October 2024

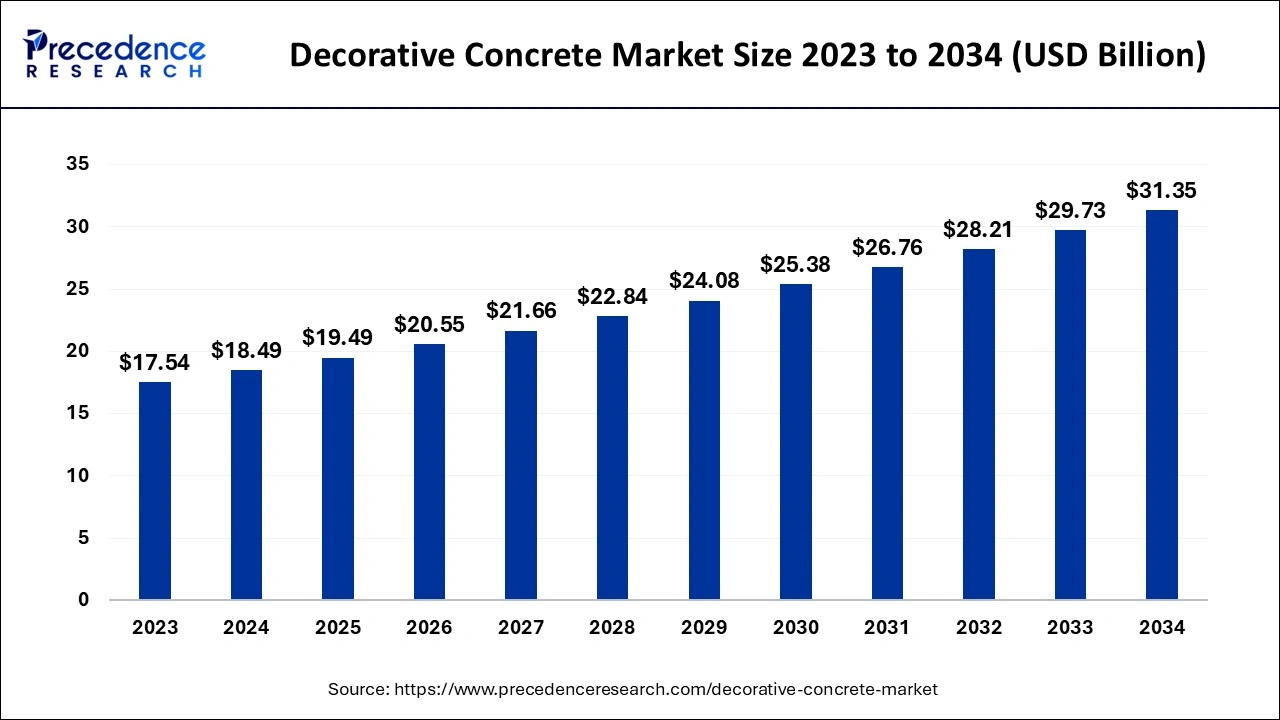

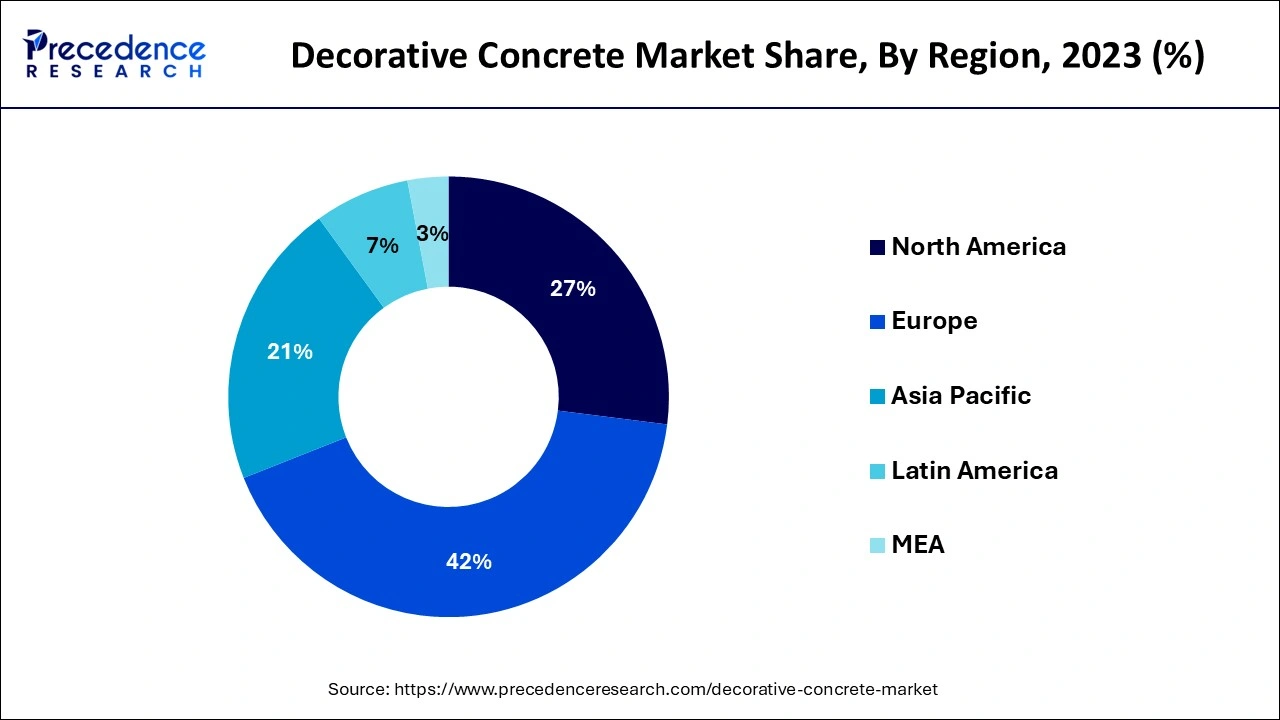

The global decorative concrete market size accounted for USD 18.49 billion in 2024, grew to USD 19.49 billion in 2025 and is expected to be worth around USD 31.35 billion by 2034, registering a CAGR of 5.42% between 2024 and 2034. The North America decorative concrete market size is evaluated at USD 7.77 billion in 2024 and is estimated to grow at a CAGR of 5.52% during the forecast period.

The global decorative concrete market size is calculated at USD 18.49 billion in 2024 and is projected to surpass around USD 31.35 billion by 2034, expanding at a CAGR of 5.42% from 2024 to 2034. The increasing preference for sustainable materials is the key factor driving market growth. Also, technical advancement along with the increasing tendency for low-maintenance alternatives is expected to fuel market growth shortly.

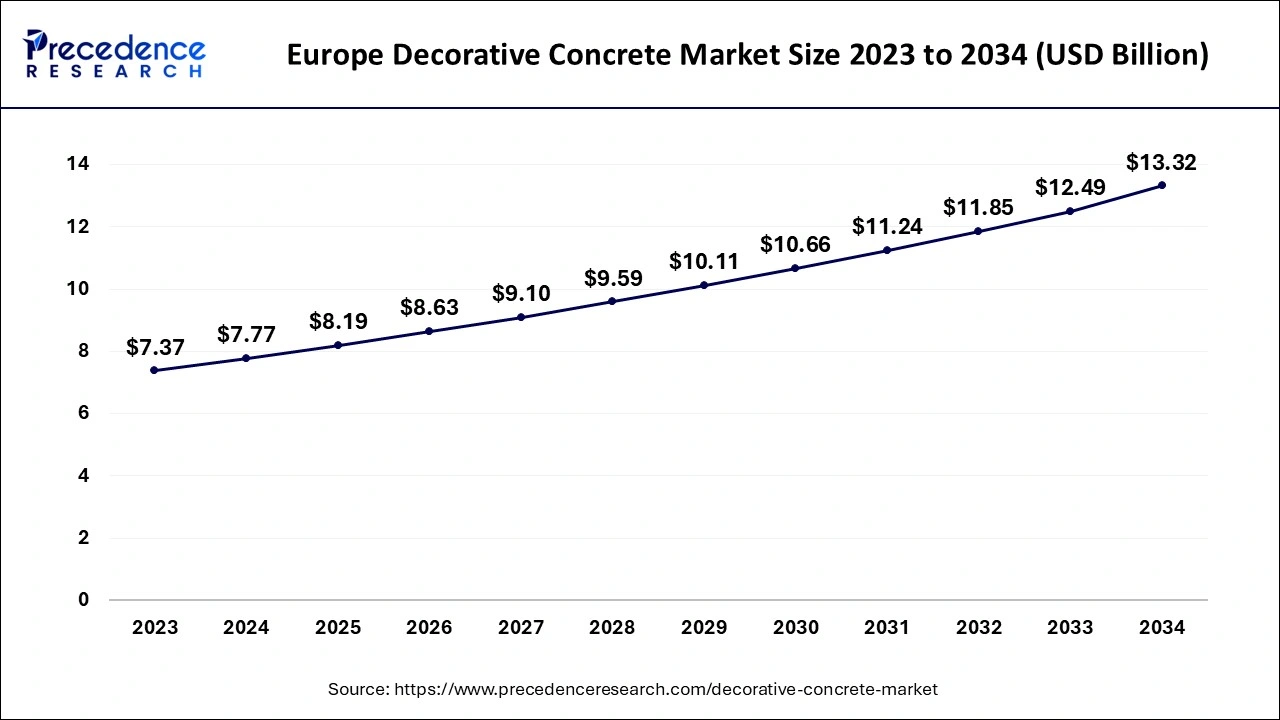

The Europe decorative concrete market size is exhibited at USD 7.77 billion in 2024 and is predicted to reach around USD 13.32 billion by 2034, growing at a CAGR of 5.52% from 2024 to 2034.

Europe dominated the decorative concrete market in 2023. The national government's significant sway over the ornamental concrete market is the reason for the segment's supremacy. Stricter rules on green building guidelines and corporate criteria are being enforced by the government. In addition, concrete ornamental options that align with these sustainability objectives are becoming more and more popular among homeowners.

The Asia-Pacific decorative concrete market is anticipated to grow at the fastest rate during the studied period. The growth of the segment can be credited to rapid urbanization, raised construction activity, and an increasing need for visually attractive materials. Moreover, expanding awareness of nutrition and healthy lifestyles, along with increasing disposable income in countries like China and India, are contributing to the region's market growth.

Decorative concrete is the kind of concrete that is utilized to offer an aesthetic appearance to a structure, which is usually preferred by architects and design consultants. The process of converting concrete into decorative concrete can be followed through numerous techniques like blending an extensive range of materials in the pouring process and mixing different colors to boost the appearance of the structure. These materials have the capability to offer durability, structural abilities, superior finish, and strength to non-residential and residential structures.

Cement Production by Country 2023

| Country | Cement Production in 2023 (1000 metric tons) |

| China | 2.1M |

| India | 410K |

| Vietnam | 110K |

| United States | 91K |

| Turkey | 79K |

| Iran | 65K |

| Brazil | 63K |

| Indonesia | 62K |

| Russia | 57K |

| Saudi Arabia | 57K |

How AI is Revolutionizing the Concrete Industry

Artificial Intelligence (AI) algorithms can create advanced and structurally appealing concrete structures. AI analyses sensor data to predict future failures in concrete design, making preventative maintenance and cutting costly repairs. Furthermore, AI-powered digital twins can monitor the health of concrete structures in real-time by extending their lifespan and enabling proactive maintenance to specify construction methods and concrete mixes to tailor specific project requirements.

| Report Coverage | Details |

| Market Size by 2034 | USD 31.35 Billion |

| Market Size in 2024 | USD 18.49 Billion |

| Market Size in 2025 | USD 19.49 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.42% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in the demand for stamped concrete for flooring applications

The growing need for stamped concrete, especially for commercial structures and hotel flooring, due to the advantages provided by stamped concrete, such as strong aesthetic appeal for the floor and resistance to wear and tear caused by heavy footfall, is the prime factor fuelling the growth of the decorative concrete market. Additionally, changing design and architectural trends are leading to renovation and remodeling operations to enhance the beauty of interior and exterior housing structures.

Increasing demand for aesthetically attractive infrastructure

The Decorative Concrete Market has become crucial in modern design and architectural values for its practicality and versatility. Designers, architects, and property owners appreciate its characteristics to mimic natural materials like wood, stone, and brick. Moreover, its sustainable approach resonates with world environmental trends by decreasing material use and waste. As consumer awareness increases, driven by the desire for sustainable and distinctive building solutions, decorative concrete can set a cornerstone in design practices and modern construction.

Increasing cost

The increase in the cost of treatment is expected to hinder the growth of the decorative concrete market during the forecast period. Moreover, huge capital investments in the market, along with the lack of awareness about decorative concrete in developing countries, can pose significant challenges to market expansion.

The growing popularity of green buildings

The construction industry globally has been experiencing new product developments, techniques, and technological advancements. Green building technology is the deployment of design in commercial spaces, buildings, and structures. Furthermore, The utilization of decorative concrete in green buildings is a feasible option as these materials are eco-friendly and do not cause air pollution. Also, the surge in the demand for green buildings can decrease the adverse effects of construction activities on the environment, resulting in the expansion of the decorative concrete market.

The stamped concrete segment led the decorative concrete market in 2023. The dominance of the segment can be attributed to the characteristic properties offered by stamped concrete, such as durability, versatility, and aesthetic appeal. Stamped concrete provides an extensive range of textures and patterns, making them the replication of materials like brick, wood, and stone. Additionally, it also offers a low-maintenance and long-lasting solution for improving the appearance of surfaces, including patios, driveways, and walkways.

The concrete dyes segment is expected to grow at a significant rate in the decorative concrete market over the forecast period. The growth of the segment can be linked to the wide range of quality offered by these dyes, including various spectrums of colors and other features. The concrete dyes are water and solvent-based dyes. Water-based dyes can create softer hues, while bolder hues are produced by solvent-based dyes. Also, these dyes are easy to apply and require less cleanup, and they are more cost-effective than concrete stains, which makes them the first choice for end users, driving the growth of the decorative concrete market.

The non-residential segment is anticipated to grow at a significant rate during the projected period. This is because, the market is mainly driven by non-residential sectors like hotels, commercial buildings, and public spaces that need durable and attractive flooring options which can sustain considerable foot traffic. Moreover, businesses tend to focus on amenities and location which makes prime commercial spaces in high-demand areas.

The floors segment led the decorative concrete market in 2023. The dominance of the segment can be driven by increasing manufacturers' focus on decorative concrete industry floors that have large visibility and large surface area, which allows a variety of designs to enhance aesthetic appeal. Furthermore, decorative concrete provides cost-effective and versatile solutions for designing durable and visually appealing floors.

Segments covered in the report

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

October 2024

February 2025