March 2025

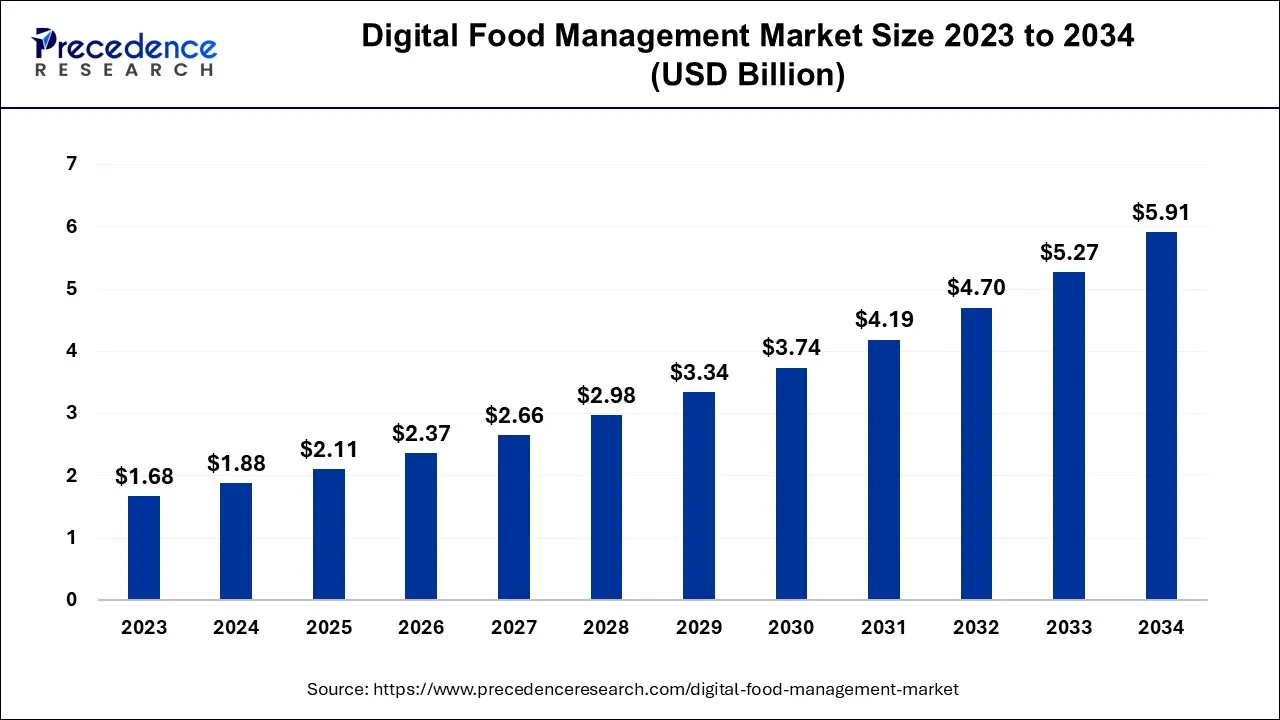

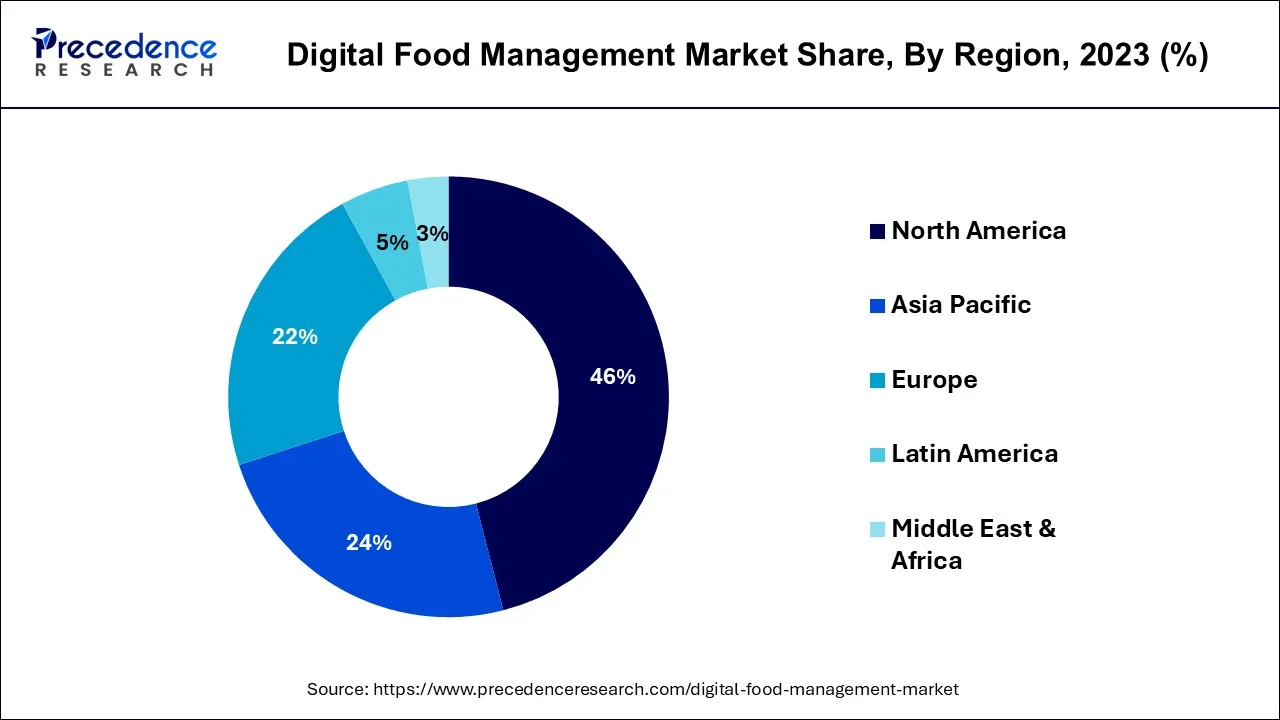

The global digital food management market size is calculated at USD 1.88 billion in 2024, grew to USD 2.11 billion in 2025, and is predicted to hit around USD 5.91 billion by 2034, expanding at a CAGR of 12.1% between 2024 and 2034. The North America digital food management market size accounted for USD 860 million in 2024 and is anticipated to grow at the fastest CAGR of 12.32% during the forecast year.

The global digital food management market size is expected to be valued at USD 1.88 billion in 2024 and is anticipated to reach around USD 5.91 billion by 2034, expanding at a CAGR of 12.1% over the forecast period from 2024 to 2034.

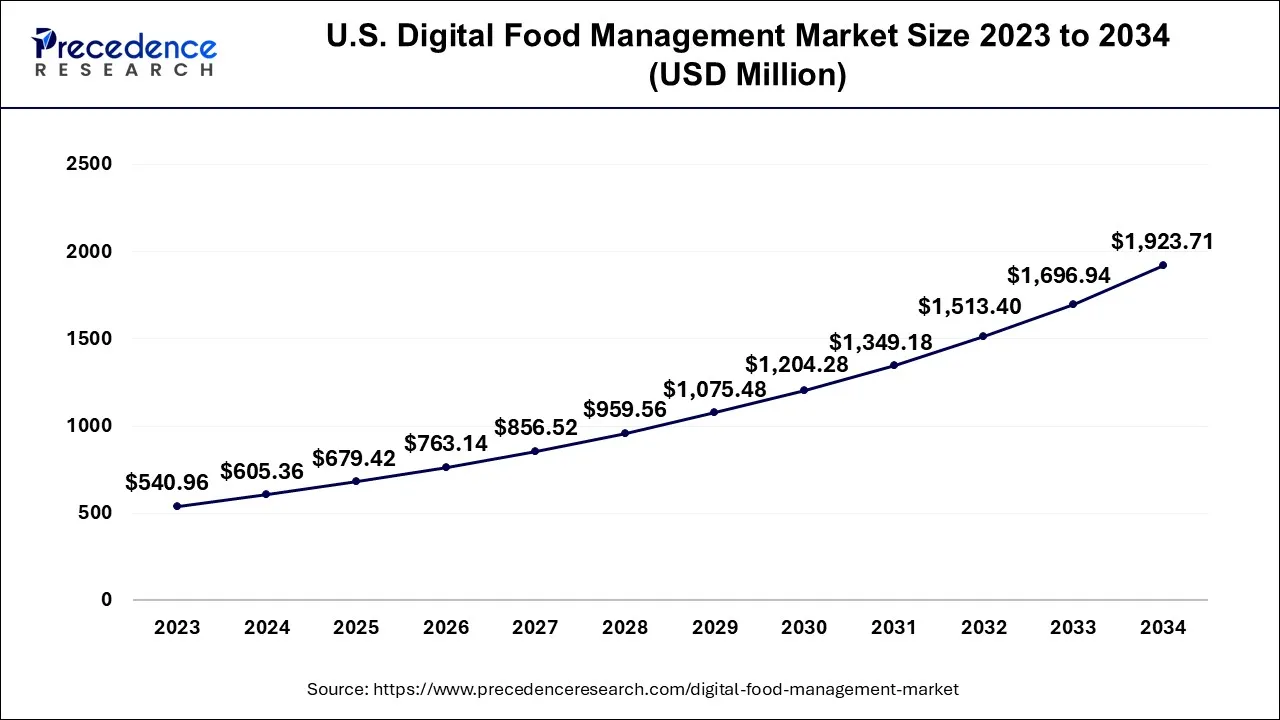

The U.S. digital food management market size is accounted for USD 605.36 million in 2024 and is projected to be worth around USD 1,923.71 million by 2034, poised to grow at a CAGR of 12.14% from 2024 to 2034.

North America has held the largest revenue share 46% in 2023. In North America, the digital food management market has witnessed a surge in demand due to changing consumer preferences and the need for contactless dining experiences amid the ongoing pandemic. Mobile apps for online ordering, curbside pickup, and digital menus have gained popularity. Moreover, food delivery services have expanded, with consumers increasingly relying on platforms like Uber Eats and DoorDash. The integration of AI-powered recommendation systems and personalized offers further enhances customer engagement.

Asia Pacific is estimated to observe the fastest expansion. In this region, the adoption of digital food management solutions has been on the rise. With a growing urban population and busy lifestyles, consumers in countries like China and India are embracing food delivery apps and online payment methods. Additionally, there's an increasing emphasis on food safety and traceability, which digital solutions can address. The market is also driven by the expansion of cloud kitchens and virtual restaurant concepts, which rely heavily on digital platforms for order management and customer interactions.

In Europe, the digital food management market is characterized by a strong focus on sustainability and eco-friendly practices. Consumers are increasingly looking for transparency in the food supply chain and are keen on supporting local businesses. Additionally, European countries have stringent regulations related to food safety and labeling, driving the adoption of digital solutions that can ensure compliance. The region also witnesses a growing demand for online reservation and booking systems in restaurants and cafes to streamline operations and enhance the dining experience.

The digital food management market refers to the use of digital technologies and software solutions to streamline and enhance various aspects of the food industry, including restaurant management, inventory control, menu planning, ordering, delivery, and customer engagement. It encompasses a range of software, hardware, and service solutions designed to improve operational efficiency, customer service, and food quality.

The market's growth is driven by the increasing demand for innovative and convenient solutions to address the evolving needs of the food service and hospitality industry, including the integration of online ordering, digital menus, and advanced inventory management systems to cater to the demands of modern consumers.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 12.1% |

| Market Size in 2024 | USD 1.88 Billion |

| Market Size by 2034 | USD 5.91 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in consumer demand for convenience and cloud-based solutions

Consumers are increasingly inclined toward convenient dining experiences. They crave the ability to effortlessly peruse menus, place orders, and handle payments, all through the convenience of their smartphones. This escalating demand has given rise to a plethora of mobile apps and online platforms for ordering, providing customers with access to a wide array of food services right at their fingertips. Particularly in a world reshaped by the COVID-19 pandemic, the convenience of digital ordering and payment solutions has become indispensable for restaurants and food service providers.

Furthermore, the digital food management landscape has witnessed a profound transformation through the incorporation of cloud-based solutions. Cloud technology delivers scalability, adaptability, and cost-efficiency, empowering businesses to streamline their operations effectively. It provides the essential infrastructure to manage the increasing volume of digital orders, payments, and data analytics, all of which collectively enhance customer service and operational efficiency. Consequently, cloud-based solutions have become a key to success in the digital food management market, propelling its expansion and empowering food service providers to cater to the ever-increasing consumer demand for convenience.

Technical challenges and digital inequality

Implementing digital food management solutions often requires technical expertise and financial resources. Many small and independent food service businesses struggle to overcome these technical barriers. Customizing software, ensuring data security, and handling complex integrations can pose challenges. Additionally, the fast-paced evolution of technology necessitates continuous updates and investments, which can be daunting for some businesses. These technical challenges limit the adoption of digital food management solutions, especially among less technologically savvy businesses.

Moreover, not all customers have equal access to digital tools or the internet. The reliance on mobile apps and online ordering platforms can exclude those who lack smartphones or stable internet connections. Moreover, some elderly or less tech-savvy individuals may face difficulties navigating digital food ordering systems. This digital inequality hampers the reach of food businesses and creates a disparity in service accessibility, limiting the market's potential. These challenges highlight the importance of addressing technical barriers and ensuring inclusivity in digital food management solutions to fully unlock their market potential.

Contactless dining, integration of AI, and automation

The digital food management market is witnessing a surge in demand driven by several critical trends. Firstly, the increase in contactless dining, prompted by health and safety concerns during the COVID-19 pandemic, has become a permanent fixture. Consumers now expect contactless solutions, including digital menus, ordering, and payments, when dining out. Restaurants and food service establishments are compelled to adopt these technologies to meet customer expectations for a safe and seamless dining experience.

Moreover, AI-powered chatbots and virtual assistants enhance customer interactions and streamline order processing. Moreover, automation technologies like robotic chefs and smart kitchens are optimizing kitchen operations, reducing labor costs, and ensuring consistency in food preparation. These advancements improve efficiency and service quality while reducing operational expenses. Overall, the digital food management landscape is evolving to provide innovative solutions that meet the demands of a tech-savvy and safety-conscious consumer base. As AI and automation become more integrated, and contactless dining becomes the norm, the market is poised for significant growth, driven by both customer expectations and operational efficiency.

According to the type, the software solutions segment has held 62% revenue share in 2023. In the digital food management market, software solutions encompass a wide range of applications designed to streamline and enhance various aspects of the foodservice industry. These software solutions include robust POS (Point of Sale) systems, digital ordering and reservation platforms, inventory management tools, and customer relationship management (CRM) software.

The market trend in this segment involves an increasing focus on cloud-based solutions, which provide scalability and accessibility from various devices, making it easier for restaurants to adapt to changing customer preferences, demand fluctuations, and evolving health and safety standards.

The service segment is anticipated to expand at a significantly CAGR of 14.8% during the projected period. Services in the digital food management market pertain to the expert guidance, technical support, and consultation offered to businesses in the food service industry. These services can range from installation, training, and maintenance of software solutions to help restaurants optimize their operations. A significant trend is the growing demand for customized services tailored to the unique needs of each establishment, ensuring they can harness the full potential of their digital food management tools. As the market continues to expand, service providers are expected to play a crucial role in helping businesses make the most of their digital technology investments.

Based on the application, end user management segment is anticipated to hold the largest market share of 38% in 2023. In the digital food management market, end-user management focuses on streamlining kitchen and staff operations, ensuring efficient order processing, and maintaining inventory control. Trend-wise, we observe a growing adoption of kitchen display systems (KDS) to optimize food preparation and delivery times. AI-powered algorithms help restaurants manage staffing levels more effectively, ensuring efficient utilization of resources.

On the other hand, the customer engagement segment is projected to grow at the fastest rate over the projected period. Customer engagement in the digital food management market centers on enhancing the dining experience. It includes features like mobile apps for menu browsing, contactless ordering, and loyalty programs. A prominent trend is the integration of augmented reality and virtual reality for immersive menu exploration, enhancing customer engagement and satisfaction. Moreover, the market sees a rise in the use of data analytics for personalized promotions and gathering customer feedback for continuous improvements.

In 2023, the restaurant and cafe segment had the highest market share of 42% on the basis of the end user. In the digital food management market, the restaurant and cafe sector plays a pivotal role. With the rise of customer demand for convenience and contactless dining, restaurants and cafes are increasingly implementing digital solutions. They have integrated mobile apps and websites for online ordering, digital menus, and cashless payments.

In response to changing customer preferences and operational efficiency, restaurants are adopting table management systems that allow diners to reserve tables and check-in digitally. These technologies streamline operations, enhance customer experience, and support the growth of the restaurant and cafe segment within the digital food management market.

The catering services segment is anticipated to expand at the fastest rate over the projected period. Catering services have also experienced a transformation. Caterers are utilizing digital food management solutions to streamline the ordering process, manage event logistics, and offer an array of menu choices online. The trend towards personalized and customized catering options, often ordered through web-based platforms, has gained momentum. This trend is particularly evident in corporate events, weddings, and private parties. As a result, digital solutions for restaurants and catering services continue to reshape the food service landscape by improving accessibility, efficiency, and customer experience.

Segments Covered in the Report

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024