List of Contents

Disappearing packaging Market Size and Forecast 2024 to 2034

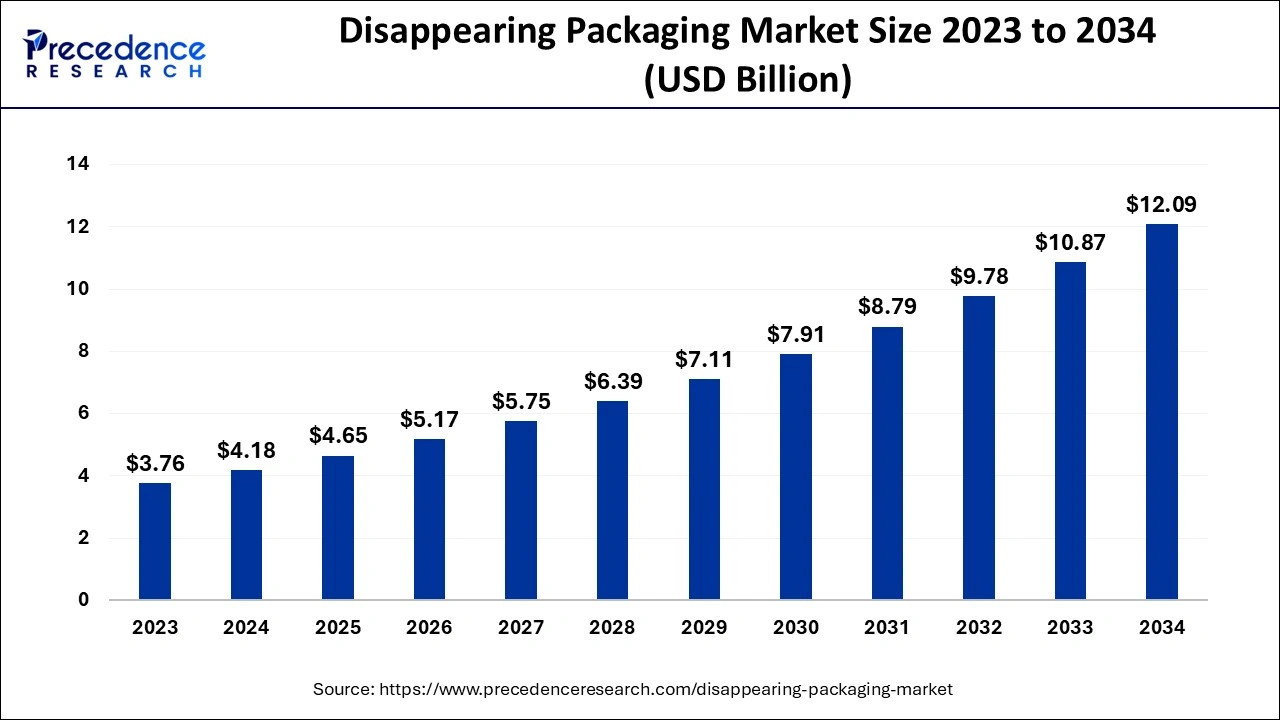

The global disappearing packaging market size is estimated at USD 4.18 billion in 2024 and is anticipated to reach around USD 12.09 billion by 2034, expanding at a CAGR of 11.20% from 2024 to 2034.

Disappearing packaging Market Key Takeaways

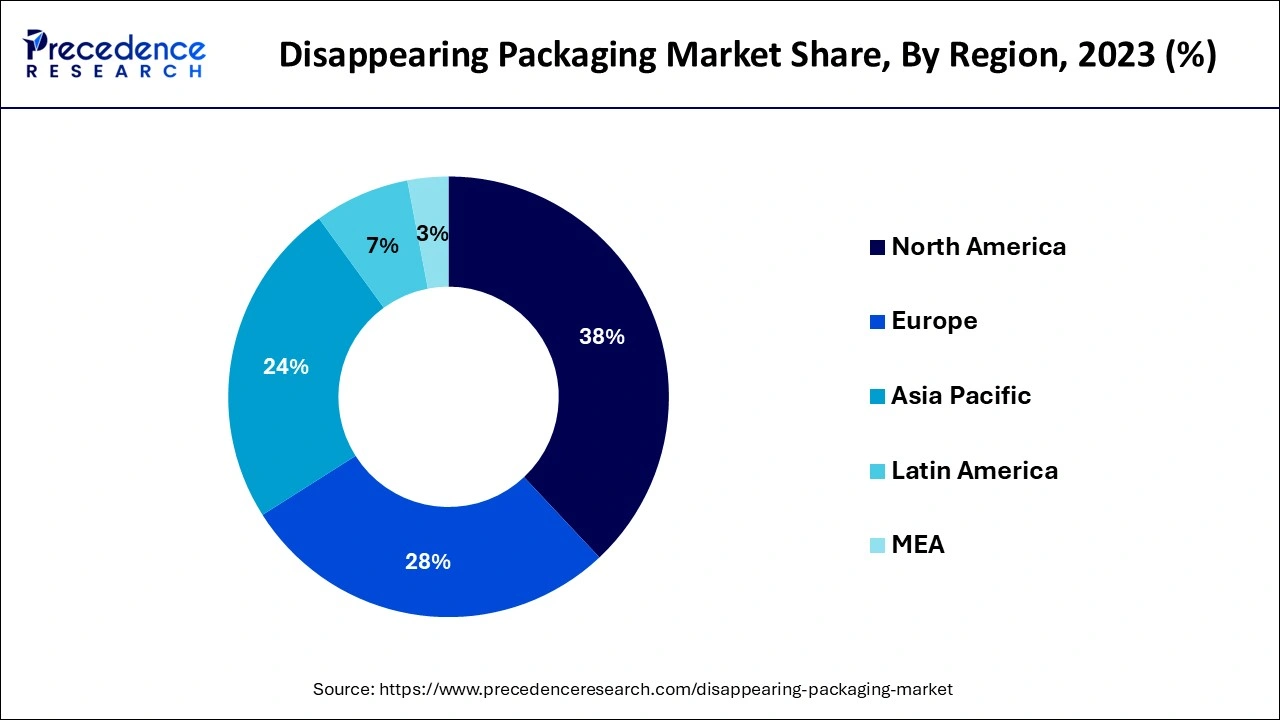

- North America dominated disappearing packaging market in 2023.

- By material, the polymer segment led the market in 2023.

U.S. Disappearing packaging Market Size and Growth 2024 to 2034

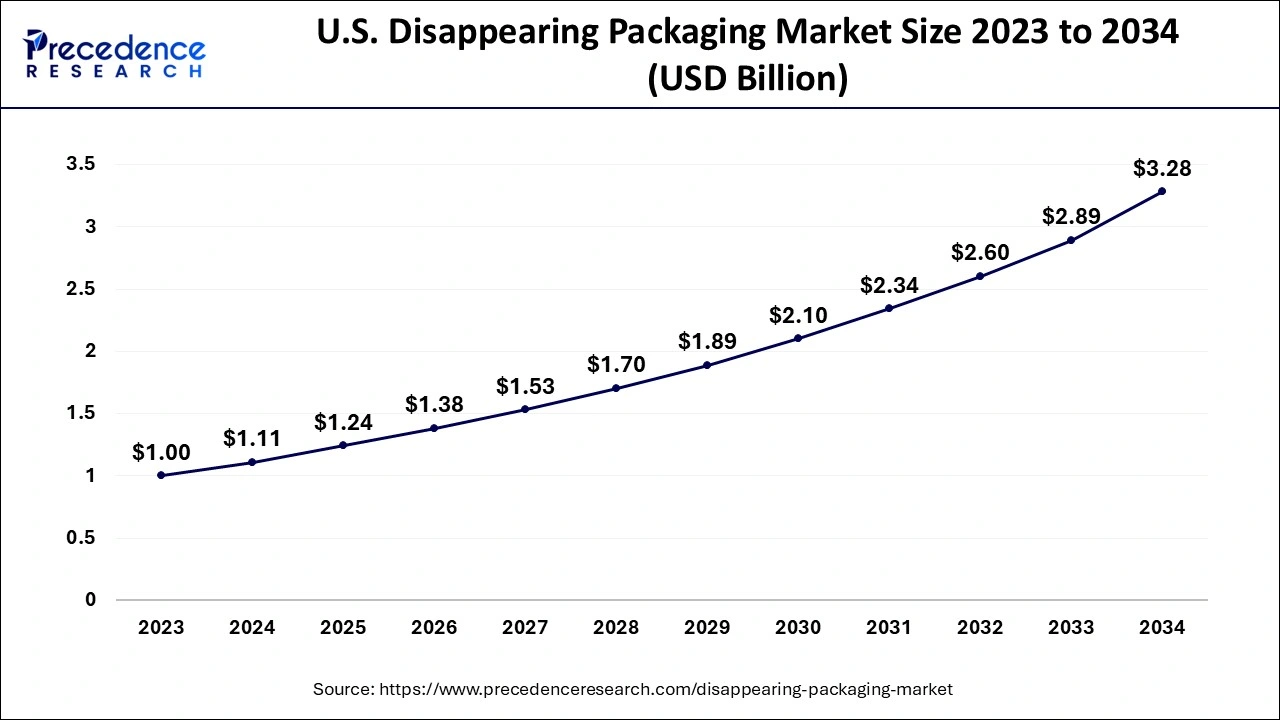

The U.S. disappearing packaging market size is evaluated at USD 1.11 billion in 2024 and is predicted to be worth around USD 3.28 billion by 2034, rising at a CAGR of 11.40% from 2024 to 2034.

The disappearing packaging industry is expected to be one of the major revenue-generating areas in North America, which had a market value of around USD 928.49 million in 2023. Due to early technological development, significant investment in environmentally friendly products, and increased consumer awareness, the United States accounts for a sizable portion of the region's value. As a result, disappearing packaging materials are increasingly replacing traditional plastic packaging, which costs more to decompose and severely harms aquatic life if left in the environment. Additionally, a growing number of US states are outlawing the use of plastics. Eight states in the United States have passed laws prohibiting the use of single-use plastic containers, including California, Delaware, New York, Connecticut, Oregon, Hawaii, Vermont, and Maine.

Market Overview

Using the Disappearing Package technology, it is feasible to make clothing packaging sustainable or even "disappear" after use. Its manufacturing detergent will disintegrate in a washing machine. Secondhand clothes shops, which are well-liked by consumers who are already motivated to recycle, are the ideal users of this packaging since they may advise customers to recycle the package in the washing machine with the item they bought. The material of choice is robust, has brief water resistance, and is completely dissolve at 40 degrees Celsius. The endeavor can serve as motivation for a circular economy.

The packaging sector is implementing procedures that promote environmental welfare. The rising usage of the vanishing materials for packaging across several industry verticals is being driven by the need for inexpensive, sustainable, and robust packaging material.

Most packaging that is disappearing is constructed of extremely useful packaging materials, which ensure sustainable end-of-life options. Packaging material makers typically like the materials that are totally compatible with plastics production equipment and do not require any extra pieces of gear for their formulation in order to replace their present product line with the highly desired vanishing packaging. By doing this, the availability of this substance would rise globally.

The majority of packaging that is being phased out is made of incredibly practical packaging materials that provide sustainable end-of-life solutions. In order to replace their current product line with the highly sought disappearing packaging, packaging material manufacturers often prefer materials that are completely compatible with plastics manufacturing equipment and do not require any additional pieces of equipment for their formulation. This would increase this substance's accessibility on a worldwide scale. Due to growing public awareness of the harmful environmental impacts of single-use plastics and government initiatives to restrict their use, the market for disappearing packaging has developed significantly.

Numerous packaging businesses can greatly benefit from using disappearing packaging, which is also less expensive than traditional plastic packaging. The rise of different industries and businesses has also raised the demand for a sustainable packaging solution. When making purchases, consumers are growing more and more worried about the environment, sustainability, ethics, safety, product price, and quality. Demand for disappearing packaging has increased as a result of the expanding use of disappearing packaging across a variety of industries, including medicines, food and beverage, agricultural, chemical, and water treatment, as well as the growing environmental and sustainability concerns. The market for disappearing packaging has grown dramatically as a result of increased public awareness of the negative environmental effects of single-use plastics and government action to outlaw their usage.

The supply chain was hampered by the present COVID-19 outbreak, which drastically decreased market value internationally. Global goliaths like the US and EU regions have been significantly impacted by the COVID-19 conundrum. Engineering companies, construction companies, original equipment manufacturers (OEMs), and other service providers are among the affected petrochemical enterprises.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.18 Billion |

| Market Size by 2034 | USD 12.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Raw Materials, Grade, End Use, and System |

Market Dynamics

Key Market Drivers

- Growing use as a sustainable and environmentally friendly packaging material: The market for disappearing packaging is expanding as a result of rising demand for these films and their growing use as a sustainable and environmentally friendly packaging material. Additionally, the benefits and simplicity of use are encouraging manufacturers to implement them in the workplace. For example, they enable detergent manufacturers to offer single-use packets that reduce wastage, spillage, and end-user overdosing. These disintegrating packing materials also aid in safeguarding industrial workers from direct contact with dangerous products in the chemical industry.

- Increasing Consumption of Household Products- The increasing need to reduce the amount of waste created globally is expected to raise the demand for disappearing packaging solutions. Because they disappear right away, these packaging materials are kind to the environment and considerably minimize pollution. Rising consumer demand for home goods, growing concern over the accumulation of non-decomposable waste, and increased adoption of eco-friendly packaging solutions are all expected to have a positive influence on the market for disappearing packaging in the coming years. These packaging alternatives are not only beneficial to the environment, but they also help consumers cut down on waste by standardizing the amount of washing powder required for each wash. Other significant growth-promoting variables include increasing disposable incomes, escalating worries about product leakage or spills, expanding industrialization, and a strong need for portable packaging.

Key market challenges

- Meeting Consumer Expectations & Current Standards - Brands naturally don't want to offer consumers a reason to try a competitor's product in its place because consumers might be fickle. Although consumer demand is evolving in favor of sustainability, this creates a significant issue since customers still want the same high-quality experience they've always enjoyed. Additionally, when used for packaging, sustainable materials must perform on par with non-sustainable alternatives. Beyond satisfying customer expectations, this also addresses the problem of food waste and/or product damage. There can be no compromises as the purpose of packing is to preserve the items within.

Key market opportunities

- Growing awareness about the environmental concerns: One of the factors driving the expansion of the disappearing packaging market is the global increase in environmental consciousness related to the use of plastic packaging. Due to their non-orderability traits, these technologies for disappearing packaging are leading consumers to believe that they are safer than plastic packaging. One of the key opportunities for the market for disappearing packaging to increase its net worth in the future is the life cycle of these packaging items and how eco-friendly people feel using them.

- Emergence of sustainable and eco-friendly detergent products:- One of the factors driving the expansion of the disappearing packaging market is the global increase in environmental consciousness related to the use of plastic packaging. Due to their non-orderability traits, these technologies for disappearing packaging are leading consumers to believe that they are safer than plastic packaging. One of the key opportunities for the market for disappearing packaging to increase its net worth in the future is the life cycle of these packaging items and how eco-friendly people feel using them.

Raw Materials Insights

The primary component and leading market share for disappearing packaging is polymer. Due to its extremely low toxicity, polyvinyl alcohol may be easily dissolved in water and is frequently utilized in a variety of commercial, industrial, medicinal, and food-grade applications. High levels of hydrolysis in the polyvinyl alcohol formulation make the product ideal for commercial packaging uses with a moderate range of operating temperatures, where the end-use product is entirely suitable for use and doesn't disintegrate. In comparison to bioplastics and many other conventional polymers, polyvinyl alcohol has a high strength resistance capability and excellent flexibility, making it a viable raw material for this use case.

Grade Insights

Due to a number of regulatory requirements that require the use of food-grade polymers for any applications involving direct contact with food, food-grade usage accounts for the largest portion of the market for disappearing packaging. Additionally, widespread use of packaged food applications has boosted demand for materials for disappearing packaging. However, due to rising worries over medical utilized wastes, a significant increase rate in the medical-grade utilization has been noted. Hospitals, clinics, and other healthcare institutions frequently discard packing materials that may have been used to package extremely contagious illnesses. This type of packaging is becoming increasingly popular among hospitals since it decomposes quickly in nature.

End Use Insights

Some of the most lucrative applications for disappearing packaging are found in the food and beverage industry. Nearly 8 million tons of plastic waste from the food and beverage industry is dumped in the ocean. Plastic product bans are being progressively enacted by several nations. The alternatives to plastic packaging that can effectively replace the plastic packaging in this situation are not easily accessible and are not cost-effective either. Demand for plastic packaging that readily decomposes at incredibly low cost, such water-soluble polymers, is highly high. In addition to food and drink, the end-uses in healthcare are expanding quickly because of the growing worry over communicable illnesses. Healthcare groups are focusing on infection control bags for everyday use and collaborating with businesses that produce plastic packaging that dissolves in water.

Disappearing Packaging Market Companies

- Lithey Inc. (India)

- Mondi Group (Austria)

- Sekisui Chemicals (Japan)

- Kuraray Co. Ltd. (Japan)

- Mitsubishi Chemical Holdings (Japan)

- Aicello Corporation (Japan)

- Aquapak Polymer Ltd (UK)

- Lactips (France)

- Cortec Corporation (US)

- Acedag Ltd. (UK)

- MSD Corporation (China)

- Prodotti Solutions (US)

- JRF Technology LLC (US)

- Amtopak Inc. (US)

Recent Developments

- With his inventive toothbrush packaging, French-Canadian designer Simon Laliberté placed third in the 2012 'Remarkable Packaging & Alternatives' competition in Paris. The inventor utilized paper created from cellulose-based wood pulp, which dissolves in water in less than ten seconds, to create the denture-shaped container. PVA, which is 100% recyclable and non-toxic, is used to mold the paper.

- The Finisterre clothing manufacturer will introduce garment packaging bags produced from Aquapak polymer in October 2019 through Aquapak Polymer Ltd. (UK). The business wants to switch out conventional packaging for soluble packaging.

Segments covered in the report

By Raw Materials

- Polymers

- Surfactants

- Fibers

By Grade

- Fruits

- Citrus Fruits

- Berries

- Other fruit types

- Vegetables

- Roots and Tubers

- Brassicas

- Flowers and Ornamentals

- Nursey Crops

- Other product types

By End Use

- Glass Greenhouse

- Horticulture Glass

- Other Glass Greenhouse

- Plastic Greenhouse

- Polyethylene

- Polycarbonate

- Polymethly-methacrylate

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client