September 2024

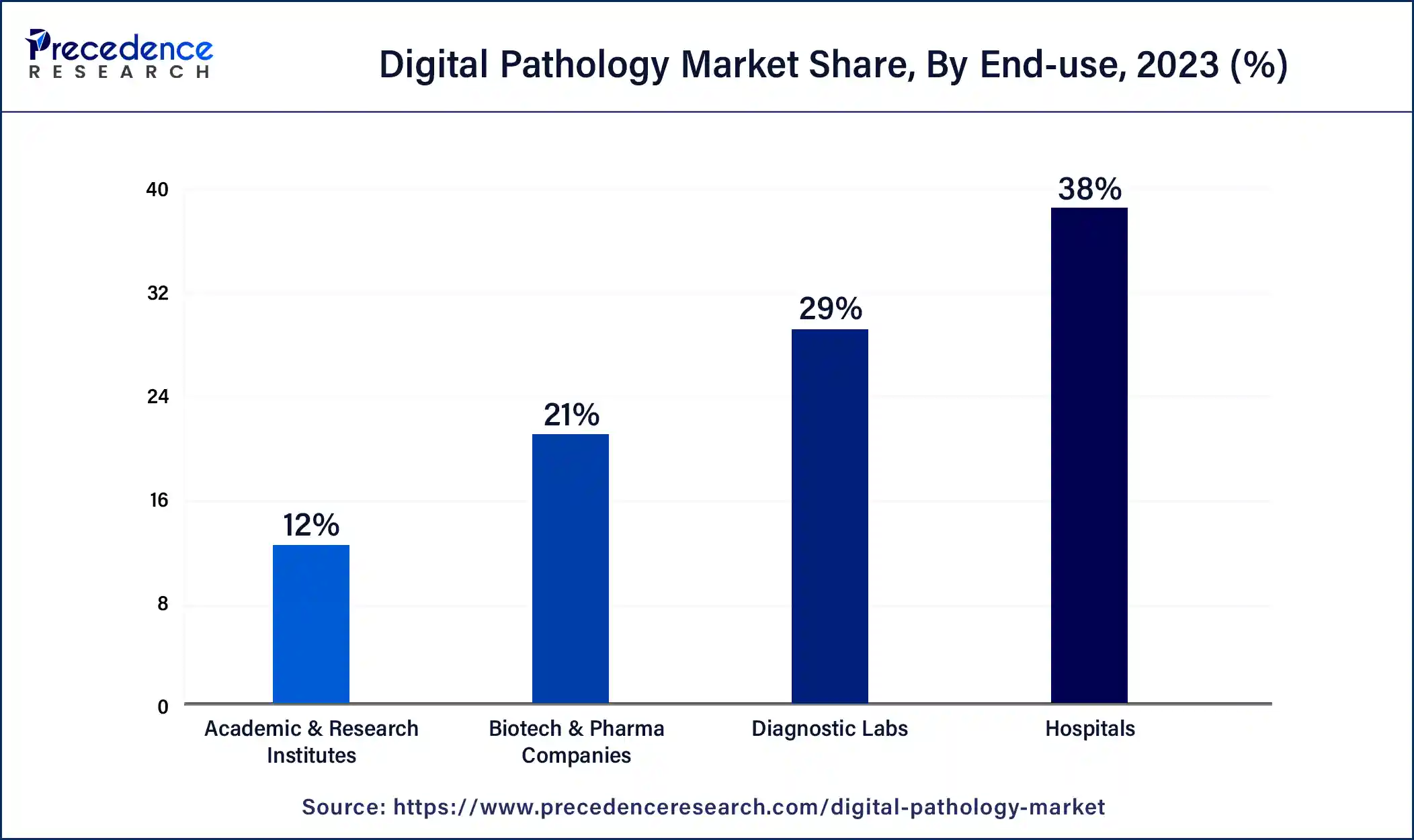

Digital Pathology Market (By Product: Software, Device, Storage System; By Type: Human Pathology, Veterinary Pathology; By Application: Drug Discovery and Development, Academic Research, Disease Diagnosis; By End-use: Hospitals, Biotech & Pharma Companies, Diagnostic Labs, Academic & Research Institutes) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

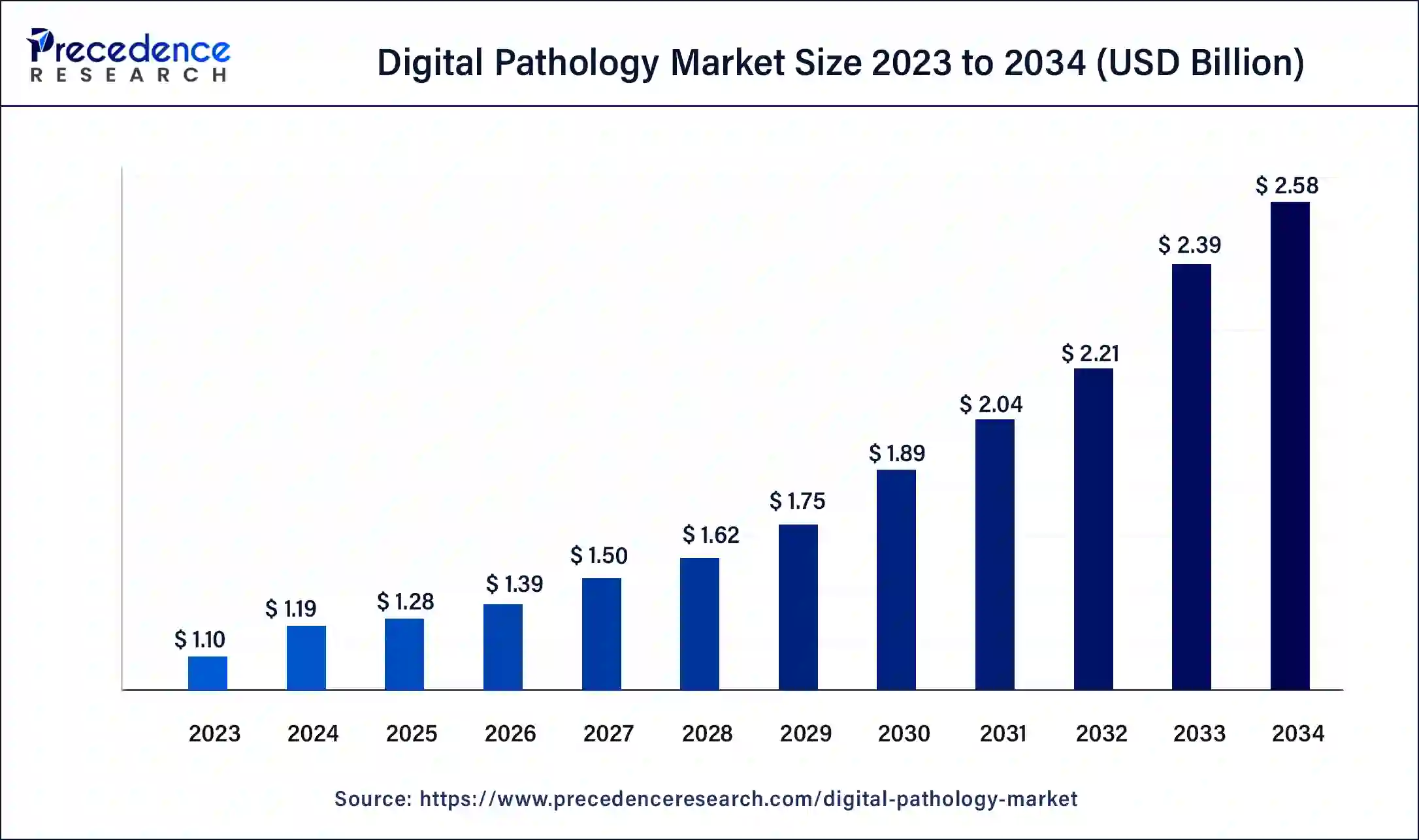

The global digital pathology market size was USD 1.10 billion in 2023, calculated at USD 1.19 billion in 2024 and is expected to reach around USD 2.58 billion by 2034, expanding at a CAGR of 8.05% from 2024 to 2034. The North America digital pathology market size reached USD 450 million in 2023. The growing prevalence of chronic disorders drives the market’s growth.

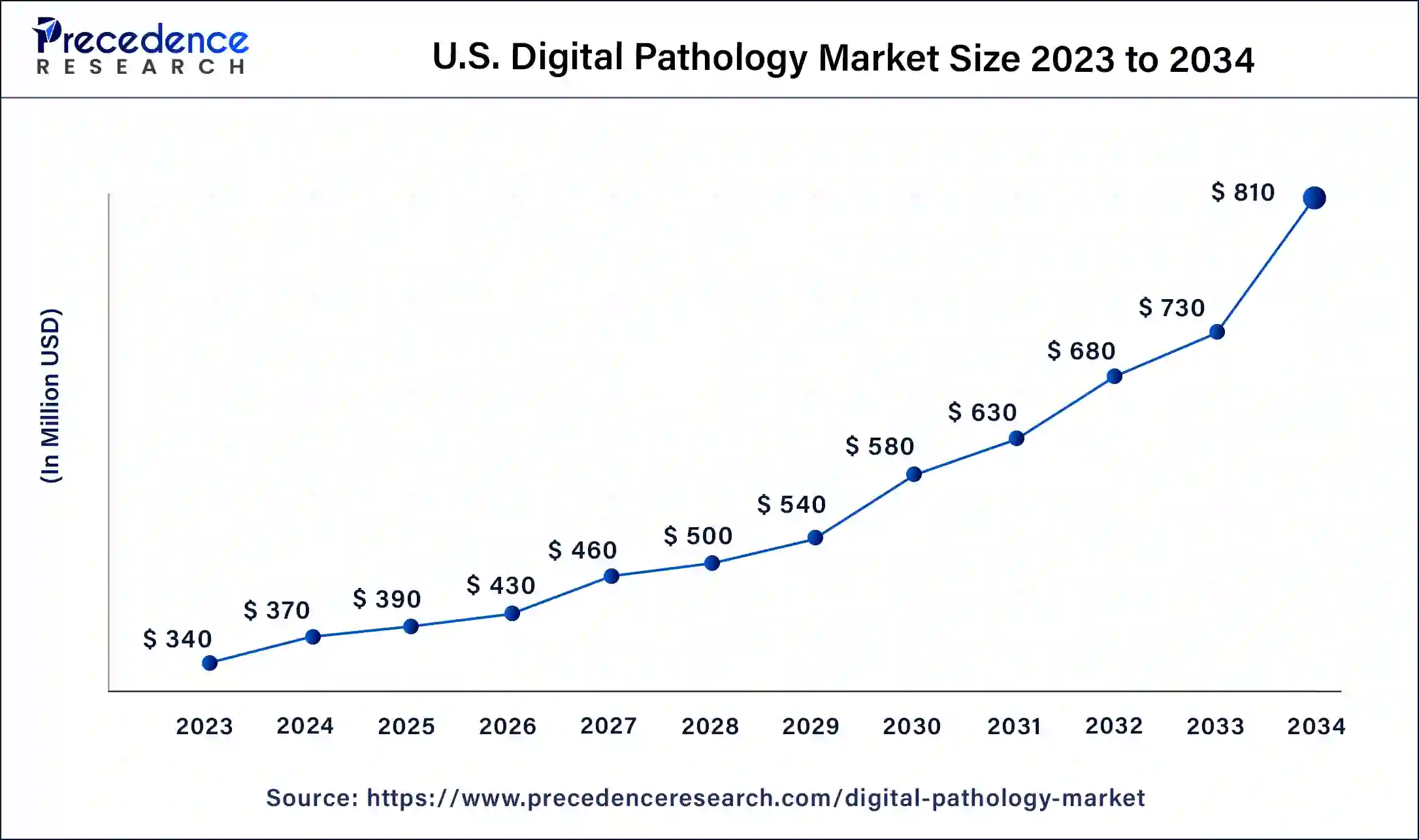

The U.S. digital pathology market size was exhibited at USD 340 million in 2023 and is projected to be worth around USD 810 million by 2034, poised to grow at a CAGR of 8.21% from 2024 to 2034.

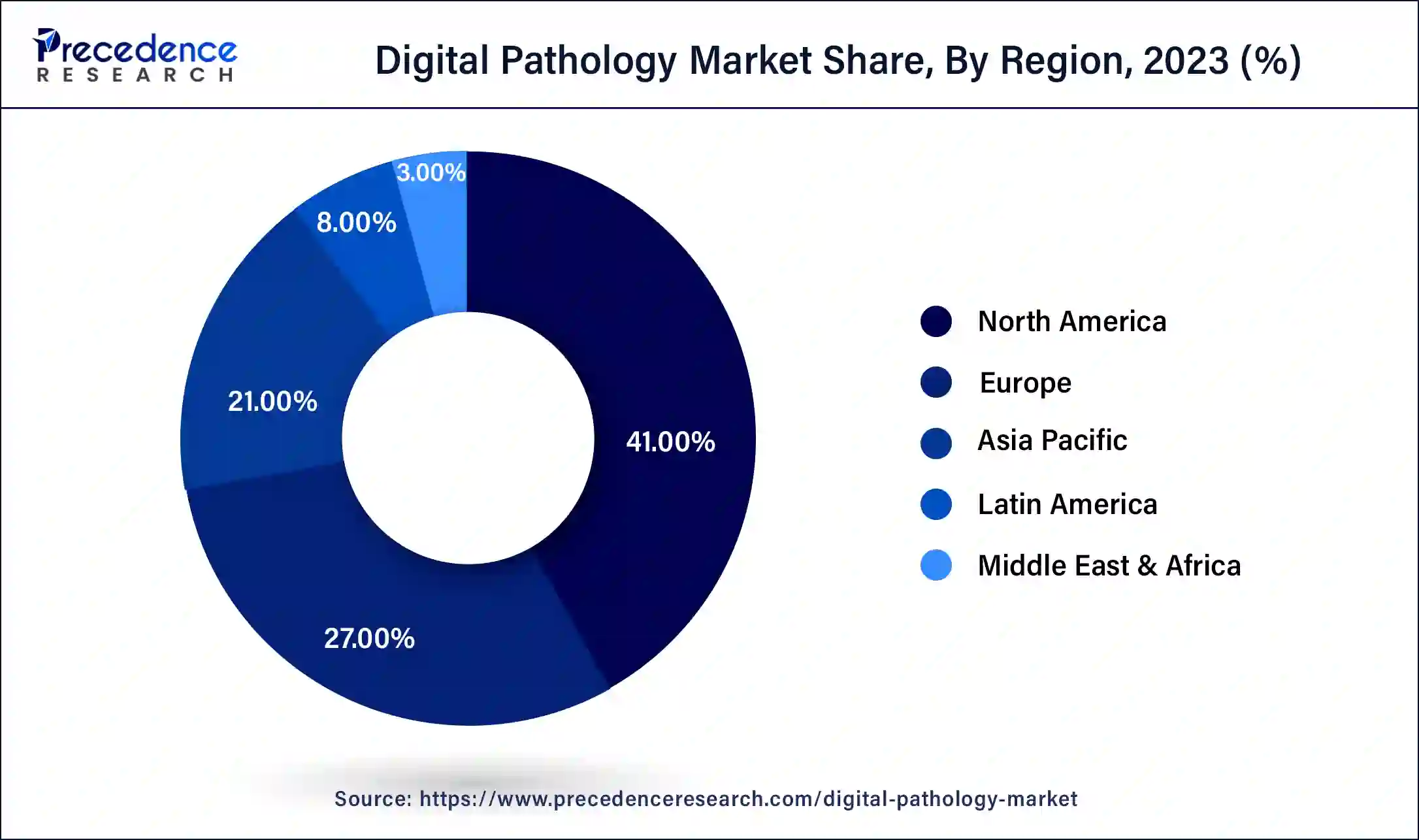

North America dominated the digital pathology market in 2023. Rising government initiatives for the development of advanced pathology technologies, increasing adoption of digital imaging, and R&D investments help the growth of the market in the North American region.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. Increasing digital imaging penetration, increasing investment, and rapid digitalization in the medical field can help the growth of the digital pathology market in the Asia Pacific region.

The digital pathology market refers to the process of converting glass transparencies containing tissue samples into digital images for analysis, dissemination, and storage. Digital pathology is a sub-field of pathology that focuses on data management based on information generated from digitized specimen slides. By using computer-based technology, digital pathology uses virtual microscopy.

The benefits of digital pathology include the potential for AI-based disease screening, reduced workload or fatigue for pathologists, improved patient outcomes like faster and higher quality results, standardization in pathology education, and transparent and consistent evaluation. Teleconsultations help pathologists to collaborate, engage, and evaluate remotely and rapidly. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.58 Billion |

| Market Size in 2023 | USD 1.10 Billion |

| Market Size in 2024 | USD 1.19 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.05% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising digital solutions adoption

The rising adoption of digital solutions helps the growth of the market. Digital pathology solution benefits include access to advanced tools that allow for workplace flexibility, improved visualization capabilities, improved distribution that enables rapid and remote collaboration and engagement, reduced risk of slide breakage at the time of transport, faster and high-quality results, and consistent and transparent evaluation. These factors help the growth of the digital pathology market.

High cost and lack of standard guidelines for digital pathology

High costs linked with the integration and implementation of software or hardware can hamper the growth of the market. The lack of standard guidelines for digital pathology may impact products' overall quality, employees’ safety and health, the company’s reputation, company’s environmental footprint, company’s capacity, and ability to meet customer demands. Disadvantages of digital pathology also include the transformation of the profession automation, working extensive screen times, regulatory requirements, best practices for safe implementation, and high investments in IT infrastructure and services. These factors can restrict the growth of the digital pathology market.

Future Projections

To transform the field of pathology as how teleradiology revolutionized the medical imaging industry, digital pathology has potential. Digital pathology technology helps to improve the digital diagnosis process. It makes it easy to give opinions on challenging cases. Image sharing with other pathologists enhances the accuracy of diagnoses.

The advantages of digital pathology include primary diagnosis of disease, easier modification of treatments for each patient, maximized patient outcomes by data analysis, it helps to give pathologists access to different patients' samples, it also helps to provide a complete view of patient’s health and care, and also eliminating barriers related to location. When there are new discoveries, digital pathology allows colleagues to work together. These factors help the growth of the digital pathology market.

The device segment dominated the market in 2023. The digital pathology device segment includes scanners and slide management systems. The benefits of scanners include ergonomics improvement, growth opportunities, faster turnaround time, better views, improved distribution, improved efficiency, and reduced errors, helping the market's growth. The benefits of slide management systems include providing a dashboard view of annotations and data, allowing for team annotation of slides, the ability to measure the number of AOI, and giving multiple angles and live zoomed views. These factors help to the growth of the device segment and contribute to the growth of the digital pathology market.

The software segment is expected to be the fastest-growing during the forecast period. The benefits of digital pathology software include allowing pathologists to collaborate, engage, and evaluate remotely and rapidly with consistency and transparency, which helps improve productivity and efficiency. Digital pathology software helps improve personalized medicines, translational research, and computer-aided diagnosis. These factors help the growth of the software segment and contribute to the growth of the digital pathology market.

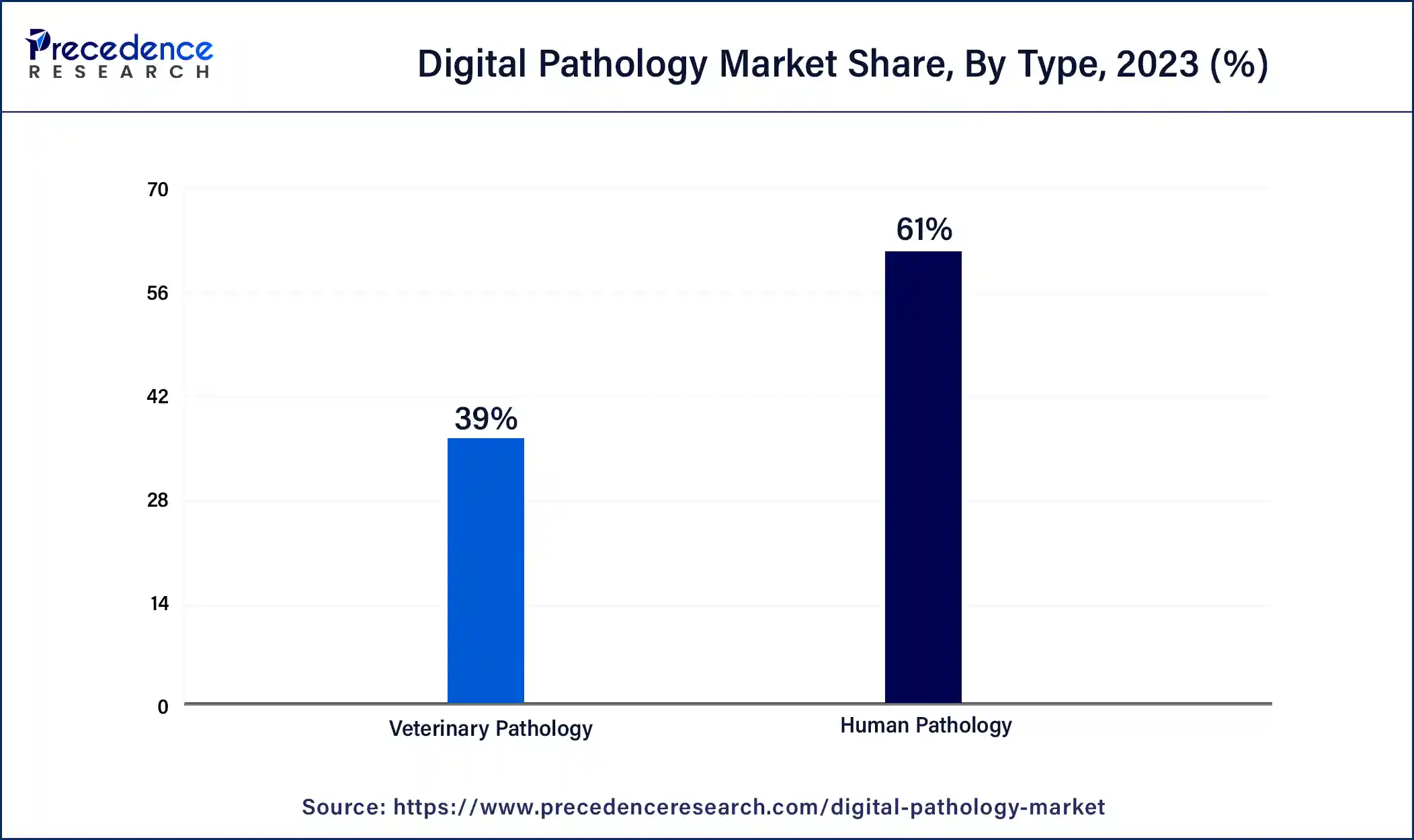

The human pathology segment dominated the digital pathology market in 2023. In the field of human pathology, digital pathology plays an important role. Digital pathology helps to improve lab productivity and eliminates the time required for disease diagnosis. The increase in the prevalence of chronic diseases in humans leads to an increase in the growth of the market. The benefits of digital pathology include improved diagnostics accuracy due to multiplane examination and high resolution. These factors help the growth of the human pathology segment and contribute to the growth of the market.

The veterinary pathology segment is anticipated to be the fastest-growing during the forecast period. The digital pathology plays an important role in veterinary pathology. Pathologists can use AI algorithms and digital imaging to analyze samples from distant locations, expanding access to improve patient care and veterinary pathology services. Digital pathology of veterinary pathology includes interpretation, sharing, management, and acquisition of pathology information by using high-resolution digital images. These factors help to the growth of the veterinary pathology segment and contribute to the growth of the digital pathology market.

The academic research segment dominated the market in 2023. Digital pathology plays an important role in academic research. The benefits include quantitative pathologic assessments, improved learning opportunities, active learning, improved accessibility, resource consumption, reduced costs, reduced resource consumption, and streamlined collaboration can help the growth of the segment. Digital pathology offers improved access, efficiency, and consistency to pathology data, which is beneficial for academic research. These factors help the growth of the academic research segment and contribute to the growth of the digital pathology market.

The disease diagnosis segment is estimated to be the fastest-growing during the forecast period. Digital pathology plays a significant role in the disease diagnosis. It offers many benefits for disease diagnosis, which include faster turnaround time, improved collaboration, remote diagnosis, data preservation, accuracy, and consistency. The benefits of disease diagnosis include primary diagnosis of disease, making easier adoption of treatments for each patient, maximizing patient outcomes by data analysis, eliminating barriers related to location, and helping to give pathologists access to different patient samples. These factors help to the growth of the disease diagnosis segment and contribute to the growth of the digital pathology market.

The hospital segment dominated the digital pathology market in 2023. Digital pathology offers many benefits to hospitals, which include several areas of expertise under one roof, cost savings, greater long-term insights, increased patient safety, increased accuracy and reliability, continuous learning, enhanced patient accessibility, enhanced precision, streamlined workflows, potential for AI-based disease screening, reduced workload/fatigue for pathologists, improved patient outcomes, remote access to expertise, standardization in pathology education, and teleconsultation. These factors help to the growth of the hospital segment and contribute to the growth of the market.

The diagnostic labs segment is anticipated to be the fastest-growing during the forecast period. Digital pathology offers many benefits for diagnostics labs, including precision of diagnosis, effective processes, wide-scale collaboration, faster diagnostics, cost savings, etc. The benefits also include ergonomic equipment, growth opportunities, faster turnaround time, increased flexibility, better views, improved efficiency, and reduced errors. These factors help to the growth of the diagnostic labs and contribute to the growth of the digital pathology market.

Segments Covered in the Report

By Product

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025