September 2024

Digital Mammography Market (By product: 3D Full Field Digital Mammography Tomosynthesis, 2D Full Field Digital Mammography Tomosynthesis; By End-use: Diagnostic Centers, Hospitals, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

The global digital mammography market size was USD 2.45 billion in 2023, accounted for USD 2.71 billion in 2024, and is expected to reach around USD 7.45 billion by 2034, expanding at a CAGR of 10.6% from 2024 to 2034.

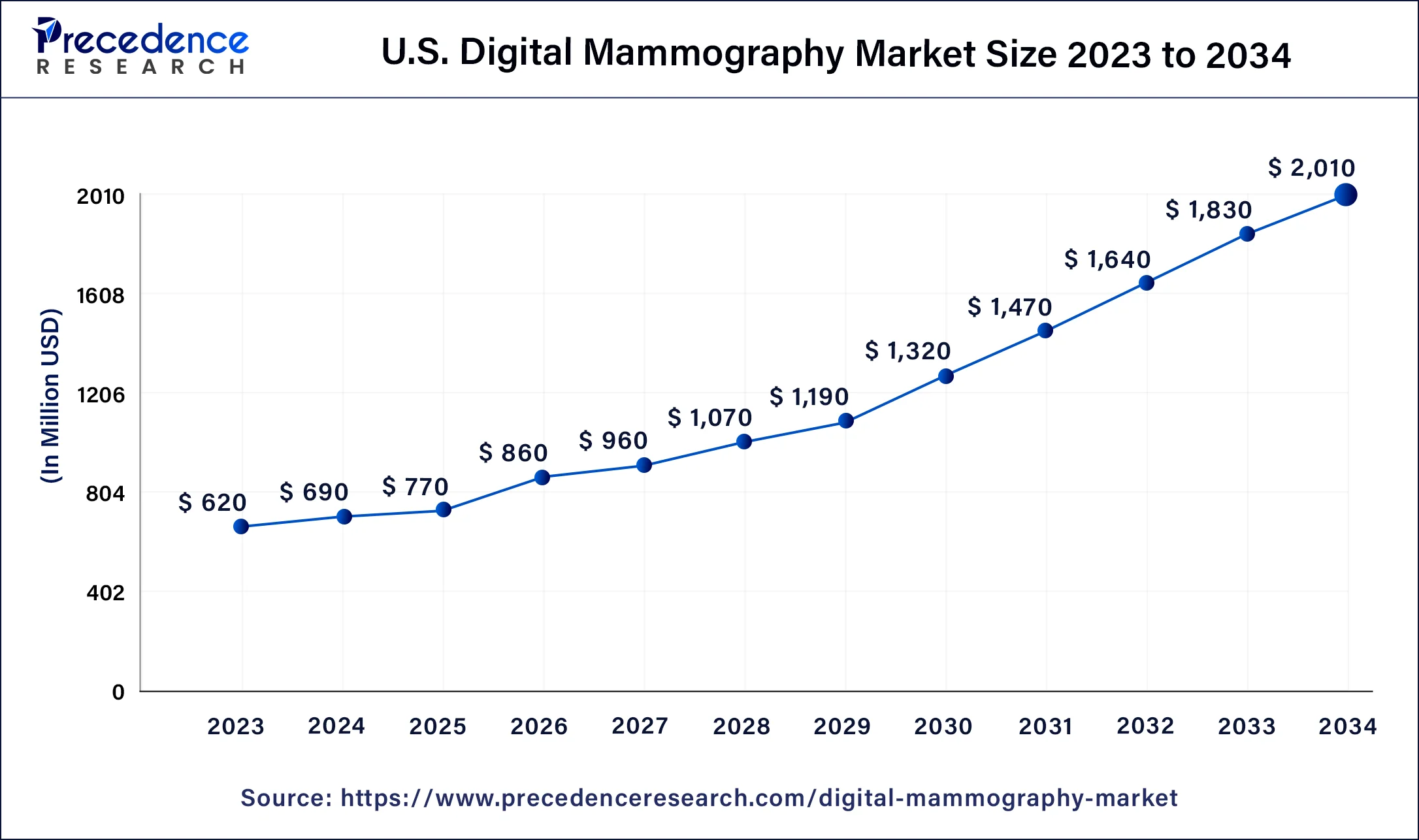

The Asia Pacific digital mammography market size was estimated at USD 620 million in 2023 and is predicted to be worth around USD 2,010 million by 2034, at a CAGR of 11.3% from 2024 to 2034.

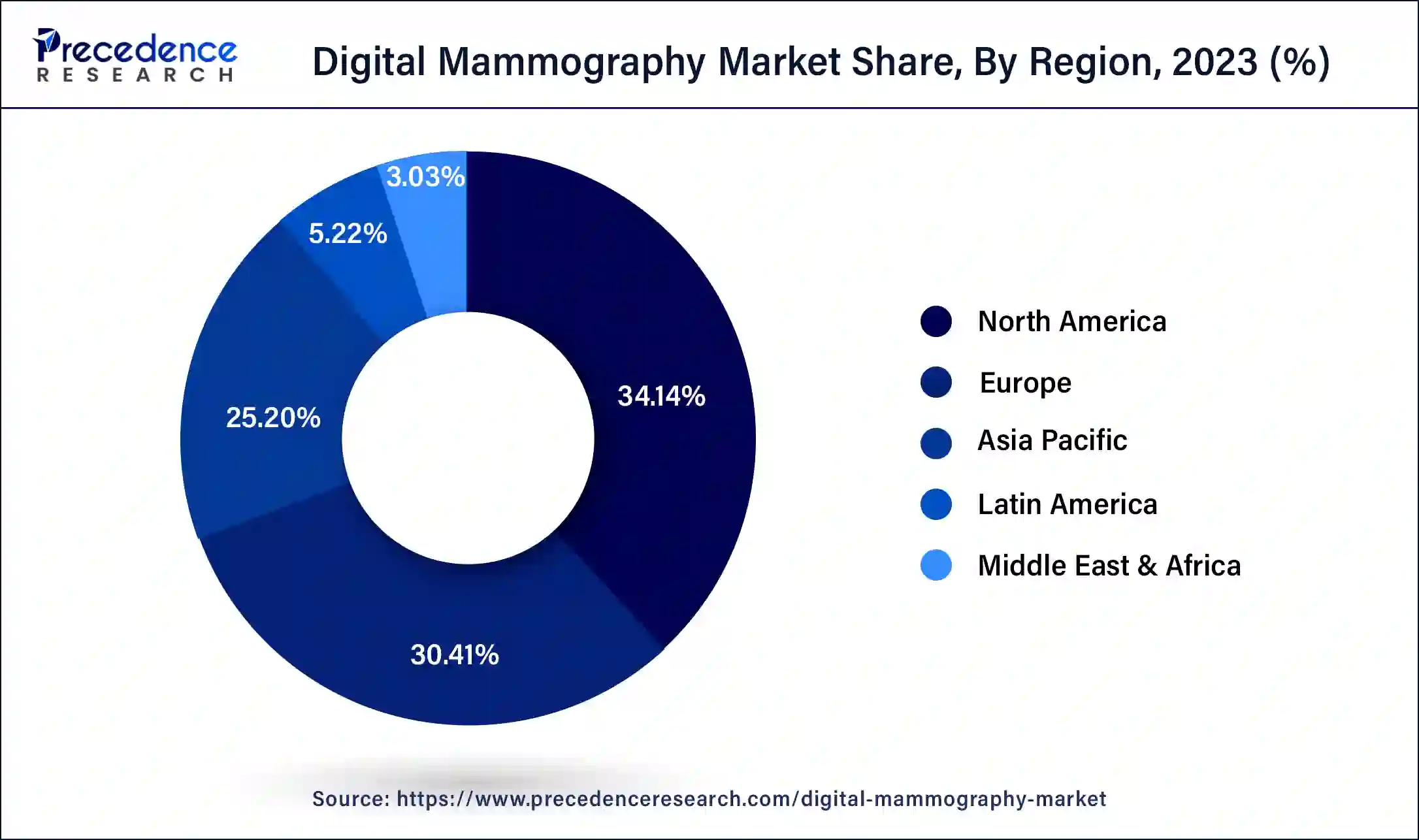

North America dominated the global digital mammography market in 2023. The region is expected to sustain its dominance during the forecast period. The increasing reimbursement from countries and progressive healthcare institutions will further fuel the growth of the digital mammography market in the region during the forecast period.

The government’s support and funding for improving the healthcare infrastructure play a crucial role in the growth of the market. North America carries a forefront healthcare infrastructure, and the continuous and rapid adoption of advanced diagnostic technologies promotes the development of the digital mammography market in the region. Along with this, the Covid-19 pandemic has boosted the deployment of home care settings, which subsequently supports the adoption of portable and digitally advanced mammography devices.

The increasing prevalence of breast cancer in the region, especially in younger women, supplements the growth of the digital mammography market in North America. According to the Cancer Net, in 2023, approximately 2,97,790 women with invasive breast cancer will be diagnosed in the United States (estimated). This element excites the demand for advanced diagnostic methods in the nation while fueling the market's growth.

The Asia-Pacific digital mammography market is expected to grow significantly due to increasing health awareness. Moreover, the increasing incidence of breast cancer will further fuel the growth of the digital mammography market in the region in the coming years. The rising demand for early detection of breast cancer in the region, with the increasing number of breast cancer patients, promotes the growth of the market in the Asia Pacific. In India, breast cancer is becoming the most prevalent type of cancer. Almost 50% of breast cancers in India are diagnosed at stage 3 and stage 4; this fact increases the requirement for more advanced and rapid diagnostic techniques for the country.

As the number of radiology centers increases in the region, along with the rising emphasis on the improvement of the healthcare infrastructure, will propel the growth of the digital mammography market during the forecast period.

Market Overview

The digital mammography market refers to the market for mammography systems that use digital technology to capture and produce mammogram images. Mammography is a medical imaging technique specifically designed for breast examination and is primarily used for the early detection and diagnosis of breast cancer.

Digital mammography systems have replaced traditional film-based mammography due to their numerous advantages. Digital technology allows for the immediate acquisition, display, and storage of high-quality digital images, offering improved image resolution and manipulation capabilities. Digital mammography also enables the use of computer-aided detection (CAD) systems, which assist radiologists in the detection of abnormalities and potential signs of breast cancer.

The increasing prevalence of breast cancer is the key factor that will boost the market's growth during the forecast period. Additionally, the incidence of breast cancer among elderly women is driving the market expansion. Relative survival from breast cancer decreases among elderly women. Thus, the growing geriatric population is expected to drive the market growth during the forecast period. In addition, several extensive studies have shown that combined 2D/3D systems of mammography are superior to 2D mammography alone in diagnosing breast cancer. Growing awareness of the use of these systems and high detection rates are critical drivers for the segment.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.45 Billion |

| Market Size in 2024 | USD 2.71 Billion |

| Market Size by 2034 | USD 7.45 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Time-Efficient Process offered by the technological advancements in digital mammography units

Digital mammography offers quick and accurate diagnostic results, that are available in less than a few hours. The time-efficient process offered by digital mammography units promotes their application in the healthcare sector. Healthcare providers are focusing on the installation of technologically advanced mammography devices. Technologically advanced mammography units are capable of offering customized outcomes while focusing on specific areas of breasts. Such advanced units can also decrease or increase the contrast to distinguish healthy breast tissues. All these elements act as a driver for the market’s growth while increasing the adoption of digital mammography units.

Limited access and awareness and high cost

In some regions, particularly low-income areas or rural communities, access to digital mammography services may be limited. Lack of awareness about the importance of regular mammograms and limited infrastructure can hinder the adoption of digital mammography in these areas. Digital mammography systems tend to be more expensive compared to traditional film-based systems, which can pose a financial challenge for healthcare facilities, especially in developing countries with limited resources. The initial investment cost, along with the costs of maintenance, upgrades, and training, can be significant.

Adoption of portable/mobile digital mammography devices

According to the Centers for Disease Control and Prevention, mobile mammography services are one of the most powerful tools to serve medically underserved communities. Mobile or portable mammography units aim to offer rapid detection of disease by reducing the patients’ visit to the hospital or diagnostic centers. Additionally, the restrictions during the Covid-19 period boosted the demand for portable and mobile healthcare services.

The adoption of portable digital mammography devices brings innovation to the industry. It allows remote and mobile monitoring. It will be able to offer services in underdeveloped areas. Also, it will promote early detection of breast cancer. Rising demand for early and rapid diagnosis will supplement portable mammography devices that offer digital images.

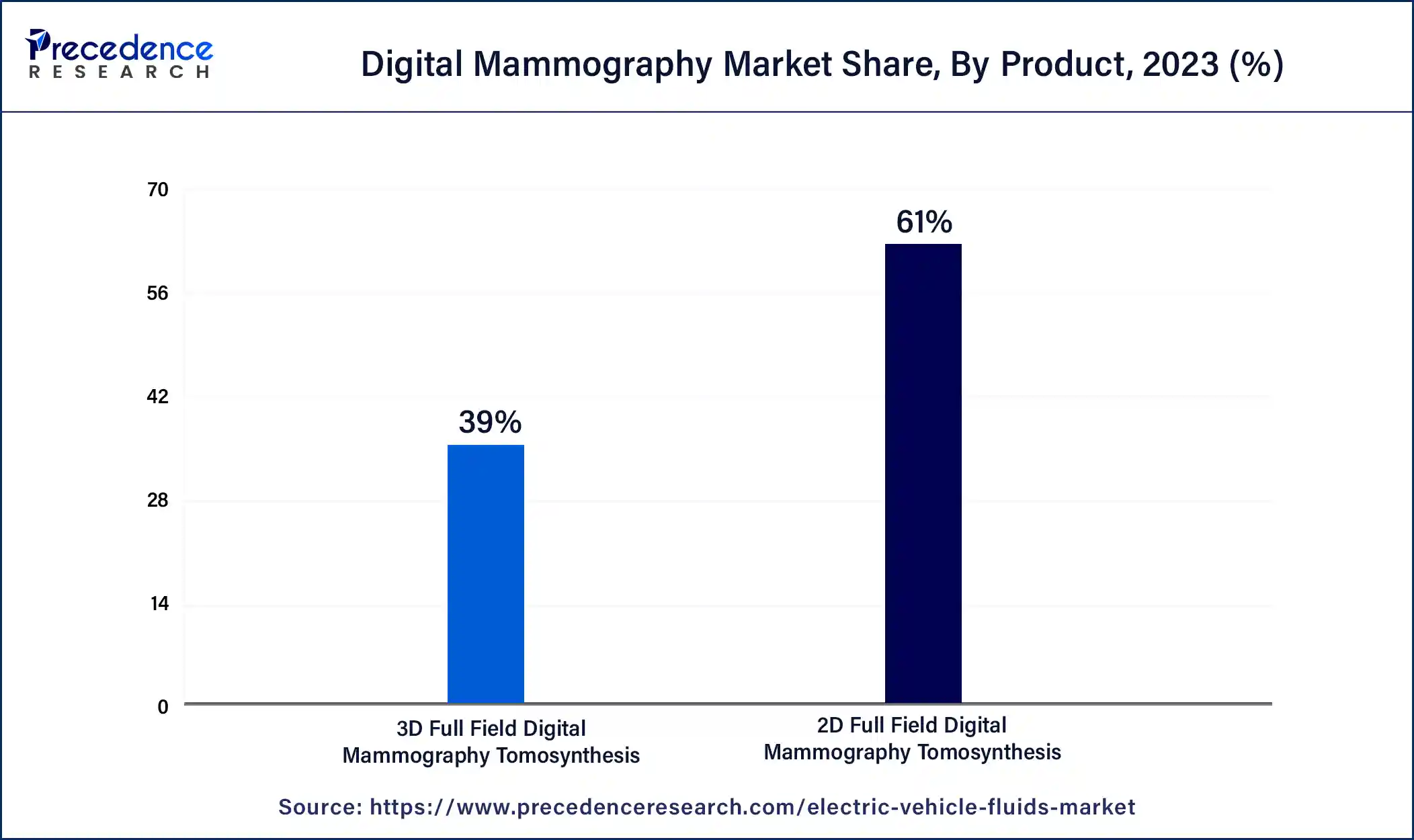

The 2D full-field digital mammography tomosynthesis segment is leading in the market with more than half the market share and is expected to grow significantly during the forecast period. In a 2D mammogram, two X-ray images are taken, one from above and one from the side. The requirement for accurate and rapid diagnostic reports along with the rapid adoption of 2D mammography devices promotes the growth of the segment.

The 3D full-field digital mammography tomosynthesis segment is expected to register the fastest growth during the forecast period. In 3D tomosynthesis, more photos are taken, resulting in images of thin sections of the breast. This implies that pictures of the opposite side of the breast are not obscured by breast tissue from the other side. 3D tomosynthesis has been shown to reduce false positives and reduce recall for further imaging. With the technological advancements and rapid adoption of advanced diagnostic mammography services, the 3d full-field digital mammography tomosynthesis segment will continue to grow.

The hospital segment contributed the largest share in 2023, the segment is expected to sustain its dominance during the forecast period owing to the presence of advanced facilities offered by hospitals for breast cancer detection. Multiple government hospitals offer cost-effective diagnostic services along with healthcare policies for cancer treatments. This factor promotes the adoption of digital mammography devices in hospitals. Hospitals often carry a significant patient population. Additionally, the presence of experienced and skilled healthcare providers supports the growth of the segment. In addition, public and private investments in the health sector are expected to accelerate the segment's growth.

The diagnostic center's segment is expected to witness the fastest growth during the forecast period. The availability of digital and 3D mammography, whole breast ultrasound, and noise magnetic resonance imaging (MRI) for risk screening, diagnosis, and treatment planning has increased the diagnosis and detection accuracy at such diagnostic stores, which is projected to support the growth of this segment shortly. The development is driven by the increased availability of comprehensive breast imaging services at cost-effective prices, the use of advanced imaging techniques, and the availability of competent and experienced professionals.

Recent Developments

Segment Covered in the Report:

By product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025