What is the Disaster Preparedness Systems Market Size?

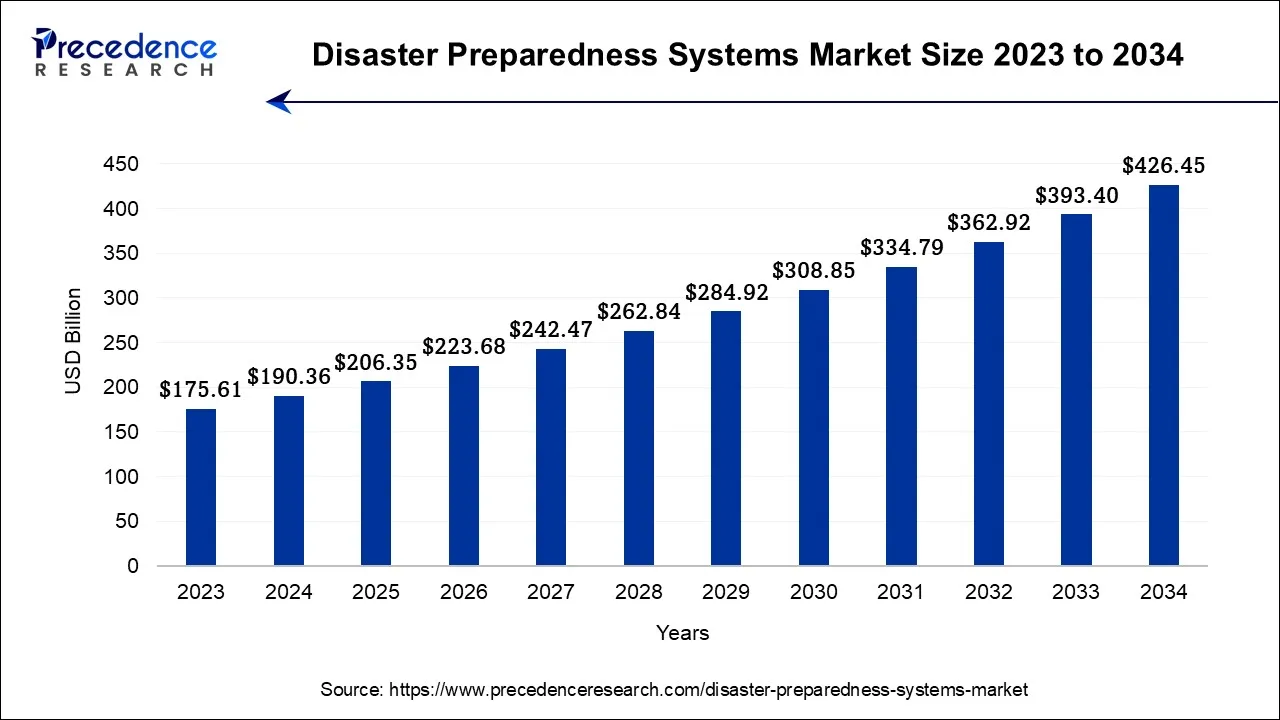

The global disaster preparedness systems market size is valued at USD 206.35 billion in 2025 andis predicted to increase from USD 223.68 billion in 2026, toapproximately reach around USD 426.45 billion by 2034, expanding at a CAGR of 8.4% over the forecast period from 2025 to 2034.

Disaster Preparedness Systems Market Key Takeaways

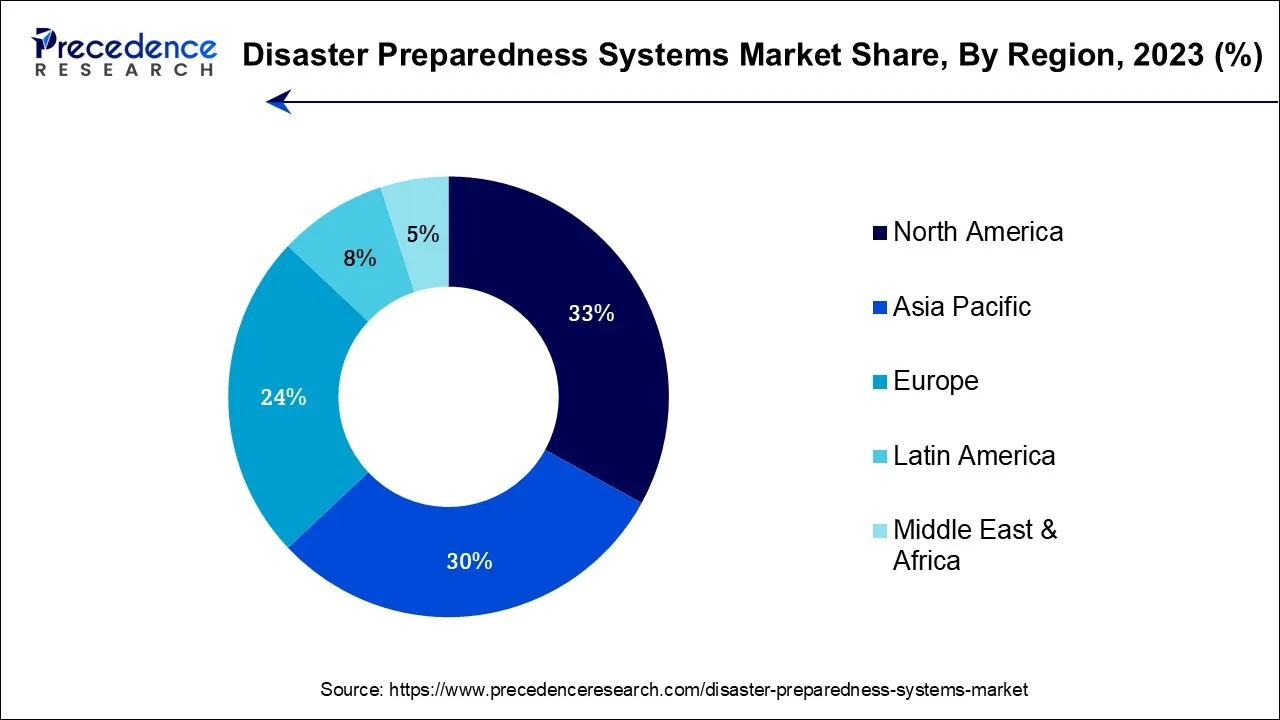

- North America led the global market with the highest market share of 33% in 2024.

- By Solution, the disaster recovery solutions segment contributed more than 43% of revenue share in 2024.

- By Solution, the situational awareness solutions segment is expected to expand at a notable CAGR of 8.7% from 2025 to 2034.

- By Services, the consulting services segment contributed more than 39% of revenue share in 2024.

- By Services, the training & education services segment is projected to grow at the fastest CAGR over the projected period.

- By Type, the surveillance system segment generated more than 35.8% of revenue share in 2024.

- By Type, the earthquake/seismic warning system segment is estimated to expand at the fastest CAGR over the projected period.

- By End-use, the BFSI segment held the biggest revenue share of 19.9% in 2024.

- By End-use, the healthcare segment is anticipated to expand at a noteworthy CAGR of 9.9% from 2025 to 2034.

- By Communication Technology, the emergency response radars segment captured 29.1% of revenue share in 2024.

- By Communication Technology, the first responder tools segment is registering at a CAGR of 9.8% from 2025 to 2034.

Market Overview

The realm of disaster preparedness system market is a dynamic and intricate industry, providing a vast array of specialized products and services tailored towards the mitigation, orchestration, and response to disasters and crises on a comprehensive scale. This sector boasts a diverse spectrum of solutions, including state-of-the-art early warning systems, sophisticated crisis communication platforms, intricately devised evacuation blueprints, resilient disaster recovery offerings, and all-encompassing educational initiatives.

Within this landscape, governments, municipalities, corporations, and individuals find the means to fortify their preparedness and adaptability, spanning a wide array of natural and human-induced cataclysms, ranging from cutting-edge seismic alerts to the intricate choreography of evacuation procedures and the in-depth knowledge dissemination found in comprehensive educational curricula. Given the relentless increase in both frequency and intensity of such calamitous events, the disaster preparedness system market plays a pivotal role in safeguarding lives, preserving critical infrastructure, and nurturing the development of pioneering solutions and continual market expansion.

Disaster Preparedness Systems Market Outlook

- Market Overview:Between 2024 and 2034, the disaster preparedness systems market is expected to grow significantly, driven by greater global awareness of natural hazards, climate-related events, and industrial risks. Companies and major infrastructure operators are adopting disaster management platforms to ensure business continuity. The growing use of IoT-enabled sensors, drones, and AI-powered monitoring solutions that provide real-time situational awareness is boosting growth.

- Technological Advancements: The disaster preparedness landscape is being reshaped by advanced technologies such as AI, machine learning, predictive analytics, and cloud-based platforms. Companies like IBM and NEC Corporation are using AI-driven modeling to predict the potential impacts of disasters and to determine how resources should be allocated during emergencies. In addition, IoT sensors and smart infrastructure solutions from firms such as Honeywell and Siemens enable real-time monitoring of buildings, bridges, and urban environments to detect potential hazards before they escalate.

- Global Expansion:Market leaders are strategically expanding their presence across high-risk and emerging regions to capitalize on increasing demand for disaster preparedness solutions. Lockheed Martin has collaborated with Southeast Asian governments to install command and control systems to manage disasters in urban areas. In Europe, Motorola Solutions is deploying mass notification and communication platforms to both public institutions and individual businesses. Countries in the Asia-Pacific, such as India, Indonesia, and Japan, are making significant investments in early warning and emergency management systems as they become more vulnerable to natural disasters.

- Major Investors: The disaster preparedness systems market is drawing interest from both strategic and private equity investors due to its long-term growth prospects and strong alignment with ESG initiatives. Recurring government contracts, high technology integration, and increasing global focus on resilient infrastructure are key factors appealing to investors. Software platforms, mass notification systems, and predictive analytics solutions have become major investment areas for firms like KKR, Carlyle Group, and Blackstone. Innovation, especially in AI-driven emergency management and cloud-based crisis site startups, is also being propelled by venture capital.

- Startup Ecosystem: The startup ecosystem within disaster preparedness is rapidly evolving, with emerging companies introducing innovative technologies that fill gaps in early warning, response, and recovery. Companies like Alertus Technologies (US) and Juvare (US) are also offering scalable alerting solutions, cloud-based incident management, and real-time tools to coordinate emergency responders. The North American, European, and Asian-Pacific regional hubs are also becoming centers of innovation for new advanced disaster preparedness programs, technological development, and market growth.

Disaster Preparedness Systems Market Growth Factors

The disaster preparedness system market is surging ahead, fueled by a confluence of factors. As the frequency and intensity of both natural and man-made disasters continue to rise, the demand for comprehensive solutions that can effectively mitigate, manage, and respond to these crises has escalated significantly. Governments worldwide are instituting stringent regulations and committing substantial budgets to bolster disaster preparedness, making it a paramount focus of public policy. In this dynamic landscape, the market offers a wide spectrum of products and services, ranging from cutting-edge early warning systems and crisis communication tools to intricate evacuation planning solutions and robust disaster recovery services.

One of the foremost growth catalysts is the unabating surge in the frequency and severity of disasters, encompassing hurricanes, wildfires, floods, and cyber incursions. This heightened risk perception has spurred governments, municipalities, businesses, and individuals to prioritize disaster preparedness, propelling the market's expansion.

Moreover, the increasing recognition and education surrounding disaster preparedness are playing a pivotal role in driving market growth. As awareness grows and stakeholders acknowledge the paramount importance of readiness, investments in training programs and the adoption of cutting-edge solutions to bolster resilience in the face of impending crises have become commonplace.

Despite its burgeoning potential, the disaster preparedness system market confronts several daunting challenges. One significant impediment revolves around the considerable costs associated with implementing comprehensive disaster preparedness measures. Smaller enterprises and cash-strapped municipalities may grapple with resource constraints when it comes to investing in the requisite systems and services, thus exacerbating disparities in resilience levels.

Another formidable challenge lies in the intricate coordination required to harmonize disaster preparedness endeavors among diverse stakeholders. Effective disaster management often hinges on seamless collaboration between governmental bodies, private sector entities, and community organizations, a logistical feat that can be demanding to execute seamlessly.

Amid these challenges, lucrative business prospects await savvy enterprises. Companies adept at delivering cost-effective solutions tailored to the unique requirements of smaller businesses and communities can exploit underserved segments of the market. Furthermore, firms specializing in interoperable and user-friendly disaster management platforms that facilitate seamless cooperation between a diverse array of stakeholders are poised for significant gains.

In summation, the disaster preparedness system market is riding a wave of substantial growth, driven by heightened disaster risks, government initiatives, technological progress, and heightened awareness. However, challenges related to costs and coordination must be surmounted. By devising innovative, cost-efficient, and collaborative solutions, businesses can seize the burgeoning market opportunities and contribute to global resilience in the face of mounting disaster threats.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 206.35 Billion |

| Market Size in 2026 | USD 223.68 Billion |

| Market Size by 2034 | USD 426.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.4% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Services, Communication Technology, Communication Technology, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Escalating disaster frequency and severity

The escalating frequency and severity of disasters are pivotal drivers of growth in the disaster preparedness system market. The growing risk perception compels stakeholders to proactively invest in disaster preparedness, thereby stimulating market expansion. Secondly, the severity of these disasters often results in extensive damage, economic losses, and human suffering. Consequently, governments are allocating substantial budgets to fortify disaster response capabilities, creating a lucrative market environment for solutions and services. Additionally, the unpredictability and complexity of modern disasters necessitate innovative technologies and strategies. The market benefits from increased demand for advanced early warning systems, data analytics, and communication tools to better prepare for, respond to, and recover from crises. In summary, the rising frequency and severity of disasters act as a catalyst for market growth by compelling stakeholders to prioritize and invest in disaster preparedness system to mitigate risks and enhance resilience in the face of mounting threats.

Restraints

Resource allocation challenges

Resource allocation challenges present a significant impediment to the expansion of the disaster preparedness system market. While the demand for robust disaster readiness systems continues to surge, governments and organizations often grapple with the intricate task of allocating adequate resources, including financial investments and skilled personnel, to support these critical initiatives. To begin, budgetary constraints can curtail the ability to invest comprehensively in preparedness systems. Many governments and entities contend with competing priorities, potentially relegating disaster preparedness to a secondary position due to more immediate concerns.

Furthermore, the allocation of resources to secure the necessary expertise and personnel for planning, implementing, and maintaining disaster preparedness systems can strain already limited capacities. Acquiring and retaining skilled professionals in this field can be an arduous undertaking, particularly in regions grappling with a dearth of specialized talent. Moreover, challenges in resource allocation may hinder the development of crucial infrastructure required for effective disaster readiness, such as the establishment of emergency shelters, well-defined evacuation routes, and robust communication networks. These resource-related constraints underscore the urgency of devising innovative funding mechanisms, fostering public-private collaborations, and optimizing the utilization of resources to surmount the financial and staffing obstacles constraining the growth prospects of the market.

Opportunities

Technological advancement in AI

Public-private partnerships (PPPs) are playing a pivotal role in creating significant opportunities within the disaster preparedness system industry. These collaborations between government entities and private sector organizations are fostering innovation, resource-sharing, and mutually beneficial ventures. Firstly, PPPs enable access to additional funding and resources.

Governments often allocate substantial budgets for disaster preparedness, and private sector participation can amplify these resources, allowing for the development of more advanced and comprehensive solutions. Secondly, private sector expertise brings innovation and efficiency to disaster preparedness. Companies specialized in technology, data analytics, and infrastructure can introduce cutting-edge tools and systems that enhance early warning, response, and recovery efforts.

Furthermore, PPPs facilitate knowledge exchange and capacity building. Collaboration between public and private entities encourages the transfer of expertise, leading to the development of skilled workforces and the proliferation of best practices. Lastly, PPPs open doors to global expansion. Private sector partners can help governments implement disaster preparedness systems that align with international standards, potentially leading to market expansion beyond domestic borders.

In summary, public-private partnerships are instrumental in catalyzing opportunities within the disaster preparedness system sector by combining resources, expertise, innovation, and global reach to develop robust and effective solutions for disaster mitigation and response.

Segment Insights

Solution Insights

According to the Solution, the disaster recovery solutions sector has held 43% revenue share in 2024. The disaster recovery solutions segment commands a significant share in the market due to its indispensable role in safeguarding businesses and organizations against data loss and downtime during and after disasters. With the increasing frequency of cyberattacks, natural disasters, and system failures, businesses are prioritizing the continuity of operations. Disaster recovery solutions offer reliable data backup, quick system restoration, and business continuity planning, ensuring minimal disruption. Additionally, regulatory compliance requirements and the growing volume of critical data have spurred investments in robust disaster recovery strategies, making this segment a vital and substantial part of the market.

The situational awareness solutions sector is anticipated to expand at a significant CAGR of 8.7% during the projected period due to its pivotal role in enhancing real-time understanding and decision-making during crises. These solutions offer comprehensive data collection, analysis, and visualization tools, providing stakeholders with critical information to respond effectively. With the increasing frequency and complexity of disasters, governments, businesses, and organizations are prioritizing situational awareness to improve disaster response and minimize damage. As a result, this segment experiences robust demand and growth, making it a major contributor to the overall market growth.

Services Insights

Based on the Services, consulting services is anticipated to hold the largest market share of 39% in 2024. The consulting services segment holds a major share in the disaster preparedness system market because it plays a critical role in guiding governments and organizations in developing effective disaster preparedness strategies. Consulting firms provide expertise in risk assessment, planning, and implementation of tailored solutions. They offer valuable insights, facilitate regulatory compliance, and help optimize resource allocation. In an increasingly complex and evolving threat landscape, consulting services are in high demand to assess vulnerabilities, design resilient systems, and ensure efficient response mechanisms, making them a cornerstone of disaster preparedness efforts and a major shareholder in the market.

On the other hand, the training & education services sector is projected to grow at the fastest rate over the projected period. The training & education services segment holds significant growth in the disaster preparedness system market due to its pivotal role in enhancing preparedness and response capabilities. With increasing awareness of disaster risks, individuals, organizations, and governments are prioritizing education and training programs to equip themselves with the necessary knowledge and skills. These services offer practical insights, best practices, and hands-on experience in disaster management, fostering resilience. As a result, the Training & Education Services segment plays a crucial part in empowering stakeholders to effectively utilize disaster preparedness tools and systems.

Type Insights

In 2024, the surveillance system sector had the highest market share of 35.8% on the basis of the Type. The Surveillance System segment commands a significant share in the market due to its paramount importance in disaster preparedness. Surveillance systems provide real-time monitoring of critical infrastructure, early detection of potential threats, and situational awareness during disasters. The integration of advanced technologies like AI and IoT has enhanced their capabilities. Governments, businesses, and organizations prioritize these systems to mitigate risks and respond swiftly to emergencies. Additionally, the increasing need for security and resilience in an unpredictable world further drives the demand for surveillance solutions, solidifying its substantial market share.

The earthquake/seismic warning system is anticipated to expand at the fastest rate over the projected period. Earthquake and seismic warning systems hold substantial market growth due to their critical role in safeguarding lives and infrastructure. These systems provide real-time alerts, allowing for early evacuation and minimizing damage during seismic events. As earthquake-prone regions grow, governments and organizations prioritize these systems to mitigate risks. Technological advancements, including AI and IoT, have enhanced the accuracy and effectiveness of these warning systems. Additionally, heightened public awareness and regulatory support further drive the demand for earthquake/seismic warning systems, solidifying their significant growth in the market.

End-use Insights

The BFSI segment held the largest revenue share of 19.9% in 2024. The Banking, Financial Services, and Insurance (BFSI) sector holds a major share in the disaster preparedness system industry due to its inherent vulnerability to various risks. BFSI institutions manage critical financial data, transactions, and customer information, making them high-value targets for cyberattacks and data breaches. Consequently, they prioritize robust disaster preparedness systems to ensure business continuity, protect customer assets, and comply with regulatory requirements. Additionally, financial institutions' global reach and interconnectedness necessitate comprehensive disaster readiness, further driving their significant presence in the market.

The healthcare sector is anticipated to grow at a significantly faster rate, registering a CAGR of 9.9% over the predicted period. Healthcare holds a significant growth in the disaster preparedness system industry due to its critical role in ensuring public health and safety during disasters and emergencies. Healthcare facilities require advanced preparedness systems to maintain operations, patient care, and vital services during crises, such as natural disasters and pandemics. These systems include emergency response plans, communication tools, medical supplies, and surge capacity solutions. The COVID-19 pandemic further emphasized the importance of robust healthcare preparedness, driving investments and innovation in this sector.

Communication Technology Insights

The emergency response radars sector has generated a revenue share of 29.1 % in 2024. Emergency response radars hold a major share in the market due to their crucial role in disaster management. These radars provide real-time data on weather patterns, natural disasters, and other emergencies, enabling early warning and rapid response. Their accuracy and speed in detecting threats like storms, hurricanes, and wildfires make them indispensable. Additionally, advancements in radar technology have enhanced their capabilities, further driving demand. Governments, first responders, and industries increasingly rely on these radars to save lives, protect property, and mitigate the impact of disasters, solidifying their significant market share.

The first responder tools sector is anticipated to grow at a significantly faster rate, registering a CAGR of 9.8% over the predicted period. First responder tools hold a major share in the disaster preparedness market due to their pivotal role in immediate crisis management. These tools encompass communication devices, protective gear, and equipment critical for rapid response and effective coordination during emergencies. With an increasing frequency of disasters, governments and organizations prioritize equipping their first responders with cutting-edge technology to enhance their efficiency and safety. As a result, investments in these tools remain high, contributing significantly to the market share as they form the frontline defense against disasters, ensuring swift and organized responses, ultimately saving lives and minimizing damage.

Regional Insights

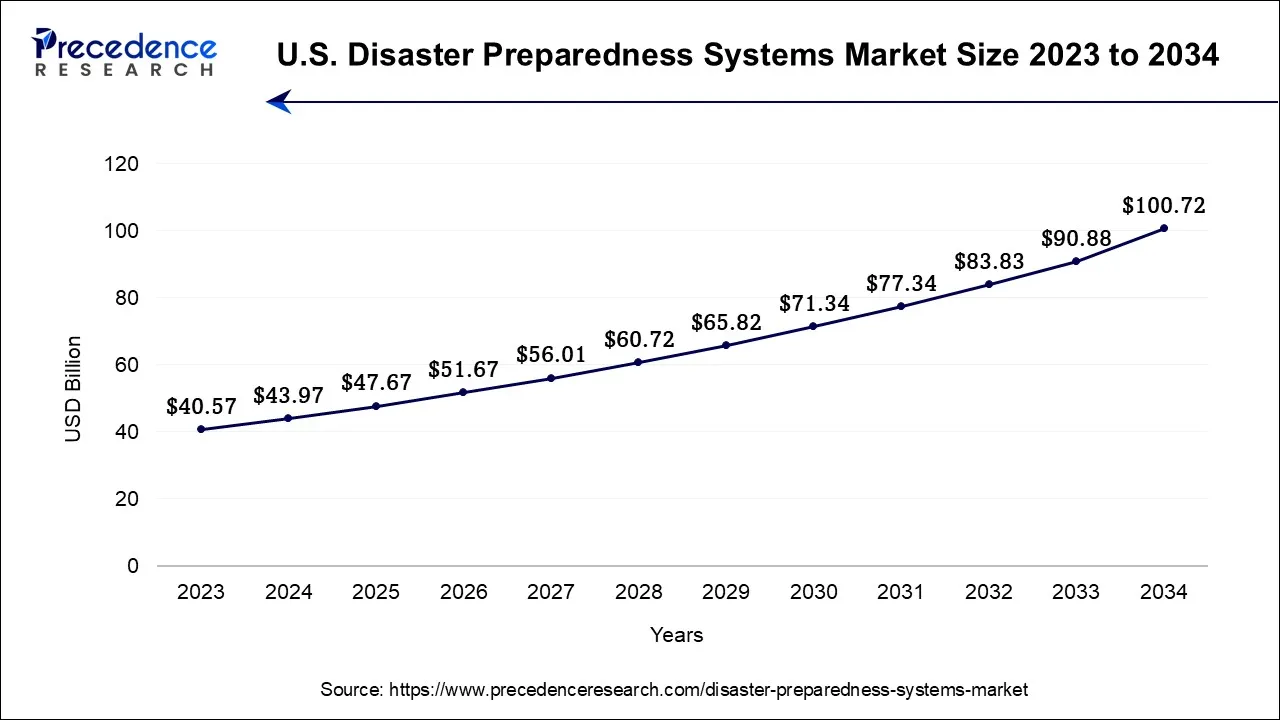

U.S. Disaster Preparedness Systems Market Size and Growth 2025 to 2034

The U.S. disaster preparedness systems market size is accounted at USD 47.67 billion in 2025 and is projected to be worth around USD 100.72 billion by 2034, poised to grow at a CAGR of 8.64% from 2025 to 2034.

North America has held the largest revenue share 33% in 2024.Firstly, the region is prone to a wide range of disasters, including hurricanes, wildfires, and earthquakes, creating a heightened awareness and demand for robust preparedness systems. Secondly, well-established government initiatives and regulations promote investment in disaster readiness. Thirdly, North America boasts a developed infrastructure and a strong private sector, facilitating the adoption of advanced technologies and services. Lastly, a culture of disaster resilience and a high level of public-private collaboration contribute to the region's dominant position in the market.

U.S. Disaster Preparedness Systems Market Analysis

The U.S. leads the market in North America, driven by substantial federal and state investments in disaster preparedness infrastructure. High-profile emergencies, including hurricanes, wildfires, and flooding, have accelerated the adoption of comprehensive emergency management systems across the country. Government agencies such as FEMA continue to strengthen regulatory frameworks and expand funding programs aimed at improving resilience in both urban and rural communities.

Asia-Pacific is estimated to observe the fastest expansion. It is highly prone to a wide range of natural disasters, including earthquakes, typhoons, and floods, necessitating robust preparedness measures. Second, rapid urbanization and infrastructure development in the region drive the demand for disaster management systems. Additionally, governments are increasingly investing in disaster resilience and emergency response capabilities. The growing awareness of the economic and humanitarian costs of disasters further fuels market growth. As a result, the Asia-Pacific region emerges as a significant growth in the global market.

Japan Disaster Preparedness Systems Market Analysis

Japan's disaster preparedness systems market is expected to grow quickly because of the country's high vulnerability to earthquakes, tsunamis, and typhoons. National strategies focus on effective early warning systems, emergency management coordination, and resilient infrastructure also support market growth. The market is bolstered by ongoing investments in advanced technologies, such as AI-based risk modeling and seismic sensor networks.

How is the Opportunistic Rise of Europe in the Disaster Preparedness Systems Market?

Europe is experiencing an opportunistic rise in the market, driven by strong regulatory frameworks and government-led initiatives that promote public safety and infrastructure resilience. Policies promoting cross-border disaster management, smart city development, and critical infrastructure protection in the European Union are among the drivers of growth. Moreover, predictive analytics, GIS mapping, and real-time decision-making tools are being improved through technological advances, enabling effective responses.

Germany Disaster Preparedness Systems Market Analysis

Germany leads the market in Europe, driven by strong national policies on disaster management, critical infrastructure protection, and urban resilience. The nation is experiencing climate-related issues such as storms and floods, which have heightened the need for preparedness and response systems. German cities invest in combined early warning systems, digital coordination applications, and social education. Growth is further encouraged by regulatory requirements and EU-wide cross-border disaster regimes.

What Potentiates the Growth of the Market in Latin America?

The disaster preparedness systems market in Latin America is expected to grow steadily in the coming years, driven by governments' increasing focus on disaster resilience amid frequent natural hazards such as earthquakes, floods, and hurricanes. The region's conditions and the inadequacy of current infrastructure are fueling the adoption of comprehensive preparedness models. Additionally, the rising emphasis on business continuity and risk mitigation among companies and municipalities is further boosting the adoption of these systems.

Brazil Disaster Preparedness Systems Market Analysis

Brazil leads the disaster preparedness systems market in Latin America due to frequent floods, landslides, and droughts impacting urban and rural areas. Federal and state officials are investing in emergency management infrastructure, an integrated communication platform, and early warning systems. There is a rising adoption of preparedness solutions by municipalities and private companies to safeguard critical infrastructure and ensure business continuity. Market growth continues to be driven by increasing urbanization and infrastructure development projects.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) offer significant opportunities in the market due to increasing government focus on disaster preparedness and infrastructure protection. The increasing awareness among private enterprises of risk mitigation and business sustainability is also helping expand the market. Training, Community awareness, and contingency planning are areas of investment that help develop the market in a stable manner.

UAE Disaster Preparedness Systems Market Analysis

The UAE is leading the market in the Middle East & Africa region, driven by a strong government focus on disaster resilience, infrastructure protection, and emergency preparedness. Growth is further supported by significant investments in smart city initiatives, critical facility surveillance, and advanced early warning systems. The region's environmental challenges, including flooding, extreme temperatures, and sandstorms, also underscore the need for robust preparedness and response solutions.

Disaster Preparedness Systems Market – Value Chain Analysis

1. Risk Assessment & Hazard Analysis

The foundation of disaster preparedness lies in identifying hazards, assessing vulnerabilities, and evaluating potential impacts on people, infrastructure, and operations.

- Key Players: RMS (Risk Management Solutions), AIR Worldwide, JBA Risk Management

2. Early Warning & Detection Systems

This stage involves deploying sensors, monitoring networks, and software platforms to detect environmental, climatic, or technological threats in real-time.

- Key Players: NEC Corporation, Siemens, Honeywell International Inc.

3. Emergency Communication & Notification

Disaster alerts are communicated to stakeholders via mass notification systems, sirens, mobile alerts, and integrated communication platforms.

- Key Players: Motorola Solutions, Inc., Alertus Technologies LLC, OnSolve

4. Response & Incident Management Solutions

Crisis management software and command-and-control systems facilitate coordinated response among emergency services, governments, and organizations.

- Key Players: Juvare, LLC, IBM, Singlewire Software, LLC.

5. Recovery & Resilience Planning

Post-disaster operations focus on infrastructure restoration, business continuity planning, and long-term resilience improvement.

- Key Players: Lockheed Martin, Siemens, IBM

6. Training & Simulation Services

Simulation platforms, drills, and training programs enhance preparedness by ensuring stakeholders know how to respond effectively.

- Key Players: Honeywell International Inc., NEC Corporation, Lockheed Martin

Disaster Preparedness Systems Market Companies

- Honeywell International Inc. (U.S.): Offers integrated emergency response systems, building safety solutions, and industrial safety technologies to enhance disaster preparedness and resilience.

- Lockheed Martin (U.S.): Provides advanced warning, surveillance, and situational awareness solutions, including command and control systems for disaster management.

- Motorola Solutions, Inc. (U.S.): Delivers communication networks, alert systems, and software platforms for first responders and emergency services.

- Siemens (Germany): Supplies smart infrastructure, critical facility management, and automation systems that support disaster detection and emergency response.

- NEC Corporation (Japan): Offers disaster early warning systems, public safety communications, and AI-driven situational intelligence solutions.

- IBM (U.S.): Provides AI-powered disaster analytics, crisis management platforms, and predictive modeling solutions for emergency preparedness.

- Alertus Technologies LLC (U.S.): Specializes in mass notification systems and emergency alert solutions for public, private, and government institutions.

- OnSolve (U.S.): Offers cloud-based critical event management solutions, mass notification systems, and emergency communication platforms.

- Juvare, LLC (U.S.): Provides software solutions for emergency management, crisis response, and public safety coordination.

- Singlewire Software, LLC (U.S.): Delivers emergency mass notification and alerting software for organizations to ensure rapid communication during disasters.

Recent Developments

- In 2021,Lockheed Martin partnered with RapidDeploy. Lockheed Martin Implemented RapidDeploy's Nimbus Solution to Support their Facility Emergency and Tactical Response Needs.

- In 2022,NEC partnered with Haven for Hope, a non-profit organization. This partnership will create Technology-Enabled Solutions that enhance safety, streamline operations, and empower clients. NEC will provide automated mass emergency notification systems to enable multi-channel broadcasts during critical events.

- In 2021,Siemens partnered with Shooter Detection Systems (SDS) to improve public safety in the event of an active shooter situation. This partnership will enable organizations to automatically alert building security by triggering alarms with Siemen's Desigo CC building management system or Cerberus danger management system software.

- In 2019,Esri Inc., the worldwide leader in location intelligence, has published a centered web application namely ArcGIS Excalibur, which provides organizations to handle and monitor all duties, metrics or performance linked to imagery necessary to make informed choices and understanding situations.

- In 2019,Ohio City and County adopts Motorola's incidence and emergency management Solutions to seamlessly share real time critical data, the solutions include Resource management software, and other cloud based services.

Segments Covered in the Report

By Solution

- Geospatial Solutions

- Disaster Recovery Solutions

- Situational Awareness Solutions

By Services

- Training & Education Services

- Consulting Services

- Design & Integration Services

- Support & Maintenance Services

By Communication Technology

- First Responder Tools

- Satellite Phones

- Emergency Response Radars

- Others

By Type

- Emergency/Mass Notification System

- Surveillance System

- Safety Management System

- Earthquake/Seismic Warning System

- Disaster Recovery and Backup Systems

- Others

By End-use

- BFSI

- Energy and Utilities

- Aerospace and Defense

- Manufacturing

- IT and Telecom

- Public Sector

- Transportation and Logistics

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344