March 2025

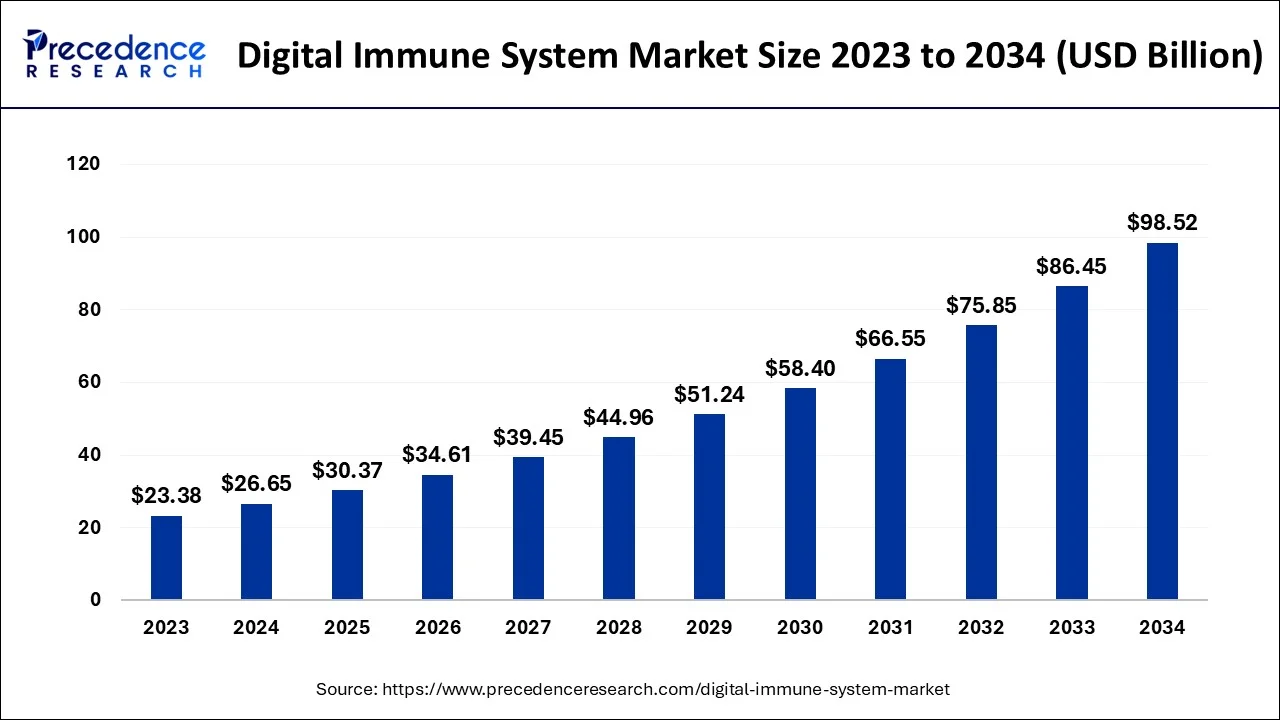

The global digital immune system market size is calculated at USD 32.50 billion in 2024, grew to USD 36.70 billion in 2025, and is projected to reach around USD 109.36 billion by 2034. The market is poised to grow at a CAGR of 12.9% between 2024 and 2034. The North America digital immune system market size is predicted to increase from USD 9.43 billion in 2024 and is estimated to grow at the fastest CAGR of 13.09% during the forecast year.

The global digital immune system market is expected to be valued at USD 32.50 billion in 2024 and is anticipated to reach around USD 109.36 billion by 2034, expanding at a CAGR of 12.9% over the forecast period from 2024 to 2034.

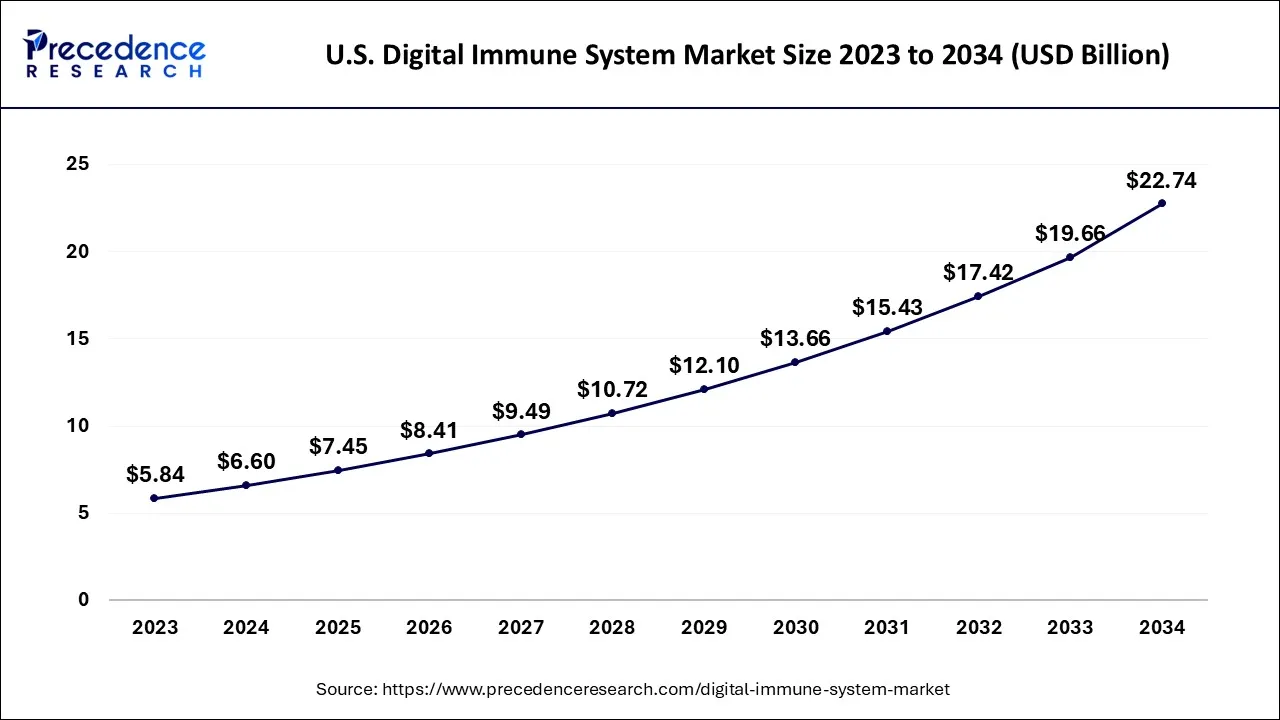

The U.S. digital immune system market size is accounted for USD 6.60 billion in 2024 and is projected to be worth around USD 22.74 billion by 2034, poised to grow at a CAGR of 13.17% from 2024 to 2034.

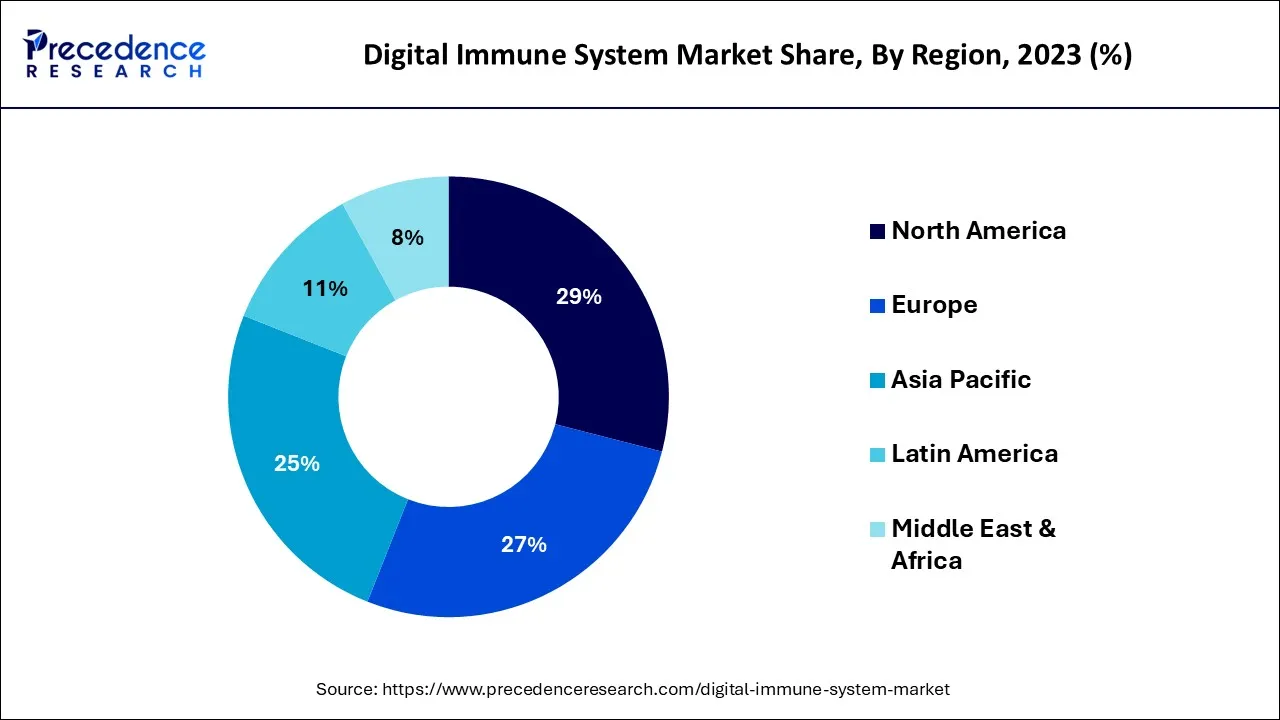

North America dominated the market with the largest market size in 2023. The growth of the region is attributed to the emerging technological advancements in the region. The rising awareness about data security results in a higher demand for digital immune systems or technologies across the region. Moreover, favorable government policies regarding cybersecurity also promote the adoption of digital immune systems in the region. in addition, the digitization in multiple industries for efficient operations will also welcome the integration of advanced security measures by creating a significant opportunity for the market.

Asia Pacific expected to witness a significant growth in the market during the forecast period. The growth of the region is attributed to the rising industrialization and increasing demand for technologies for better workflow. The rising prevalence of cyberattacks in the region will increase the demand for better cybersecurity software and resulting the growth of the market. Rising research and development programs will be anticipated to the growth of the market across the region.

As the world is experiencing enormous growth in every sector with substantial technological advancement, the threats associated with data security arise. Emerging technologies carry positive as well as negative aspects. Data security and cyberattacks are the most common threats for each and every sector. The digital immune system is the most prominent term or technology which is used by many of the industry vertices for achieving security from software bugs, cyberattacks, and other business risks.

The digital immune system is designed to offer protection to the services and applications from abnormalities that may occur during the operation. It works to reduce software bugs or security issues and make applications more resilient for faster recovery from failures. It will minimize the continuity risk made when services and applications stop working together. Reduced risk improves the productivity and efficiency of the organizations.

The digital immune system works on the combination of a range of technologies and practices from development, software designs, operation analytics, and automation for boosting the experiences of the users and minimizing the failures. Such solutions also improve business efficiency. While organizations, companies and industries are focusing on reducing risks, inducing business efficiency, and improving customer experiences, the market for digital immune system is observed to grow. The global digital immune system market offers multiple practices such as observability, artificial intelligence testing, chaos testing, auto-remediation and software supply chain security.

A major factor to accelerate the market’s growth in the upcoming years is the penetration of artificial intelligence, generative solutions and their automation solutions in the digital immune system. AI augmenting testing allows the organization to make software testing more effective without human participation. It includes fully automated creation, planning, maintenance, and analysis of tests.

With the rising availability of data and applications in every sector, the system operators are always concerned about the security as well as the integrity of their platforms while offering visibility and transparency to the users. In addition, rising concerns about cyberattacks and cybercrimes highlight the growth of the digital immune system market.

| Report Coverage | Details |

| Market Size in 2024 | USD 32.50 Billion |

| Market Size by 2034 | USD 109.36 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.9% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Deployment, By Security Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Integration of biometrics systems

Biometric systems go beyond token identification by leveraging unique biological data from a user as identification. Utilizing a fingerprint, facial scan, or even DNA profile can significantly increase system security because they are much more difficult to forge or hack than a password or software key. Multiple corporate offices, educational institutions and even airport authorities are implementing biometric services to add a security level at the place. Such biometric systems are implemented with certain software that contains data or details associated with the users and operators. Keeping this integrated data safe becomes important for operators, thus digital immune systems or technologies are highlighted that can stop the data and information from being attacked or exploited. Thereby, the increasing integration of biometrics into various sectors acts as a driver for the market.

Lack of awareness

Insufficient or lack of awareness about digital immune systems or associated technology is the major hurdle in the growth of the market. Specifically, small or medium scale industries are more likely to avoid the integration of such advanced systems into the firm due to lack of knowledge and less chances of cyberattacks. Moreover, technologically backward areas.

Government support

Several regional governments have developed supportive regulations in the field of cyber security. Many of them stand in favor of data security by forming collaborations with private companies to improve cyber defense, develop incident response capabilities, and information sharing. Many governments implement a robust digital immune system for enhancing national cybersecurity strategies. Increasing investment by the private sector in the development of digital immune systems also leads to the growth of the market. The favorable regulatory framework offered by governments creates significant opportunities for the market’s growth.

The solution segment dominated the market in 2023, the segment is expected to sustain its dominance throughout the forecast period.

The growth of digital immune system as a solution is rising owing to the increasing cases of cyberattacks. Increasing threats are becoming more difficult as cybercriminals and hackers with the most advanced technologies are likely to break security procedures and take the benefits of unprotected data of organizations. In such circumstances, the solution segment offers security assurance in organizations to reduce the risk and improve visibility to the potential threats.

The on-premises segment dominated the market with the largest market share in 2023. The on-premises systems are installed and work within the business infrastructure. On-premises systems refer to both tools and rules in place for the protection of accessibility and security of computer networks including software and hardware. On-premises deployment offers additional control over the accessibility of operations, they offer network customization for personalized solutions. The less requirement for internet connectivity makes on-premises deployment a more preferable option for industries.

The network security segment dominated the market in 2023. The segment is expected to sustain its dominance throughout the forecast period. The growth of the segment is attributed to its capability of identifying unauthorized access in the organization’s network. There are several network administrations in network security that are responsible for applying various defensive methods to protect the network from security risks. Network security works in the method of multiple layers of protection on the edge and between the networks. The security layers can be set in a manner in which they only access the networks which are authorized by the organization's network and restricts the unauthorized network.

The IT and telecom segment led the market with the highest market share in 2023, the segment will continue to grow at a significant rate during the forecast period. IT and Telecom industry is a prominent industry that connects the world 24/7. As the most emerging industry cyberthreats are also prone to increase. IT and the telecom industry have many cyber issues. Telecom companies have major threat to DDoS attacks. IoT security is also one of the major challenges in the field of telecommunication and information technology industry. The larger network serves the larger pool for cybercriminals for severe hacking, data breach, etc. so there is a higher demand for the digital immune system for reduced cyber threats and risks. This element is expected to promote the segment’s growth.

Segments Covered in the Report

By Component

By Deployment

By Security Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024