January 2025

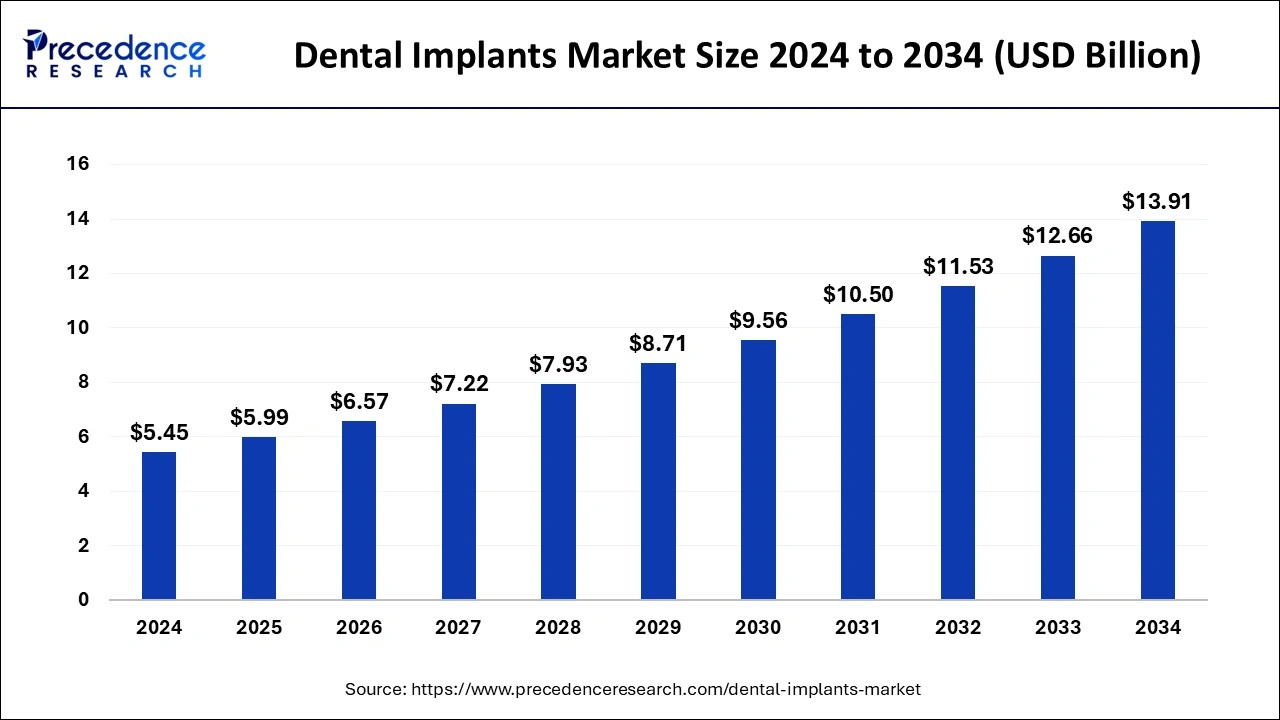

The global dental implants market size is calculated at USD 5.99 billion in 2025 and is forecasted to reach around USD 13.91 billion by 2034, accelerating at a CAGR of 9.82% from 2025 to 2034. The North America dental implants market size surpassed USD 2.08 billion in 2024 and is expanding at a CAGR of 9.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental implants market size was estimated at USD 5.45 billion in 2024 and is anticipated to reach around USD 13.91 billion by 2034, expanding at a CAGR of 9.82% from 2025 to 2034.

The dentistry industry has experienced a paradigm preference with the advent of dental implants. These innovative biocompatible fixtures provide an aesthetically and permanent pleasing solution for missing teeth, fostering enhanced oral health and overall well-being. There are various advantages of this AI integration in dental implants, such as optimizing efficiency and cost, improved patient comfort, reduced risk and faster recovery, personalized treatment and enhanced planning and precision.

AI has the ability to analyze huge amounts of patient data, such as digital impression and 3D scans. AI algorithms can help dentists tailor treatment plans to each individual’s needs, by analyzing patient data and medical history, AI can contribute to a reduction in surgical risks like nerve damage or infection, with more accurate planning and implant placement. AI can contribute to overall efficiency in implant procedures, by streamlining workflows and potentially reducing complications, further contributed to revolutionize the growth of the dental implants market. In addition, with even more exciting possibilities on the horizon, the integration of AI in implant dentistry is still evolving.

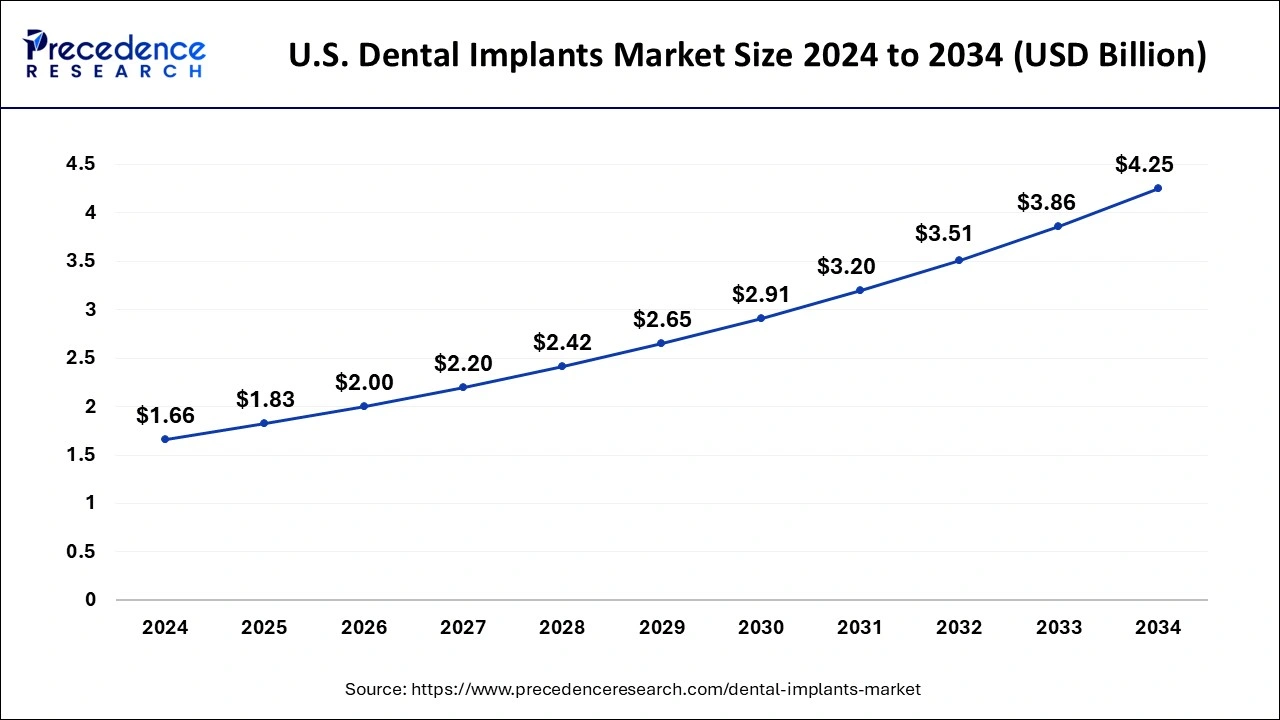

The U.S. dental implants market size was evaluated at USD 1.66 billion in 2024 and is predicted to be worth around USD 4.25 billion by 2034, rising at a CAGR of 9.86% from 2025 to 2034.

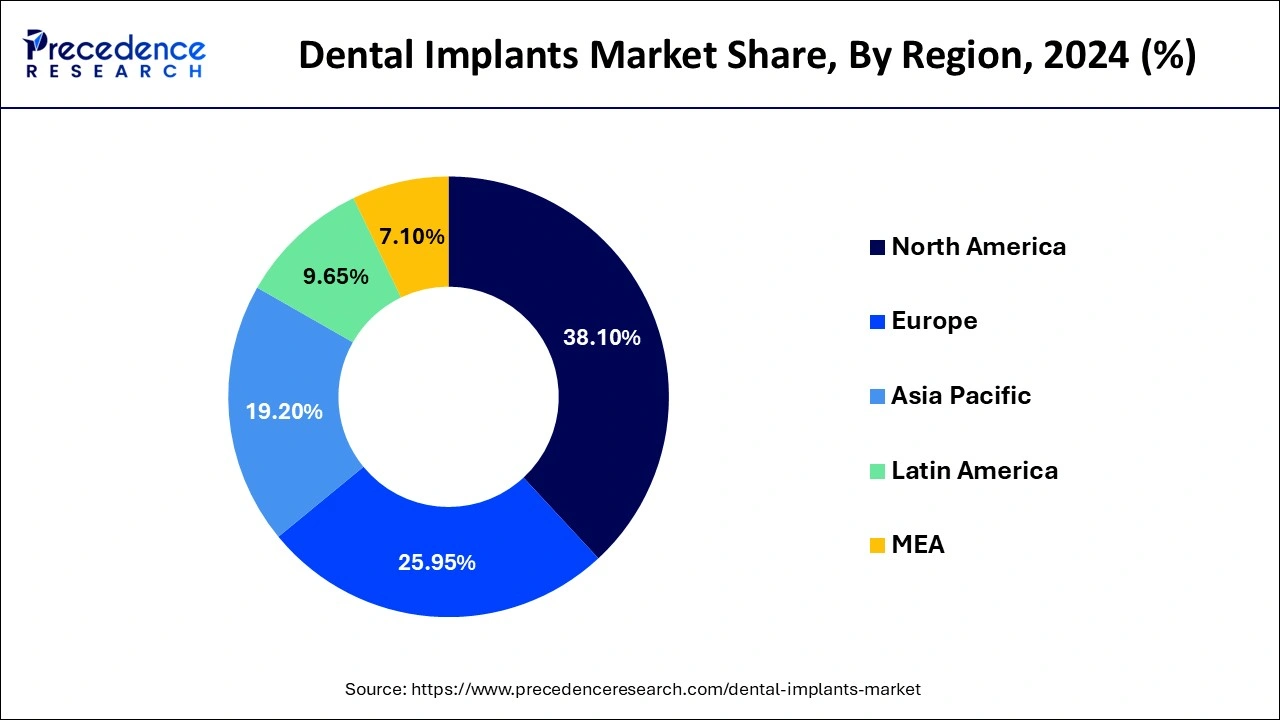

North America dominated the global dental implants market, garnering a market share of around 38.10% in 2024. The presence of high geriatric population in the region and rising incidences of tooth decay and dental carries is driving the market growth. According to the CDC, about 16% of the population aged between 5 years to 19 years and about 31% of the population aged between 20 years to 44 years in US lives with dental carries. The increasing number of campaigns and initiatives by the organizations like American Dental Association has significant contributions in spreading the awareness among the population regarding dental carries. The rising adoption of advanced dental equipment, increased prevalence of edentulism, and higher acceptance of digital dentistry are among the major factors that has driven the growth of the North America dental implants market.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. The surging number of geriatric population, rising number of road accidents, rising healthcare expenditure, rising personal disposable income, rising awareness regarding the cosmetic dentistry, growing prevalence of dental carries among the children and adult population, and rising penetration of dental clinics in the region are some of the significant factors that are expected to drive the growth of the dental implants market in Asia Pacific. According to the United Nations, around 80% of the global geriatric population will be living in low and middle income countries by 2050. Moreover, as per the World Health Organization, around 93% of the road accidents occur in the low and middle income countries. The rising adoption of the digital technologies in the hospitals and dental clinics will significantly contribute towards the market growth.

Dental implants market deals with artificial tooth roots, typically made from titanium, that are surgically placed into the jawbone to replace missing teeth. These metal frames or posts are designed to offer a strong foundation for removable replacement or fixed teeth that are made to match natural teeth. The market growth is attributed to the rising demand for cosmetic dentistry, rising number of dental problems and increasing rate if tooth decay.

In addition, focus on oral healthcare, higher life expectancy and better quality of life are the major factors expected to drive the growth of the dental implants market. Furthermore, increasing adoption of inorganic growth strategies such as partnership and acquisition by major market players are anticipated to enhance the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.45 Billion |

| Market Size in 2025 | USD 5.99 Billion |

| Market Size by 2034 | USD 13.91 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, End User, Product, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, MEA |

Increasing demand for prosthetics

Demand for dental implants is projected to increase owing to rising demand for prosthetics. Dental implants are used for oral rehabilitation and restoring oral function & facial anatomy of a patient. In the U.S., over 15 million people undergo bridge and crown placements for missing teeth annually, according to American Academy for Implant Dentistry, which in turn boosts demand for dental implants. The acceptance and adoption of dental implants are increasing among patients and dental surgeons specifically due to limitations such as discomfort, low aesthetic appeal and high maintenance of removable prosthetics. Prosthetics mounted on dental implants do not encroach soft tissues and enhance aesthetics, which increases their adoption. The rising popularity of dental implants can be attributed to growing awareness about their efficiency and high success rate.

The increasing disposable income in developing countries

The market is witnessing significant opportunities in the developing countries. The population in developing nations have greater affordability for expensive treatments such as dental implants, with rising disposable incomes and rapid economic growth. In addition, the rising availability of dental tourism and increasing awareness about oral healthcare are enhancing the adoption of implants in low-income economics. Furthermore, the rising technological advancements are also playing an important role and further driving the growth of the dental implants market.

The titanium implants segment accounted for a market share of over 92% and dominated the global dental implants market in 2024. This is attributed to the increased adoption of the dental implants made from titanium. The biocompatibility of the titanium is a major factor that boosts the demand for the titanium implants. Moreover, the suitability of titanium to all type of implants and its non-allergic nature has contributed significantly towards the growth of this market.

On the other hand, the zirconium is estimated to be the most opportunistic segment during the forecast period. The zirconium has same function as the titanium. The rising adoption of the one-piece system of zirconium implants among the population is expected to boost the growth of this segment in the forthcoming future.

The tapered was the dominant segment in the global dental implants market in 2024. The tapered wall implants facilitates immediate placement. Moreover, it is ideal and well designed for the gaps between the adjacent teeth. It provides improved stability in the soft bones, which makes it the most demanded product in the market.

The parallel wall implants is expected gain rapid traction during the forecast period owing to its greater stability. The surging awareness regarding the benefits of the parallel wall implants will boost its demand.

Depending on the end user, the dental clinics segment dominated the global dental implants market in 2024. This can be attributed to the increased preference for the dental clinics among the population for the treatment of oral issues. Moreover, the availability of the specialized equipment and experienced and skilled dentists in the dental clinics has fostered the growth in the past years. The growing adoption of the latest and digital technologies in the dental clinics is expected to further drive the growth of this segment.

Hospitals is estimated to be the fastest-growing segment during the forecast period. The rising number of road accidents, growing geriatric population, and the rising penetration of the multi-specialty hospitals across the globe are some of the major factors that drives the growth of the hospitals segment.

The dental implants market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

By Material

By Product

By End User

By Type

By Procedure

By Demographics

By Price

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023