September 2024

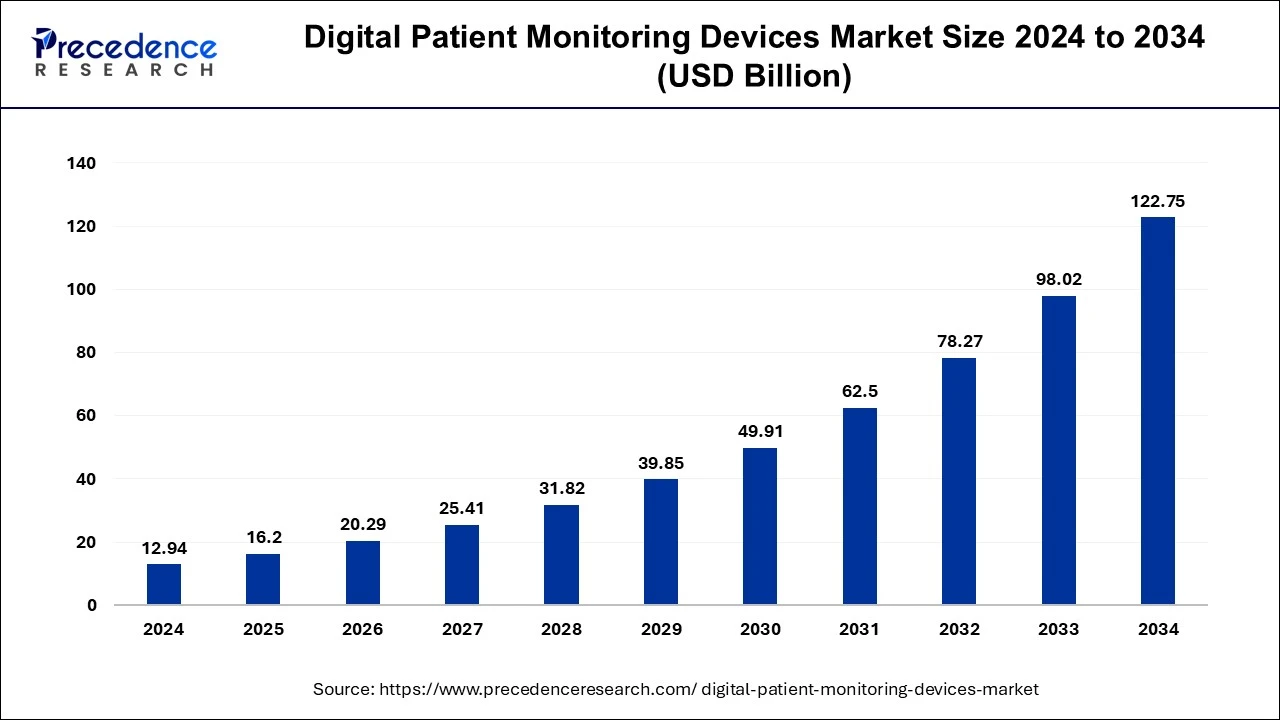

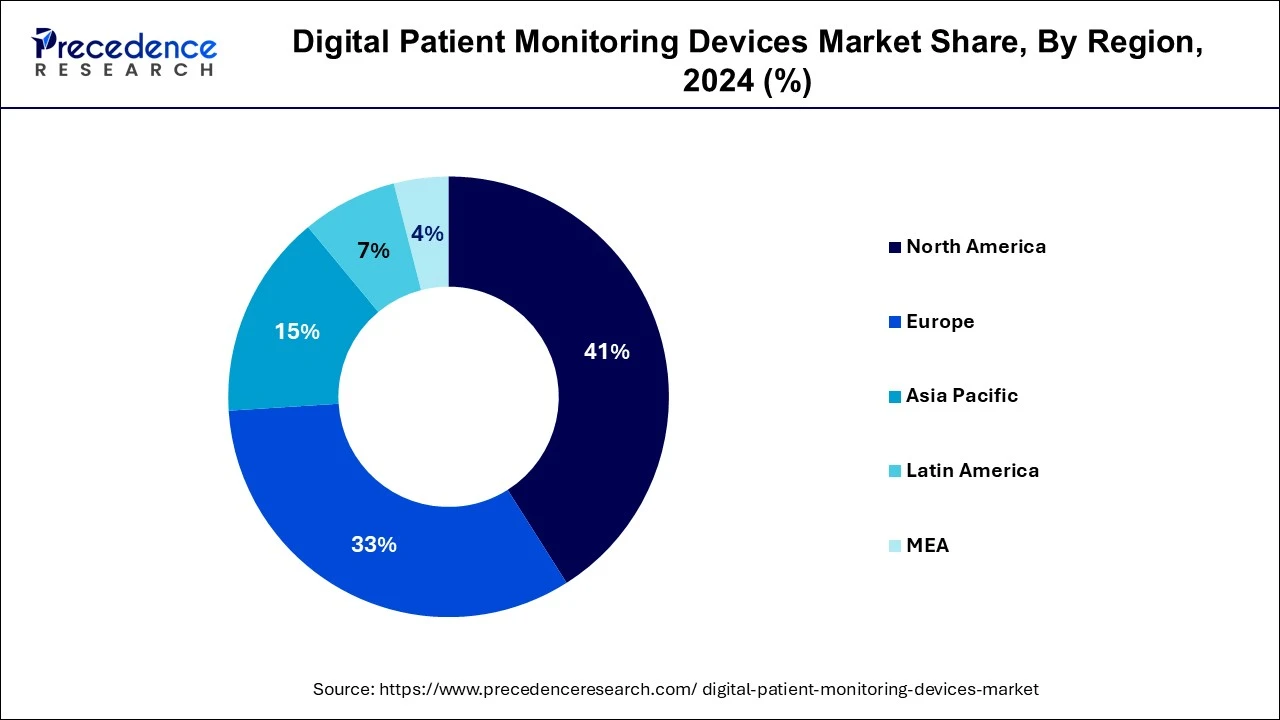

The global digital patient monitoring devices market size is calculated at USD 16.2 billion in 2025 and is forecasted to reach around USD 122.75 billion by 2034, accelerating at a CAGR of 25.23% from 2025 to 2034. The North America digital patient monitoring devices market size surpassed USD 5.31 billion in 2024 and is expanding at a CAGR of 25.26% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital patient monitoring devices market size was estimated at USD 12.94 billion in 2024 and is anticipated to reach around USD 122.75 billion by 2034, expanding at a CAGR of 25.23% from 2025 to 2034.

AI plays a significant role in the digital patient monitoring devices market. The integration of AI in patient monitoring devices helps in enhancing patient care and enabling early interventions. Also, AI-based devices help in analyzing patient data for healthcare providers to identify health issues and take action as per requirement. Moreover, AI algorithms help in detecting subtle changes in vital symptoms that may indicate potential health risks associated with different patients.

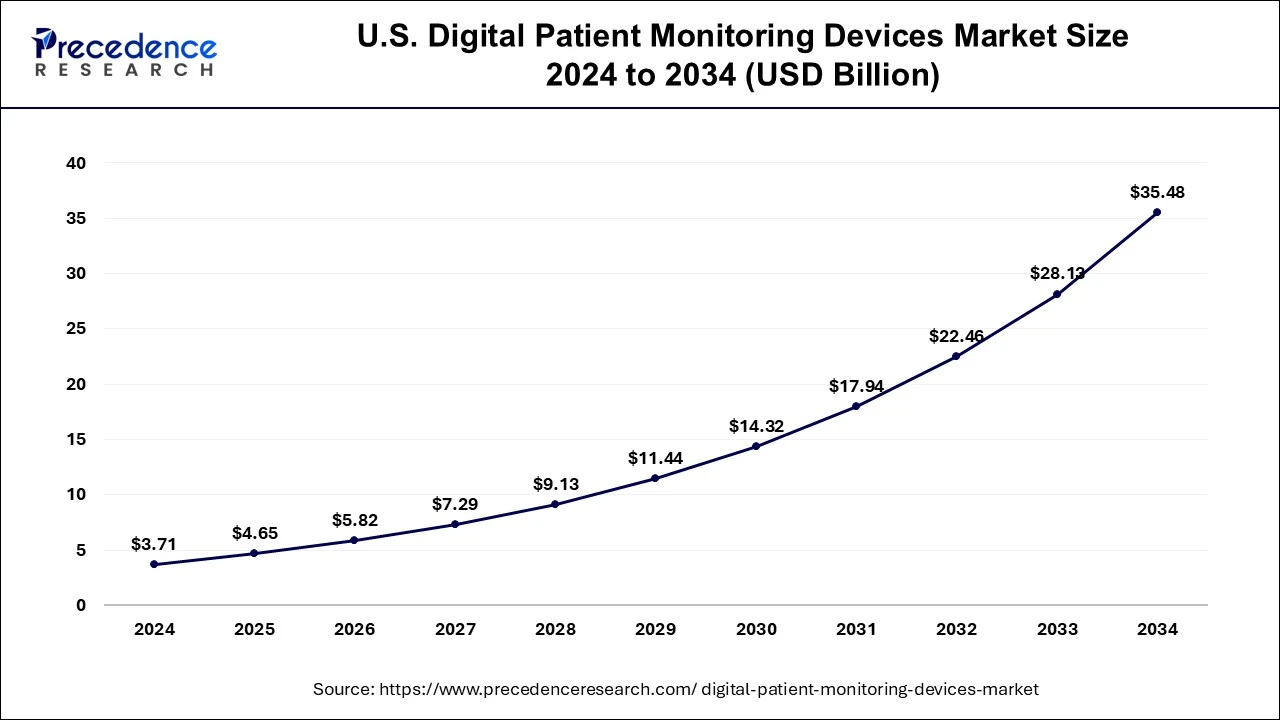

The U.S. digital patient monitoring devices market size was evaluated at USD 3,71 billion in 2024 and is predicted to be worth around USD 35.48 billion by 2034, rising at a CAGR of 25.32% from 2025 to 2034.

North America dominated the digital patient monitoring devices market. The rising prevalence of diabetes among people is driving the market for digital patient monitoring devices in the U.S. Also, the government of Canada and the U.S. has made several investments for advancing technologies related to healthcare sector. Moreover, the healthcare providers are adopting wireless monitoring devices for detecting the health conditions of the people of this region. Furthermore, the presence of several companies such as Abbott, GE Healthcare, VitalConnect and some others has played a crucial role in shaping the industry in a positive direction.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Due to increased prevalence of chronic disease and the growing elderly population, as well as the growing number of smartphone users across the region, Asia-Pacific is predicted to see significant market expansion in the digital patient monitoring devices market. Also, government of several countries such as India, Japan, South Korea and some others have launched several digital patient monitoring platforms to enhance the healthcare procedures. Moreover, the rising awareness of telehealth services among the people is likely to propel the growth of the digital patient monitoring devices market in this region.

Digital patient monitoring devices market is a subset of telehealth market that uses digital technologies to collect medical and other types of data about patients outside of the healthcare system. The blood pressure, blood sugar, weight, and oxygen levels are all examples of data that can be sent to healthcare professionals or doctors using a telehealth computer system and software that can be loaded on a smartphone, computer, or tablet. Digital patient monitoring devices assists health workers in monitoring the condition of patients from all over the world and enhancing the quality of care provided to each and every patient.

The surge in demand for digital patient monitoring tools for chronic disease management, as well as the robust growth of the geriatric population worldwide with ailments that require quick treatments, such as heart stroke, diabetes, and chronic diseases is the fundamental factors driving the market demand for digital patient monitoring devices. This industry is expected to rise significantly with the growth of the medical devices industry in different parts of the world

| Report Coverage | Details |

| Market Size in 2024 | USD 66.8 Billion |

| Market Size in 2025 | USD 66.8 Billion |

| Market Size in 2034 | USD 66.8 Billion |

| Growth Rate from 2025 to 2034 | 21.1% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Region |

Rising Demand for Smartwatches

The trend of wearables has grown rapidly in different parts of the world. Among the wearables, the demand for smart watches has increased significantly for monitoring several health conditions such as blood pressure, glucose, oxygen level and some others. These smart watches are integrated with advanced technologies for providing accurate insights about human body. Moreover, these devices can be connected with smartphones and can be used via different apps. Thus, the growing demand for smartwatches to enhance remote patient monitoring is expected to boost the market growth.

In September 2024, Amazfit launched GTR 4 smartwatch in India. This smartwatch comes with several healthcare features such as sleep monitoring, heart rate monitoring and stress monitoring.

Internet Problems & Lack of Knowledge

The lack of adequate internet connectivity in developing and underdeveloped regions, as well as a lack of knowledge and value recognition of digital patient monitoring devices, are projected to restrain the global digital patient monitoring devices market growth during the forecast period.

Advancement in Sensor Technology

There are different types of sensors used in healthcare monitoring devices that helps in detecting numerous health conditions in patients. Nowadays, the application of wearable sensor has increased rapidly for several applications such as detecting heart rate, blood pressure, and oxygen levels. Moreover, the growing adoption of implantable sensors for monitoring internal organs has gained traction. Thus, advancements in medical sensors is expected to create opportunities for the market players in the upcoming days to come.

The wearable devices segment led the industry. The wearable devices consist of blood pressure monitors, wearable ECG monitors, wearable biosensors and some others. The wearable device adoption across numerous application sectors, customer preference for linked devices, and the growing population of IoT and related devices are all driving the growth of the wearable devices segment. This, in turn drives the market growth.

The mHealth segment is likely to experience the fastest growth rate during the forecast period. Growing smartphone and internet connectivity penetration, as well as supportive government initiatives, is among the primary factors driving segment expansion. The segment is predicted to rise due to rising demand for preventative healthcare and increased funding for mHealth entrepreneurs. The rise in number of mHealth platforms and mobile apps is driving the market expansion.

The diagnostic monitoring devices segment held the largest share of the market. The growth of the segment can be linked to an increase in demand for diagnostic monitoring devices that measure, record, distribute, and show a variety of biometric parameters such as temperature, oxygen, and blood pressure. The technological advancements in diagnostic monitoring devices for providing accurate insights about the health condition of the patient is driving the market growth.

The therapeutic monitoring devices segment is projected to witness the fastest CAGR during the forecast period. The rising prevalence of chronic diseases such as cancer in emerging nations such as China and India are predicted to present a wide range of potential prospects for therapeutic monitoring devices competitors. The rapid adoption of these devices for analyzing the effect of medicines in human beings has driven the industrial expansion.

Due to the company’s strong focus on research and development (R&D), Philips N.V. occupied a prominent position in the market. Maternal Patch and Pod and Avalon CL, an obstetrics monitoring solution, will be available in the U.S. in June 2020. The key market players are adopting marketing strategies such as partnership, acquisition, merger and acquisition, and joint venture to create prominent position in the digital patient monitoring devices market.

By Type

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

December 2024