March 2025

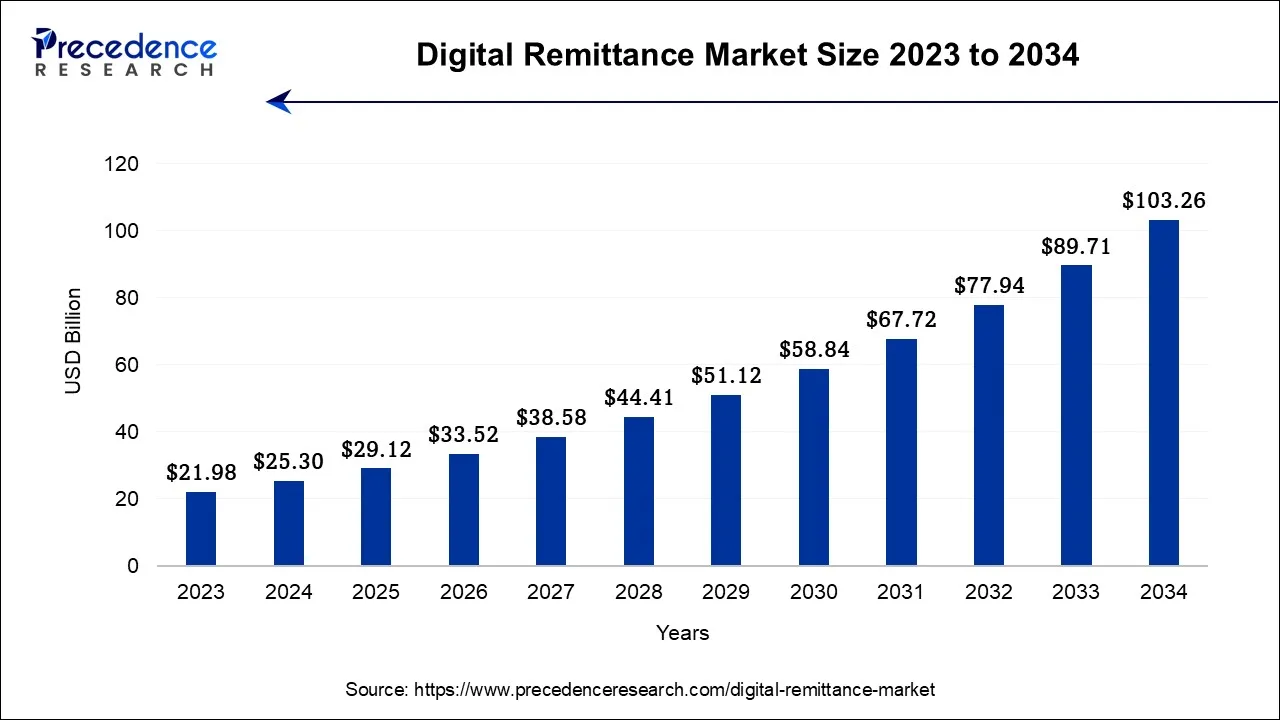

The global digital remittance market size is calculated at USD 25.30 billion in 2024, grew to USD 29.12 billion in 2025, and is predicted to hit around USD 103.26 billion by 2034, poised to grow at a CAGR of 15.1% between 2024 and 2034. The North America digital remittance market size accounted for USD 7.59 billion in 2024 and is anticipated to grow at the fastest CAGR of 15.29% during the forecast year.

The global digital remittance market size is expected to be valued at USD 25.30 billion in 2024 and is anticipated to reach around USD 103.26 billion by 2034, expanding at a CAGR of 15.1% over the forecast period from 2024 to 2034.

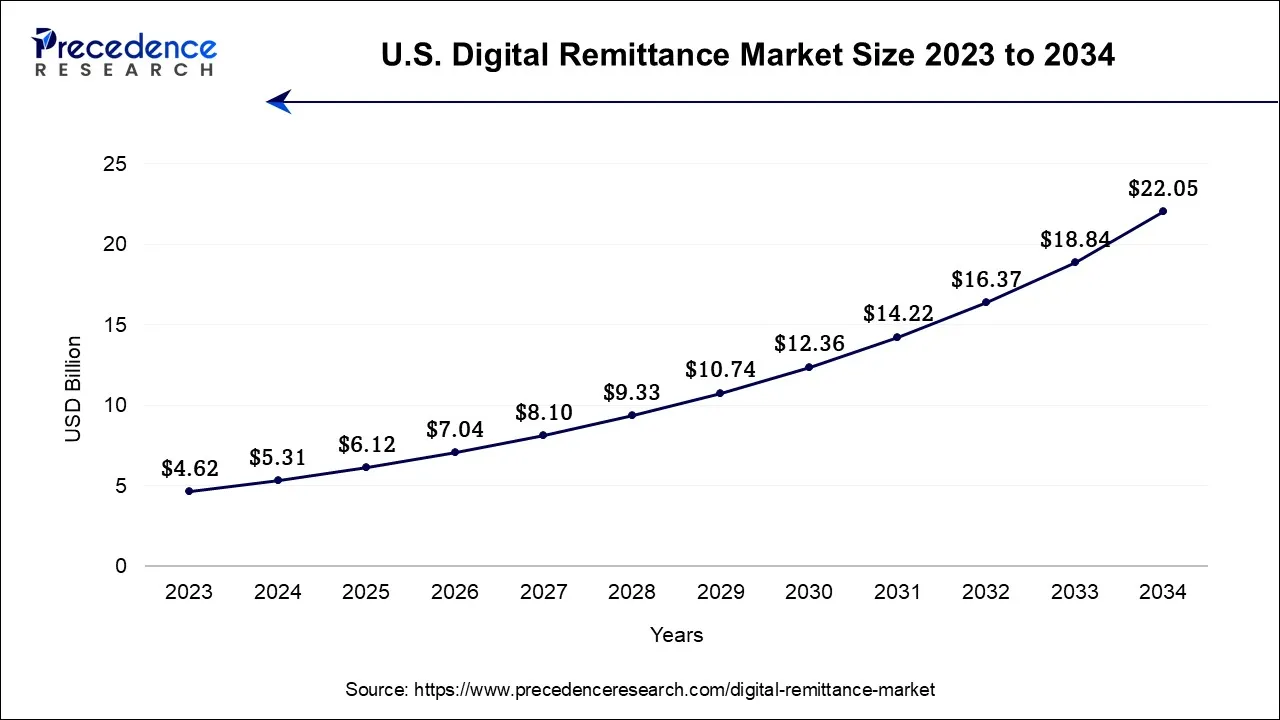

The U.S. digital remittance market size is accounted for USD 5.31 billion in 2024 and is projected to be worth around USD 22.05 billion by 2034, poised to grow at a CAGR of 15.3% from 2024 to 2034.

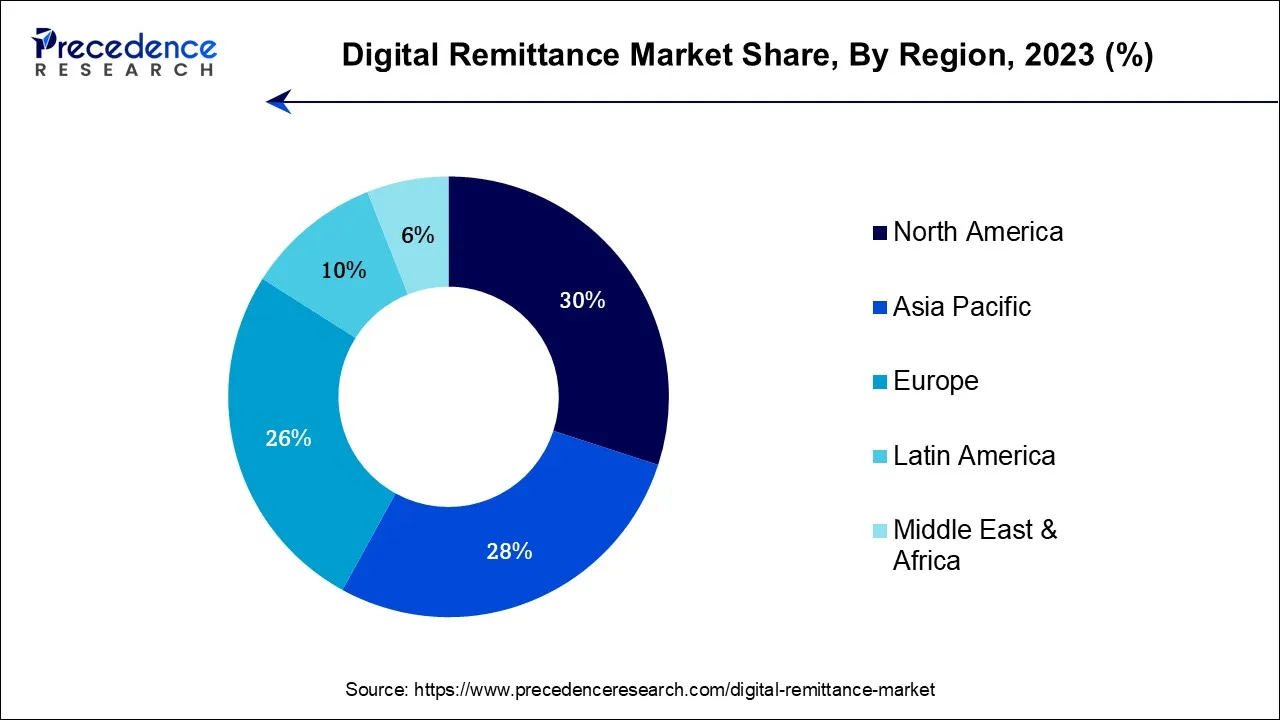

North America has held the largest revenue share of 30% in 2023. North America claims a significant share in the digital remittance market due to several key factors. First, the region boasts a substantial immigrant population, including a considerable number of remittance senders, who rely on digital channels for cross-border money transfers. Second, the well-developed financial infrastructure and high internet penetration rates in North America facilitate the adoption of digital remittance services. Furthermore, a competitive landscape and the presence of leading fintech companies offering innovative remittance solutions contribute to North America's dominant market position. Finally, a strong regulatory framework instills trust among users, further fueling the region's market share.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific secures a dominant growth in the digital remittance market due to several pivotal factors. Firstly, it boasts a substantial migrant worker population who frequently remit funds to their countries of origin, generating robust demand for cross-border remittance solutions. Secondly, the region's robust economic growth and accelerated digitalization have propelled the adoption of online and mobile payment platforms, fostering market expansion. Lastly, the supportive regulatory environment and government policies promoting fintech and digital payment initiatives, particularly in nations such as India, China, and the Philippines, have further catalyzed the growth of digital remittance services, reaffirming Asia-Pacific's prominent market growth.

The digital remittance market encompasses the utilization of digital advancements within the financial sector to facilitate the seamless transfer of funds across international borders. It entails the electronic transmission of money across nations, predominantly through online platforms or mobile applications, which offer unparalleled convenience, rapidity, and cost-efficiency in contrast to conventional channels.

This market has witnessed substantial expansion in recent times, propelled by globalization, augmented international migration, and the heightened adoption of digital payment solutions. Entities operating within this market provide services that empower individuals and enterprises to conduct international money transfers, rendering it an indispensable element of the worldwide financial landscape and a vigorously competitive sector characterized by continuous technological advancements.

The digital remittance sphere has emerged as a dynamic and transformative segment within the financial realm. It revolves around harnessing digital technology to expedite secure cross-border money transfers. This innovative approach has garnered attention due to its efficiency, cost-efficiency, and user-friendliness, surpassing conventional remittance methodologies. Key players offer online platforms and mobile applications that empower individuals and enterprises to conduct global fund transfers, cementing the digital remittance market as an integral component of the worldwide financial framework.

Numerous pivotal trends and growth catalysts are steering the digital remittance market's trajectory. Foremost among these is the rapid globalization and heightened international mobility, which amplifies the demand for streamlined cross-border fund transfers. Moreover, the ubiquitous adoption of smartphones and internet connectivity has further accelerated the digital remittance market's expansion, rendering it accessible to a wider audience. The ongoing evolution of blockchain and cryptocurrency-based remittance solutions also holds substantial potential, offering swifter and more secure transactions while reducing transaction costs.

Despite its promising prospects, the digital remittance sector encounters distinct challenges. Compliance with intricate regulations and disparate financial norms across diverse nations can pose formidable obstacles for service providers. Moreover, persistent concerns pertaining to cybersecurity and data privacy remain pertinent, given the industry's handling of sensitive financial data. Market competition is fierce, compelling companies to continually innovate to stand out and seize market share. Economic volatility and fluctuations in exchange rates can also impact the appeal of digital remittances for consumers.

Within these challenges lie significant business prospects. Concentrating on regulatory adherence and forging strategic alliances with financial institutions can aid companies in navigating the intricate regulatory landscape. Innovations in cyber security and data safeguarding can cultivate trust among users, positioning a provider as a secure option. The rising prominence of digital currencies and blockchain technology opens doors for companies to pioneer fresh, efficient remittance solutions. Furthermore, broadening service offerings to underserved regions and enhancing user experiences through intuitive interfaces can unlock hitherto untapped markets.

In summation, the digital remittance market is undergoing remarkable expansion propelled by globalization, technological advancements, and evolving consumer preferences. Nonetheless, it is not devoid of its share of challenges, ranging from regulatory intricacies to cybersecurity apprehensions. Nevertheless, these challenges can be transformed into opportunities through strategic initiatives and inventive solutions, positioning the digital remittance market as a pivotal player in the continually evolving landscape of international finance.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 15.1% |

| Market Size in 2024 | USD 25.30 Billion |

| Market Size by 2034 | USD 103.26 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Channel, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Globalization and international migration

Globalization and the surge in international migration play pivotal roles in propelling the digital remittance market's expansion. Firstly, the ongoing process of globalization fosters increased cross-border economic interactions and global trade, heightening the demand for efficient, cost-effective cross-border money transfer solutions. Digital remittance services aptly cater to this need, providing rapid, accessible, and often more economical avenues for international fund transfers, aligning seamlessly with the interconnected nature of contemporary global commerce. Secondly, the uptick in international migration has given rise to a larger diaspora of individuals residing and working abroad, many of whom regularly send financial support to their families and networks in their countries of origin.

Digital remittances emerge as a dependable and expeditious conduit for channeling these funds, ensuring that financial assistance reaches its intended recipients promptly and effectively. This reliance on digital remittance mechanisms underscores their relevance in serving a diverse, globally dispersed user base, thereby fortifying the market's role as a vital element within the intricate web of international finance.

Cybersecurity risks

Cybersecurity risks present a significant restraint on the digital remittance market's growth. As these services handle sensitive financial data and transactions, they become prime targets for cybercriminals seeking to exploit vulnerabilities. Security breaches, data theft, or fraudulent activities can erode user trust and confidence in digital remittance platforms. Such incidents not only result in financial losses for users but also inflict reputational damage on service providers, hindering market growth.

To mitigate these risks, digital remittance companies must allocate substantial resources to cybersecurity measures, including encryption, multi-factor authentication, and continuous monitoring. These investments add to operational costs and can reduce profit margins, impacting the competitiveness of digital remittance services. Moreover, regulatory bodies increasingly require stringent cybersecurity compliance, necessitating ongoing adaptations and investments to meet evolving standards. Failure to meet these regulatory requirements can result in legal challenges and penalties, further restraining market growth. Overall, the persistent and evolving nature of cybersecurity threats poses a substantial challenge to the digital remittance market's expansion and sustainability.

Blockchain and cryptocurrency integration

The integration of blockchain technology and cryptocurrencies within the digital remittance market is forging compelling opportunities for advancement and expansion. Blockchain's decentralized, immutable ledger system offers heightened security, transparency, and traceability, cultivating trust among users seeking dependable and secure cross-border transaction solutions, thus propelling market adoption. Meanwhile, cryptocurrencies, particularly stablecoins, introduce the potential for swift and cost-effective international transfers, effectively bypassing conventional intermediaries such as banks. This can translate into more competitive pricing and faster transaction settlements, effectively addressing longstanding grievances associated with traditional remittance methods.

Furthermore, the versatility of blockchain and cryptocurrencies allows providers to penetrate previously underserved markets with limited banking infrastructure, significantly broadening the market's accessibility and global reach. With these technologies continually maturing and gaining acceptance, digital remittance entities that embrace them can distinguish themselves, captivate tech-savvy clientele, and innovate new revenue streams, strategically positioning themselves for success within this rapidly evolving industry.

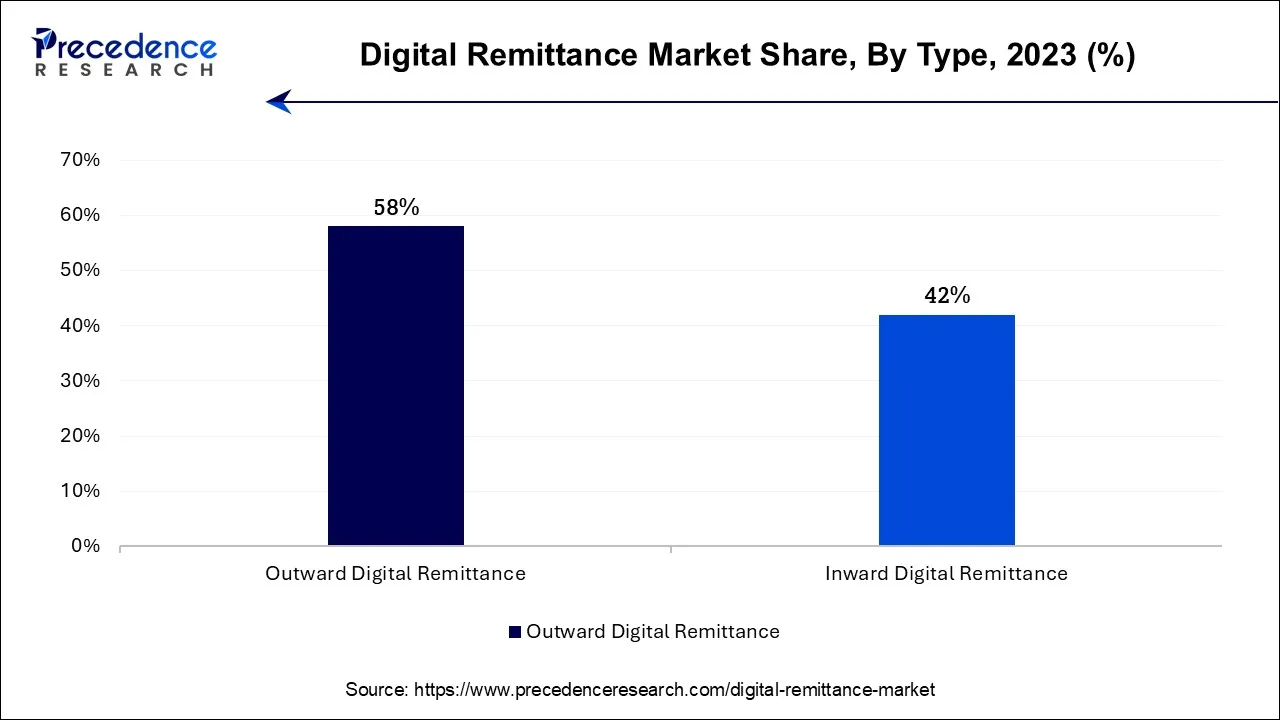

According to the Type, the outward digital remittance sector has held 58% revenue share in 2023. The outward digital remittance segment holds a major share in the market due to several reasons. Firstly, it caters to the substantial demand from individuals and businesses sending money across borders to support families, invest, or conduct international trade. Secondly, the segment benefits from the convenience, speed, and cost-effectiveness of digital platforms compared to traditional methods.

Additionally, globalization and increased international migration have fueled the need for outward remittances. Lastly, providers have focused on expanding their outbound services to reach a wider customer base, solidifying the segment's dominance in the digital remittance market.

The inward digital remittance sector is anticipated to expand at a significantly CAGR of 18.7% during the projected period. The inward digital remittance segment commands a substantial growth in the market due to several key factors. Firstly, it caters to the significant volume of international migrants who send money to their home countries, reflecting the growing trend of global migration. Secondly, it benefits from the convenience and cost-effectiveness of digital platforms, which are often preferred by recipients. Additionally, inbound remittances are generally less susceptible to regulatory barriers compared to outbound transfers. As a result, service providers focus on enhancing the accessibility, speed, and competitive pricing of inward digital remittance services, contributing to their dominant market growth.

In 2023, the money transfer operators sector had the highest market share of 39.8% on the basis of the Channel. Money transfer operators (MTOs) hold a significant share in the remittance market due to their established networks, wide accessibility, and trusted brand recognition. They have built robust partnerships and extensive agent networks, allowing them to reach even remote areas. Additionally, MTOs offer various options for sending and receiving money, catering to diverse customer preferences. Their familiarity and long-standing presence in the market instill confidence in users, particularly in regions with limited digital infrastructure. While digital remittance is growing, MTOs continue to play a vital role in serving the needs of millions of customers, contributing to their dominant market share.

The online platforms is anticipated to expand at the fastest rate over the projected period. Online platforms command a substantial growth in the digital remittance market primarily due to their user-friendly interfaces, convenience, and round-the-clock accessibility. These platforms empower users to initiate cross-border fund transfers effortlessly, utilizing their devices from virtually anywhere.

The ubiquity of smartphones and internet connectivity has further amplified the dominance of online platforms. Moreover, they frequently provide competitive exchange rates and reduced transaction costs in comparison to conventional banking avenues or physical remittance agents. Consequently, consumers and enterprises are increasingly opting for the rapidity, cost-effectiveness, and ease of use offered by online platforms, underscoring their significant market growth.

The personal segment held the largest revenue share of 44.9% in 2023. The personal segment holds a major share in various markets due to its substantial user base and diverse needs. In the context of digital remittance, the personal segment includes individual users sending money to family members, friends, or for personal expenses. This segment dominates the market because of the sheer volume of personal transactions made on a regular basis, often driven by factors like international migration, education, and financial support for loved ones. The convenience, speed, and cost-effectiveness of digital remittance services appeal to this broad user base, making it a dominant force in the market.

The migrant labor workforce is anticipated to grow at a significantly faster rate, registering a CAGR of 15.9% over the predicted period. The migrant labor workforce segment exerts significant growth on the market owing to its substantial impact on cross-border remittances. Migrant workers consistently remit a substantial portion of their earnings to their home nations, supporting their families and local communities. Consequently, they heavily rely on digital remittance services for efficient, cost-effective money transfers. The sheer magnitude of the global migrant labor force, coupled with the frequency and magnitude of their financial transactions, positions them as a dominant and influential user category, cementing their role as a primary driving factor within the digital remittance market.

Segments Covered in the Report

By Type

By Channel

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024