November 2024

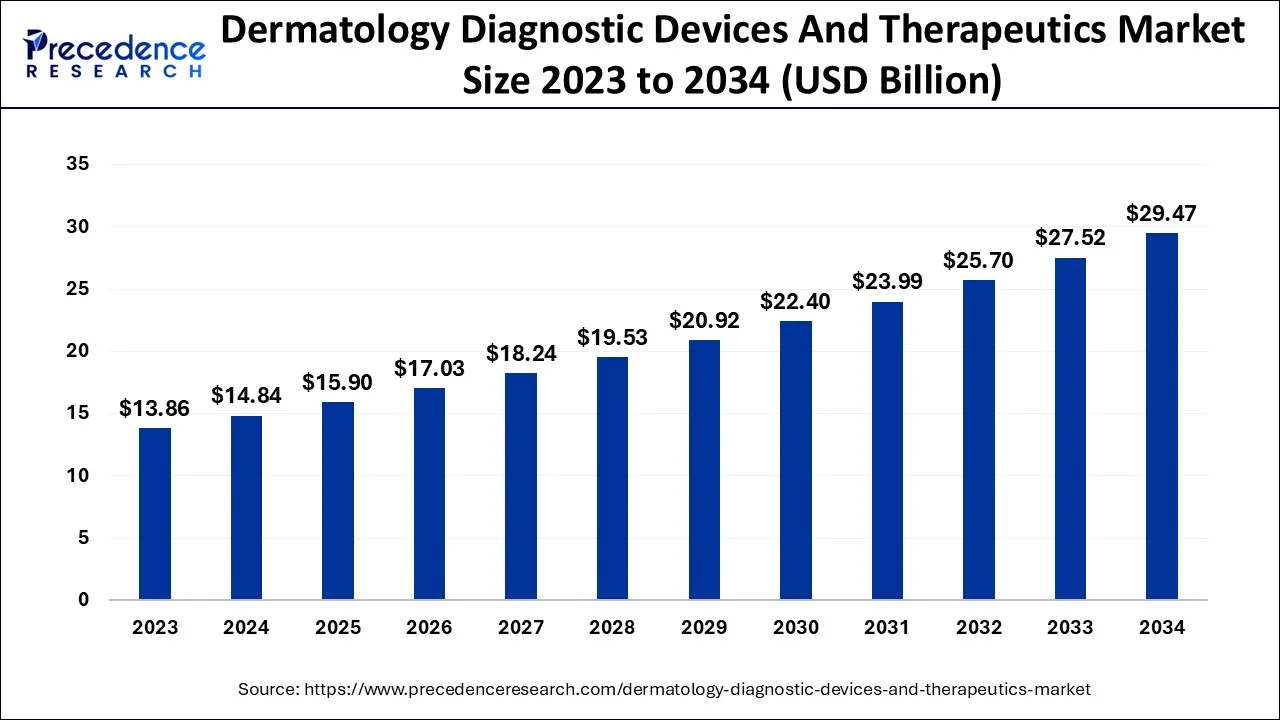

The global dermatology diagnostic devices and therapeutics market size accounted for USD 14.84 billion in 2024, grew to USD 15.9 billion in 2025 and is predicted to surpass around USD 29.47 billion by 2034, representing a healthy CAGR of 7.10% between 2024 and 2034. The North America dermatology diagnostic devices and therapeutics market size is calculated at USD 6.08 billion in 2024 and is expected to grow at a fastest CAGR of 7.22% during the forecast year.

The global dermatology diagnostic devices and therapeutics market size is estimated at USD 14.84 billion in 2024 and is anticipated to reach around USD 29.47 billion by 2034, expanding at a CAGR of 7.10% from 2024 to 2034. Dermatology diagnostic devices and therapeutics are used for diagnosing skin wounds, skin-related disorders, pigmentation acne, and assisting in the diagnosis of skin cancer.

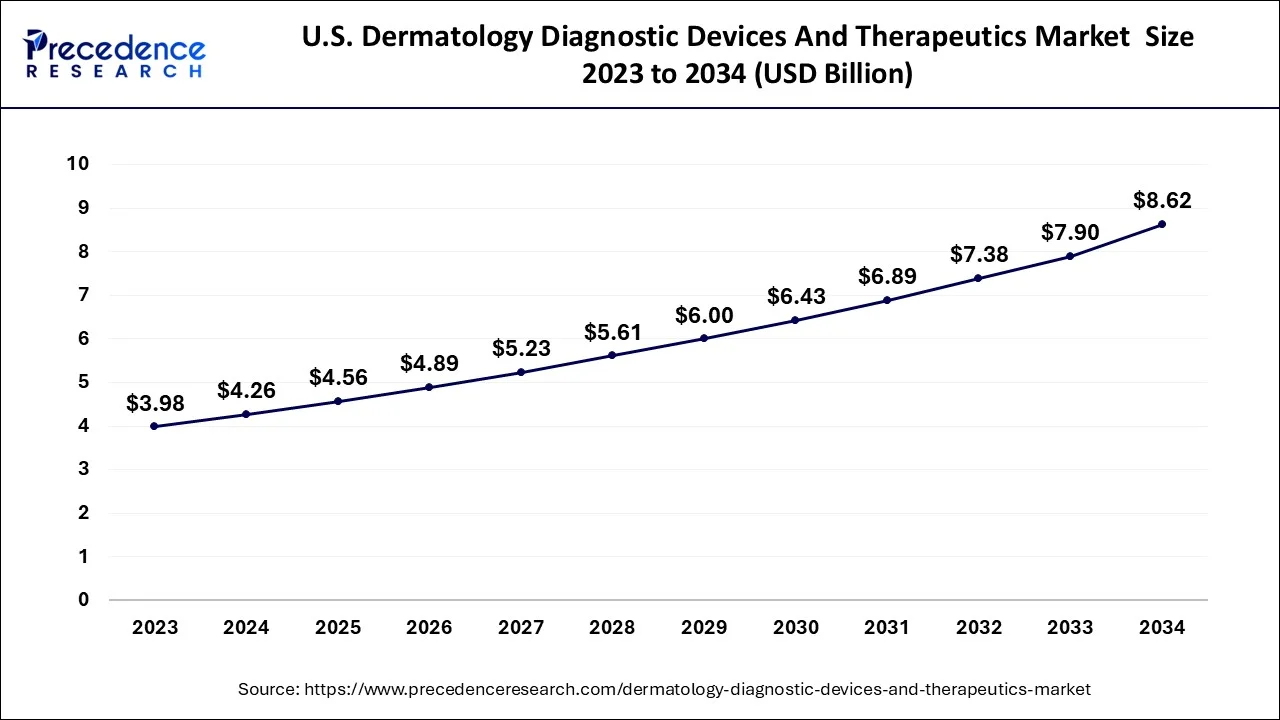

The U.S. dermatology diagnostic devices and therapeutics market size is estimated at USD 4.26 billion in 2024 and is expected to be worth around USD 8.62 billion by 2034, rising at a CAGR of 7.28 from 2024 to 2034.

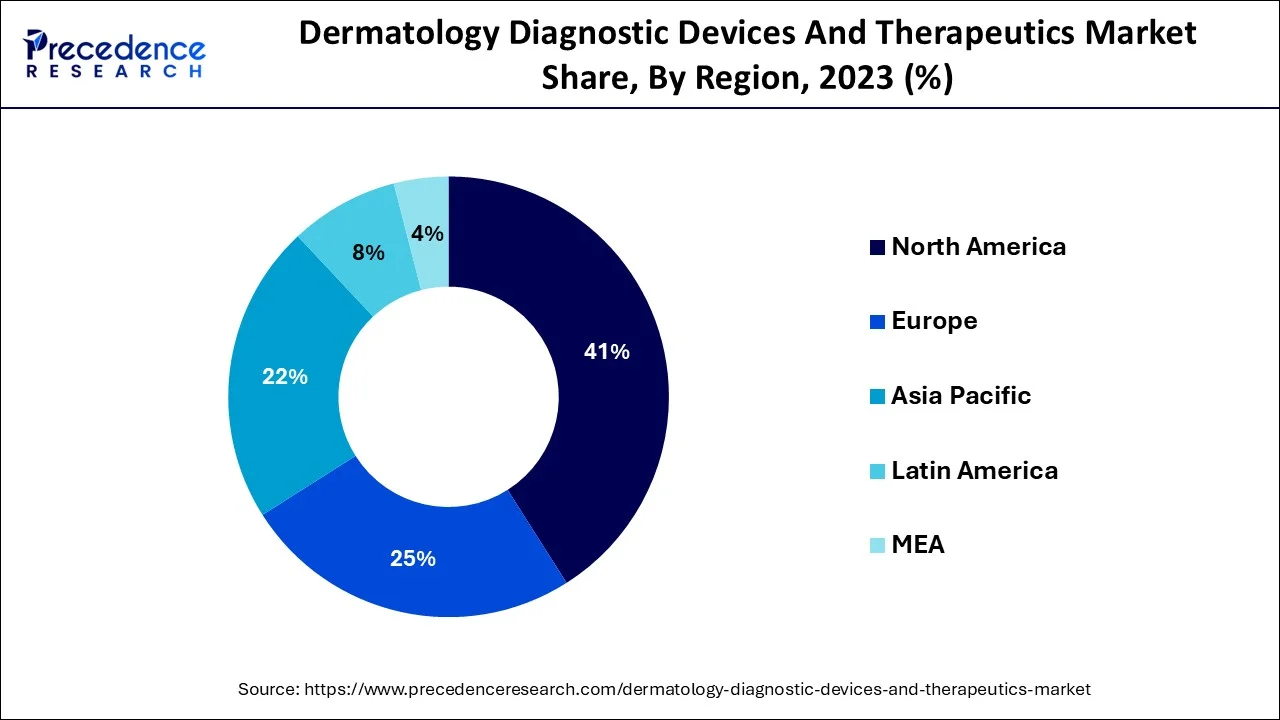

The region with the highest revenue share in 2023—more than 45%—was North America. During the projection period, the regional market is expected to maintain its dominance and develop at a steady CAGR. The increased prevalence of skin cancer and other skin problems including eczema and rosacea, as well as the expanding usage of cosmetic procedures, are two major factors contributing to the regional market's development. 80% of Americans will encounter acne vulgaris at some time in their lives, and 20% of those people may have severe acne that might leave them permanently emotionally and physically damaged.

From 2024 to 2034, the Asia Pacific regional market is anticipated to develop at the quickest rate. An increase in the number of multinational corporations engaging in R&D in the Asia Pacific has shown to be a significant driver of the regional market. Rising consumer awareness of beauty is also projected to stimulate product demand, fostering regional market expansion.

The market growth for dermatological diagnostic equipment would be greatly impacted by the rising incidence of skin cancer. UV radiation exposure is a cause of skin cancer. According to the American Academy of Dermatology, 1.9 million individuals were expected to have melanoma in 2019. Additionally, the Skin Cancer Foundation predicts a 2% increase in new melanoma occurrences in 2020. The demand for dermatological devices will also increase during the next years due to the increasing requirement for quick diagnostics of skin cancer and other associated skin problems. The size of the market for dermatological diagnostic equipment will increase over the future years due to technological developments in the field of dermatology. Manufacturers should benefit from these technical developments in order to preserve their place in the market. The adoption of dermatological diagnostic devices will also be influenced by the development of diagnostic tools for treating malignant skin cancer and other conditions like squamous cell carcinoma. Similarly to this, as dermatological diagnostic gadgets become more digitalized, more people will use them, increasing the market's growth. Therefore, the industry of dermatological diagnostic devices will have the potential for significant growth due to ongoing improvements in dermatology equipment. The market for dermatological diagnostic equipment and therapies is gaining momentum due to the proliferation of specialist clinics, in addition to the rise in cases of hair loss and skin illnesses and technological advances in the industry. Additionally, the development of e-commerce and the rise of the cosmetics industry are anticipated to have a beneficial impact on this market. On the other hand, high prices for dermatological diagnostic tools and associated treatments prevent the market from growing more profitably.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.84 Billion |

| Market Size by 2034 | USD 29.47 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.10% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Geriatric people are using aesthetic operations more frequently

Increasing use of non-invasive and minimally invasive aesthetic treatments

Clinical risks and complications associated with dermatology procedures

Demand for minimally invasive/non-surgical procedures is rising

Advancements in skincare treatments

The market for dermatology has been divided into imaging equipment, microscopes and trichoscopy, and dreamscapes based on diagnostic tools. The report categorizes imaging devices into optical coherence tomography, ultrasound, X-ray, magnetic resonance imaging, and magnetic resonance spectroscopy. Microscopes and trichoscopy are further divided into reflectance confocal microscopy, multispectral photoacoustic microscopy, Raman spectroscopy, and other categories. Additionally, there are three different types of dermatoscopes: hybrid, cross-polarized, and contact oil immersion. These include the sub-segments of imaging equipment, which had the highest revenues in 2023 and are expected to see above-average CAGR growth of 7.96% from 2024 to 2034. The imaging equipment market is booming as a consequence of its successful detection rates, real-time diagnostic picture production, and high sensitivity.

With a market share of over 15% in 2023, the hair removal therapy application sector will also have the fastest CAGR between 2023 to 2032. The treatment application segment is further divided into the following sub-segments: cellulite reduction, vascular and pigmented lesion removal, skin rejuvenation, hair removal, acne, psoriasis, and tattoo removal; wrinkle removal and skin resurfacing; removal of wrinkling and age spots; and others. Laser hair removal equipment in particular has been shown to be less uncomfortable and safer for all skin tones and hair colors, which is driving the expansion of this market.

A major portion of the market, more than 54.60%, was accounted for by the hospital sector in 2023 due to the widespread use of cutting-edge dermatological equipment in hospital settings. Numerous visits are made to these facilities for the diagnosis and treatment of skin diseases as a result of the availability of a variety of treatment choices, which in turn promotes the segment's expansion. The end-user category for clinics is anticipated to see the fastest CAGR between 2023 to 2032. Clinics that specialize in the diagnosis and treatment of skin diseases are called dermatology offices. Certified plastic surgeons provide both surgical and nonsurgical procedures in dermatological clinics.

According to TripleTree, the United States will have 14,000 dermatologists and 9,000 dermatology practices in 2020. 34% of all practices were single operations, while 48% of all operations had three or more physicians. Patients frequently attend specialty dermatological clinics for quick and efficient care as the need for specialized dermatology treatments increases, which fuels the segment's expansion. In addition, more people are attending dermatological clinics for treatment and care due to the global growth in skin cancer and melanoma prevalence and the expansion of clinics providing dermatology services.

By Diagnostic Devices

By Application Class

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

December 2024

November 2024

August 2024