March 2025

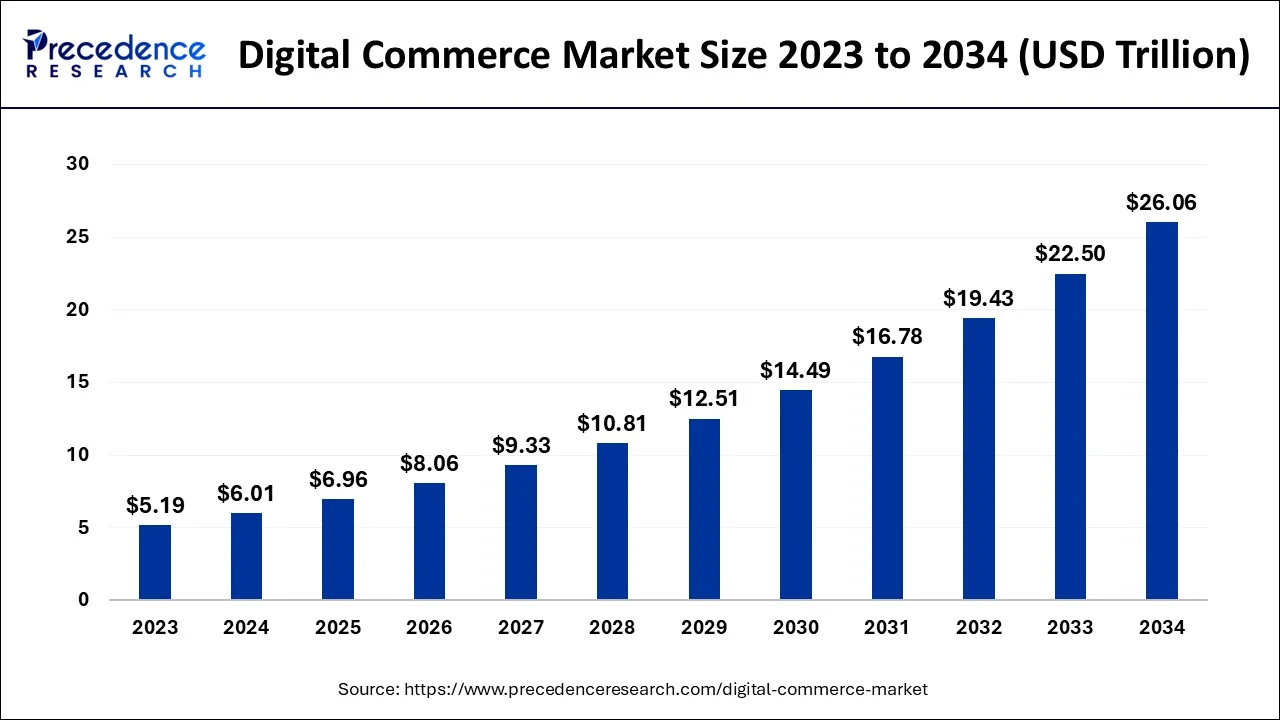

The global digital commerce market size accounted for USD 6.01 trillion in 2024, grew to USD 6.96 trillion in 2025 and is predicted to surpass around USD 26.06 trillion by 2034, representing a healthy CAGR of 15.80% between 2024 and 2034.

The global digital commerce market size is accounted for USD 6.01 trillion in 2024 and is anticipated to reach around USD 26.06 trillion by 2034, growing at a CAGR of 15.80% from 2024 to 2034.

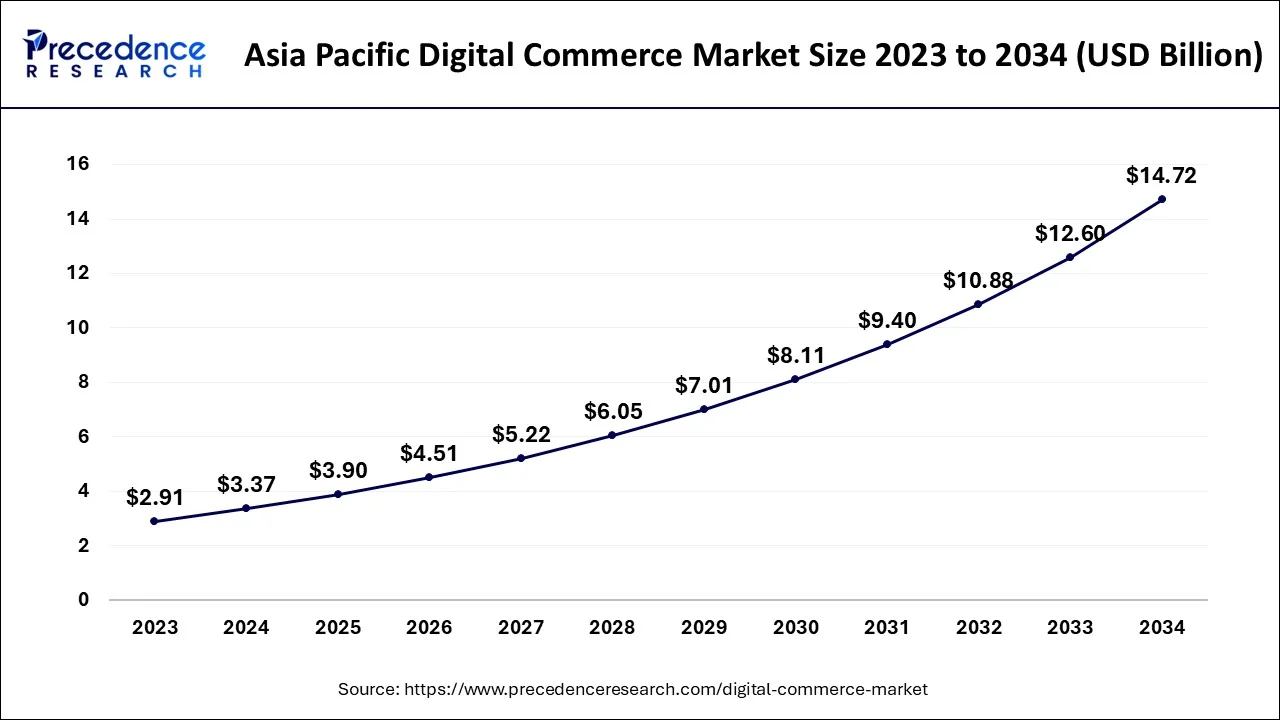

The Asia Pacific digital commerce market size is evaluated at USD 3.37 trillion in 2024 and is predicted to be worth around USD 14.72 trillion by 2034, rising at a CAGR of 15.88% from 2024 to 2034.

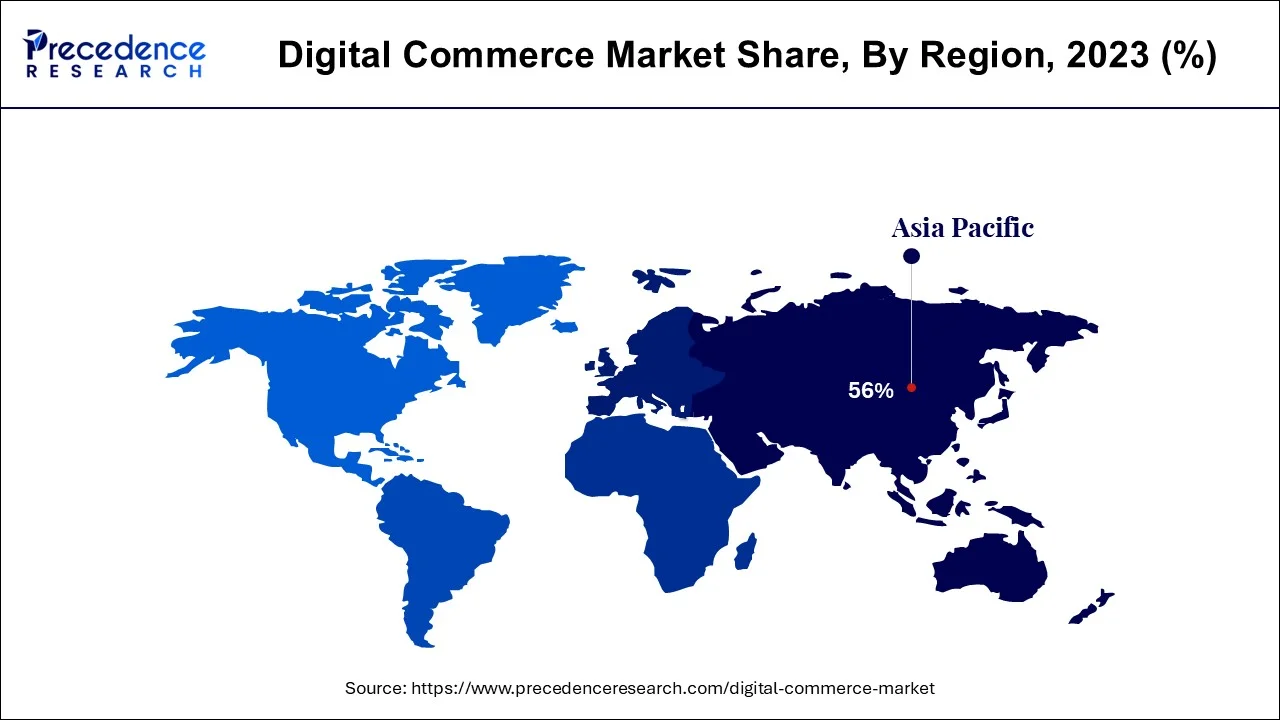

With a share of 56% in the digital commerce market in 2023, Asia Pacific led the way and is predicted to expand at the quickest rate between 2024 and 2034. This might be linked to enterprises' increasing propensity for doing transactions through B2B digital commerce platforms. Additionally, expanding infrastructural facilities and an increase in internet users are anticipated to boost regional market expansion.

In addition, the area is anticipated to see an increase in the demand for B2B digital commerce adoption, which can be ascribed to the widespread use of smartphones. A consumer revolution is also taking place in the Chinese market, where foreign goods are utilizing cutting-edge marketing, research, and advertising strategies. Brand awareness is becoming more significant in luring Chinese consumers. In China, the market for luxury products and services is expanding significantly.

Over the projection period, North America and Europe are expected to see consistent growth. The American public is receptive to foreign companies and goods. They are increasingly conscious of environmental issues and overconsumption. Consumers are quite particular about the product's content, price, and quality. One of the greatest levels of internet penetration is seen in North America. A burgeoning young population and the fast-developing internet retail industry are likely to drive considerable growth across the Middle East, Africa, and Latin America in the next years.

The exchange of products and services, or the transfer of money or data, through an electronic network basically the internet is known as digital commerce. The internet is the driving force behind digital commerce, allowing customers to explore an online store, order goods or services using their own devices, and pay for their purchases. These commercial exchanges take place between businesses and consumers (B2C), businesses and businesses, consumers and consumers, or consumers and businesses. E-business and digital commerce are frequently used interchangeably. The transactional procedures that make up online retail shopping are commonly referred to as e-tail.

The estimated market share for digital commerce in 2021 is expected to surpass pre-COVID-19 projections. This is a result of the supply chain disruptions brought on by the COVID-19 epidemic, which have caused a sharp increase in demand for digital commerce. Additionally, there is a significant amount of demand for online buying across many industries, which forces the food and beverage, industrial, and logistics industries to expand their investments in robotics, including supply chain automation, which in turn propels the market's expansion. Due to the fact that many businesses were impacted by this epidemic and found it challenging to maintain their intricate trading networks, the need for digital commerce increased.

One of the main reasons fueling the market's expansion is the rapid urbanization of the world. Additionally, rising internet usage and the use of gadgets like smartphones, laptops, and tablet to use digital commerce portals are boosting industry expansion. Through digital commerce, companies may conduct transactions without having a physical presence, which lowers their infrastructure, communication, and administrative expenses. The industry is also fueled by the rising popularity of online shopping, particularly among women, and the expanding impact of social networking sites on purchasing decisions. Online retail channels provide consumers a hassle-free buying experience while offering a large selection of goods to pick from, all at reasonable price points. Additionally, the emergence of direct-to-consumer and private-label business models is fostering optimism for market expansion. This makes it possible for businesses to gather and use consumer data in order to offer customers customized goods and services. As a result of lockdown and social isolation measures, the spread of the coronavirus illness (COVID-19) has given digital commerce operations an additional boost. Customers are turning to online platforms to acquire necessary supplies.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.01 trillion |

| Market Size by 2034 | USD 26.06 trillion |

| Growth Rate from 2024 to 2034 | CAGR of 15.80% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Payment, Component, Browsing Medium, Business Type, Industry Vertical and Geography |

In terms of payment methods, the digital wallets market category accounted for around two-fifths of the worldwide market for digital commerce in 2023, and it is anticipated that it will continue to lead the pack throughout the forecast period. From 2024 to 2034, the digital wallets category is predicted to have the fastest CAGR, at 17.98%. The market for card payments is anticipated to be the greatest portion of all digital commerce in 2023. Because of its widespread acceptance, popularity, and discounts and rewards provided by digital commerce platforms for card payments, this market has a sizable presence in both developed and developing nations. The digital commerce portal's support of the usage of digital wallets, together with convenience and security aspects, is expected to provide considerable development potential for the category of digital wallets over the next years.

In terms of browsing media, the mobile/tablet category accounted for more than three-fifths of the global market in 2023. The mobile/tablet sector is predicted to experience the fastest CAGR of 16.6% between 2024 and 2034.

The desktop/laptop sector is anticipated to hold the biggest market share for global digital commerce in 2023. The significant market share of this sector is partly because to the rise in desktop and laptop sales during the COVID-19 epidemic as a result of the culture of working from home.

Due to increased adoption of digital commerce software, which is anticipated to integrate with current software and inventory control solutions to provide useful insights for the growth of the digital commerce market, the business to enterprise segment dominated the worldwide market in 2023 and is anticipated to maintain this trend during the forecast period.

However, the business to consumer category is anticipated to see the greatest CAGR over the projected period due to the rapid uptake of digital commerce and digital commerce among consumers, which offers retail customers a convenient and efficient method of purchasing.

According to digital commerce market trends by industry vertical, the automotive segment generated the most revenue in 2023 and is expected to continue to lead during the forecast period. This is because more automotive manufacturers are implementing digital commerce solutions to gain a competitive edge, which is due to increased competition between digital commerce and omni-channel players. But throughout the anticipated period, the retail and consumer goods industry is anticipated to develop at the fastest rate. It is a result of the use of digital technology in product sales and marketing. Moreover, the market is growing as more people use smartphones.

By Payment

By Component

By Browsing Medium

By Business Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024