September 2024

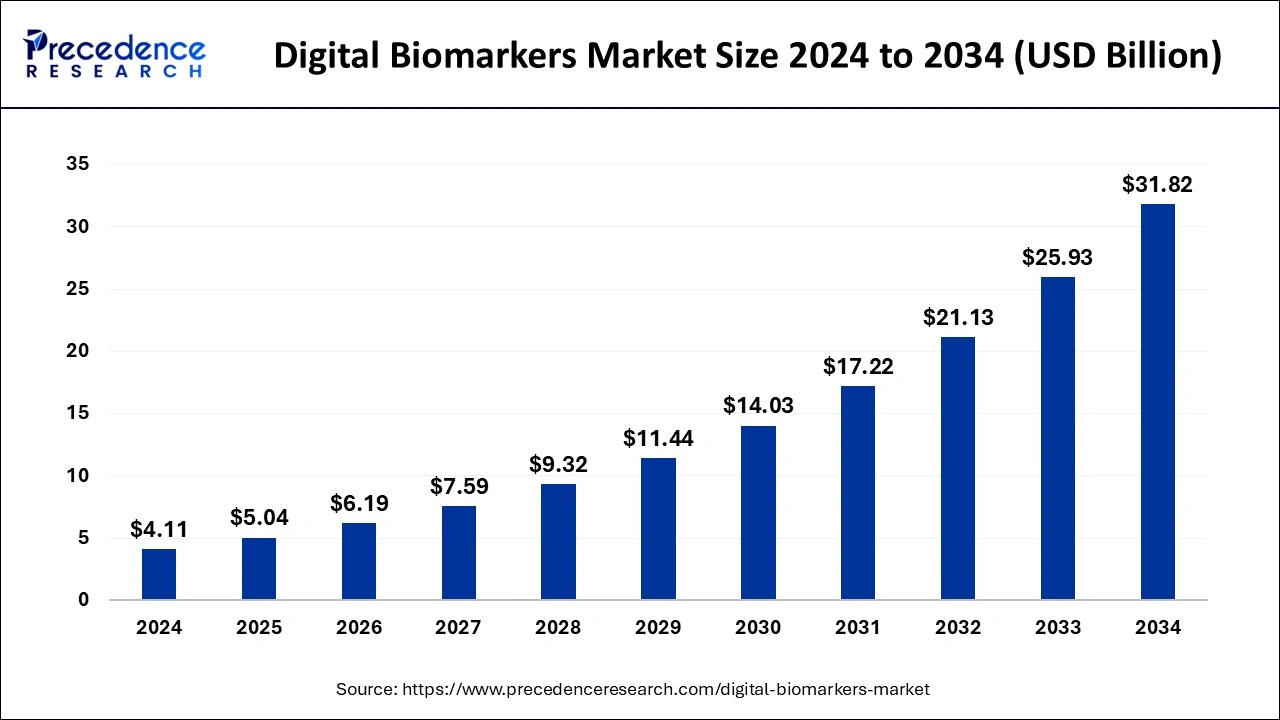

The global digital biomarkers market size was accounted for USD 4.11 billion in 2024, grew to USD 5.04 billion in 2025 and is predicted to surpass around USD 31.82 billion by 2034, representing a healthy CAGR of 22.71% between 2025 and 2034. The North America digital biomarkers market size was calculated at USD 2.40 billion in 2024 and is expected to grow at a fastest CAGR of 22.73% during the forecast year.

The global digital biomarkers market size was estimated at USD 4.11 billion in 2024 and is anticipated to reach around USD 31.82 billion by 2034, expanding at a CAGR of 22.71% from 2025 to 2034. The growing focus on developing novel therapeutics for treating various diseases has boosted the growth of the digital biomarkers market.

AI has transformed the landscape of the overall healthcare industry. The biomarker companies have started developing AI-based platforms for deriving information of health. In genomics sector, AI algorithms including convolutional neural networks (CNNs) helps in decoding genomic sequences, identifying variations with precision for developing novel medicines. In proteomics, AI enhances mass spectrometry-based protein analysis that improves the process involved in drug discovery. In epigenetics, AI helps in identifying different diseases and enhances chromatin accessibility and histone modifications that are integral for biotech companies. Thus, AI plays a transformative role in the positively shaping the digital biomarkers market.

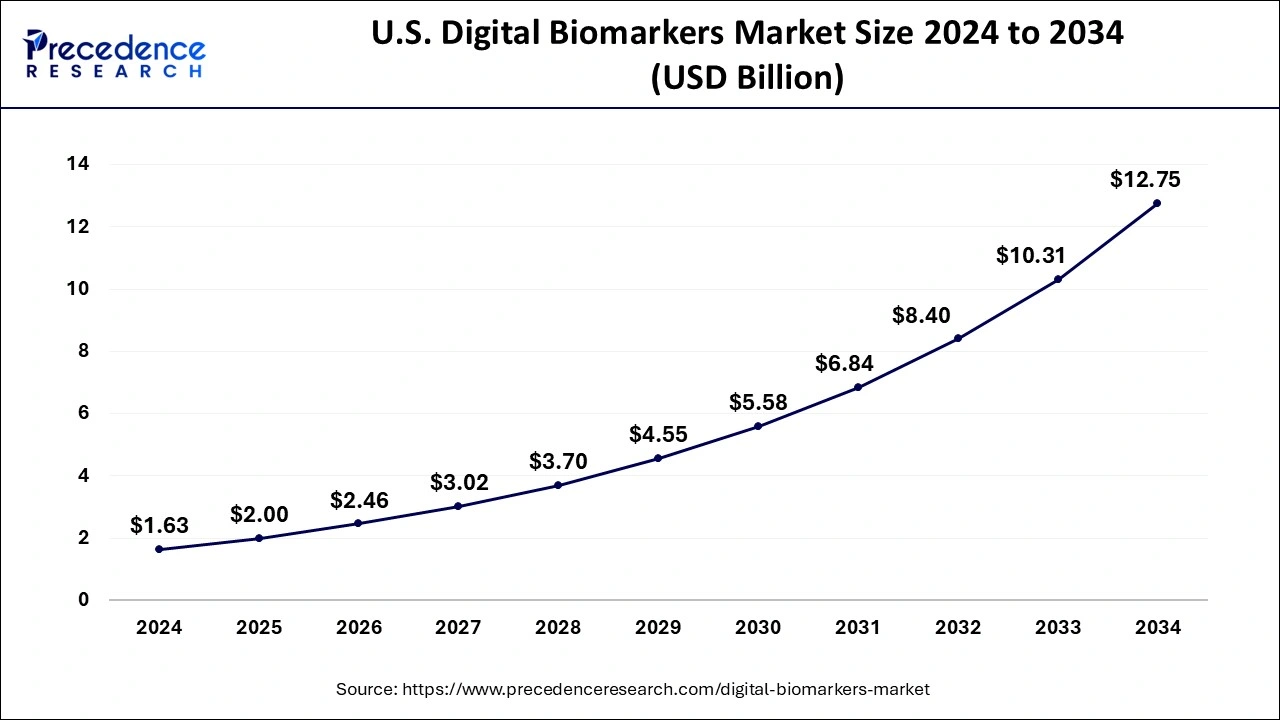

The U.S. digital biomarkers market size was evaluated at USD 1.63 billion in 2024 and is predicted to be worth around USD 12.75 billion by 2034, rising at a CAGR of 22.83% from 2025 to 2034.

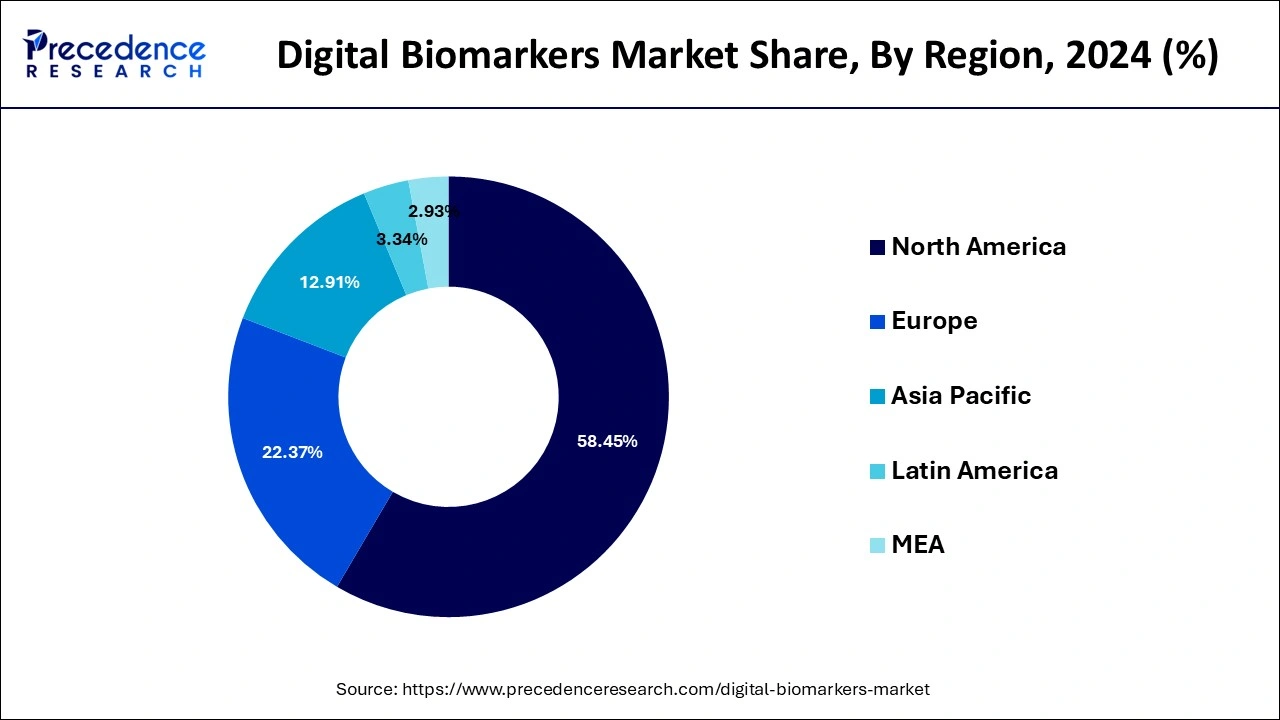

North America dominated the digital biomarkers market with the largest market share of 58.45% in 2024. The increased healthcare expenditure along with the presence of huge geriatric population in the developed market such as U.S. and Canada is augmenting the adoption of the digital biomarker in the North American healthcare industry. The higher adoption rate of digital technologies in North America has significantly driven the market growth.

In USA, the presence of several digital biomarker companies such as BrainStorm Cell Therapeutics, Amgen Inc. and Empatica Inc. has boosted the market growth. Moreover, there are several research institutes involved in medicine discovery that increases the demand for digital biomarker, thereby fostering the industrial expansion.

Asia Pacific is expected to expand at a double digit CAGR of 23.52% during the forecast period. The increased government expenditure on the development of the strong and advanced healthcare infrastructure in the region in the past few years has significantly boosted the adoption of the digital biomarkers in the Asia Pacific market. The proliferation of the digital technologies and its increasing adoption in the healthcare sector in Asia Pacific is fueling the growth of the market. Moreover, the presence of huge population and rising prevalence of chronic diseases along with the growing geriatric population is expected to exponentially augment the demand for the digital biomarkers in the foreseeable future.

The digital biomarkers market is a crucial segment of the life sciences industry. This industry deals in developing digital biomarkers for manufacturing different medicines. There are different types of components used in this industry comprising of mobile apps, wearable, digital platforms, biosensors, desktop-based software and some others. There are various kinds of biomarkers available in the market consisting of diagnostic digital biomarkers, monitoring digital biomarkers, predictive and prognostic digital biomarkers and some others. These biomarkers are used in various therapeutic areas including cardiovascular and metabolic disorders (CVMD), respiratory disorders, psychiatric disorders, sleep & movement disease, neurological disorders, musculoskeletal disorders and some others. This industry comprises of several end-users such as Healthcare Companies, Healthcare Providers, Payers and some others.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.11 Billion |

| Market Size in 2025 | USD 5.04 Billion |

| Market Size by 2034 | USD 31.82 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 22.71% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Component, Application, End Use |

Regulatory Flexibility Towards Digital Health Solutions Drives the Industry

For digital biomarkers, FDA has employed more than approach in order to increase the number of products in the market. For instance, the agency has modified its guidelines regarding the software as-medical-device (SaMD). This agency has also launched a pre-certification program, PreCert. As per the program, FDA would approve the company and not the product manufactured by it. By this program, the agency aims to improve the entry process of a company in the market and add in product modification process of the company. Other than the new initiatives, the agency has also revised its stand on digital health tools and FDA’s Center for Devices and Radiological Health has made a committee solely focused on the software solutions. Thus, the regulatory flexibility towards digital health solutions is anticipated to boost the growth of the digital biomarkers market.

Data Security Issues along with Sample Collection Issues Hampers the Industry

The digital biomarkers market faces several issues in their daily operations. Firstly, there are various security related issues related to biomarkers that creates negative impact in the industry. Secondly, numerous problems arise in sample collection and processing. Thus, these factors are expected to restrain the growth of the digital biomarkers market.

Rapid Adoption of Wearables and Advancements in Sensors to Shape the Upcoming Days

The popularity of wearables among people has gained traction in recent times. These wearables are used for generating real-time health data which can be further translated into digital biomarkers. It is also used for evaluating the efficacy and/or safety of any medical intervention. Moreover, numerous technological advancements in medical sensors are useful for various applications such as data collection, data analysis, digital biomarker fingerprint. Thus, rising adoption of wearables and technological advancements in sensor technology is expected to create ample growth opportunities for the companies in the future.

The data collection tools segment led the market in 2024. Data integration systems segment is likely to experience the fastest growth during the forecast period. This is attributable to the increased adoption of the smartphones and wearable devices among the population that helps in the collection of data significantly. The wireless connectivity and internet is a major tool that facilitates easy data collection and easy transfer of the data. The biosensors constitute a major portion of the data collection tools.

The cthe cardiovascular diseases segment held the largest market share in 2024. In terms of revenue and is estimated to sustain its dominance during the forecast period. This is simply attributed to the increased prevalence of cardiovascular diseases among the global population. According to the World Health Organization, the cardiovascular diseases accounts for around 32% of the global deaths. It is known as the leading causes of deaths. The rising prevalence of cardiovascular diseases due to various factors like increased consumption of tobacco, unhealthy food habits, and smoking is further expected to augment the growth of this segment in the forthcoming years. The cardiovascular diseases segment accounted for over 25% of the market share in 2020. The digital biomarkers collects the patients’ data and enhances the patient care and treatment outcomes.

On the other hand, the respiratory disease segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the rising prevalence of respiratory diseases like asthma and chronic obstructive pulmonary disease across the globe.

The diagnostic digital biomarkers segment contributed the highest market share in 2024. These biomarkers are used for improving several healthcare applications including early disease detection, disease management, personalized treatment, revolutionizing diagnosis and management and some others. The growing use of diagnostic digital biomarkers in research institutes has boosted the market expansion.

The monitoring digital biomarkers segment is projected to rise with the highest growth rate during the forecast period. These biomarkers are used for several applications such as personalized treatment, health status monitoring, neurological and motion disorders and some others. The rising use of monitoring digital biomarkers for detecting CVDs has driven the market growth.

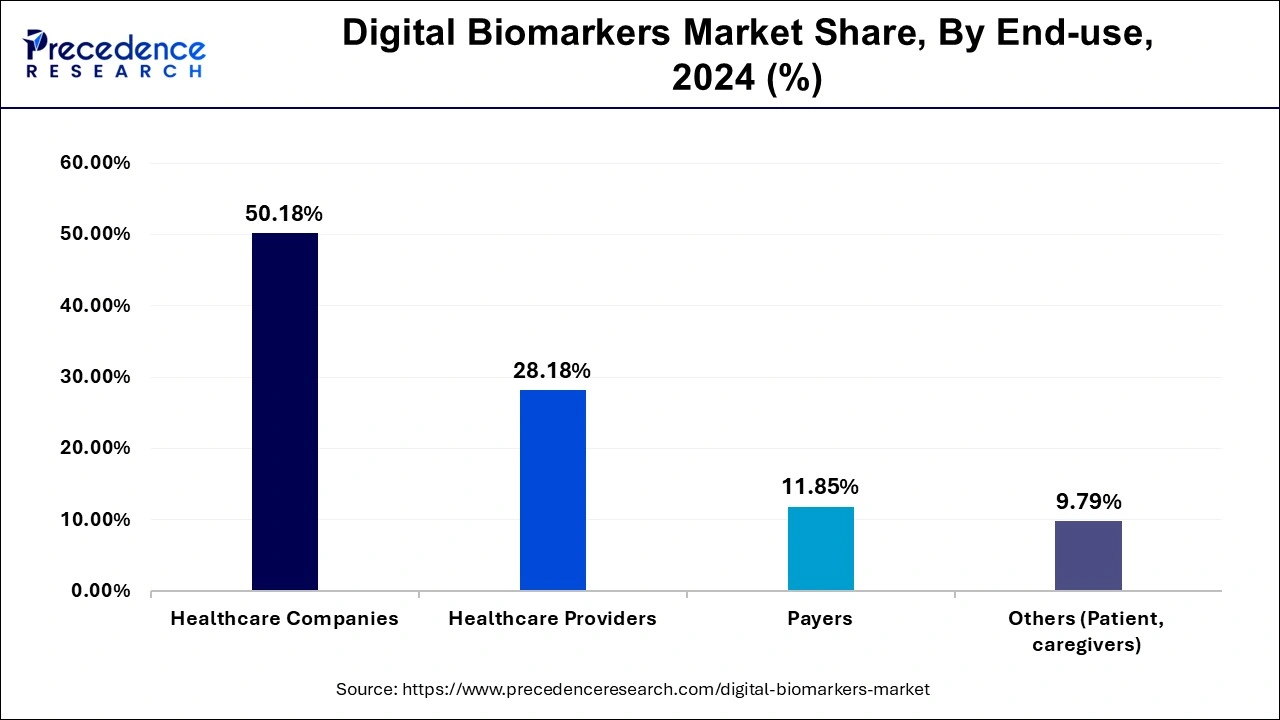

The healthcare companies segment contributed the biggest market share of 50.18% in 2024. The rising adoption of advanced technologies in healthcare companies has boosted the market growth. The healthcare companies have started using biomarkers for different applications used in drug development. These biomarkers are used in clinical trials for evaluating different therapies. It also helps pharmaceutical companies for finding efficient ways for monitoring patients long-term such as with sensing modules in drug delivery devices.

The ayers segment is projected to grow at a solid CAGR of 24.5% during the forecast period. The rise in number of insurance companies providing several healthcare policies has driven the market growth. These insurance companies have started using digital biomarkers for detecting the efficacy of diseases that are claiming their policies for treatment. Thus, the adoption of biomarkers by insurance providers enhances the disbursement process and helps in providing the legal claims to the authenticated consumers.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The various developmental strategies like acquisitions and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By System Component

By Application

By Clinical Practice

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025