January 2025

Dental Syringes Market (By Product: Reusable Syringes, Disposable Syringes; By End-use: Hospitals, Outpatient Facilities, Research & Manufacturing) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

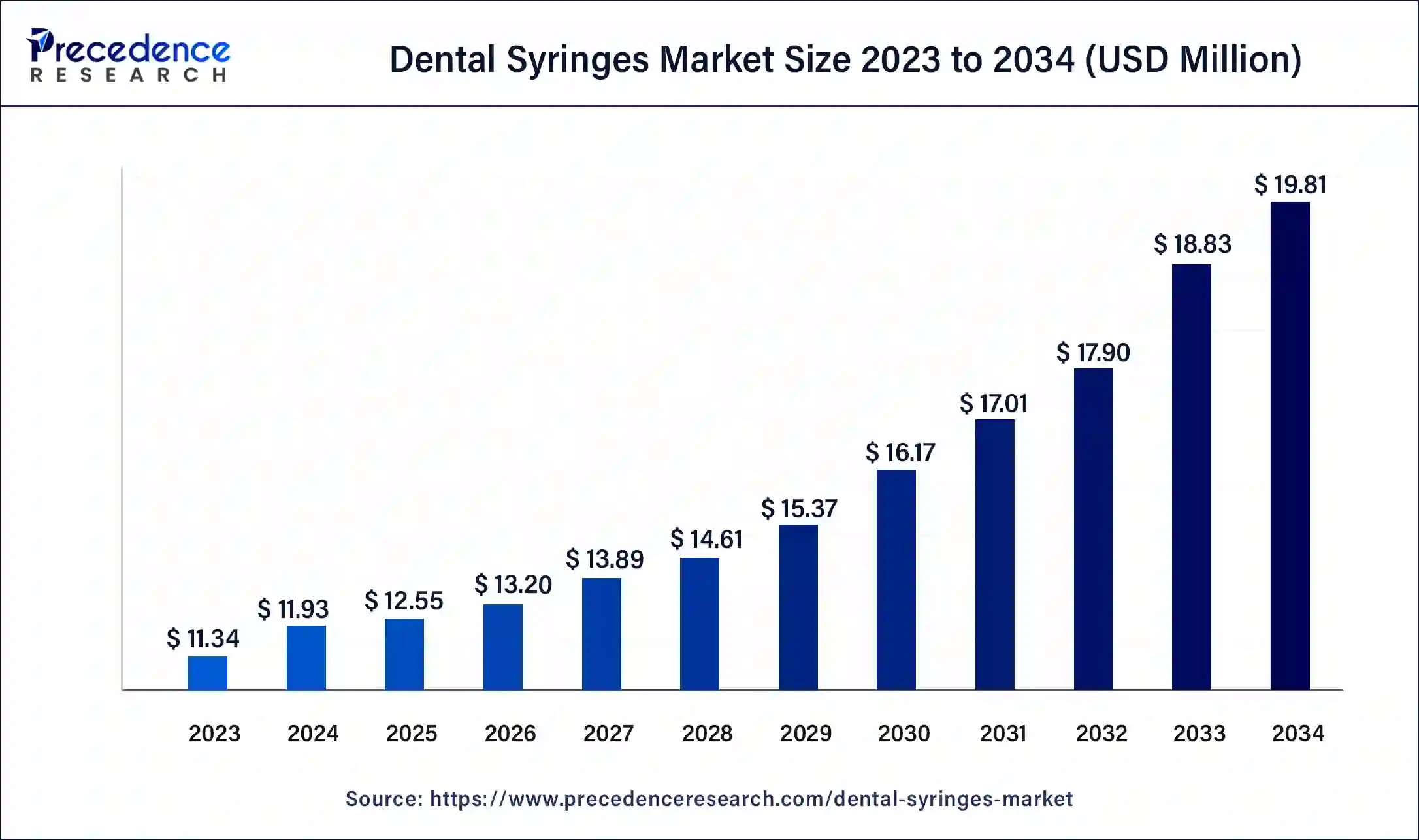

The global dental syringes market size was USD 11.34 million in 2023, accounted for USD 11.93 million in 2024, and is expected to reach around USD 19.81 million by 2034, expanding at a CAGR of 5.2% from 2024 to 2034. The North America dental syringes market size reached USD 3.97 million in 2023. This growth of the dental syringes market can be attributed to the increasing prevalence of dental disorders and other chronic diseases that lead to dental issues.

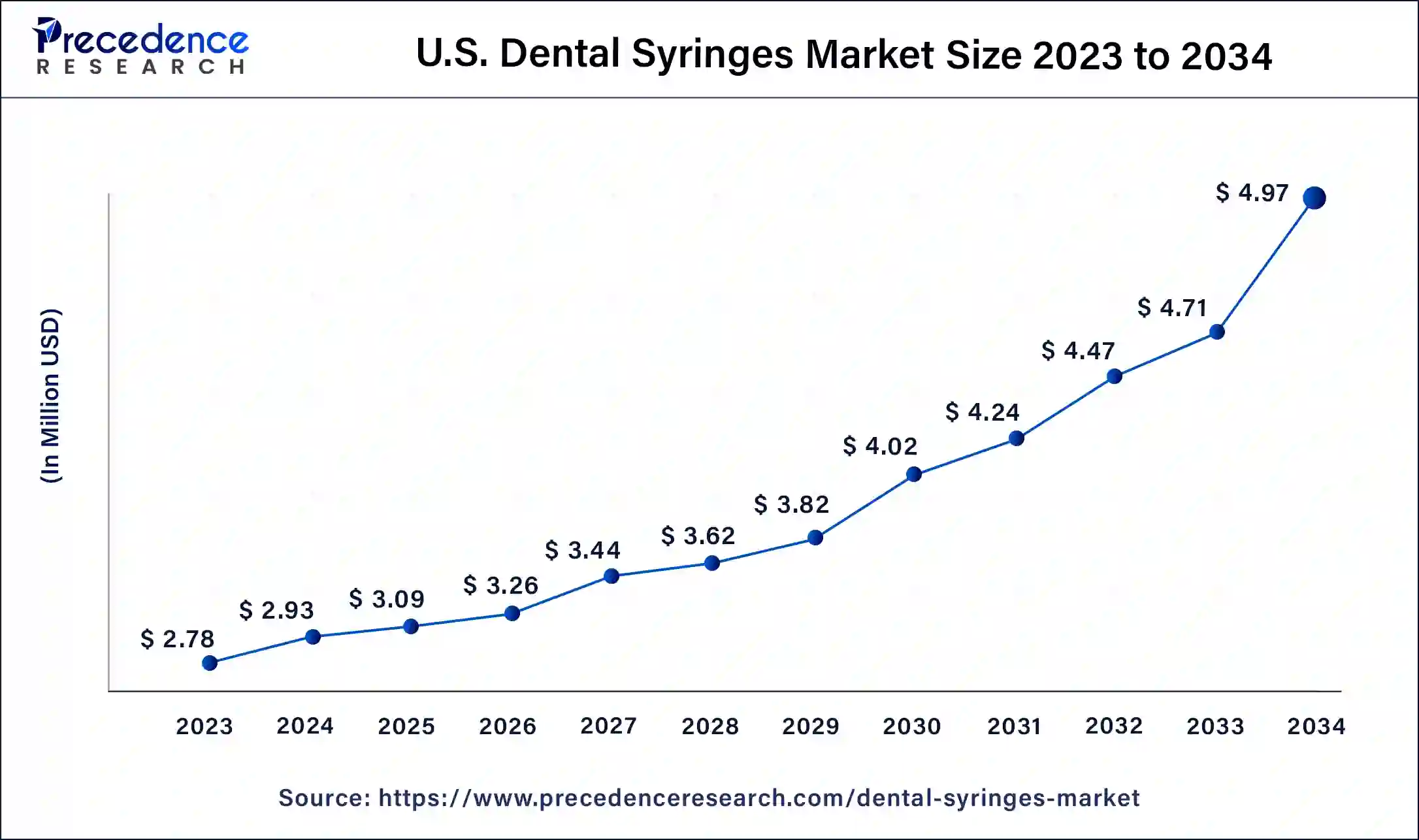

The U.S. dental syringes market size was estimated at USD 2.78 million in 2023 and is predicted to be worth around USD 4.97 million by 2034, at a CAGR of 5.4% from 2024 to 2034.

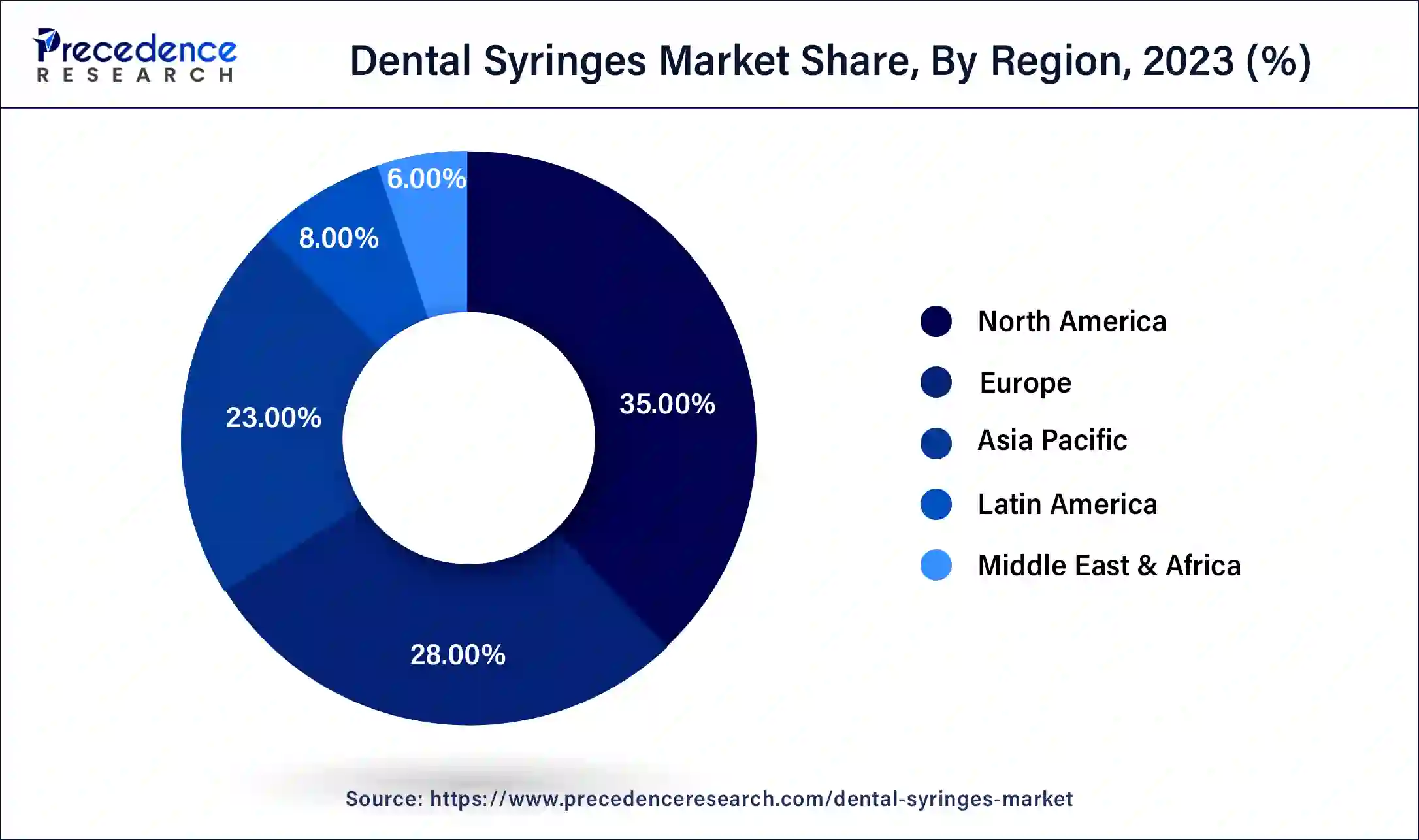

North America dominated the global dental syringes market because of the growing number of dental diseases, higher healthcare spending, and major industry players in the region additionally, increased awareness about preventive healthcare and rising healthcare expenditures fuel market growth. Furthermore, the market is expected to receive a boost from the approval of more products by the United States Food and Drug Administration (USFDA) and the introduction of new products by key companies.

Asia Pacific is projected to experience rapid growth during the forecast period. This growth is attributed to several factors, including the widespread occurrence of dental diseases, rising awareness about oral health, developmental efforts, and regional income levels. Additionally, the area benefits from a high prevalence of dental issues and a substantial number of dentists, which are expected to drive market expansion in the coming years.

A dental syringe is a tool used by dentists to inject anesthesia into a patient's mouth before dental procedures. It consists of a cartridge containing anesthesia attached to a syringe. This syringe not only delivers anesthesia but also supplies water and mist to clear debris from the mouth, aiding the dentist during treatment. It's commonly used to numb gums for procedures like root canals and teeth scaling.

Different syringes have features like aspiration, where the plunger is pulled back to ensure the needle isn't in a blood vessel before injecting anesthesia. Self-aspirating syringes automatically check for blood vessels when the plunger is pressed, reducing the risk of complications like injecting into blood vessels or injuring nerves. Technological advances in the dental industry can further propel the dental syringes market expansion over the projected period.

In 2022, Essential Innovations and new technological advances will make dental Surgical Instruments a critical component of the software industry. Demand has increased as manufacturers have developed better versions. Everyone in the industry has been under pressure to keep up with new products, further boosting innovation.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.2% |

| Global Market Size in 2023 | USD 11.34 Million |

| Global Market Size in 2024 | USD 11.93 Million |

| Global Market Size by 2034 | USD 19.81 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in the prevalence of dental issues and treatment

Consumers increasingly seek dental services in developing countries where dental treatments are more affordable than in developed countries. The growing dental syringes market in these regions provides quality care at reasonable prices. Technological advancements and evolving techniques are driving dental tourism in developing countries. This increase in dental tourism is a significant trend contributing to the growth of the dental syringes market.

Factors like changing lifestyles, technological advancements, and social media influence are expected to increase the demand for dental syringes further. Around 60% of practitioners have noted that many patients are interested in aesthetic dental procedures, influenced by trends on social media.

Recruitment challenges

Dental practices face challenges hiring staff for various roles, such as administrative staff, dental hygienists, and dentists. A report by the Health Policy Institute (HPI) of the American Dental Association (ADA) found that over one-third of dental practices struggle to find staff, primarily due to the challenging recruitment process. This shortage affects the efficiency of practices and the quality of care for patients, potentially hindering the growth of the dental syringes market.

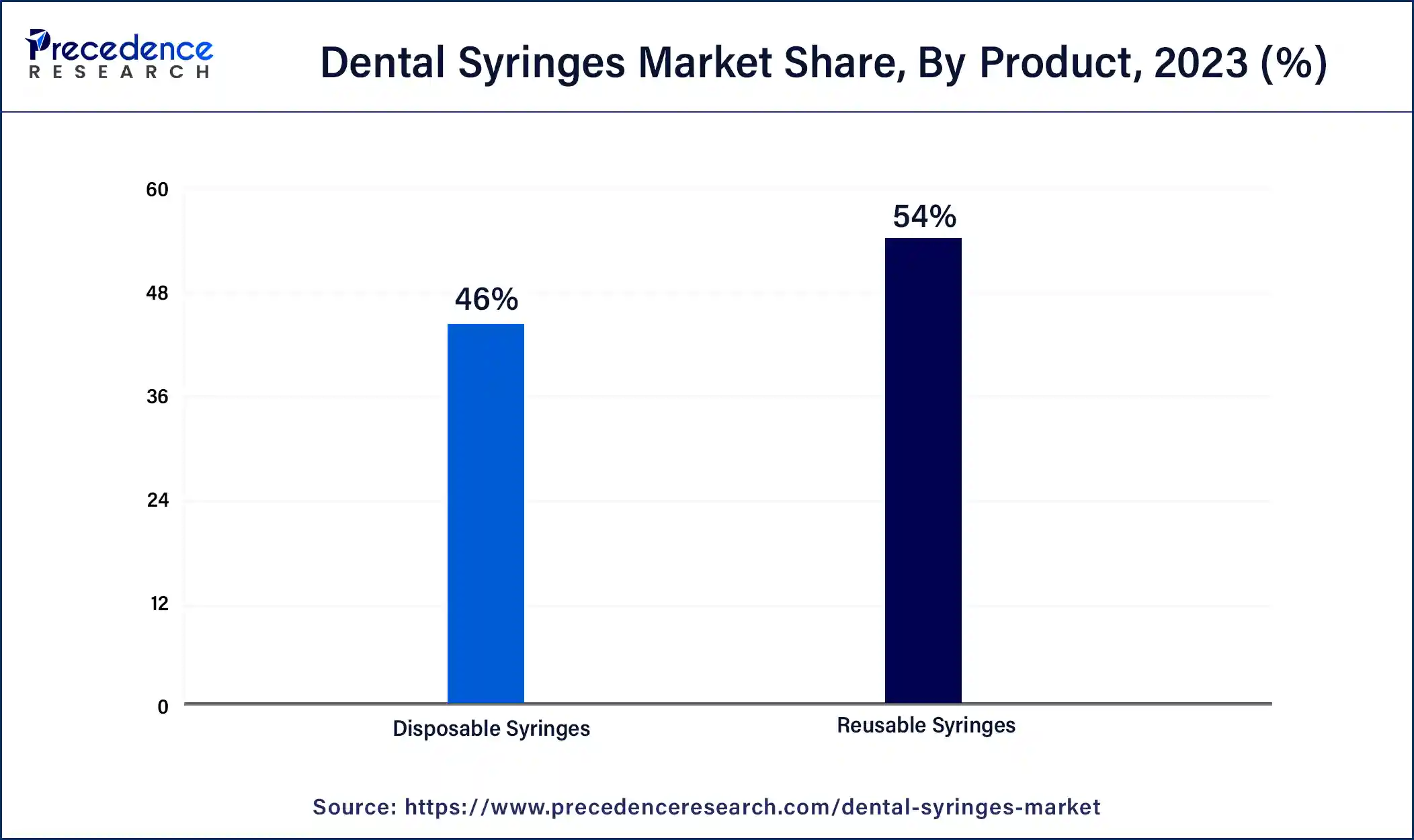

Rise in the use of reusable syringes

Dental professionals increasingly opt for reusable dental syringes to administer anesthesia because they are more affordable and can be reused. With the growing number of patients visiting dental clinics due to increasing dental diseases, there is a higher demand for dental consumables like reusable syringes. Additionally, reusable syringes are environmentally friendly, reducing pollution. The rise in dental and oral diseases caused by unhealthy eating habits and vitamin deficiencies is a significant factor driving market growth. Furthermore, strategic initiatives by market players are also contributing to the expansion of the dental syringes market.

The reusable syringes segment dominated the dental syringes market in 2023. Dental professionals are increasingly choosing reusable dental syringes for administering anesthesia because they are affordable and can be used multiple times. As the number of patients visiting dental clinics rises due to increasing dental diseases, a growing demand for dental consumables like reusable syringes is growing. Additionally, reusable syringes offer the benefit of being eco-friendly, helping to reduce environmental pollution.

The disposable syringe segment is expected to grow fastest over the forecast period. The rising adoption of disposable syringes, aimed at reducing the risk of infection and enhancing patient safety, is projected to boost segmental growth. Additionally, the growing awareness among individuals about the importance of dental health for overall physical well-being, leading to an increase in dental check-ups, is expected to contribute to market expansion.

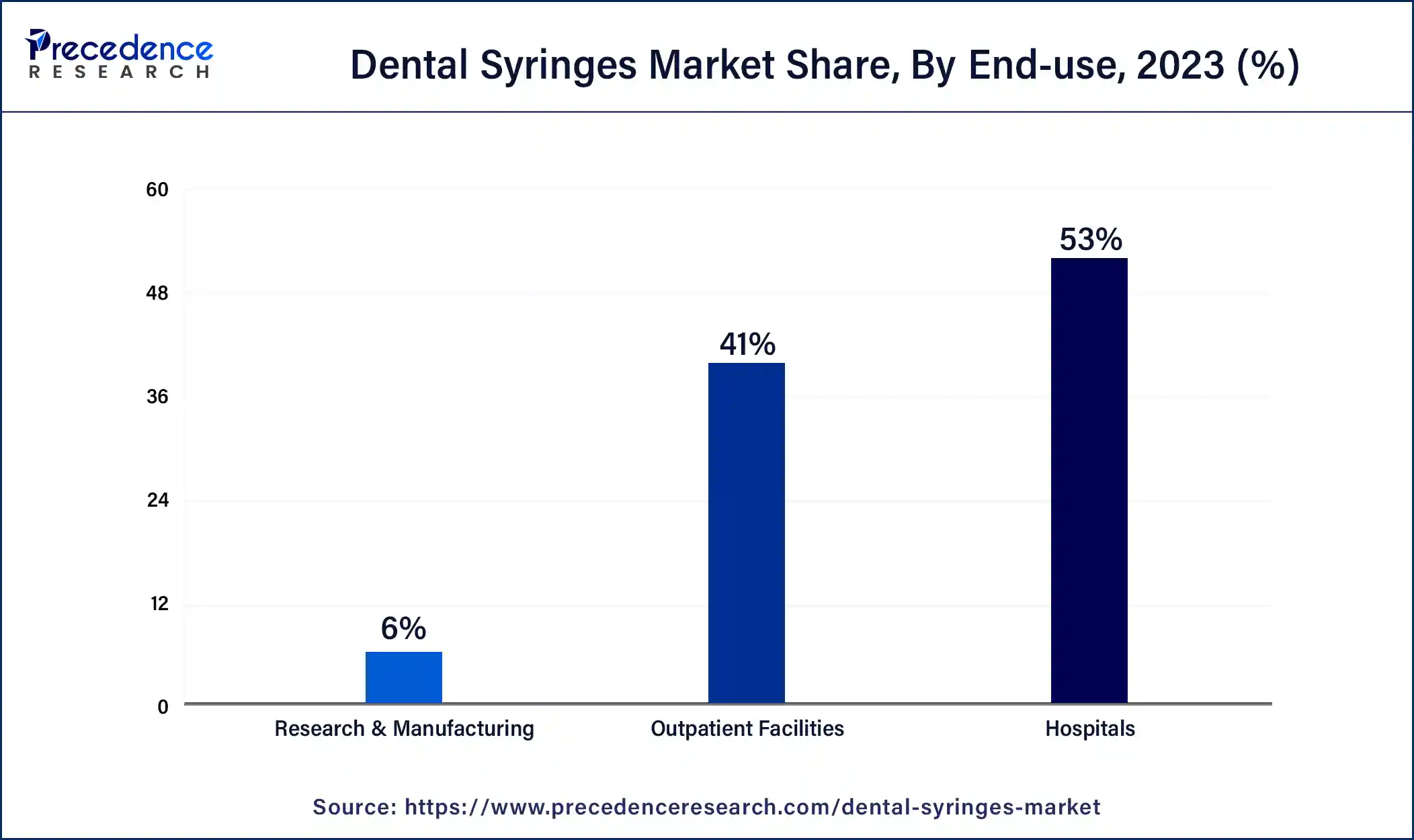

The hospital segment dominated the dental syringes market in 2023. This segment's growth can be attributed to the fact that hospitals are easily accessible to a significant portion of the population, and people trust the services provided by hospitals. Moreover, initiatives by both government and non-governmental organizations to raise awareness and enhance dental care services are expected to drive market growth further.

The outpatient facilities segment is projected to experience the highest growth during the forecast period. This growth is primarily due to the quick and efficient procedures and treatments these facilities provide and their cost-effectiveness. These facilities also improve people's overall access to oral health services and promote treatments, which is expected to drive further market growth.

Segments Covered in the Report

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023