January 2025

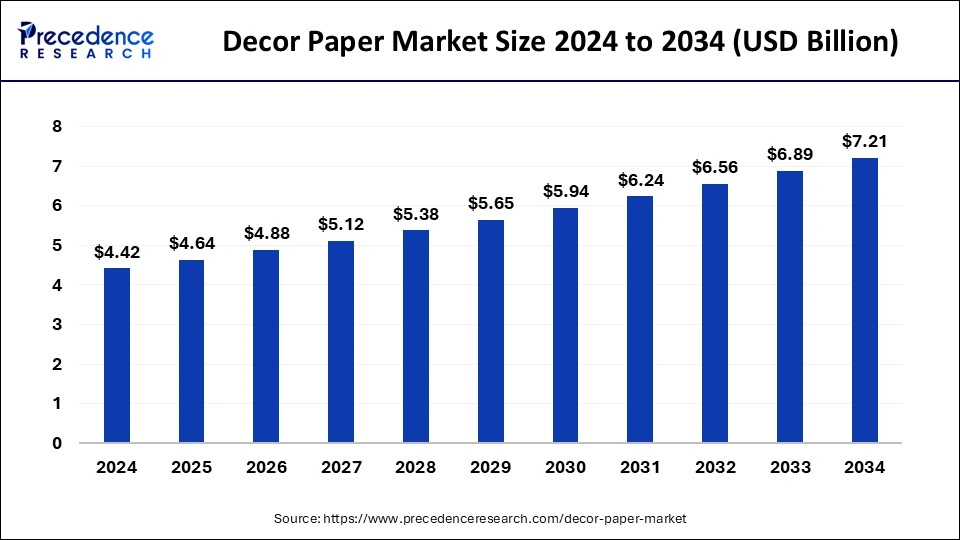

The global decor paper market size is accounted at USD 4.64 billion in 2025 and is forecasted to hit around USD 7.21 billion by 2034, representing a CAGR of 5.02% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global decor paper market size was calculated at USD 4.42 billion in 2024 and is predicted to increase from USD 4.64 billion in 2025 to approximately USD 7.21 billion by 2034, expanding at a CAGR of 5.02% from 2025 to 2034. The rise in construction activities and the driving culture of aesthetic look to the houses or commercial buildings drive the growth of the market.

Decor papers are specialized papers that are used on timber objects to produce high-quality finishes. They are printed in a single color with a variety of designs or utilized exactly as they are. Paneling, flooring, and furniture surfaces are all made with them. There is a vast array of colors and weights available for decor papers. They have two options for surfaces: machine-smoothed or satin-finished. Outstanding characteristics also include color consistency, excellent porosity, wet strength, and light resistance. The rising construction activities and the higher demand for the aesthetically appealing look of the walls, furniture, etc., in residential and commercial buildings are driving the growth of the decor paper market.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.21 Billion |

| Market Size in 2025 | USD 4.64 Billion |

| Market Size in 2024 | USD 4.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.02% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Printing Technology, Basis of weight, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising interest in home interior

The increasing spending on the lifestyle and the growing inclination toward the home interiors are driving the expansion of the market. Rapid urbanization and the rising real-estate industry due to the growing population have led to a higher demand for residential and commercial properties, which drive the demand for the more aesthetically appealing look of the properties that drive the growth of the market. The rising disposable income in the population drives lifestyle changes and demand for high-quality services and products in their household or commercial properties. Rising inclination toward the home interior is one of the major factors that propel the demand for decor paper for the walls of the home, which boosts the growth of the decor paper market.

Availability of alternative

The decor paper market is facing challenges due to the growing availability of alternative materials and the unpredictable nature of raw material prices. These factors are constraining the demand for decor paper and consequently hindering market expansion. The availability of substitutes is leading consumers to explore other options for their decor needs, impacting the demand for traditional decor paper. Additionally, the volatility in raw material prices is causing uncertainty for both suppliers and consumers, further hampering market growth. As a result, the decor paper industry needs to adapt by potentially diversifying its product offerings and finding ways to stabilize raw material costs to stimulate demand and foster market expansion.

Increasing construction activities

The increase in global population and rapid urbanization across the world is driving the demand for more residential and commercial properties, which tends to increase construction activities around the world. Increasing industrialization and commercialization are driving the demand for better-looking interiors in commercial properties, which attracts the consumer to visit. Decor paper comes in various variants in terms of colors, patterns, texture, etc., for the type of commercial properties that also enhance the sales of the decor paper. The rising construction of commercial buildings such as malls, movie theaters, hospitals, banks, and other corporate offices is heavily contributing to the growth of the decor paper market.

The printed paper segment dominated the decor paper market in 2024. The growth of the segment is attributed to the rising demand for printed paper in commercial and residential buildings, which drives the demand for the printed paper segment. Printed paper comes in several variants and provides more versatility in terms of colors, patterns, texture, etc. The rising construction activities and the rising demand for printed paper for home decor or commercial interiors to enhance the beauty of the walls of the properties drive the demand for the segment. Additionally, the availability of a number of designs in printed papers with cost-effective pricing and durability drives the demand for the decor paper market segment.

The rotogravure printing segment dominated the market in 2024. The growth of the segment is attributed to the rising adoption of the segment for the various printing processes due to its increased speed and effective workflow. Rotogravure printing is a form of printing that uses fluid ink that is transferred from printing plate depressions to paper. It is an intaglio process, named for the fact that the printing plate's surface is etched or engraved with the design to print. Rotogravure is so commonly used for printing calendars, ads, illustrated books and magazines, catalogs, and newspaper supplements (such as color magazine sections). On cellophane and related materials, it is also used to print labels and wraps. For printing long runs of materials with black-and-white or color images, rotogravure is a high-speed printing method that works optimally.

The heavy-weight segment held the largest decor paper market share in 2024. The growth of the segment is attributed to the rising adoption of heavy-weight decor paper due to its higher durability and strength. The heavy-weight paper is often used for furniture surfaces and panels, which undergo frequent handling and exposure to the environment. Heavy-weight paper gives higher durability to environmental impacts and changes, and its easy installation makes it efficient and easy to use and drives the demand for heavy-weight decor paper. The rising demand for the segment from commercial properties like malls, theaters, and hospitals is driving the expansion of the market.

The furniture segment dominated the market with the largest decor paper market share in 2024. The growth of the segment is attributed to the higher adoption of decor papers in furniture to enhance the look of the furniture. Decor paper adds more aesthetic appeal to the furniture with the increased texture, patterns, and colors, which increases the lifecycle of the furniture. Decor paper in the furniture is also used to serve the changing preferences of the consumer with their home interiors, which also boosts the growth of the market. The greater availability in the designs of the decor paper for the various shapes and sizes of the furniture for residential and commercial purposes is further propelling the growth of the market.

The commercial segment dominated the decor paper market in 2024. The growth of the segment is attributed to the rising construction industry due to the rising population that led to high-end commercial properties for their basic needs such as healthcare, entertainment, education, etc., which led to the increasing construction of commercial buildings like hospitals, malls, movie theaters, schools, colleges, and others. The higher number of commercial buildings is anticipated to lead to a higher demand for high-quality and smart interiors in the buildings, which drives the growth of decor paper and other home decor products that enhance the look of the building and attract consumers. Thus, the rising commercial construction activities in economically developed and developing countries are driving the growth of the decor paper market.

Asia Pacific led the decor paper market in 2024. The growth of the market in the region is increasing due to the rising construction and real estate industry due to the rapid urbanization and the continuously evolving population in countries like India and China, which leads to a higher demand for residential and commercial buildings. The rising disposable income of the people and surging spending on lifestyle and home decor drive the expansion of the market in the region. The rising competition among the major market players in home decor and the availability of decor paper in the major e-commerce sites are driving the growth of the decor paper market in the region.

North America is observed to be the fastest growing marketplace in the decor paper market during the forecast period. The growth of the market in the region is attributed to the higher presence of economically developed countries like the United States and Canada, which leads to the increased construction industry and the rising number of residential and commercial building projects that lead to the higher demand for the market. The surging interest in home decor due to the upgradation in lifestyle and spending on the lifestyle and home interiors to enhance the look of the houses or offices drives the demand for the decor paper market in the region.

By Product

By Printing Technology

By Basis of Weight

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

November 2023

May 2024