March 2025

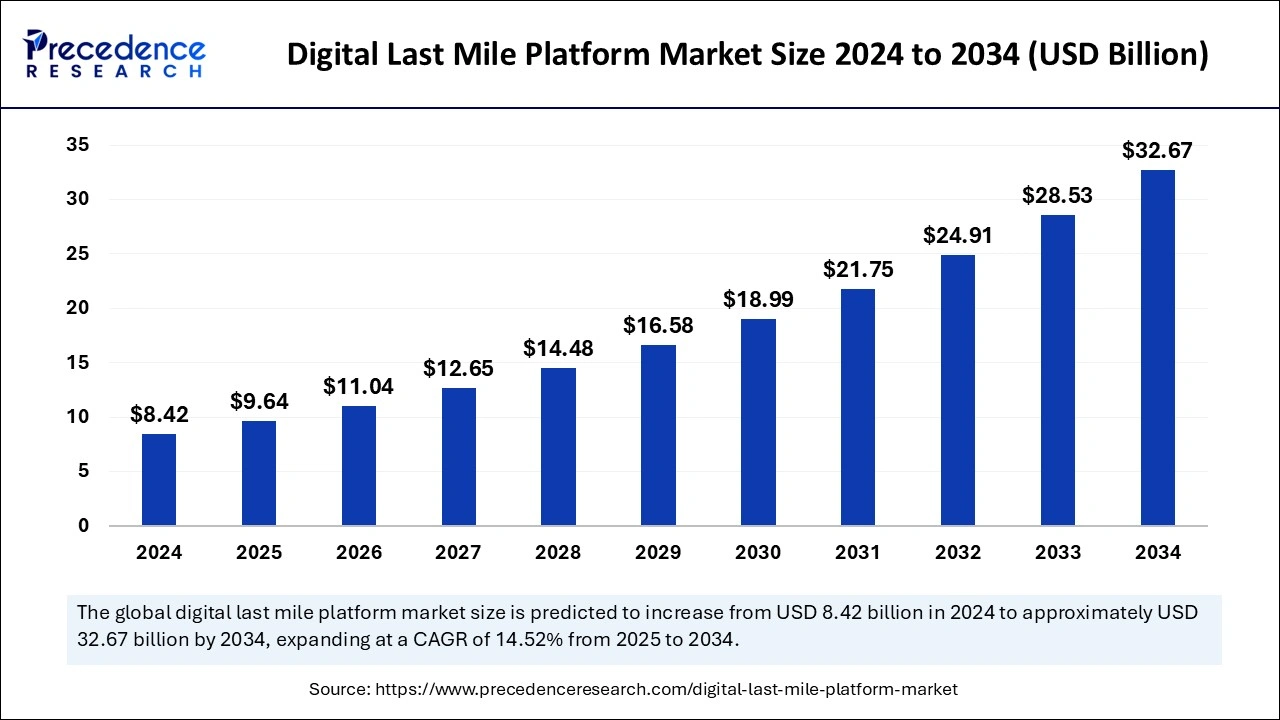

The global digital last mile platform market size is accounted at USD 9.64 billion in 2025 and is forecasted to hit around USD 32.67 billion by 2034, representing a CAGR of 14.52% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital last mile platform market size was calculated at USD 8.42 billion in 2024 and is predicted to reach around USD 32.67 billion by 2034, expanding at a CAGR of 14.52% from 2025 to 2034. The demand for efficient delivery services is driving the digital last-mile platform market. Rapidly grown e-commerce utilization is making rapid ways for digital last-mile platform services. The rowing consumer demand for delivery transparency is the key factor fueling digital last-mile platform manufacturing.

The development of sustainable delivery solutions and location-based tracking are transforming the global digital last-mile platform market.

Artificial intelligence has become the primary technology in business, including in the digital last mile platform market. Several factors, including the determination of sustainable delivery, quick and efficient delivery, customer-centric and authentic delivery of goods, and transportation to provide a location and the ability to track delivery processes, are lubricating the AI leverage in digital last-mile solutions. Moreover, e-commerce adoption has increased the need to leverage automation to improve optimization mechanisms.

The massively expanding business requires automated technology to manage, optimize, and handle its logistics. Businesses are facing challenges to comply with customers' unique demands and preferences, where AI is seen as the customization to be used to boost consumer experiences, trust, and interest in their company as well as in their brand. The surge of organizations adopting cutting-edge technologies like AI to improve their last-mile platform is rapidly transforming the market.

The last mile performance is the definition of delivery of consumer goods (CPG), retail, or e-commerce businesses. The rising consumer awareness of delivery transparency is the factor involved in the innovation of the digital last mile platform market. The adoption of digital solutions, including electronic proof of delivery software (e-POD) and online payments, is transforming the last-mile delivery platform market. The digital last mile platform is a software-based system that helps to manage and optimize the final delivery process, including the selection and tracking of packaging, route of delivery, coordinator of delivery, and time outlook of the consumer goods.

Growing concern for continuous delivery solutions, along with improving safety standards, is shaking the market. Technological advancements in retail omnichannel and the utilization of predictive logistics are drawing opportunities for the platform to be enhanced. Furthermore, the digital last-mile platform is rapidly transforming due to rising demands for fast, efficient, last-mile delivery services. The increased demand for faster deliveries has surged due to the adoption of e-commerce gains to improve logistics and transportation settings.

| Report Coverage | Details |

| Market Size by 2024 | USD 8.42 Billion |

| Market Size in 2025 | USD 9.64 Billion |

| Market Size in 2034 | USD 32.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Components, Deployment, Application, End-User, and Regions. |

| Regions Covered | America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Expanding e-commerce platform

The booming e-commerce use has led to online shopping and consumer demands for fast and reliable deliveries. To comply with consumer expectations, companies are developing efficient digital last mile platform market solutions. The rising need for transportation in deliveries due to increased complexity in omnichannel is surging due to the adoption of digital last-mile platforms.

E-commerce has offered platforms to ask for customized options and efficient services; the demands for personalized delivery options and real-time tracking are driving the need for digital last-mile platforms. Moreover, delivery last-mile platform provider companies are collaborating with e-commerce platforms to improve delivery capabilities and contribute to innovations. The utilization of e-commerce platforms has attributed to the need for personalized, efficient, and affordable last-mile delivery services, boosting the adoption of digital last-mile platforms.

High logistics cost

The high cost of operations and expenses related to the adoption of modern technologies is hampering the digital last mile platform market. Operation cost-related fuel and labor causes significant costs to the business. High logistics costs further restrain the adoption of cutting-edge technologies, infrastructure, and growth initiatives. The limited access to modern technologies and investments in infrastructure development challenges the growth of digital last-mile platforms. However, government support and investments in businesses and companies can help overcome such hindrances and help them invest in cost-saving technologies and optimize operations.

Rising demand for sustainable delivery

The awareness of environmental impacts and reduction of carbon emissions has surged for the adoption of sustainable and eco-friendly delivery options, including drones, robotic deliveries, and electric vehicles. The increased adoption of mobile phones and e-commerce activities has fueled online delivery demands in every possible area, including resource-limited or hard-to-reach areas where robotic delivery helps to deliver small packages along with full transparency of the delivery process.

In the digital last mile platform market, drones have emerged with the advantage of reducing time and cost. Similarly, electronic vehicles provide an excellent consumer experience by providing delivery transparency. Electronic vehicles are experts in fast delivery services. Furthermore, major companies intend to invest in eco-friendly delivery solutions to promote sustainability and improve business outcomes.

The software/platform segment has held the largest digital last mile platform market share in 2024. The segment growth is attributed to software, as it is pivotal for providing efficient optimization and management of last-mile delivery operations. Software/platform components can conduct a broad, streamlined delivery process. Software helps to reduce costs and improve efficiency by providing optimization of last-mile delivery operations. The software further helps to improve customer experiences by providing tracking access and real-time visibility to businesses to improve their delivery operations and conduct data-based and quick decisions.

Additionally, the services segment is expected to grow at a remarkable CAGR during the forecast period. The service segment is further divided into Business-to-Consumer (B2C), Business-to-Business (B2B), and Consumer-to-Consumer (C2C). Several services, including consulting services, managed services, support services, and implementation & integration services, are contributing to improving last-mile platform operations and consumer experiences. Managed services provide delivery and logistics management. On the other hand, consulting and support services provide development strategies to enhance operations and support customers to solve their inquiries and issues. Similarly, implementation and integration services allow access to cutting-edge technologies and systems to existing business systems.

The cloud segment held a significant share of the digital last mile platform market in 2024 due to the increased adoption of cloud-based platforms and services. Startups and small-scale businesses have surged in focus on the adoption of cloud-based solutions to improve route optimization and efficiency of last-mile delivery. The segment growth is further accounted for by the rising collaboration between startup businesses and end consumers to provide efficient real-time tracking and enhance consumer experiences. The ability of cloud-based solutions to provide real-time updates helps to improve delivery time and customize deliveries.

The route optimization segment led the digital last mile platform market in 2024. Business extremes include the adoption of route optimization software to enhance last-mile delivery efficiency, reduce cost, improve speed and sustainability, and reduce errors. Route optimization helps to understand fuel consumption and find simple and accurate routes, which further helps to improve customer experiences. Access to route optimization for delivery operators and end consumers helps enhance route efficiency. The surge of businesses to reduce carbon footprints also plays a crucial role in the adoption of route optimization software.

On the other hand, the tracking segment is expected to expand at the fastest CAGR over the projected period due to increased consumer demand for delivery transparency. Tracking software allows real-time tracking of consumer goods by providing tracking of the packaged location, shipping location, and end delivery route locations. Tracking helps to provide accurate delivery updates and makes it convenient for the customers. The rising consumer requirement for control of the delivery process makes tracking applications more popular.

The retail and e-commerce segment accounted for the biggest digital last mile platform market share in 2024. This growth is accounted for by the increased utilization of e-commerce platforms and online shopping. The determination of retail and e-commerce platforms to deliver timely and efficient transportation of products makes them significant for market expansion. Retail & e-commerce platforms use advanced technologies such as route optimization algorithms, real-time tracking systems, and predictive analytics to enhance last-mile delivery operations and improve consumer satisfaction. The increased consumer demands for fast, flexible deliveries are driving the adoption of digital last-mile platforms in retail and e-commerce solutions.

On the other hand, the logistics segment is projected to grow in the forecast period due to increased demand for fast and reliable delivery services. Growing utilization of e-commerce led to demand for speedy deliveries. Furthermore, consumer demands for real-time tracking and route optimizations to improve their convenience are fueling the segment expansion. The demand for same-day and next-day deliveries has enhanced, making it more essential for logistics companies to adopt digital last-mile platforms. Moreover, companies' determination to increase consumer experience and delivery services is leading to the utilization of digital last-mile platforms.

North America led the global market with the largest market share in 2024 due to the extensive use of e-commerce and the presence of major businesses in the region. The increased demand for faster and more efficient deliveries is driving the market in North America. Moreover, the integration of cutting-edge technologies, including AI, Machine Learning, big data, and the Internet of Things (IoT) is fueling this growth. North American companies are raising collaborations and investments for the development of innovative delivery solutions to meet consumer expectations and enhance brand popularity.

The United States is leading the North American digital last mile platform market due to increased demand for same-day and next-day delivery services. The early adoption of digitalization has slowed this growth of the market. Additionally, the growing shift toward sustainability is encouraging the development of creative and eco-friendly delivery solutions in the country, which raises the need for digital last-mile platforms. Canada accounted for the second-least country leading the North American market due to increased government investments in digital infrastructure.

Asia Pacific is anticipated to grow at the fastest CAGR in the digital last mile platform market during the forecast period due to increased government support for digitalization and the utilization of e-commerce platforms. Competitive landscapes are steadily adapting cutting-edge technologies, including AI, ML, and IoT technologies. The advancing logistic and transportation infrastructure is allowing the region to contribute to the development of efficient and fast delivery services, which requires a digital last-mile platform.

China is leading the Asia Pacific digital last mile platform market due to the growing population of countries and the adoption of advanced technologies, the utilization of e-commerce platforms, and advanced logistics networks. However, India is expected to lead the Asian digital last-mile platform market in the forecast period due to rising government initiatives and investments in the development of digital infrastructure in the country. This investment further allows key Indian companies to collaborate and develop innovative digital last-mile platform solutions. The surge of companies providing delivery services in remote and rural areas is contributing to this growth.

By Components

By Deployments

By Applications

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024