September 2024

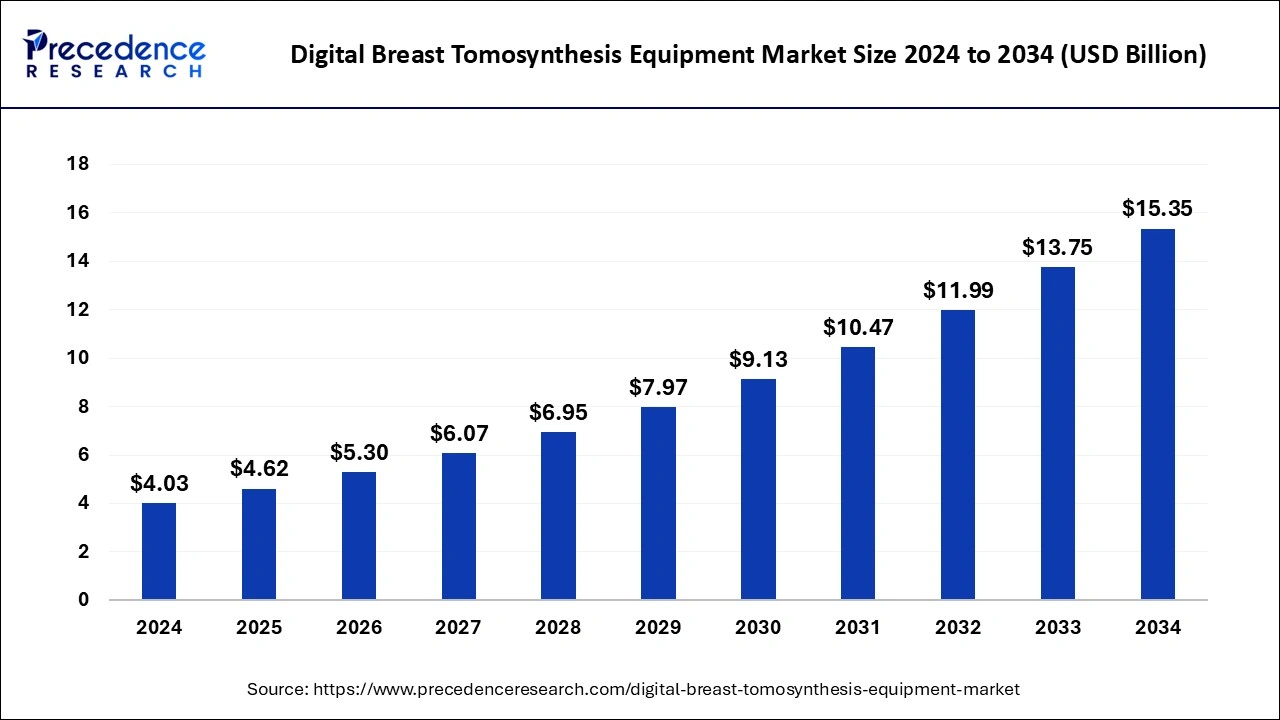

The global digital breast tomosynthesis equipment market size is accounted at USD 4.62 billion in 2025 and is forecasted to hit around USD 15.35 billion by 2034, representing a CAGR of 14.31% from 2025 to 2034. The North America market size was estimated at USD 1.89 billion in 2024 and is expanding at a CAGR of 14.35% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital breast tomosynthesis equipment market size was calculated at USD 4.03 billion in 2024 and is predicted to reach around USD 15.35 billion by 2034, expanding at a CAGR of 14.31% from 2025 to 2034. The digital breast tomosynthesis equipment market is growing because the use of tomosynthesis in screening can increase the detection of breast cancer, and reduce recurrence and adverse events, and thus the positive effects of cancer screening and the impact on healthcare costs and mental health have been well-studied.

Artificial intelligence algorithms can help reduce antibiotic dosage and improve lesion conspicuity in synthetic 2D DM images. The use of AI algorithms can also improve workflow efficiency and reduce electricians’ translation time. There has been significant growth in research using cognitive behavioral therapy for DBT, and several concepts have been approved for clinical use by the U.S. Food and Drug Administration. Further development of AI models for DBT has the potential to improve applications for cancer screening and diagnosis, and ultimately improve patient health outcomes. The use of AI-powered tools can reduce reader interpretation time compared to independent raters while providing the same level of performance measurement. The development of an AI model for DBT could help predict cancer risk because it combines analysis of patient history, improved cancer diagnosis by visually extracting tissue from the breast, and the production of SDM images at lower radiation doses, which has led to the growth of the digital breast tomosynthesis equipment market.

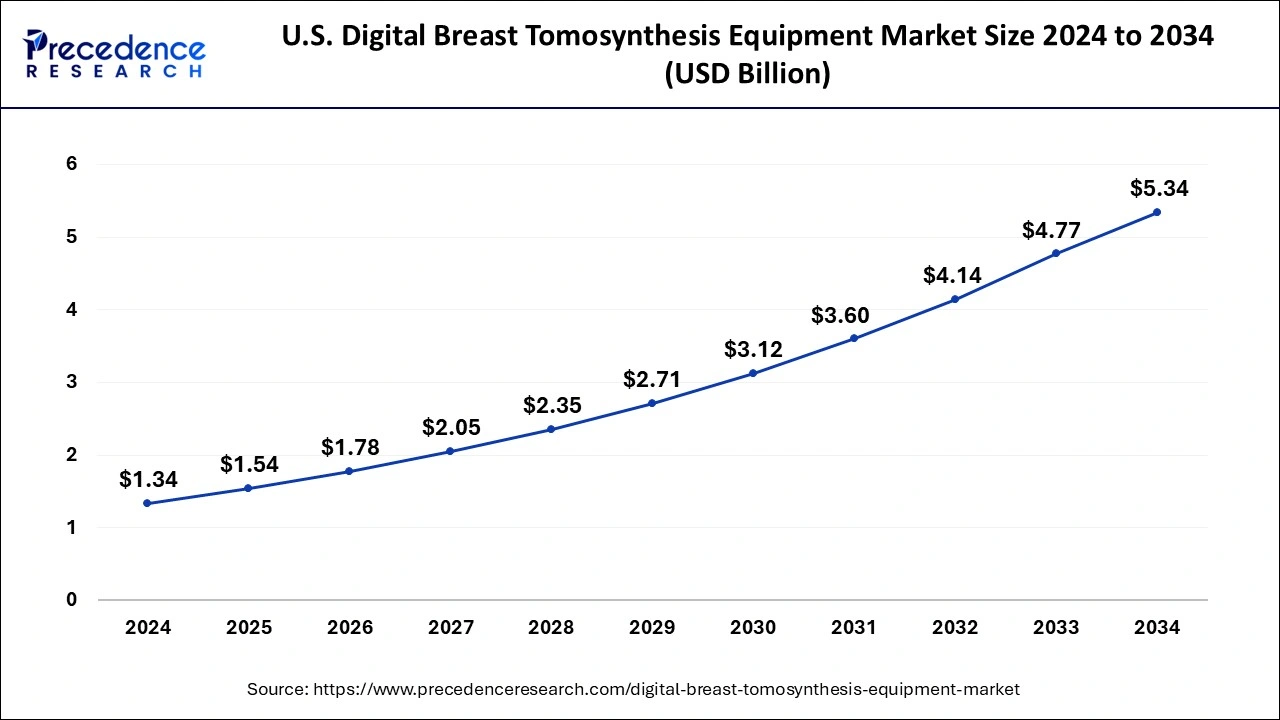

The U.S. digital breast tomosynthesis equipment market size was evaluated at USD 1.34 billion in 2024 and is projected to be worth around USD 5.34 billion by 2034, growing at a CAGR of 14.83% from 2025 to 2034.

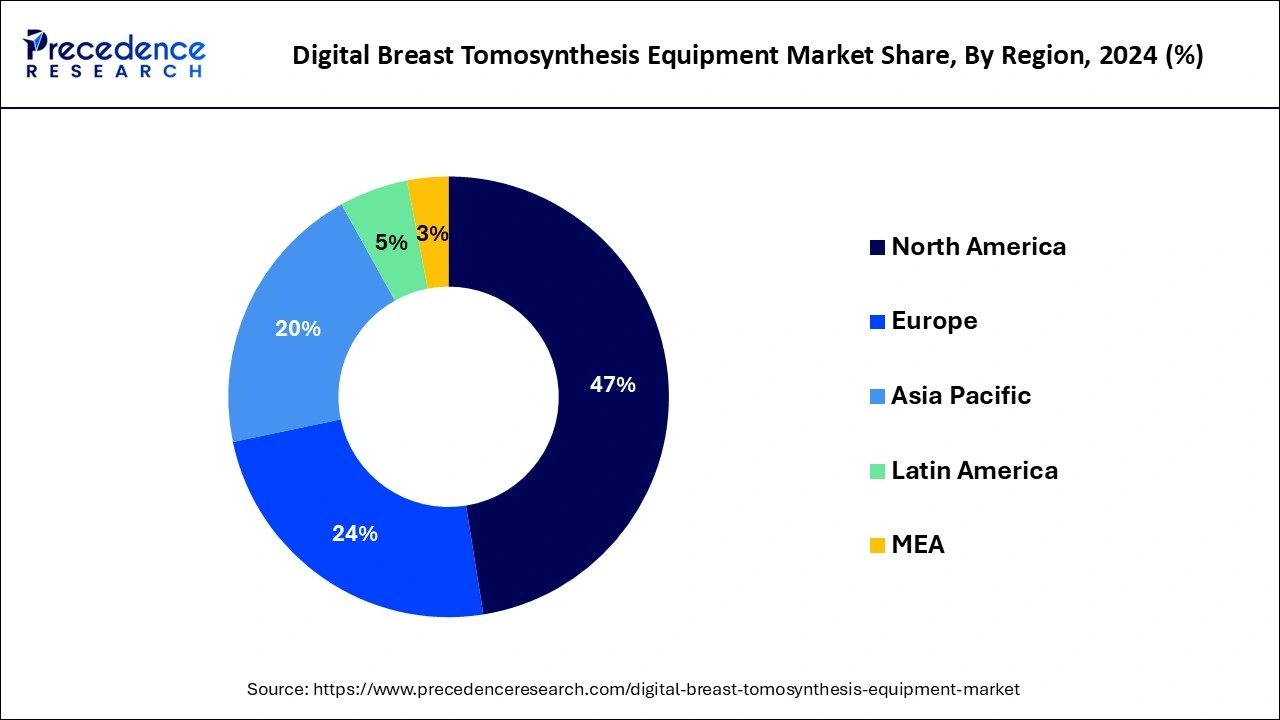

North America held the largest share of 47.14% in 2024, the region is expected to maintain dominance during the forecast period.

Breast cancer is significant in North America because of its growth due to well-trained healthcare professionals, greater affordability, well-developed healthcare infrastructure, and a rise in breast cancer. Breast cancer is frequent in women in the United States, and about 13% of every American woman may have invasive breast cancer.

For instance, in 2022, an estimation of 287,850 new patients with invasive breast cancer will be detected in women in the United States, in addition to 51,400 new breast cancer cases. Growing instances require more healthcare infrastructure to provide medical support to patients and raise the use of digital breast tomosynthesis to detect breast issues.

Asia- Pacific shows lucrative growth in the digital breast tomosynthesis equipment market during the forecasted timeframe.

Asia Pacific regions mainly the countries like India with lack of proper hygiene, and poor lifestyle leads to the increase a greater number of breast cancer, requirement for good hospital such as Fortis hospital considered as the best cancer hospitals in India with a stellar reputation to have digital magnetic resonance imaging (MRI) technology and expertise in radiation therapy.

For instance, In December 2022, AI-derived medical imaging instrument company Lunit signed a deal to supply AI-derived breast cancer screening solutions to Hong Kong Women's Imaging diagnosis imaging center and Mongolia's National Cancer Center, indicating an increasing demand for advanced mammography solutions worldwide.

Breast tomosynthesis is a breast imaging technique that uses low-dose X-rays to diagnose cancer in an early phase when it is most treatable and an advanced form of mammography. It is only available in some imaging facilities. Digital breast tomosyntheses, like digital mammography and film, still require breast compression. It offers the potential to overcome one of the fundamental drawbacks of mammography, which is the inability to image over-lapping dense normal tissue. This common clinical finding can reduce conventional and digital mammography's accuracy in distinguishing malignant and benign lesions. It creates multiple projections reflected across various viewing angles to produce a series of section images. It eventually reduces the superimposition of breast tissue in each tomosynthesis section with presumed improved sensitivity for small tumors.

Hologic, a global medical-based technology company, offers cutting-edge solutions that focus on improving people's lifestyles. The company has stated its annual revenue in the breast health market to be $275.1 million by 2022.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.62 Billion |

| Market Size by 2034 | USD 15.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.31% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | Product and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The dominance of digital breast tomosynthesis equipment over mammography

With the advancements in the overall healthcare sector, the oncology sector also demands multiple technological advancements. Digital breast tomosynthesis equipment digital breast tomosynthesis is used to improve the detection and characterization of breast lesions especially in women with non-fatty breasts. As tomosynthesis is the only equipment that detects the total radiation dose, patient motion, image time, detector motion, and detector performance, and even picturizes the whole breast, with a complete future biopsy ability for those lesions fueling the breast tomosynthesis equipment market.

Mainly in the developing regions, the high cost of equipment is hindering the growth of the market. The cost of digital breast tomosynthesis equipment varies for different models and companies. For instance, the 2D model mammography price is between $65,000-$95,000 for Hologic and GE Healthcare Inc products, whereas the 3D model of the same company is between $90,000-$200,000. Moreover, the 3D models of premium equipment of Hologic Inc. and GE Healthcare are priced between $1,40,000 and $2,75,000. The high cost of breast tomosynthesis equipment is a significant concern for the clients, the high cost of equipment results in hefty diagnosis processes, which limits healthcare providers from installing such equipment ultimately restraining the growth of the digital breast tomosynthesis equipment market.

Incorporation of AI with breast tomosynthesis technique

Technology, such as AI and machine learning, play an integral part in acknowledging risk. Analytical, integrative techniques and advanced data are used as information for an individual based on multiple data sources, such as medical health records, smartphone health data, and germline genome data, to assess cancer risk. The demand is growing due to the aging population, changing patient expectations, lifestyle changes, and the never-ending innovation cycle. Artificial intelligence (AI) has the potential to revolutionize healthcare and help address challenges by rapidly improving breast imaging and mammography. Digital breast tomosynthesis serves its purposes in almost every step: generating a picture, denoising risk prediction, cancer detection, and, finally, selecting therapy and, later, the results.

Standalone 3D System shows significant growth in the digital breast tomosynthesis equipment market. Advancements in the healthcare infrastructure across the globe demand advanced machinery for diagnosing breasts under 3D mammography, which can make tumor detection easier by limiting the effect of covering the breast tissue. The 3d standalone system has brought modification in mammography. Allowing radiologists to take images from various angles for proper cancer diagnosis by looking into multiple pictures helped specialists discover more significant cancer growths than with 2D images alone. 3D mammography can help reduce the chances of false outcomes. Rising cases of cancer require a rapid diagnosis.

2D-3D Combination Systems are expected to grow in the digital breast tomosynthesis equipment market. This combination of 2D-3D systems helps us to detect cancerous factors more than a single mammography method. Integrating 2D and 3D capabilities into a single system streamlines the imaging process. Instead of using separate equipment for 2D and 3D imaging, healthcare providers can perform both procedures with a single device, reducing patient waiting times and optimizing resource utilization. Furthermore, image acquisition and interpretation workflows can be more efficient as radiologists can switch seamlessly between 2D and 3D modes. As the benefits of tomosynthesis become more recognized and its adoption increases, the integration of 2D capabilities allows for a smoother transition for healthcare providers who may still rely on 2D mammography for some reference. It provides a more gradual and adaptable approach to fully embracing 3D tomosynthesis.

Hospitals are dominating the end-user segment in the digital breast tomosynthesis equipment market during the predicted period. The rising prevalence of breast cancer in female is highly growing and so the demand for hospitals have increased on a large scale. Cancer patients undergoing nausea, pain, and shortness of breath highly prefer hospitals for casualty as it provides specialized treatments under brilliant teams of doctors, nurses, allied professionals and support staff.

Diagnostic Centers is the fastest growing segment in the digital breast tomosynthesis equipment market throughout the forecast period. Governments worldwide are implementing various initiatives to improve breast cancer screening rates and outcomes. For example, some governments offer free or subsidized breast cancer screening programs, increasing the demand for DBT equipment and diagnostic services. Increase in awareness among women about the importance of early detection of breast cancer, leading to an increased demand for breast cancer screening services.

By Product

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025