December 2024

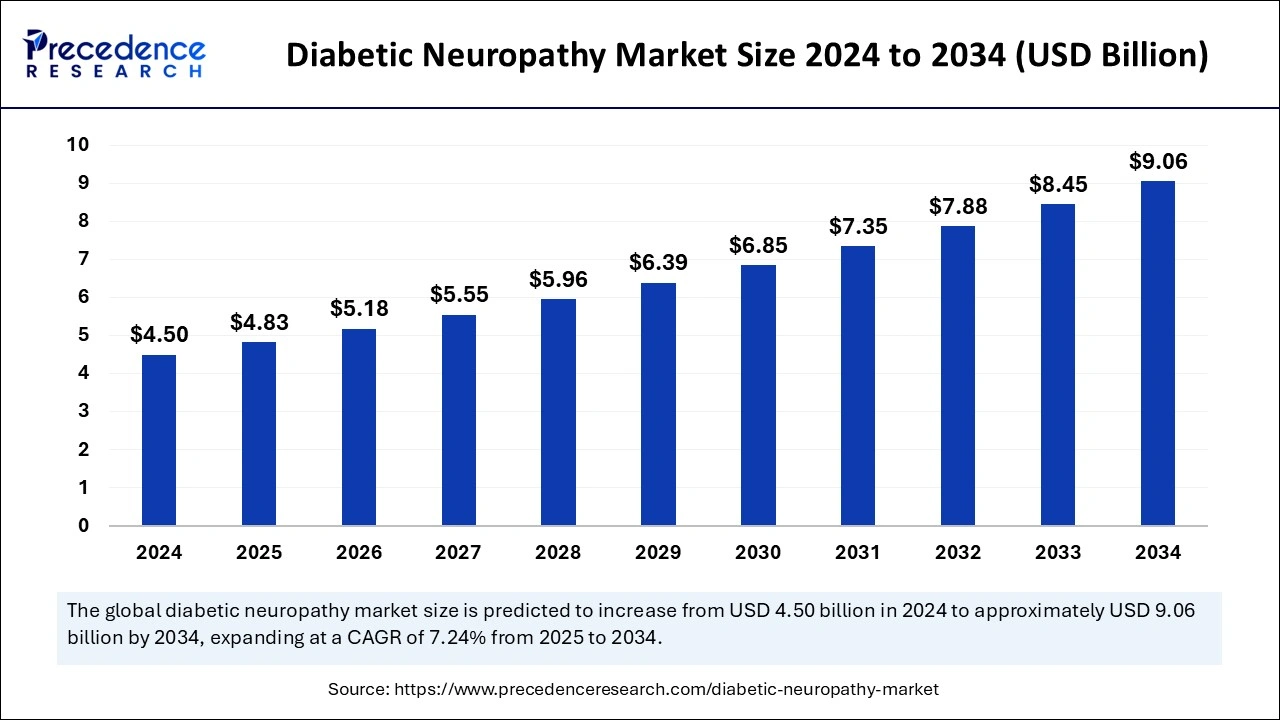

The global diabetic neuropathy market size is accounted at USD 4.83 billion in 2025 and is forecasted to hit around USD 9.06 billion by 2034, representing a CAGR of 7.24% from 2025 to 2034. The North America market size was estimated at USD 1.71 billion in 2024 and is expanding at a CAGR of 7.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global diabetic neuropathy market size was calculated at USD 4.50 billion in 2024 and is predicted to reach around USD 9.06 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034. The increasing prevalence of diabetic neuropathy in geriatric patients already affected by diabetes and further innovations in the development of novel drugs in the treatment of conditions drive the growth of the market.

The implementation of artificial intelligence into the diabetic neuropathy market is one of the fastest-growing applications and technologies for improving efficiency and efficiency. In the case of diabetic neuropathy, the type 2 diabetic has an 8-45% chance of having the neuropathy conditions. AI helps filter the patients who have a greater risk of diabetic neuropathy. With the diagnosis, AI can also provide different treatment strategies for the treatment or management of diabetes. AI helps in improving the treatment and management of diabetes neuropathy with reduced medical costs and better patient outcomes.

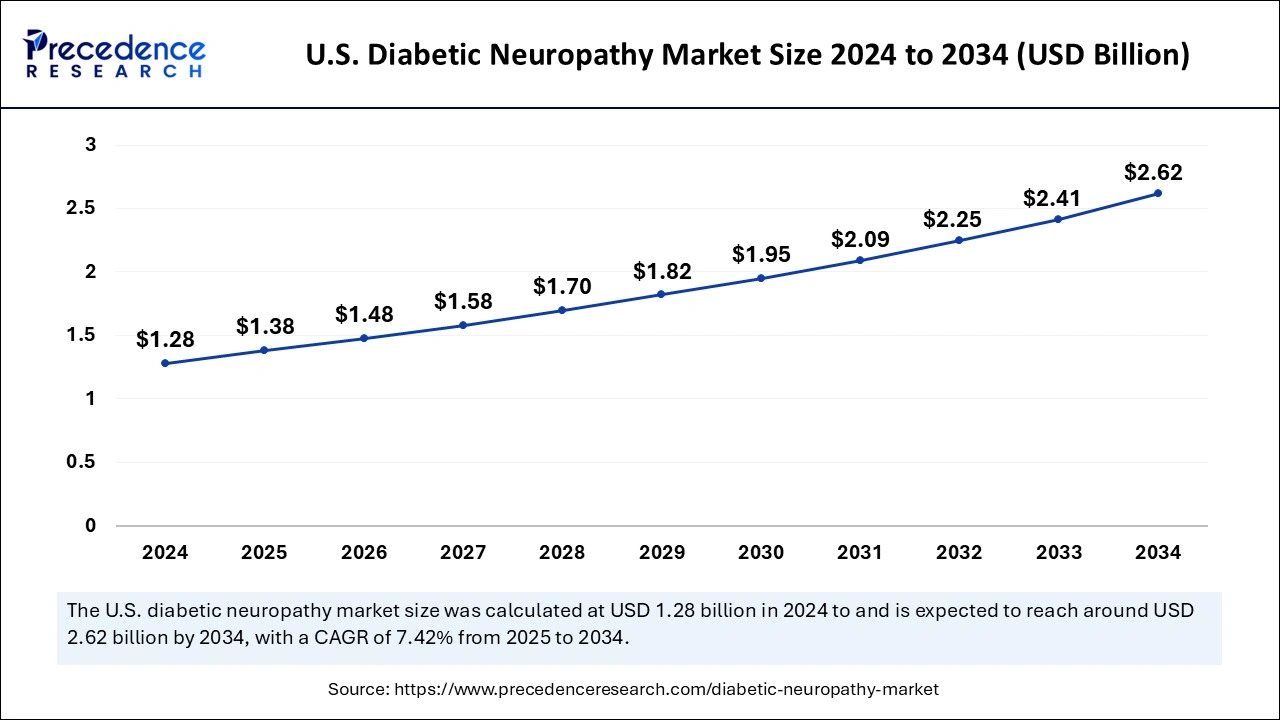

The U.S. diabetic neuropathy market size was exhibited at USD 1.28 billion in 2024 and is projected to be worth around USD 2.62 billion by 2034, growing at a CAGR of 7.42% from 2025 to 2034.

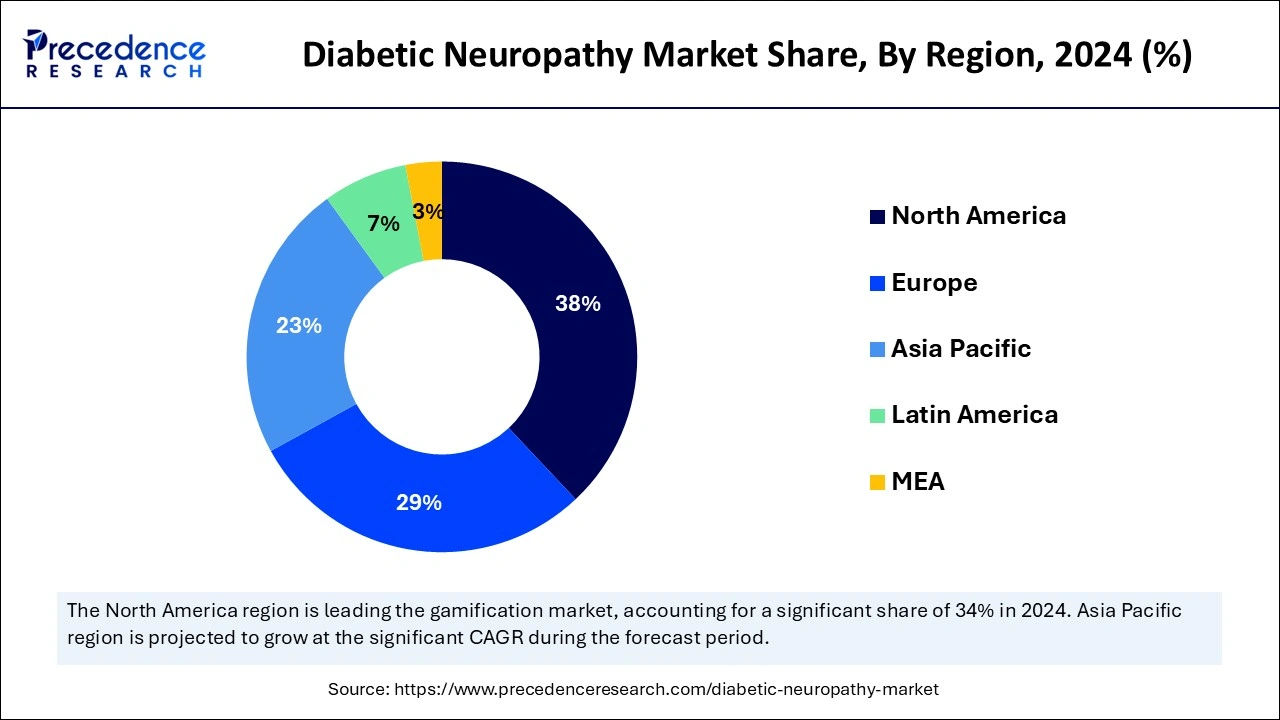

North America dominated the global diabetic neuropathy market in 2024. The growth of the market is attributed to the rising prevalence of lifestyle diseases such as high blood pressure, diabetes, and others due to the changing lifestyle preferences, acceptance of sedentary lifestyle, eating habits, increasing consumption of sugar, higher consumption of alcohol and smoking which is the major cause of diabetes that boosts the cases of diabetic neuropathy.

Additionally, the rising healthcare infrastructure in regional countries like the United States and Canada, which is the availability of skilled healthcare professionals and technological advancements in medical devices for the treatment of several diseases, including diabetic neuropathy, is contributing to the expansion of the diabetic neuropathy market in the region.

The Asia Pacific is expecting substantial growth in the diabetic neuropathy market during the predicted period. The rising cases of diabetic neuropathy cases in regional countries such as China, India, and Japan, owing to the presence of a large number of geriatric populations with diabetes, are driving the demand for treatment for diabetic neuropathy and other diabetes-related disease. The growing healthcare and pharmaceutical infrastructure in the regional countries, with the ongoing investment and initiatives in healthcare development, boosts the efficiency in the treatment of several chronic diseases.

The increasing research and development program in diabetes treatment contributes to the growth of the diabetic neuropathy market across the region. India is one of the leading prevalent countries in the world in terms of the rising number of diabetic people. According to the Indian Council of Medical Research, the prevalence of diabetes in India will be 10.1 crores in 2023. While China has one of the largest numbers of people with diabetes there are 118 million people are affected by diabetes, which is approximately 22% of the global diabetic population.

Diabetic neuropathy is a health issue related to diabetes that can lead to nerve damage throughout the body. Diabetes can affect the nerves of the body, leading to dysfunction in movement and sensation. Several leading factors are the major cause of diabetic neuropathy, such as high blood sugar (glucose), metabolic factors, and inherited factors. The neuropathy condition occurs within 10 years after the diagnosis of diabetes. Diabetic mononeuropathy, diabetic polyneuropathy, diabetic autonomic neuropathy, and proximal neuropathy (diabetic amyotrophy) are some types of diabetic neuropathy. The increasing cases of diabetes in the population globally accelerate the cases of diabetic neuropathy and the diabetic neuropathy market.

| Report Coverage | Details |

| Market Size by 2024 | USD 4.50 Billion |

| Market Size in 2025 | USD 4.83 Billion |

| Market Size in 2034 | USD 9.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease Type, Drug Type, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing diabetes cases

The increasing prevalence of diabetes patients in the world is due to the increasing presence of the geriatric population, changing lifestyles, habitat, genetics, and several other factors that are anticipated to increase the chance of nerve damage, which drives diabetic neuropathy cases in diabetic patients. An increasing number of patients with diabetes have diabetic neuropathy conditions with the symptoms of numbness in the different body parts. The rising economic development in various countries drives the per capita income, which leads to lifestyle changes and consumption of smoking and alcohol, which is the leading factor that contributes to the growing number of diabetes cases in adults.

High cost

The increased cost of formulation and development of drugs for the treatment of diabetic neuropathy and the availability of alternative treatments with better patient outcomes are restraining the growth of the diabetic neuropathy market.

Advancements in the treatment of diabetic neuropathy

The increasing investment in research and development activities in the further expansion and launch of new advancements in the medication and treatment of diabetes and related health issues, such as diabetic neuropathy for the early detection for preventing it from spreading complications and timely intervention drives the potential growth in the diabetic neuropathy market. Leading pharmaceutical companies are investing in the development of diabetes neuropathy management solutions.

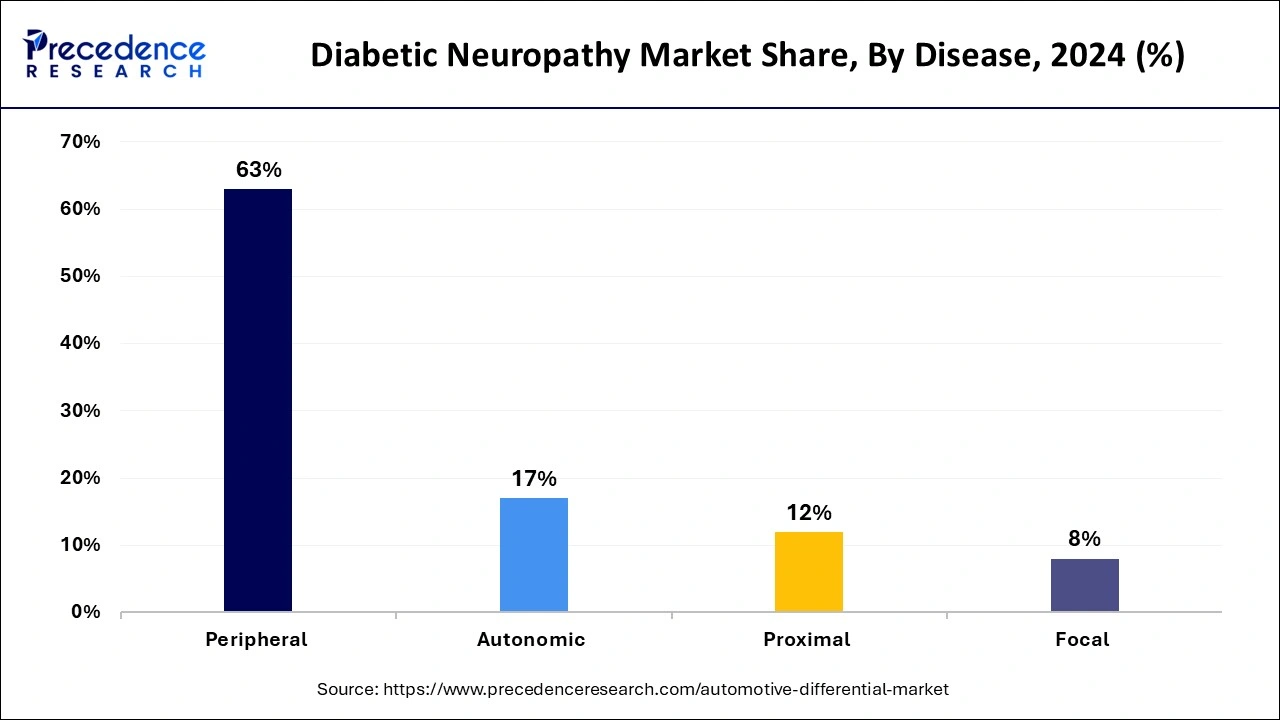

The peripheral segment led the global diabetic neuropathy market in 2024. The increasing prevalence of diabetes in the population due to the aging population, changing lifestyle, and genetics drives. Peripheral neuropathy is a type of diabetic neuropathy; it is the damaged nerve that is used to affect legs, feet, hands, and arms sometimes. In the case of peripheral neuropathy includes symptoms like pickling, numbness, or tingling on hands and feet, sensitivity, muscle weakness, inability to move motor nerves, and others. It can be treated by different diagnostic methods, therapies, and medicines.

The autonomic segment has notable growth in the market during the forecast period. The increasing cases of autonomic neuropathy are due to the increasing cases of diabetes in the population. Autonomic neuropathy damages the nerve that is responsible for automatic body functions. Body temperature, blood pressure, heart rate, urination, digestion, and bowel movement are the major functions that are affected by autonomic neuropathy.

The non-steroidal anti-inflammatory drugs segment dominated the diabetic neuropathy market in 2024. The non-steroidal anti-inflammatory drugs are widely accepted for the treatment of diabetic neuropathy due to their effectiveness in neuropathy dysfunction. It helps in reducing and managing pain and is mostly prescribed by doctors as the first line of treatment for neuropathy dysfunction. Non-steroidal anti-inflammatory drugs restrict the production of prostaglandins, which reduce peripheral and central sensory hypersensitivity and cause inflammation associated with nerve injury. The increasing investment in the development of diabetic neuropathy drug types is driving the growth of the non-steroidal anti-inflammatory drugs segment.

The opioid segment expects substantial growth in the market during the predicted period. The opioid is used in the management of chronic neuropathic pain and is prescribed as the second or third line of treatment for the reduction and management of diabetic neuropathy. The increasing prevalence of diabetic neuropathy in the population boosts the demand for efficient drugs or treatment types.

The hospital pharmacies will witness substantial growth during the predicted period. The rising acceptance of the hospital pharmacies for the medication for diabetic neuropathy. The increasing rate of hospitalization for diabetic neuropathy for the management and treatment due to the higher availability of skilled professionals and technologically advanced medical devices that help in effective diagnostics and treatment of the disease.

Disease Type Insights

Drug Type Insights

Distribution Channel Insights

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

March 2025

February 2025