March 2025

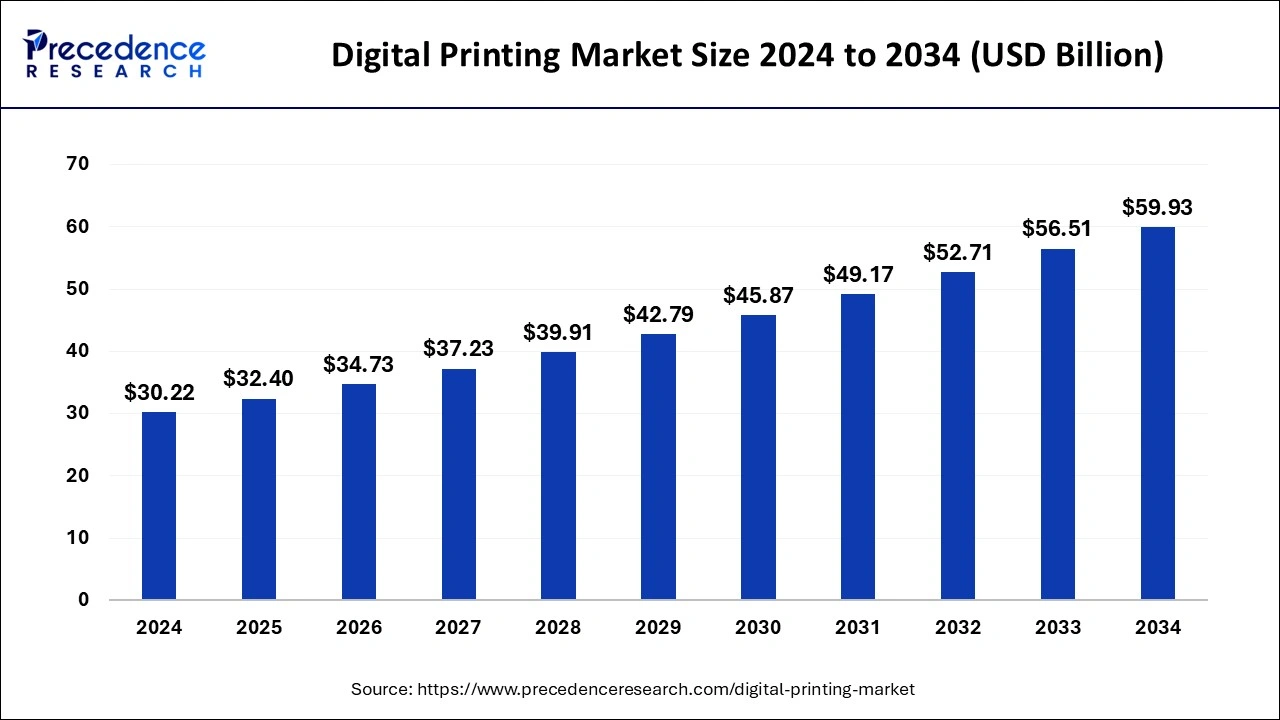

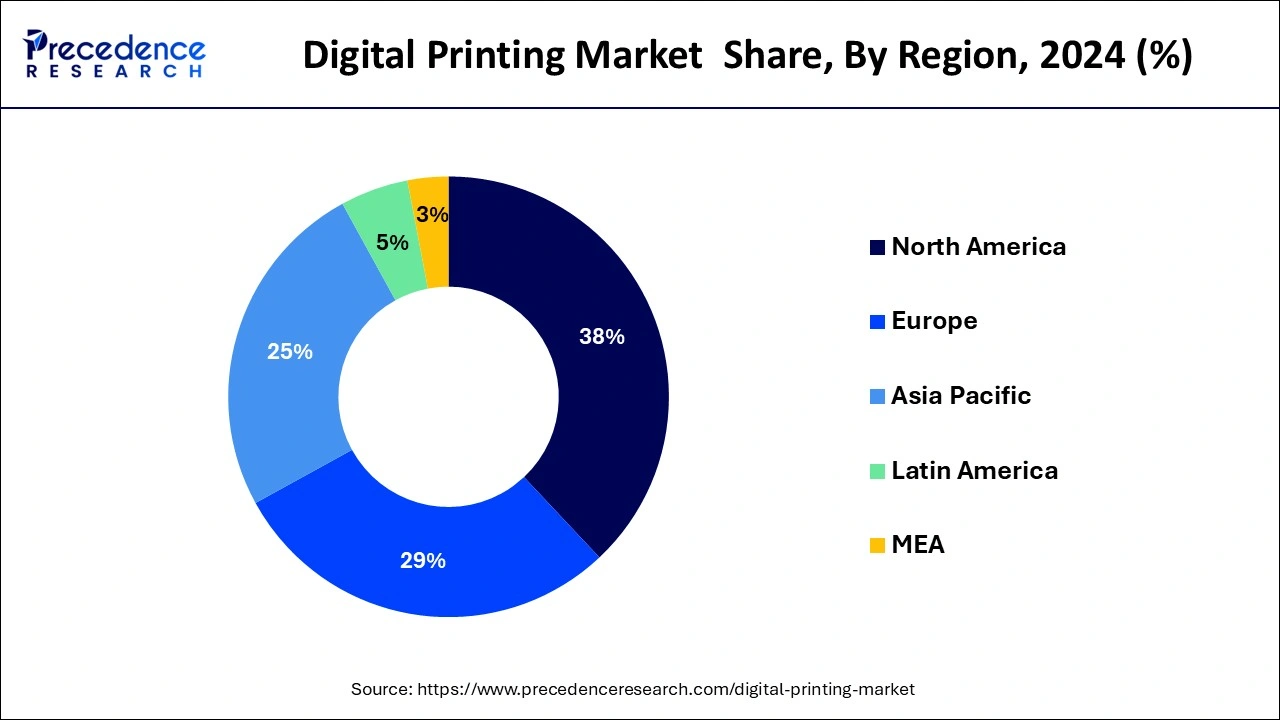

The global digital printing market size is calculated at USD 32.40 billion in 2025 and is forecasted to reach around USD 59.93 billion by 2034, accelerating at a CAGR of 7.09% from 2025 to 2034. The North America digital printing market size surpassed USD 11.48 billion in 2024 and is expanding at a CAGR of 7.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital printing market size was accounted for USD 30.22 billion in 2024, and is expected to reach around USD 59.93 billion by 2034, expanding at a CAGR of 7.09% from 2025 to 2034. The digital printing market is growing due to the rise in sustainability in the packaging and textile industries.

The influence of artificial intelligence on the digital printing sector is already evident. making calculations easier and using materials more efficiently. Businesses have a significant edge over rivals because of artificial intelligence systems. Disruptions to the supply chain might maintain high substrate costs even when the printing industry's margins are still narrow. In the continuous fight to make the printing sector more climate-friendly, any chance to cut waste is appreciated. It is predicted that short-run bespoke print items will increase in popularity as AI-based technologies make innovative ideas more accessible. Printers now have access to a new market.

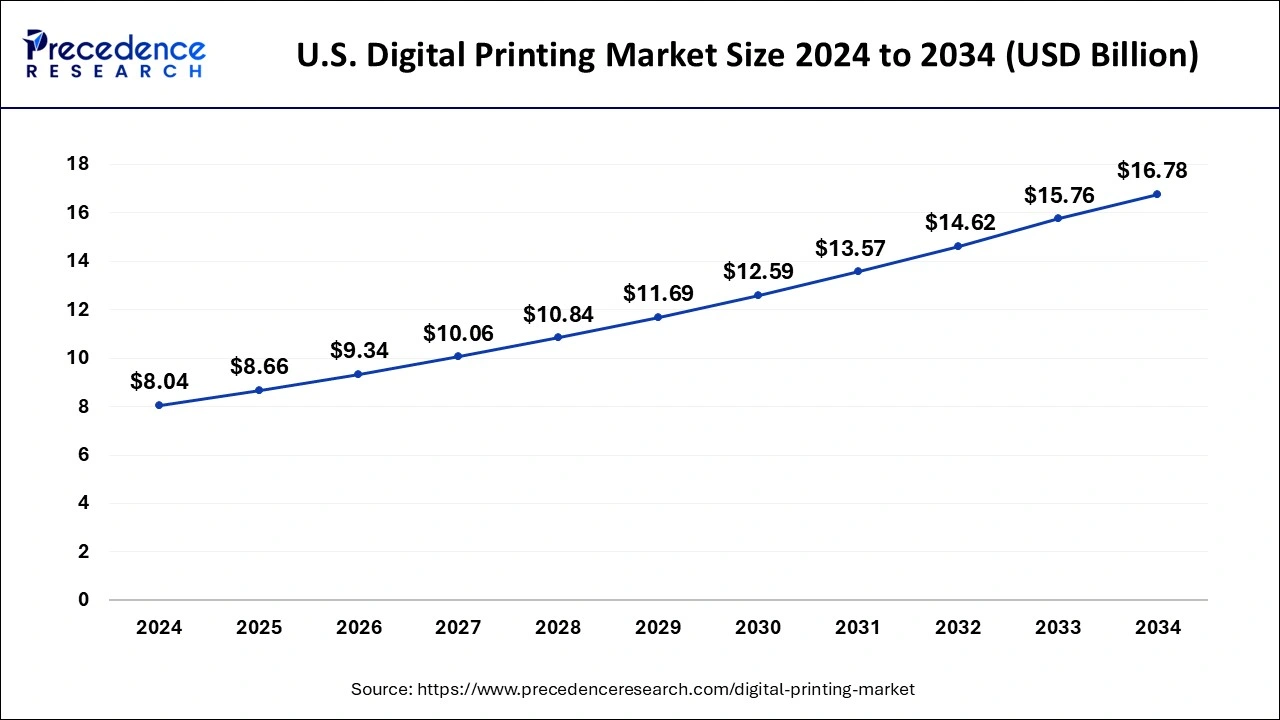

The U.S. digital printing market size was estimated at USD 8.04 billion in 2024 and is predicted to be worth around USD 16.78 billion by 2034, at a CAGR of 7.64% from 2025 to 2034.

The global digital printing market is divided into North America, Europe, Asia Pacific, and RoW based on geographical analysis. The highest market share belonged to the North America segment, which is anticipated to expand at a CAGR of 5.60% over the course of the forecast period. In practically every industry, including automotive, building, infrastructure, manufacturing, and technology, North America is the most developed area in the world. This region's prosperous state is a result of its strongly interconnected markets. In terms of revenue, the market is expanding strongly.

The economies of nations like the United States and Canada dominate the North American area due to their highly diverse industrial markets. Compared to other regions, this region's industries are more flexible in terms of expansion and innovation.

Asia Pacific is estimated to grow at the fastest rate in the digital printing market during the forecast period. The increase in demand across a range of applications is the cause of this. Additionally, because of the growing demand from the food and beverage sector in the area, nations like China, India, and Japan are significant market customers. The area is adopting digital printing due to the increasing need for food packaging and the increased focus on packaged goods for communicating information about the composition, nutritional value, and shelf life of products. The area will thus probably experience rapid expansion in the near future.

China is the second biggest national economy in the world, with a gross domestic output of over 13.37 trillion U.S. dollars. China already has significant global market shares in flexible packaging. Artificial intelligence (AI) and robots are two cutting-edge technologies that are essential to the Chinese packaging industry. In terms of the entire industry, mainland China has three of the top ten businesses worldwide, around 38% of the global packaging market, and the only segment of the semiconductor value chain in which it leads.

The cutting-edge printing technique is known as "digital printing systems" uses electronic "les" that were conceived using computer software for printing. Images are printed using digital formats like PDF and JIP on medium surfaces including paper, cloth, and ceramic. The end-use manufacturer may accelerate the creation and manufacturing of images thanks to digital printing. The ink is ejected onto the surface in an exact pattern by inkjet-based printing, which makes use of thermal bubble creation technology. Additionally, inkjet printing enables the printing of efficient materials in three dimensions.

Short-run color printing that is precise, cost-effective, and delivered quickly is the goal of digital printing techniques. In comparison to traditional printing methods, digital printing systems are equipment built to provide high-quality finished goods. In comparison to more conventional approaches, it offers the most affordable alternative for personalized marketing materials including business cards, letters, direct mail, and more. Additionally, digital printing speeds up the delivery of the final product by reducing the length of the production cycle.

The overall quantity of waste in the print sector has decreased as a result of significant advancements in supply chain management, time-efficient production, and print manufacturing efficiency. Digital printing has benefited from technological improvements that have made waste reduction possible while retaining good print quality.

In comparison to conventional printing methods like offset printing and solid ink printing, digital printing uses mild solvents and less dangerous chemicals. As a result, the market for printed electronics is seeing an increase in demand for digital printing solutions, which is putting a greater emphasis on eco-friendly printing and efficient production.

| Report Coverage | Details |

| Market Size in 2025 | USD 32.40 Billion |

| Market Size by 2034 | USD 59.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.09% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Ink, By Digital Printing, By Print Head, By Printhead, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

There are structural and transitional changes occurring in commercial printing

The latest advancements

The digital printing market's overall market growth is constrained by expensive investments

The rapid adoption of digital printing

The rise in the adoption of laser and inkjet printing solutions

The worldwide digital printing market is divided into many ink categories based on type, including aqueous, UV-cured, solvent, dye sublimation, latex, and others. The market for UV-cured inks is expected to have the highest revenue in 2024. An ink that cures when exposed to UV light is known as UV ink. The majority of the vehicle in these inks consists of monomers and initiators. The ink is applied to a surface and then exposed to UV light, which causes the release of highly reactive atoms from the initiators, which causes the monomers to swiftly polymerize and the ink to solidify into a film. Nearly all of the ink is used to create the film since UV curing does not require parts of the ink to evaporate or be removed.

The total amount of ink used is decreased, lowering the cost of printing as a whole. Environmental friendliness is another benefit of UV inks. Their good opacity suggests that the print work is crisp, distinct, and easy to read on the page. In contrast to regular ink, which can smear and appear unsightly and unprofessional, UV ink also resists spreading. They are much contrasted, which makes reading them much simpler. This ink creates a lovely high gloss that is practical and visually beautiful. It guarantees print consistency: the print work will appear the same throughout the whole run without fading. Eliminating the need for frequent cleaning results in significant time, financial, and waste savings. Reading is made easier because of UV inks' ability to capture and reflect light.

Over the projected period, the latex market is anticipated to develop moderately. Latex ink, although water-based, is a heat-fusing kind that enables printing on a variety of uncoated base materials. It may be bonded to the base material like a solvent ink and has comparable handling characteristics as water pigment ink. This makes it waterproof and scratch-resistant. Depending on the substance and whether it is used indoors or outdoors, latex ink has a different lifetime. In addition to being water and chemical resistant to varying degrees, latex printing is also scratch and abrasion-resistant.

The global market is divided into laser and inkjet segments based on the print head. The inkjet market held the highest market share in 2023. Thermal inkjet, electronic inkjet, piezo inkjet, and micro-electro-mechanical system (MEMS) inkjet are the other divisions. Small and inexpensive thermal inkjet (TIJ) printers are capable of printing high-resolution codes on a variety of surfaces. There are several brands and versions of TIJ printers, each with a unique set of advantages (mobility, substrate specialty, print height, etc.). They are able to meet the needs of the modern manufacturing line without compromising quality. With TIJ printers' ink cartridge system, print head services like routine maintenance are not required. If there is an issue, it is typically quickly and easily fixed by just changing the ink cartridge with a new one. The four-step thermal inkjet printing process is substantially simpler than the continuous inkjet printing method, which employs ink-filled tanks, pressurizes, and piezoelectric print heads. The drop ejection technique's simplicity enables TIJ machines to be substantially more compact than other printer types, which lowers maintenance costs.

The laser market is growing at the highest CAGR over the forecast period. In contrast to the conventional ink-on-paper printing technique, a laser printer prints utilizing a laser and electrical charge. The neatness and sophistication of print goods have increased thanks to laser printers, which typically have resolutions of 600 dots per inch or more. In a laser print procedure, a laser beam is directed at a mechanical cylinder known as a photoreceptor. The photoreceptor, therefore, develops a pattern, which is subsequently coated with toner. Due to electrical charges, toner sticks to the paper in patterns predetermined by the printing software. Finally, by heating the paper, the toner is fused to the paper. It generates prints the quickest when compared to other printers. Compared to ink cartridges, toner cartridges are more durable, produce more pages, and do not dry up like ink. High-quality printouts are produced using laser printers, which are silent.

Market Segmentation

By Ink

By Digital Printing

By Print Head

By Printhead

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

April 2025

April 2025