January 2025

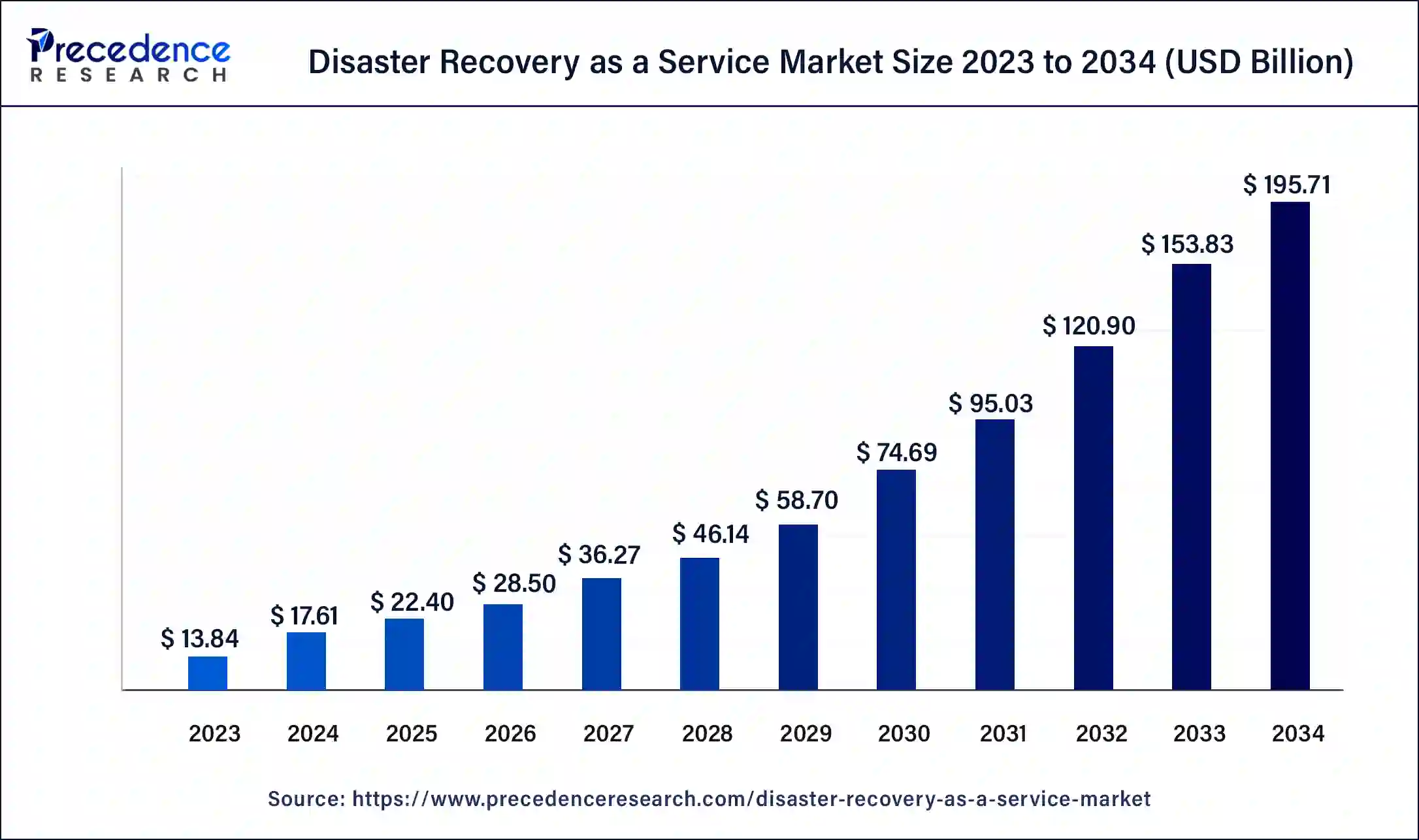

The global disaster recovery as a service market size was USD 13.84 billion in 2023, calculated at USD 17.61 billion in 2024 and is expected to be worth around USD 195.71 billion by 2034. The market is slated to expand at 27.23 % CAGR from 2024 to 2034.

The global disaster recovery as a service market size is projected to be worth around USD 195.71 billion by 2034 from USD 17.61 billion in 2024, at a CAGR of 27.23% from 2024 to 2034. The benefits of disaster as a service include external IT experts, accessibility, platform agnosticism, data safety and security, frequent backup and quick recovery, etc. help the market’s growth.

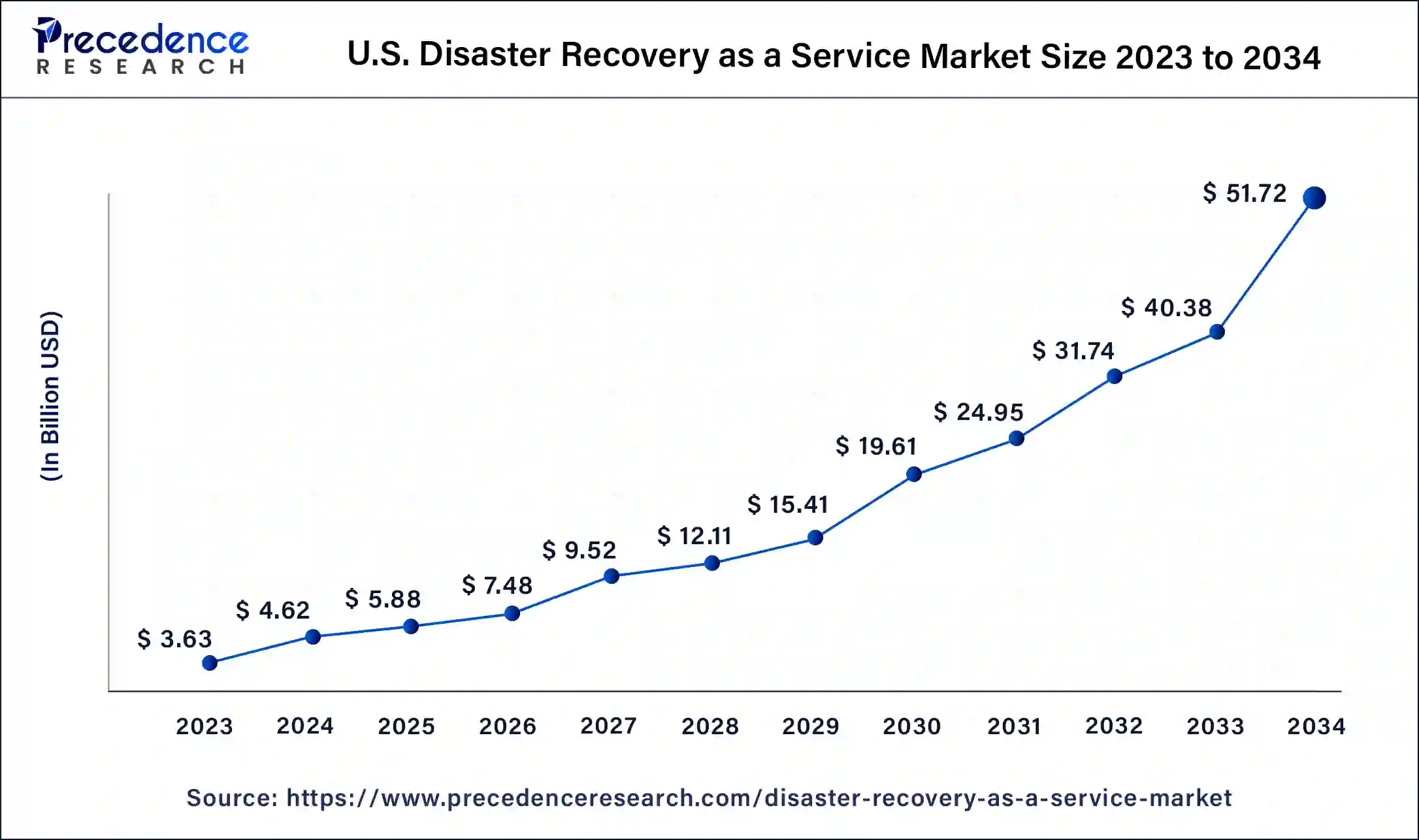

The U.S. disaster recovery as a service market size was exhibited at USD 3.63 billion in 2023 and is projected to be worth around USD 51.72 billion by 2034, poised to grow at a CAGR of 27.31% from 2024 to 2034.

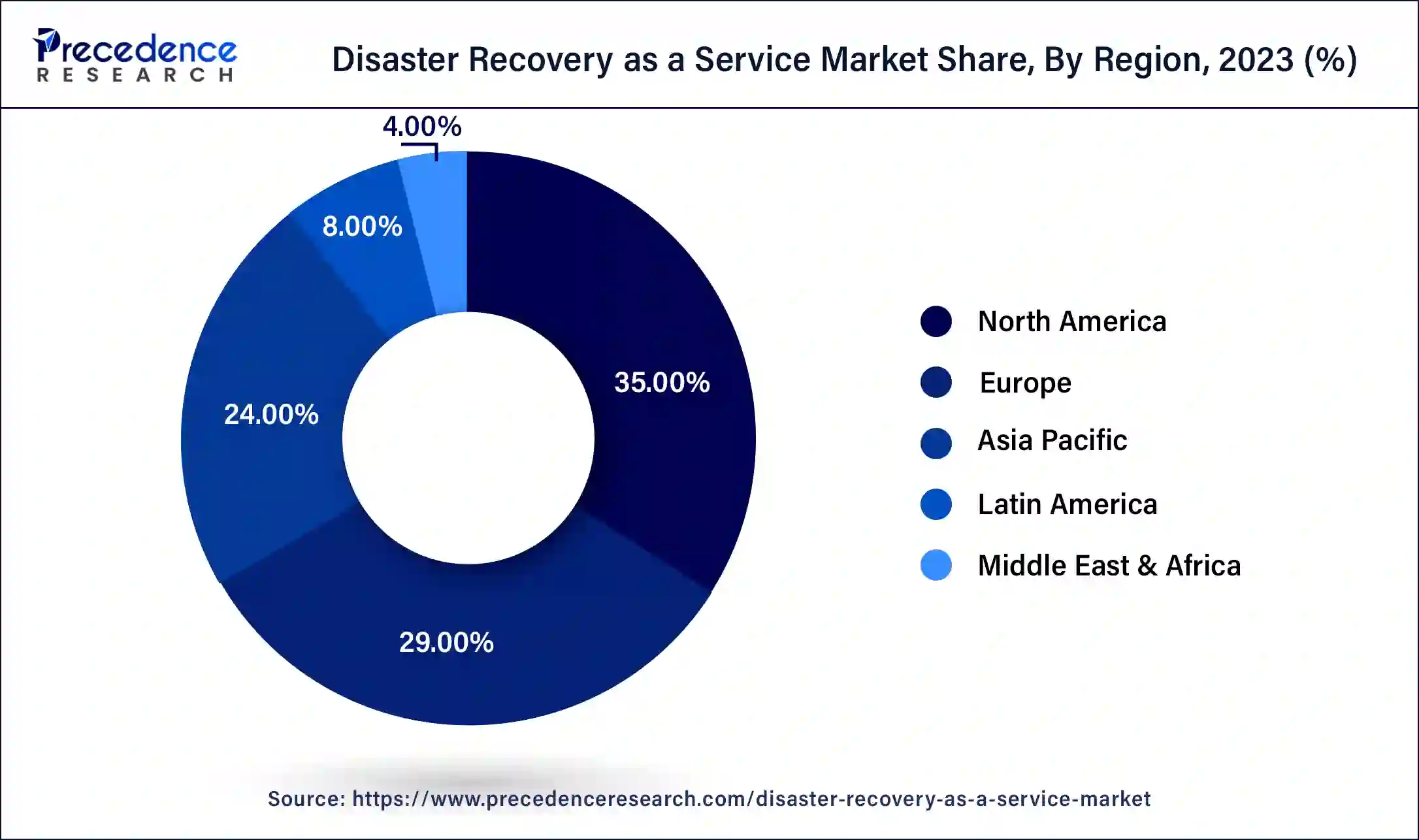

North America dominated the disaster recovery as a service market in 2023. The increased advanced technologies and substantial investments in the disaster recovery industry, as well as the increasing imperative to safeguard critical data for many organizations in sectors like healthcare, government, BFSI, and others, led to increased demand for new products and the adoption of DRaaS, which helped the market grow.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. A remarkable trend in the Asia Pacific region is increasing the focus on data compliance and sovereignty, which helps disaster recovery as a service market growth. With the transformation of data privacy regulations in different countries like India, organizations are tending towards DRaaS solutions that ensure the data stays within their country's borders and complies with local laws.

The disaster recovery as a service market (DRaaS) provides for the recovery of enterprise applications at another location in the event of a disaster. Disaster recovery as a service (DRaaS) is a third-party solution that delivers data recovery and data protection capabilities to enterprises on-demand over the Internet and on a pay-as-you-go basis. The benefits of disaster recovery as a service include faster implementation, expert guidance, and assistance in every step, better access to your system from anywhere, saving costs, freeing up valuable internal resources, instant recovery, no additional hardware required, no additional hardware required, accessibility, etc. contribute to the growth of the market.

How is AI revolutionizing Disaster Recovery as a Service?

The use of AI in disaster recovery as a service benefit includes AI being more powerful, scale, speed, and near-time information processing. Advanced artificial intelligence (AI) tools that may help organizations handle an array of censorious tasks. These tasks include quarantining, identifying, and reducing potentially compromised data after security breaches and building an emergency notification system. AI is helpful in monitoring ongoing threats and potential status.

| Report Coverage | Details |

| Market Size by 2034 | USD 195.71 Billion |

| Market Size in 2023 | USD 13.84 Billion |

| Market Size in 2024 | USD 17.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 27.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service Type, Deployment, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising data security demand

There is an increased demand for data security as a service during disaster recovery. Best practices to protect sensitive data at the time of natural disasters include employee education and training, recovery and backup strategies for sensitive data, physical security measures implementation to prevent sensitive data, and the importance of disaster recovery planning and risk assessment planning contribute to the growth of the disaster recovery as a service market.

Privacy and security concerns and other downsides

The privacy and security concerns in the existing infrastructure integration of DRaaS may be complex. DRaaS downsides also include businesses may trust service providers to implement their plan in the event of a disaster and meet the RPO (recovery point objective) and RTO (recovery time objective). AI makes it totally data-dependent. These factors can hamper disaster recovery as a service market growth.

Rising demand to reduce downtime

The rising demand for reducing downtime contributes to the growth of disaster recovery as a service market. The increased adoption of hybrid cloud disaster recovery as a service and the high use of disaster recovery as a service by mobile service providers are opportunities that contribute to the growth of the market. The use of cloud-based/native solutions, subscription-based models, real-time backup solutions, regulatory compliance, multi-cloud strategies, artificial intelligence (AI) and machine learning (ML), automation, and orchestration contribute to the growth of the market.

The recovery & backup services segment dominated the disaster recovery as a service market in 2023. The benefits of recovery & backup services include IT resources being managed in a better way, service providers allowing employees to work efficiently and fast, security of your data, saving time and money, which helps to increase income with time, data versioning being done accurately, added security, technology may fail, protects the business reputation, raised reliability, quick access to data, etc. contribute to the growth of the market.

Alliance Partners of Veeam Software Include

The real-time replication services segment is expected to be the fastest-growing during the forecast period. The benefits of real-time replication services include disaster recovery, such as cyber-attacks, floods, or fires, replicating data into analysis and reporting, security, and regulatory compliance, which helps the growth of disaster recovery as a service market. Organizations in utility, automotive, aerospace, healthcare, finance, and other highly regulated industries are required to perform regular data archival and backups. Performance and load balancing, data availability, and the single source of truth.

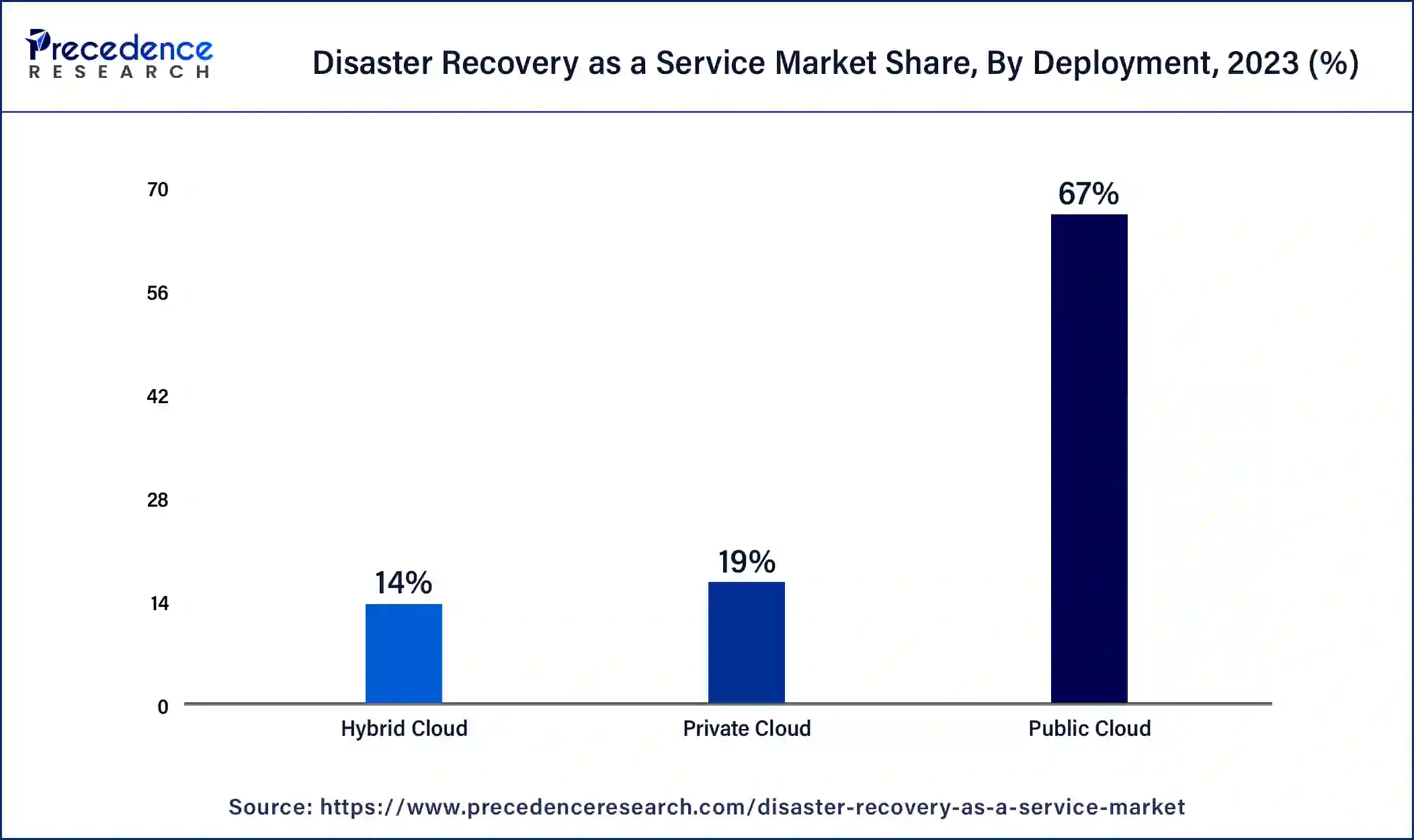

The public cloud segment dominated the disaster recovery as a service market in 2023. The basic benefits of the public cloud include freeing up IT talent, saving money, saving time, improved security with controlled access, regular penetration testing, security innovation, and more modern technology, as well as cyber security expertise. The benefits of the public cloud include it allows agility and DeOps success, location independence, no long-term contracts, cost-effectiveness, less expensive, faster, and easier setup as compared to on-site IT infrastructure, vast network of servers or high reliability, on-demand resources or near-unlimited scalability, no maintenance or service provider handles maintenance, lower costs or you pay only for the service you use, etc. contribute to the market’s growth.

The hybrid cloud segment is estimated to be the fastest-growing during the forecast period. The benefits of a hybrid cloud include improved risk management and security, business continuity, increased innovation and agility, improved control and scalability, reduced costs, better support for a remote workforce, multi-cloud options, access to new technologies, including AI, responsiveness to business needs, cost optimization, improved security and risk management, business continuity, regulatory compliance, data residency, increased computing workloads and control over data, etc. contribute to the growth of the disaster recovery as a service market.

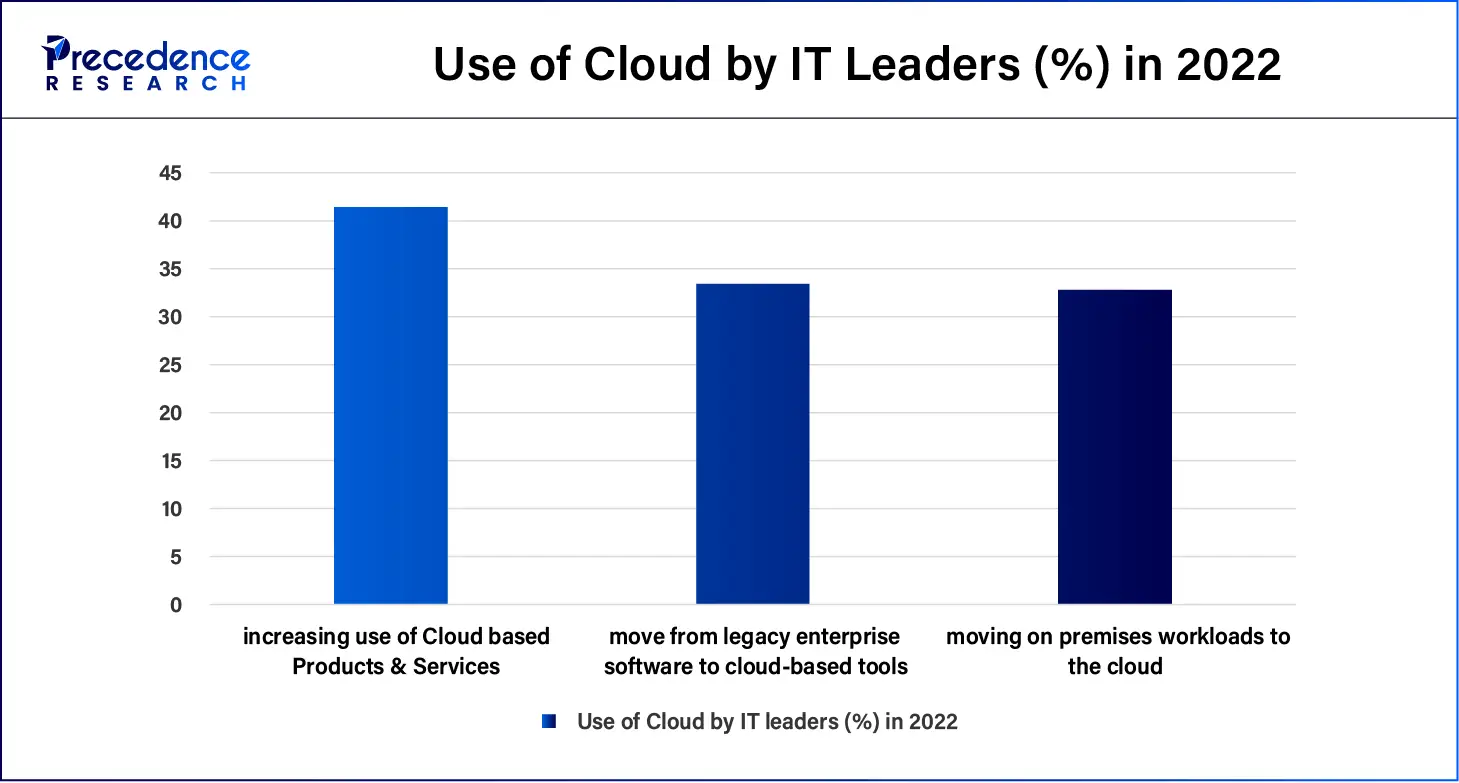

Because of the microeconomic climate, cloud readers are increasing their use of cloud-based products and services (41.4%), planning to move from legacy enterprise software to cloud-based tools (33.4%), and moving on-premises workloads to the cloud (32.8%).

The BFSI segment dominated the disaster recovery as a service market in 2023. The benefits of the banking, financial services, and insurance (BFSI) sector include career opportunities like rapid career growth, high compensation packages, and a high range of work options, economic growth including managing risk, facilitating trade & investment, mobilizing savings, and diversification include spreading investments across many institutes and financial instruments lowers overall risks contribute to the growth of the market’s growth.

The information technology & telecommunication segment is anticipated to be the fastest-growing during the forecast period. The benefits of IT & telecommunication are many and far-reaching, touching nearly every characteristic of our daily lives. With the help of telecommunication, it helps to improve global communication and connectivity. It helps a lot of people to make remote work accessible, which helps the growth of disaster recovery as a service market. Sectors like entertainment, education, and healthcare have completely changed with the influence of the Internet. A big change may be seen in e-commerce.

Segments Covered in the Report

By Service Type

By Deployment

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

December 2024

December 2024