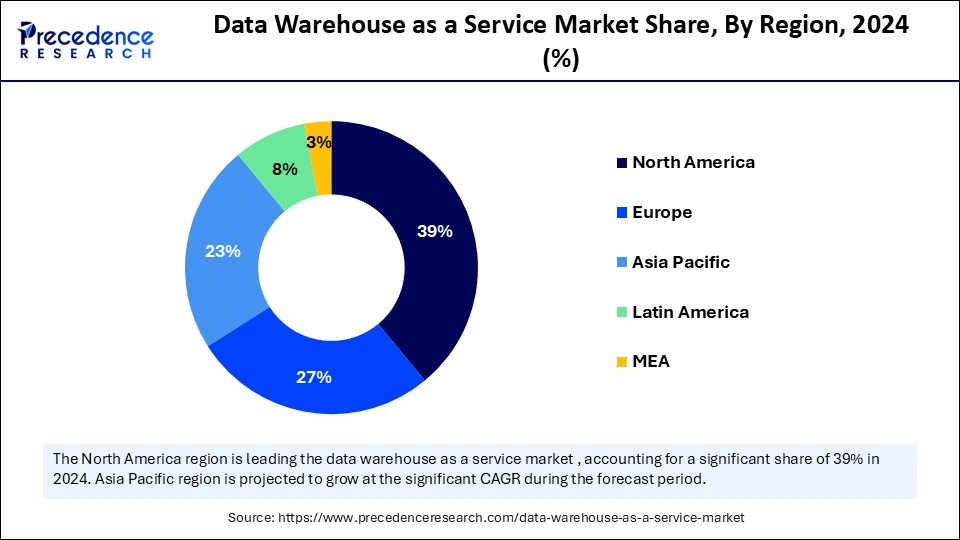

The global data warehouse as a service market size is accounted at USD 8.13 billion in 2025 and is forecasted to hit around USD 37.84 billion by 2034, representing a CAGR of 18.64% from 2025 to 2034. The North America market size was estimated at USD 2.67 billion in 2024 and is expanding at a CAGR of 18.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data warehouse as a service market size was calculated at USD 6.85 billion in 2024 and is predicted to increase from USD 8.13 billion in 2025 to approximately USD 37.84 billion by 2034, expanding at a CAGR of 18.64% from 2025 to 2034. The data warehouse as a service market propelled due to organizations need scalable cloud data management systems that reduce costs while offering complete data storage solutions.

The data warehouse as a service market experiences a data transformation through artificial intelligence integration which helps organizations better manage and analyze their data. Businesses achieve faster, precise outcomes, automatic data preparation, and anomaly detection through the combination of AI with the market. Through AI-powered DWaaS systems organizations attain superior data administration through enhanced data quality, regulatory adherence, and information security frameworks. Enterprises benefit from AI integration because it enables scalable and efficient operations which make data warehouses adaptable and intelligent.

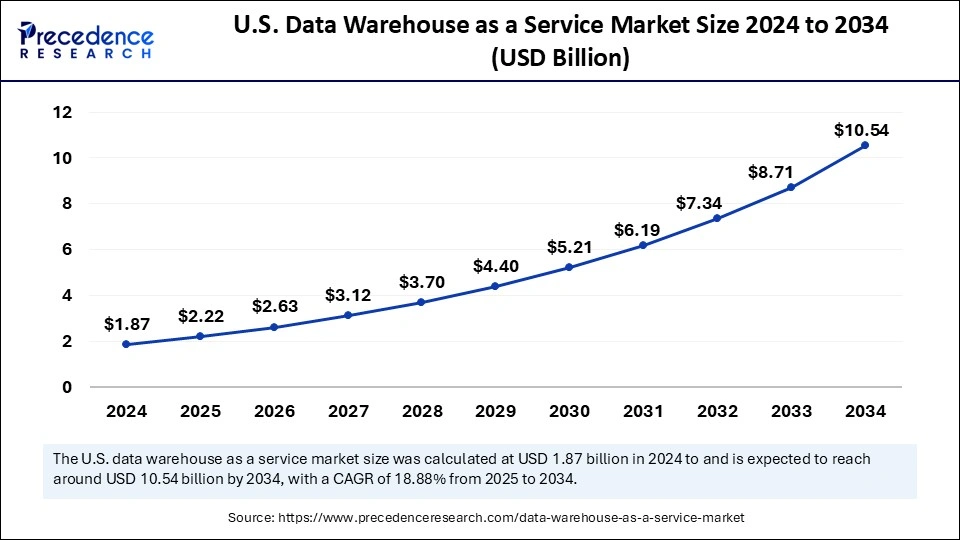

The U.S. data warehouse as a service market size was exhibited at USD 1.87 billion in 2024 and is projected to be worth around USD 10.54 billion by 2034, growing at a CAGR of 18.88% from 2025 to 2034.

North America held the dominating share of the data warehouse as a service market in 2024. The region possesses advanced data warehouse infrastructure and an extensively developed cloud computing ecosystem to demonstrate its strong leadership. North American industries including finance, healthcare, retail, and manufacturing recognize DWaaS solutions as their preference to process and analyze substantial data volumes. The evolution of cloud computing technologies enables North American enterprises to use DWaaS to create more efficient data search capabilities while making better decisions.

The DWaaS sector shows strong leadership from the United States because the country has extensively implemented analytics solutions throughout the finance, retail, and healthcare industries. Cloud-based data warehouse solutions achieve increased popularity because organizations need efficient operational data management therefore they select these solutions to structure their data storage and analysis processes.

Asia Pacific Data Warehouse as a Service Market Trends

The Asia Pacific market region will experience the fastest growth throughout the projected period. DWaaS services have gained popularity because of rapid technological advancements and major industrial investments in developing countries such as China, India, and Japan. DWaaS solutions receive growing demand because of cloud technology adoption and digital transformation initiatives spread across the region. DWaaS providers should focus on the Asia Pacific because the area benefits from technological innovation, operational efficiency improvement, and improved customer service

Cloud technology and data analytics adoption is increasing rapidly within Chinese industries which include e-commerce, manufacturing, and finance. The modernization efforts and innovation initiatives implemented by China with government-supported digital transformation programs have established a beneficial setting for DWaaS solutions. Chinese business organizations are using cloud-based data warehouses as investments to optimize their data management capabilities and develop better business decisions while enhancing customer service operations.

Europe Data Warehouse as a Service Market Trends:

Europe also emerged as a significant market for smart contracts, accounting for a substantial market share in 2024 because Cloud-based data platforms receive increased selection from European businesses at steadily rising frequencies. The demand for cloud solutions grows critical for managing large volumes of data because regional business activities need a storage platform that offers flexibility and scalability. Cloud-based data warehouses gain more popularity because organizations need real-time analytics systems and improved data processing capabilities.

DWaaS allows organizations to handle structured and unstructured data which enables them to merge and transform multiple types of data during real-time analysis. DWaaS operates as a managed service that gives organizations the ability to grow their data warehouses according to demand using fewer resources compared to traditional on-premises solutions. This solution delivers quick and efficient actionable insights through its seamless integration of advanced analytics and automated backup features.

DWaaS stands as an essential digital transformation and business intelligence-enabling technology that enables organizations to manage their strategic operations with data. DWaaS becomes an appealing choice because it provides efficient scalable and cost-effective solutions for data storage processing requirements.

The market demand for flexible data warehousing services increases because organizations need business intelligence and real-time analytics capabilities. DWaaS adoption rates continue to rise due to cloud computing adoption and increasing IoT devices since businesses need adaptable data platform solutions for managing data movements.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.84 Billion |

| Market Size in 2025 | USD 8.13 Billion |

| Market Size in 2024 | USD 6.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.64% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | offering type, deployment mode, data type, end-user industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Adoption of Cloud-Based Solutions

DWaaS market growth results from growing business interest in cloud-based operational systems. The cloud transition of organizations' data infrastructure occurs quickly to obtain better scalability features and operational cost reduction while keeping fast response times. This implementation speed and tool connection ease and instant data access reported through DWaaS cloud delivery enhance operational speed and improve decision performance. DWaaS functions as a fundamental element of modern data strategies since companies embrace cloud solutions at higher speeds thus driving substantial transformation within data warehousing systems.

Data Security Concerns

Data security concerns function as a substantial obstacle that hampers the expansion of the Data Warehouse as a Service market. Data security concerns become more critical because organizations face obstacles with compliance violations and regulations that require complex implementation. The essential implementation of security measures which include data encryption with masking features and secure access protocols proves costly because it requires extensive resources primarily affecting small to medium-sized businesses.

Disaster Recovery and Backup

DWaaS solutions deliver key operational features that use backup and disaster recovery systems to protect enterprise data assets. The platform features to protect information from hardware failure and cyber threats alongside natural disasters through robust recovery functionalities. The regulatory requirements as well as data integrity benefit from built-in protection systems that provide extensive operational advantages. DWaaS providers actively pursue enterprises in need of comprehensive solutions that guarantee a continuous operational system and rapid recovery as well as minimal disruption to services.

The ETL solutions segment led the data warehouse as a service market and accounted for the largest revenue share in 2024. ETL tools continue to gain popularity because organizations need them to achieve efficient data integration and management practices. ETL tools remove data from multiple databases to apply business rules on data transformation before storing the standardized results in a single data warehouse. The standardized method enables consistent and high-quality data which becomes ready for analytical work as well as reporting needs and machine learning requirements.

The statistical analysis segment is anticipated to show considerable growth in the data warehouse as a service market over the forecast period. DWaaS helps businesses conduct advanced statistical computations to create predictive models because it provides efficient data analytics services at low costs. Data warehouses as a service offer exceptional value to retail, healthcare, and financial organizations because trend and behavioral analysis form the base for strategy development. The use of integrated statistical tools for DWaaS platforms will continue growing because data complexity increases and real-time decision-making needs become essential.

Cloud-based solutions obtained the highest industry revenue share in 2024. The cloud technology market drives performance growth because businesses choose cloud solutions instead of traditional classic data systems to benefit from advanced scalability lower costs and higher adaptability. The digital transformation within industries drives cloud-based DWaaS solutions to transform data management through their user-friendly interfaces while providing mobile accessibility with drag-and-drop functionality. The leading position of cloud-based DWaaS in the market is supported by its preferential standing due to these advantages which indicate continuous growth.

The on-premises segment is expected to show substantial growth in the data warehouse as a service market. The management of on-premises data warehouses operates from the Organization because this deployment model allows organizations to preserve complete control over security standards and privacy norms as well as compliance rules. The model appeals significantly to organizations in sectors like government, healthcare, and finance because it provides maximum control over sensitive data protection. On-premises DWaaS platforms will continue to expand due to business requirements for secure management systems and self-governed platforms which primarily address enterprise clients.

The unstructured data segment led the data warehouse as a service market and accounted for the largest revenue share in 2024. The increase in unstructured data happens because of rapid source expansion which includes social media activities, email communications, documents, images, videos, and additional multimedia content types. Most unstructured data exists without pre-defined organization formats which creates challenges for the analysis of this information type. DWaaS solutions capable of handling unstructured data will experience elevated demand in the market leading to greater prominence within the segment.

The semi-structured segment is anticipated to show considerable growth in the data warehouse as a service market over the forecast period. The JSON, XML formats, and NoSQL databases establish themselves between structured and unstructured data by offering data organization flexibility while keeping some data structure intact. Semi-structured data demand continues to grow because organizations use web-based applications and collect sensor data, generate log files, and operate e-commerce platforms. DWaaS market growth accelerates because customers require solutions that effectively handle the storage and analysis of their increasing semi-structured data.

The BFSI contributed the most revenue in 2024 and is expected to be dominant throughout the projected period. DWaaS allows financial organizations to execute superior analytics that strengthen operational effectiveness, business strategy development, and service quality improvement for customers. DWaaS solutions include multi-dimensional advantages that combine elastic operational capabilities with cloud technology expertise, BI analytics, and enterprise administration capabilities. The BFSI sector has become a prominent growth segment of the data warehousing market because organizations rely strategically on DWaaS to make data-driven decisions.

The healthcare segment is expected to show substantial growth in the data warehouse as a service market. DWaaS has experienced massive implementation growth primarily due to technology's quick development in handling big healthcare and administrative databases. DWaaS solutions enable healthcare operators to handle vital healthcare information regarding patient files, medicinal testing, and scientific research information. Healthcare advances through artificial intelligence make DWaaS more capable to forecast health trends and create better therapeutic strategies that benefit patients. DWaaS solutions have gained popularity in healthcare because medical organizations need data-driven insights and better medical results.

By offering type

By deployment mode

By data type

By end-user industry

By region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025