January 2025

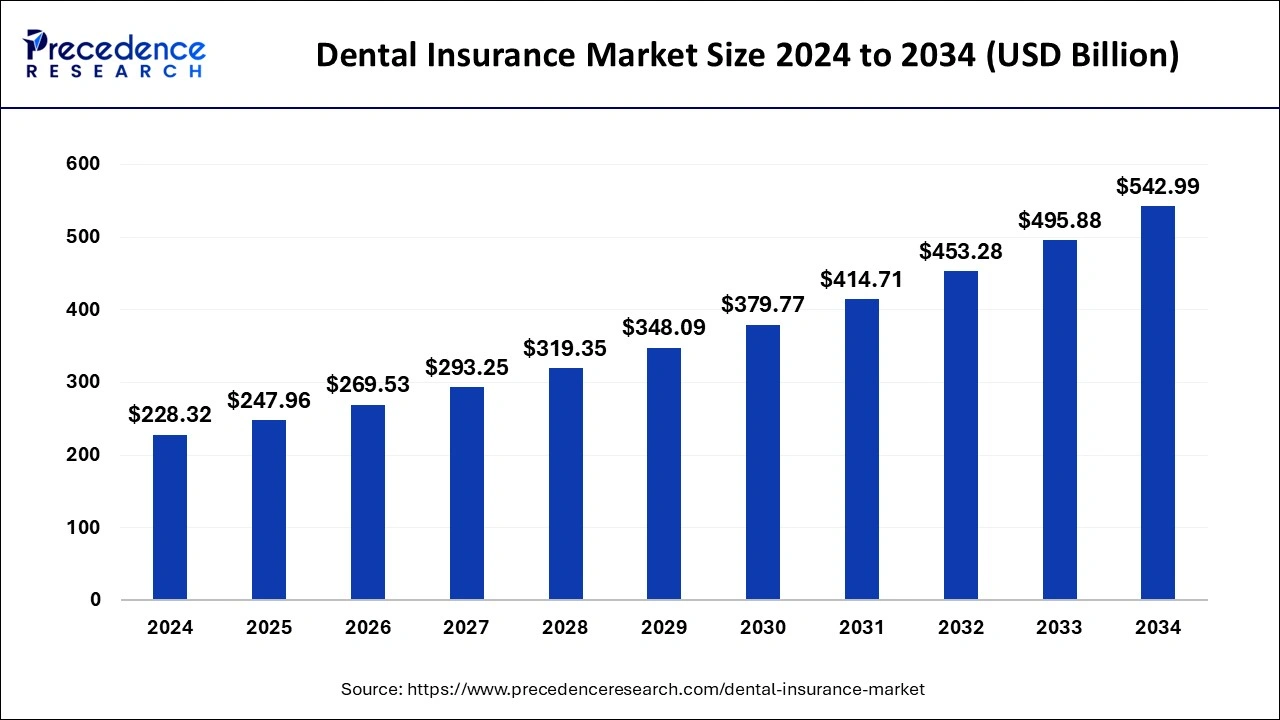

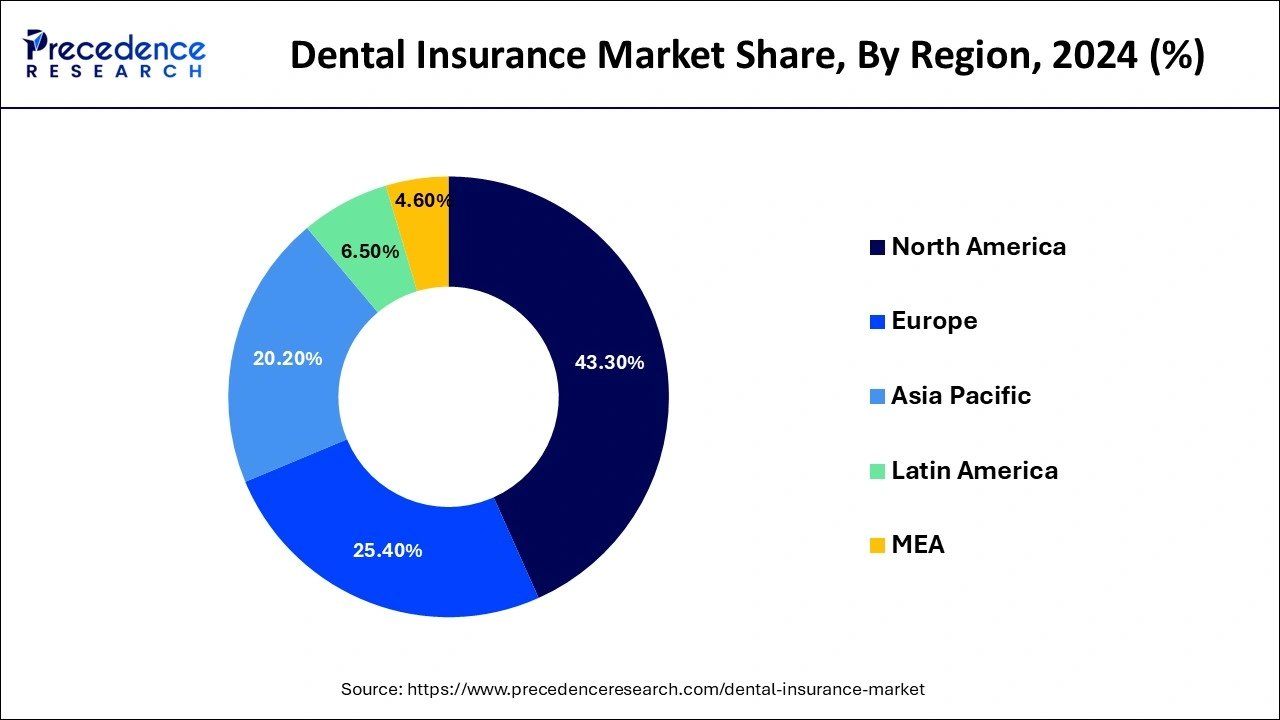

The global dental insurance market size is calculated at USD 247.96 billion in 2025 and is forecasted to reach around USD 542.99 billion by 2034, accelerating at a CAGR of 9.10% from 2025 to 2034. The North America market size surpassed USD 98.92 billion in 2024 and is expanding at a CAGR of 9.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental insurance market size accounted for USD 228.32 billion in 2024 and is expected to exceed around USD 542.99 billion by 2034, growing at a CAGR of 9.10% from 2025 to 2034. The growth of the dental insurance market is majorly driven by the increasing offerings of customized insurance plans by insurance companies, rising awareness regarding dental insurance, and rising incidence of various oral disorders like tooth decay, oral cancer, gingivitis, broken teeth, and others.

Artificial Intelligence (AI) integration has revolutionized the dental insurance sector. The crucial role of AI in supporting dental insurance and positively the landscape of dental care in the coming years. The AI in dental insurance processes has brought several remarkable improvements. Artificial Intelligence (AI) integration into dental insurance processes has resulted in several benefits including accurately automating dental insurance verification, impacting the workflow of dental insurance, and enabling real-time utilization. The utilization of AI in dental insurance has empowered insurers to explore new avenues and develop more advanced dental insurance plans, benefitting both policyholders and insurers. Artificial Intelligence (AI) tools assist in empowering brokers to deliver advanced dental plans that reduce costs for clients, ensure early detection and prevention, and enhance long-term retention. AI is shaping the future of dental insurance and is characterized by real-time data insights, scalability, and rising adoption of AI within dental insurance plans.

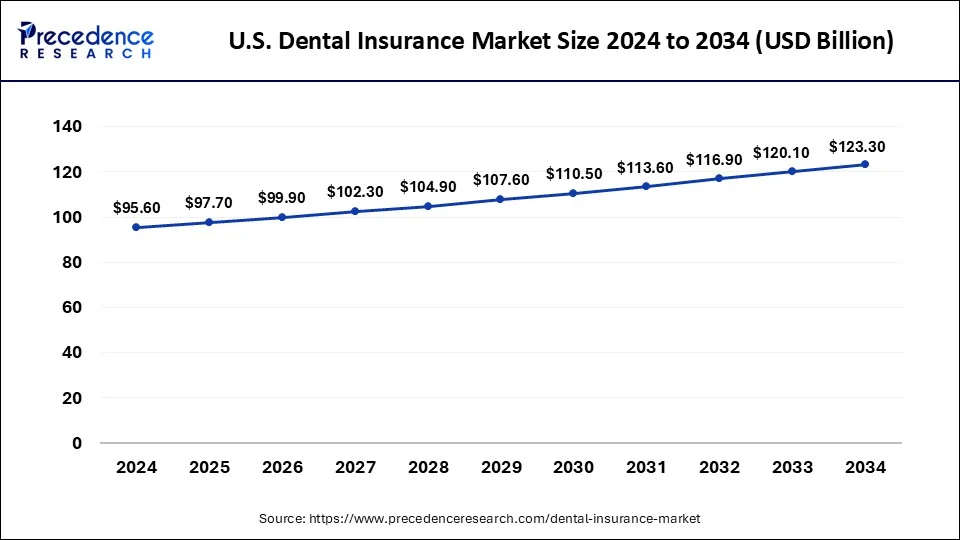

The U.S. dental insurance market size was exhibited at USD 95.6 billion in 2024 and is projected to be worth around USD 123.3 billion by 2034, growing at a CAGR of 2.62% from 2025 to 2034.

Based on the region, the North American market had the largest market share of 42% during the revent years due to adoption of dental insurance in this region. The second largest market share was held by the European region due to an awareness regarding the dental insurance and the adoption of the same by the people in this region.

The Asia Pacific region is also expected to have significant growth due to an increased awareness regarding the same in the people. Due to an increased disposable income with the rise in awareness towards oral hygiene and health, security standards of the dental insurers and the developments and advancements of medicines for the treatments of the teeth. There's a convergence of dental insurance coverages in the health insurance. According to the Centers for Disease Control and Prevention about 50.2% of the adults in United States have dental care coverage with their health insurance.

Dental insurance is a health care policy that provides reimbursement for dental care and the expenditures incurred on the treatment. The reimbursement is provided by the payment of monthly premiums, partial payments or complete coverage against any of the dental procedures. It extensively covers root canals, fillings, preventative care, tooth extractions or even oral surgeries. Dental insurance policy helps paying for the unexpected dental emergencies. There are indemnity plans and direct reimbursement plans that come under the dental insurance.

Dental insurance is also called as a dental plan. It is a type of health insurance which are designed to take care of the dental health. Various types of insurances are provided like group dental insurance, family dental insurance and individual dental insurance. Due to the pandemic, there was a decline in the growth of this market there was a direct impact due to social distancing restrictions. Lockdown also impacted the movement of consumers and disrupted the businesses worldwide. The utilization of dental oral exams, cleanings, services that needed urgent X-rays had all been postponed due to the coronavirus outbreak.

| Report Coverage | Details |

| Market Size in 2025 | USD 247.96 Billion |

| Market Size in 2034 | USD 542.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Dominating Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period2025 to 2034 | 2025 to 2034 |

| Segments Covered | Coverage, Procedure, Demographics, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for dental insurance

The rising demand for dental insurance is expected to accelerate the growth of the dental insurance market. Dental diseases are a major public health burden around the world causing several health issues such as causing pain, discomfort, disfigurement, and others. Dental insurance offers coverage protection for dental treatments for various oral disorders such as tooth decay, oral cancer, gingivitis, broken teeth, and others. For instance, ccording the WHO, It is estimated that oral diseases affect nearly 3.5 billion people. A dental insurance policy pays a portion of the costs associated with dental treatment and preventive dental care. It assists in paying for unexpected expensive dental emergencies. Over the years, Developing and developed economies have become increasingly concerned regarding oral health has led to an increasing demand for dental care. Therefore, the increasing importance of oral care and oral care products is anticipated to boost the growth of the market.

High cost

The high cost associated with the insurance premiums is anticipated to hamper the growth of the market. In addition, several middle- and lower-income countries lack suitable healthcare infrastructure and lack dental insurance awareness may restrict the expansion of the global dental insurance market during the forecast period.

Rising government initiatives and policies

The increasing Government initiatives and policies to boost the growth of the dental insurance industry, are projected to offer lucrative growth opportunities to the minimally invasive surgical instruments market. Several governments around the world support dental insurance companies by protecting dental insurers and formalizing dental care services in both developed and developing nations. Government support has helped insurers to avail of dental insurance coverages with more alternatives and customized options in the market. For instance, The Indian government has launched a scheme 'Ayushman Bharat', an initiative that covers dental insurance and intends to offer dental services in the country. Such factors are fuelling the expansion of the dental insurance market in the coming years.

In terms of the coverage, the dental preferred provider organization segment had the largest market share in the year 2022 and is expected to dominate the market during the forecast. It provides financial incentives for the DPPO members to stay in the network, and it is therefore expected to grow during the forecast. That DPPO segment provides the option to the customers to consult any licensed dentist or specialist. In the indemnity dental plans a percentage of the cost of services is paid to the dentist. In the dental health maintenance organization plans there are little or no waiting periods. While covering the major dental work the deep treatment is expected to hold the largest market share because it is cost effective and easy to use.

On the basis of the procedure, the dental insurance market can be segmented into preventive, major and basic. The preventive segment is dominated the market with largest revenue share in 2022. The basic procedure segment is expected to have the highest CAGR during the forecast. The various procedures lead dental insurance market. Teeth removal, treatment of the infected nerves, dental surgeries and removal of minor or major oral infections are leading to an adoption of dental insurance, which is expected to help in the market growth.

The basic procedural segment is anticipated to reach U.S. dollars 92 billion by 2023. The preventive segment has dominated the dental insurance market and is expected to maintain the dominance during the forecast period as it helps in providing 100% insurance coverage to the customers.

Due to growing adoption, dental insurance by companies that they provide to their employees, the enterprises segment is expected to grow during the forecast. Apart from enterprises, the individual segment is also expected to have a growth good growth rate During the forecast.

On the basis of demographics, the market can be segmented into minors, adults, and senior citizens. The minor segment is expected to have the fastest growth due to the prevalent dental issues in the minors. The adult segment is also expected to grow due to the rising awareness regarding dental insurance amongst them.

By Coverage

By Procedure

By Demographics

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023