January 2025

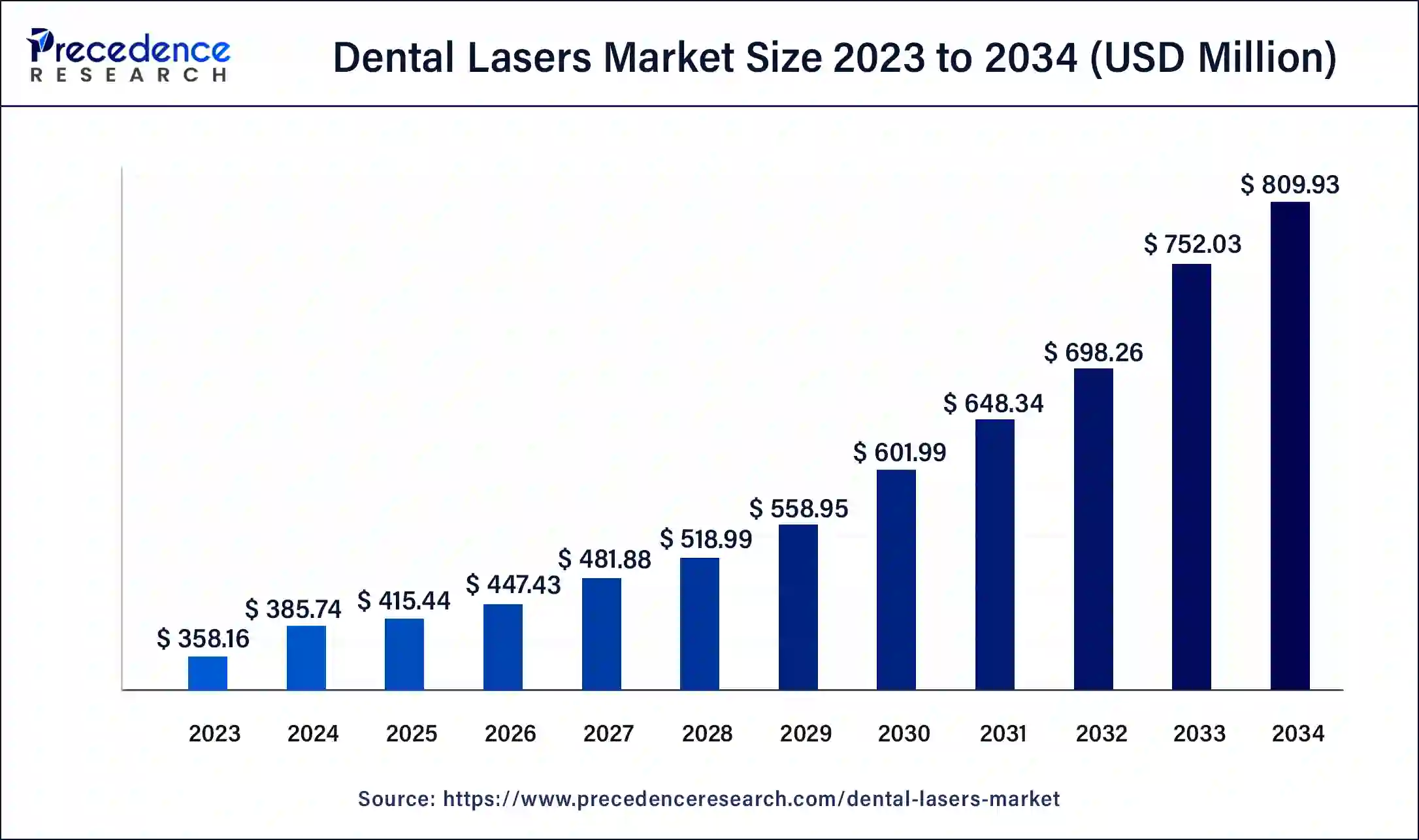

The global dental lasers market size is estimated at USD 415.44 million in 2025 and is predicted to reach around USD 809.93 million by 2034, accelerating at a CAGR of 7.70% from 2025 to 2034. The North America dental lasers market size surpassed USD 173.58 million in 2024 and is expanding at a CAGR of 7.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental lasers market size was valued at USD 385.74 million in 2024, and is expected to reach around USD 809.93 million by 2034, expanding at a CAGR of 7.70% from 2025 to 2034. This market growth can be attributed to the rising prevalence of dental disorders and rising awareness regarding oral hygiene across the globe.

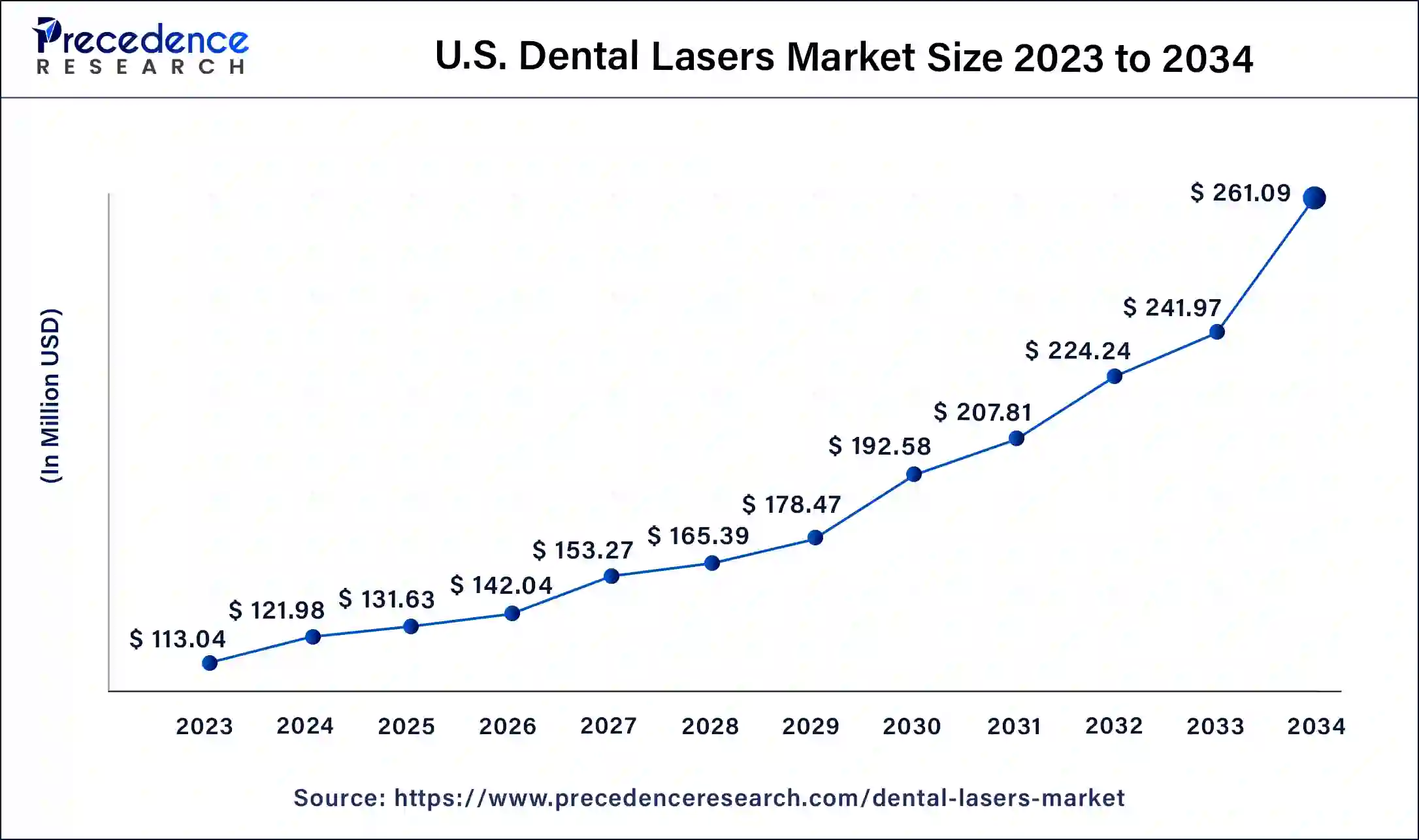

The U.S. dental lasers market size was estimated at USD 121.98 million in 2024 and is predicted to be worth around USD 261.09 million by 2034, at a CAGR of 7.72% from 2025 to 2034.

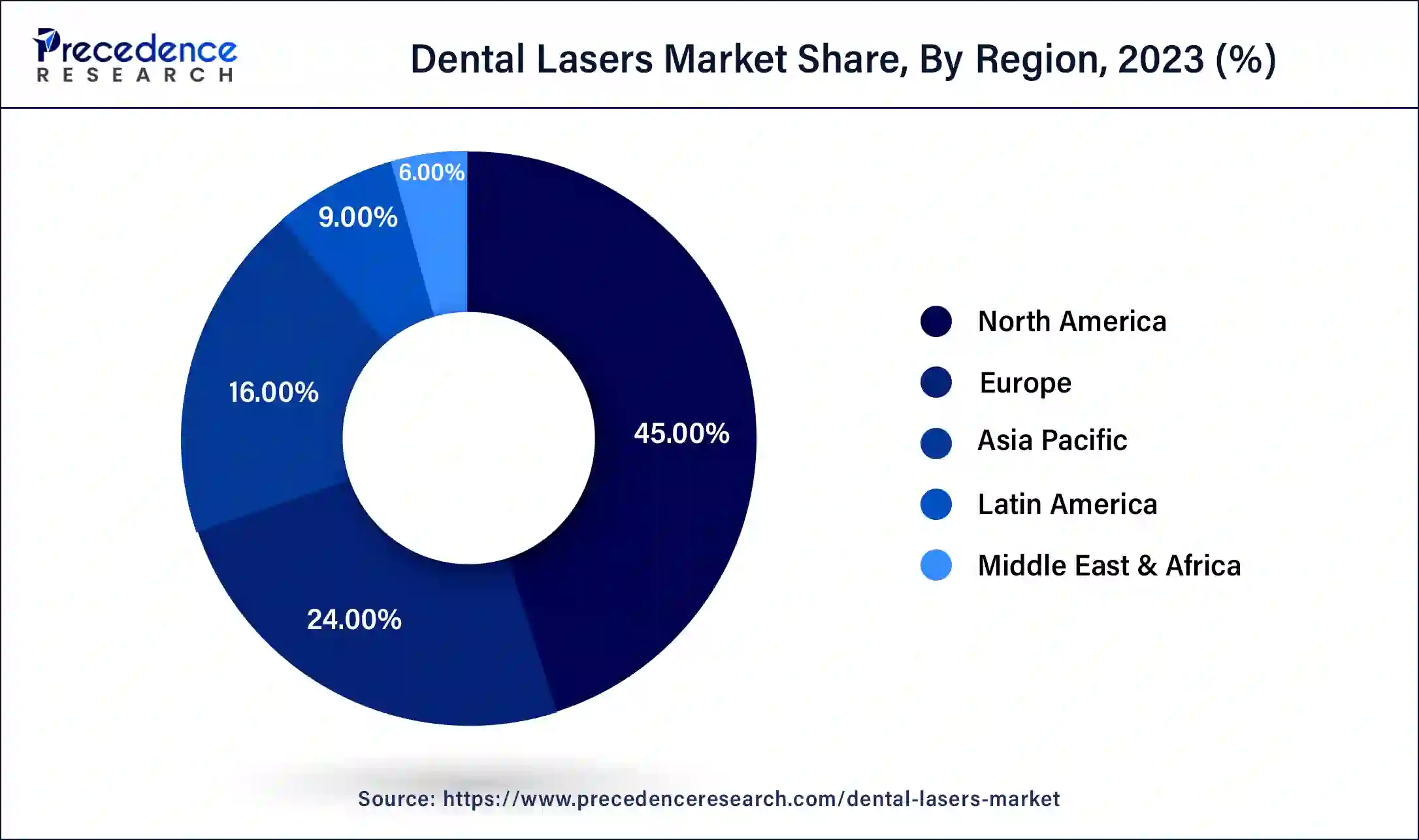

North America dominated the market due to several factors. These include the growing use of advanced laser technology in dentistry, the increasing occurrence of dental issues like cavities, and the presence of many companies offering dental lasers. Additionally, there's a rise in awareness about oral health and an increase in the prevalence of dental caries in the region. North America benefits from a well-established healthcare system and a higher adoption rate of laser technology compared to traditional tools. The market growth is also supported by various product approvals and contract agreements made by key players in the region.

Asia Pacific is expected to experience the fastest growth rate over the forecast period. This growth is fueled by rapid urbanization and an increase in disposable income, leading to a greater demand for advanced dental treatments. Dental lasers have become increasingly popular among both patients and dental professionals due to their many advantages and advancements in technology. Moreover, the dental lasers market has expanded with the introduction of tele-dentistry, allowing individuals to receive dental advice and guidance remotely from professionals without needing to visit a dental clinic in person.

Dental lasers are cutting-edge tools in dentistry that harness concentrated beams of light to address a range of dental issues, from gum disease to tooth decay and even teeth whitening. Compared to traditional methods, they boast several advantages, such as enhanced precision, decreased patient discomfort, and quicker recovery times. By leveraging the power of focused light energy, dental lasers have revolutionized dental practices, providing meticulous and minimally invasive treatment options that result in less bleeding, reduced post-operative discomfort, and minimal harm to surrounding tissues.

Dental lasers are used for whitening teeth, treating gum disease, removing cavities, and performing soft tissue surgeries. They help patients heal faster and sterilize the treatment area, reducing the chance of infection. With their ability to offer better dental care, lasers have become an asset for dentists, which improves patient experiences and results.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.9% |

| Market Size in 2024 | USD 385.74 Million |

| Market Size in 2025 | USD 415.44 Million |

| Market Size by 2034 | USD 809.93 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing preference for minimally invasive surgeries

Patients nowadays prefer less invasive surgeries, and even surgeons are opting for methods that involve smaller incisions to speed up recovery. To perform these minimally invasive procedures, dental professionals are turning to dental lasers, which don't require anesthesia. There's a growing demand for dental lasers to treat conditions like implant therapy, canker sores, and periodontal therapy.

Manufacturers of dental lasers are focusing on innovation to increase their sales globally. Additionally, the presence of key players in advanced laser technology and initiatives to train dentists in using dental lasers effectively are expected to drive growth in the dental lasers market.

The high cost of treatment

The upfront cost of purchasing and installing dental lasers can be high, especially for smaller dental practices, which slows down the growth of the dental lasers market. Since many dentists and hygienists are accustomed to traditional tools, adopting dental lasers requires learning new skills, which further hinders their adoption and limits market growth. Also, besides the initial expense, there are ongoing costs for maintenance, upgrades, and training for dental staff.

Health tourism is providing lucrative opportunities in developing countries

The developing countries in the world are expected to benefit from advancements in the dental lasers market. This is due to consistent growth and innovations in periodontal disease treatment, government-supported research and development initiatives in healthcare services, and a large population of patients.

China, Japan, and India are the leading contributors to revenue in the Asia Pacific dental lasers market. Moreover, increasing awareness of dental tourism, which offers cost-effective options, shorter wait times, and easier visa processes for medical treatments, is contributing to revenue growth in the region. The expanding healthcare sector in developing economies is driving market growth further.

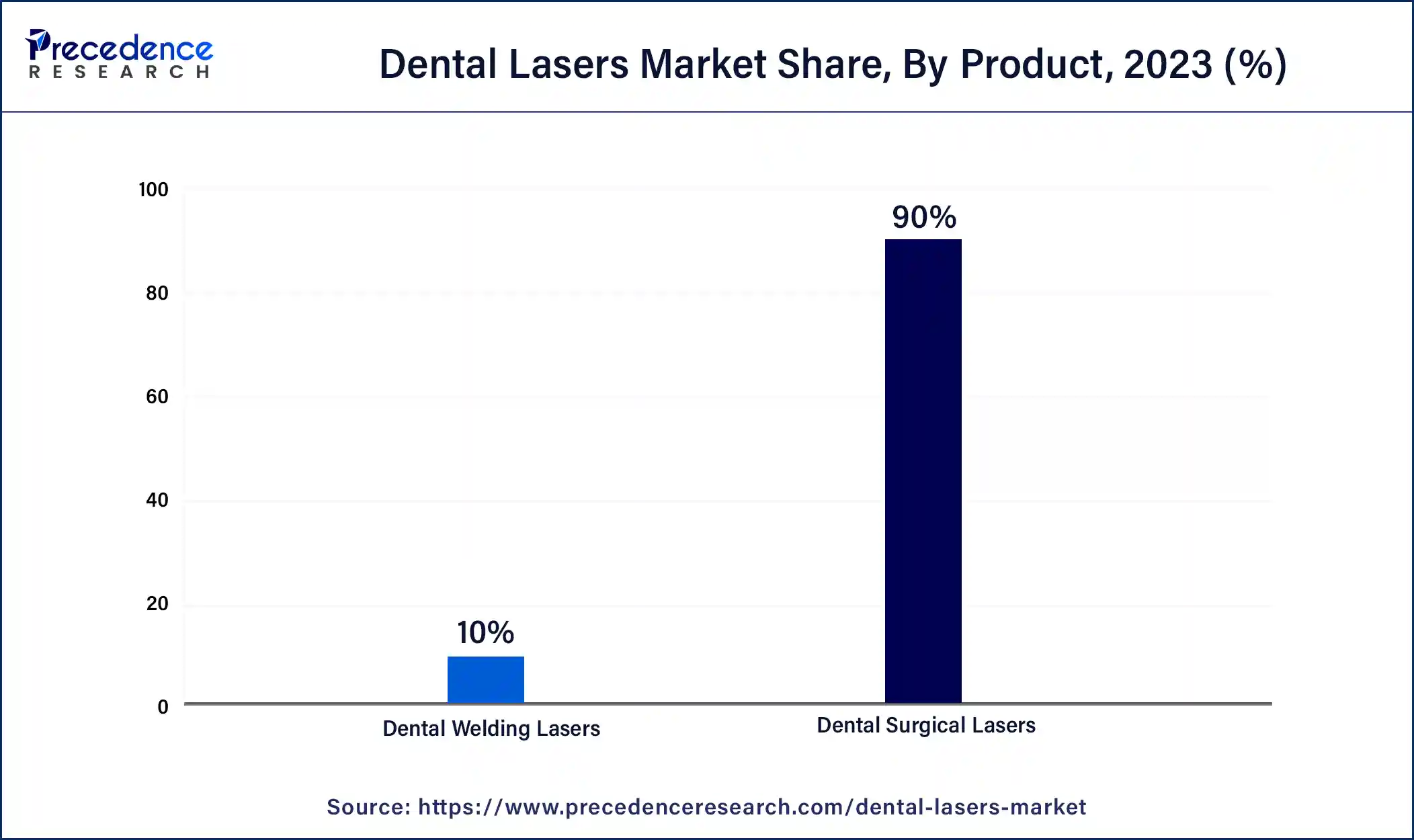

The dental surgical laser segment dominated the market in 2024. This segment is also anticipated to grow at the fastest rate over the forecast period. The growth in the dental lasers market is driven by the increasing use of surgical lasers for various dental procedures, such as soft tissue surgeries, gum surgeries, and biopsies.

These surgical lasers offer precise cutting, ablation, and coagulation capabilities, resulting in better surgical outcomes and fewer complications after surgery. The benefits of reduced bleeding and minimal damage to surrounding tissues, along with faster healing, have contributed to the rising demand for the dental lasers market. Furthermore, advancements in laser technology, including improved design and versatile laser systems, are also driving the growth of the dental surgical lasers segment.

The periodontics segment held the largest market share in 2024. This growth can be linked to the rising incidence of periodontal diseases like gingivitis, which is because of an unhealthy lifestyle. The increasing cases also create a high demand for specialized treatments and procedures.

The oral surgery segment is expected to see the fastest growth rate over the forecast period. This is because there's a growing demand for specialized oral surgical procedures driven by increasing awareness and focus on oral health. As people become more aware of the importance of maintaining good oral hygiene and addressing dental problems early, there's a greater need for oral surgery to handle complex dental issues and perform procedures like extractions, implants, and corrective jaw surgeries.

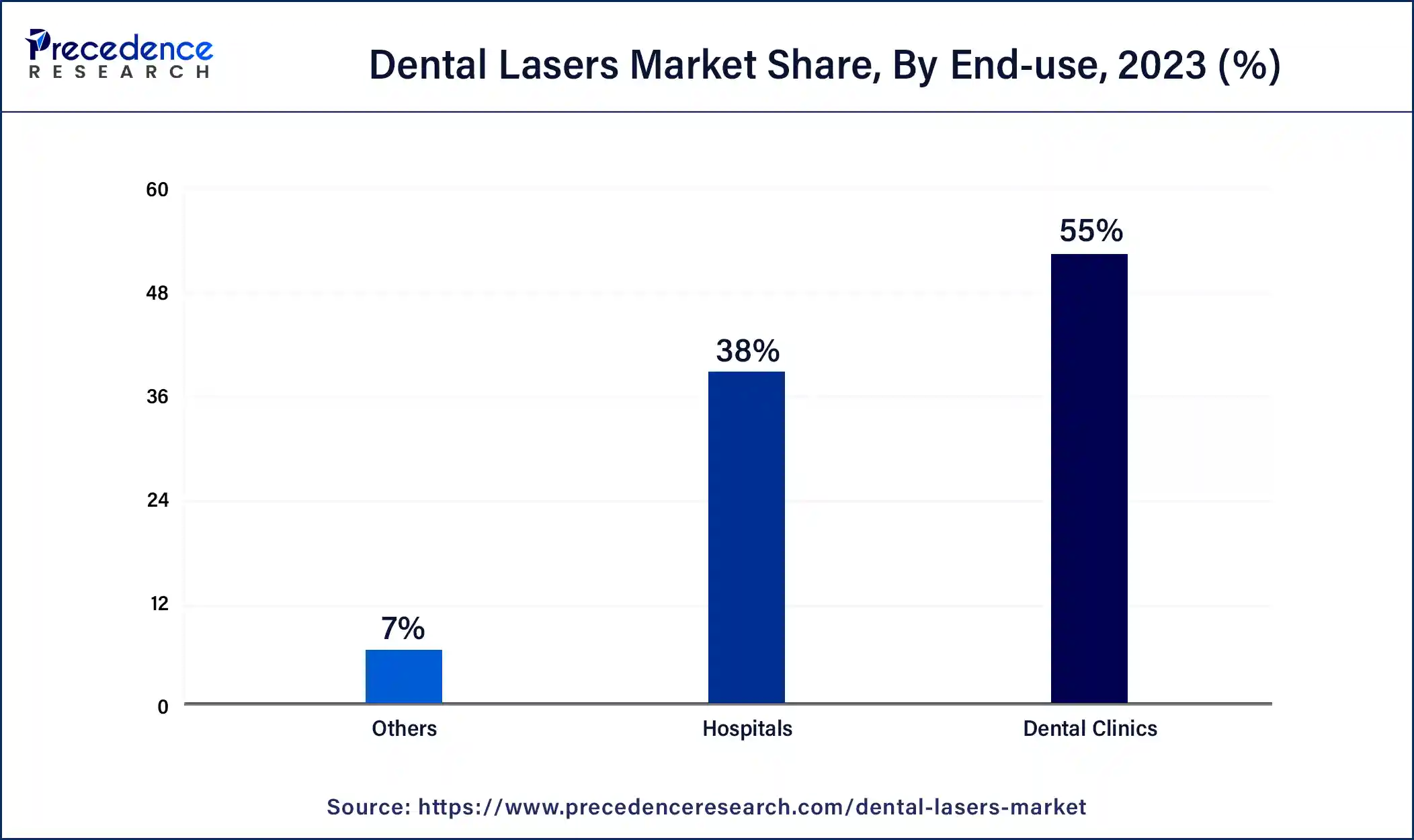

The dental clinics segment dominated the market in 2024. This segment is also expected to grow the fastest during the projected period. This is due to the widespread availability of dental clinics that offer comprehensive dental care services, which is a significant factor driving the growth of the dental lasers market. Dental clinics serve as the main destination for individuals seeking various dental treatments, including laser procedures.

As more clinics adopt dental lasers, patients can enjoy less invasive treatments, faster recovery times, and improved accuracy. The convenience and accessibility of dental clinics, coupled with the increasing demand for advanced dental procedures, have led to this segment capturing the largest share of revenue in the dental lasers market.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

May 2025

October 2023