April 2025

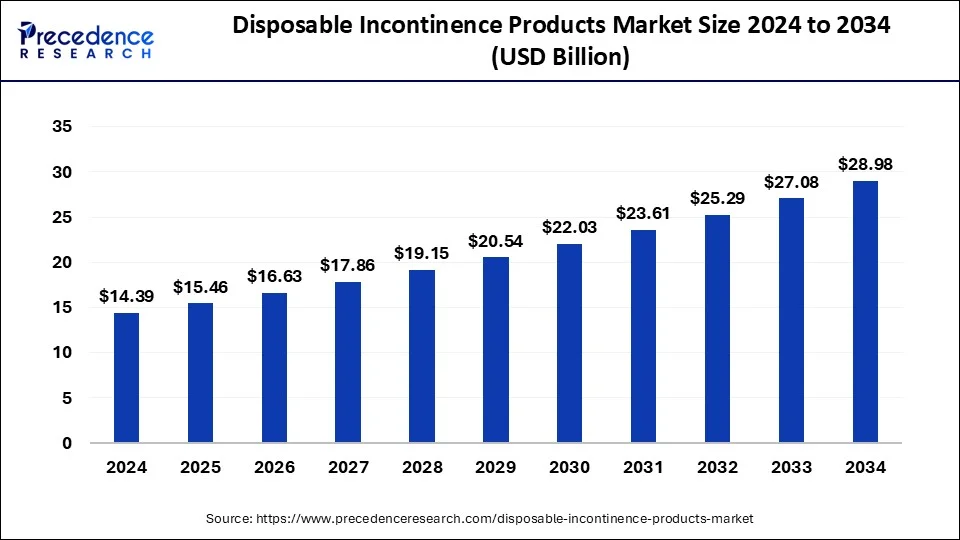

The global disposable incontinence products market size is calculated at USD 15.46 billion in 2025 and is forecasted to reach around USD 28.98 billion by 2034, accelerating at a CAGR of 7.20% from 2025 to 2034. The Europe disposable incontinence products market size accounted for USD 5.84 billion in 2025 and is expanding at a CAGR of 6.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global disposable incontinence products market size was estimated at USD 14.39 billion in 2024 and is predicted to increase from USD 15.46 billion in 2025 to approximately USD 28.98 billion by 2034, expanding at a CAGR of 7.20% from 2025 to 2034. More elderly people drive the disposable incontinence products market.

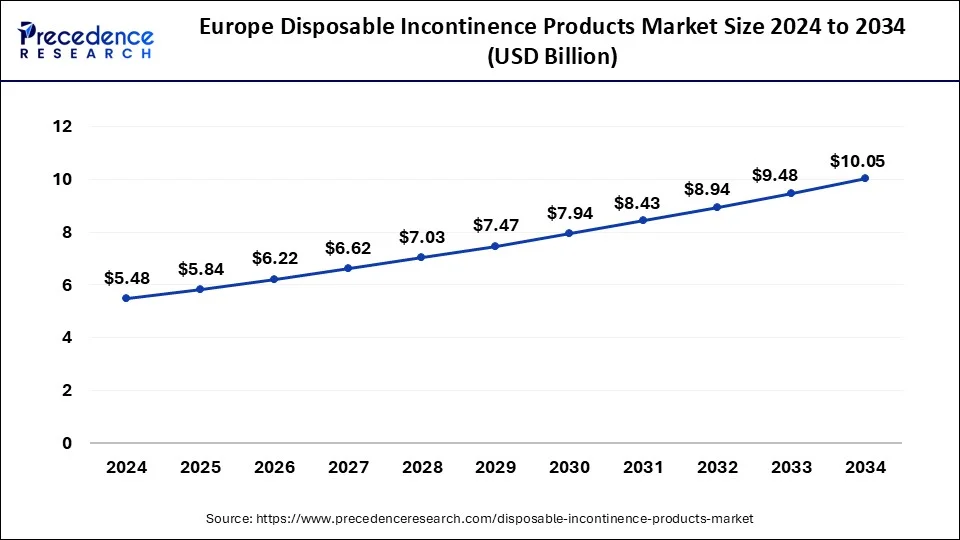

The Europe disposable incontinence products market size reached USD 5.48 billion in 2024 and is predicted to be worth USD 10.05 billion by 2034, growing at a CAGR of 6.20% from 2025 to 2034.

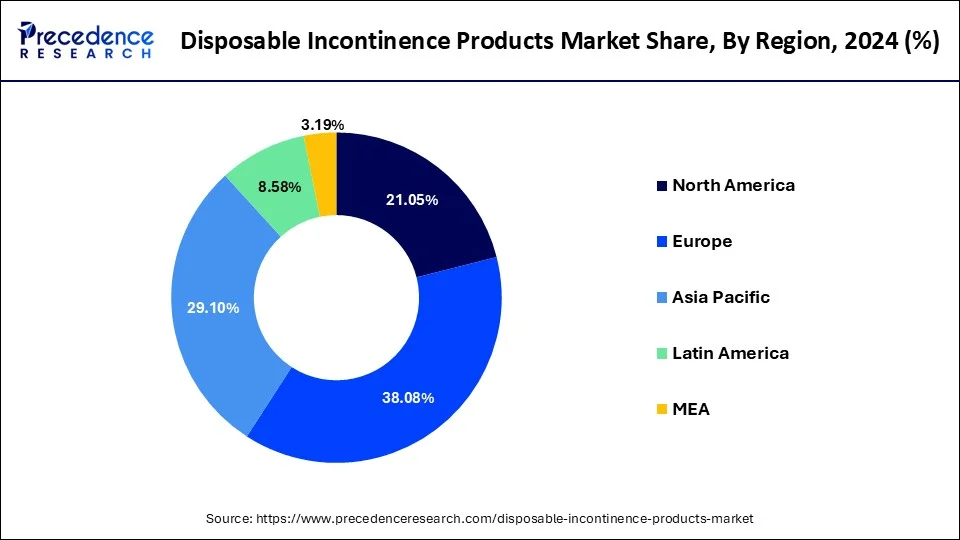

Europe has its largest market share in 2024 in the disposable incontinence products market throughout the predicted timeframe. Despite economic ups and downs, Europe continues to be one of the richest continents in the world, with a comparatively high standard of life. Due to the affordability of high-end disposable incontinence products, the industry is growing, and the region's most significant revenue share is being maintained. In Europe, there has been a noticeable rise in the understanding and acceptance of incontinence problems. The stigma associated with incontinence has decreased due to the work of public health campaigns, advocacy organizations, and healthcare professionals. This has encouraged people to get aid and use disposable incontinence devices as a solution.

Asia- Pacific is the fastest growing in the disposable incontinence products market during the forecast period. Due to advances in medical technology and better healthcare services, people are living longer. The probability of developing urinary or other types of incontinence rises with age. As a result, the need for disposable incontinence solutions to treat these disorders is rising. Stress, poor eating habits, and sedentary lifestyles are some of the causes of the growth in incontinence occurrences. As a result, the need for disposable incontinence products is rising to assist those managing these conditions with comfort, convenience, and sanitation.

The market for disposable incontinence products is essential for meeting the needs of people who struggle with bowel or bladder control. These items, which include adult liners, pads, and diapers, are made to absorb and retain bodily fluids while maintaining the user's dignity and comfort. Those with larger discretionary incomes can prioritize improving their quality of life by investing in incontinence solutions. The rising emphasis on improving lifestyles promotes the growth of the disposable incontinence products market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.2% |

| Market Size in 2025 | USD 15.46 Billion |

| Market Size by 2034 | USD 28.98 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Incontinence Type, Disease, Material, Gender, Distribution Channel, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing prevalence of incontinence across the globe

Urinary incontinence can result from weakening muscles and nerves that regulate bladder function as people age. With many people entering their senior years, the world's population is shifting demographically toward older age groups. Several chronic medical illnesses, including diabetes, neurological impairments, difficulties with the prostate, and prolapse of the pelvic organs, can also result in incontinence. Incontinence of the urine or feces may result from several disorders, which may directly or indirectly impact bladder function. The incidence of incontinence is expected to rise due to the rising frequency of chronic diseases worldwide, especially in underdeveloped nations where healthcare infrastructure may be inadequate. Thereby, such a growing prevalence of incontinence is observed to act as a driver for the disposable incontinence products market.

Health problems, including incontinence, can be caused by sedentary behavior, poor diets, obesity, and smoking, among other aspects of modern lifestyle. Being sedentary can weaken the pelvic floor muscles, which are essential for controlling one's bladder, and obesity can increase strain on the bladder and its supporting tissues.

Increasing incidence of chronic diseases coupled with rising elderly population

Disposable incontinence devices are becoming more widely available and reasonably priced due to rising healthcare costs worldwide. Government programs and insurance policies guarantee that more people, especially the elderly and those with long-term medical conditions, can obtain these products. A person's quality of life can be significantly impacted by incontinence, which can result in humiliation, social isolation, and limited mobility. By offering a workable solution for handling these problems, disposable incontinence products help people keep their dignity and independence.

Lack of awareness and availability of alternative treatment methods

It is possible that disposable incontinence solutions do not always satisfy the unique requirements or preferences of people with different body types, mobility levels, and cultural backgrounds. Without access to a range of customized treatments, some people might be disappointed with the options that are provided, which could prompt them to investigate alternate therapies or stop therapy entirely. People living in areas with poor access to healthcare providers or infrastructure may not obtain appropriate incontinence diagnosis, treatment, or education. This lack of availability worsens awareness and prevents disposable incontinence products from being used widely. Thereby, the lack of awareness of such products and the availability of alternatives create a significant restraint for the disposable incontinence products market.

Advancements in the technology

Technology has enabled the development of cutting-edge product designs that put user convenience and choice first. Today's manufacturers can create items that are more flexible, thinner, and better fit the body, preserving the dignity and self-assurance of their consumers. The emergence of wearable technology has facilitated the creation of intelligent incontinence devices. These items may use sensors and connection technologies to track usage patterns for improved management and treatment, monitor moisture levels, and send real-time notifications to caregivers or users.

It has completely changed how disposable incontinence products are distributed, opening new markets. Customers can buy products secretly and conveniently using online platforms and e-commerce solutions, while telehealth services offer virtual consultations and tailored recommendations.

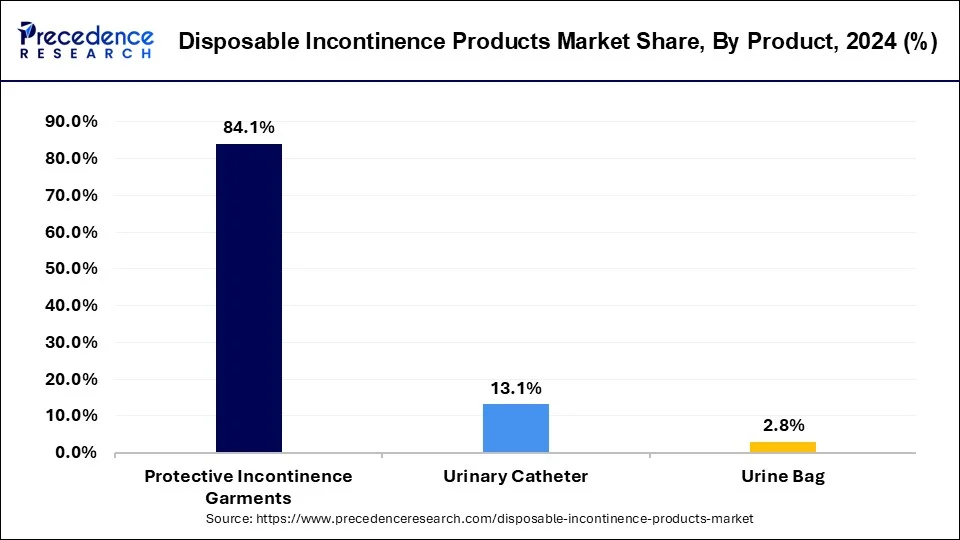

The protective incontinence garments segment dominated the disposable incontinence products market in 2024. Pull-up briefs and adult diapers are two examples of protective incontinence apparel that provide users with great comfort and convenience. Because of their resemblance to everyday underwear, they fit comfortably and covertly. Those who wish to manage their incontinence while retaining their independence and dignity may find this feature especially appealing. One benefit of disposable incontinence items is that they are simple to discard, even for protective clothing. They don't require washing and reusing after use, which may be uncomfortable or problematic for some people, particularly those with restricted access to laundry facilities or mobility issues. Instead, they can simply be thrown away after use.

The urinary catheter segment is observed to be the fastest growing in the disposable incontinence products market. Older adults are becoming more and more likely to experience urine incontinence because of the world's population aging at a rate never seen before. The aging process decreases a person's bladder control, which can result in incontinence. This demographic trend significantly influences urinary catheter demand.

Disposable Incontinence Products Market Revenue, By Product 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Protective Incontinence Garments | 10,377.9 | 11,213.9 | 12,100.5 |

| Urine Bag | 350.5 | 376.1 | 403.0 |

| Urinary Catheter | 1,621.5 | 1,748.8 | 1,883.4 |

The fecal incontinence segment dominated the disposable incontinence products market in 2024. Bowel incontinence, commonly referred to as fecal incontinence, is a prevalent ailment that impacts millions of individuals globally. Age, childbearing, neurological conditions, and gastrointestinal illnesses are just a few causes. Effective management solutions are in greater demand as the elderly population increases and medical disorders linked to fecal incontinence become more common.

With improved performance and discretion, disposable incontinence products have become more appealing to customers coping with fecal incontinence. Innovations like improved absorbency, discrete packaging, and thinner designs have made users feel more at ease and confident, which has led to a more prominent preference for disposable products over more conventional options like reusable pads or diapers.

Disposable Incontinence Products Market Revenue, By Application 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Urine Incontinence | 7,032.3 | 7,582.5 | 8,164.3 |

| Fecal Incontinence | 3,039.3 | 3,291.8 | 3,560.3 |

| Dual Incontinence | 2,278.3 | 2,464.5 | 2,662.3 |

The mixed segment dominated the disposable incontinence products market in 2024. Products that address various incontinence needs, such as diapers, pads, liners, and protective undergarments, are often included in the mixed sector. Because of this variability, businesses in this market can target various populations, from young children to senior citizens, with varying degrees of incontinence severity. Moreover, customization choices like different absorbency levels and sizes increase customer happiness and loyalty.

Products in the mixed section are generally accessible via several distribution channels, such as pharmacies, grocery stores, internet merchants, and medical supply shops. Regardless of location or chosen shopping method, this vast distribution network guarantees accessibility and ease for customers looking for incontinence goods.

The chronic disease segment dominated and sustained to be the fastest growing in the disposable incontinence products market. Discreet, comfortable, and effective disposable incontinence devices are now possible thanks to technological advancements in product design. These goods' performance and user experience have been improved by innovations, including superabsorbent materials, odor control features, and breathable fabrics, which have increased their adoption among consumers with chronic illnesses. The way that society views incontinence has changed dramatically; people are now more aware of it and embrace it as a medical illness rather than a taboo topic. More people, especially those with chronic diseases, are being pushed by this societal trend to look for and use disposable incontinence solutions.

The cotton fabrics segment dominated the disposable incontinence products market in 2024. As cotton materials are renowned for being breathable and soft, they are a great option for disposable incontinence solutions. Since consumers of these goods frequently wear them for extended periods, comfort is essential. Cotton, as opposed to synthetic textiles, permits air to flow freely, lowering the possibility of skin irritation and discomfort. Cotton may initially cost more than synthetic textiles, but its efficacy and durability make it a more affordable option over time. For incontinence products to properly control urine and feces leaks, cotton's superior absorbent qualities are crucial. Quick moisture absorption by cotton fibers keeps skin dry and reduces the chance of bacteria and odor developing.

Disposable Incontinence Products Market Revenue, By Material 2022-2024 (USD Million)

| Material | 2022 | 2023 | 2024 |

| Plastic | 2,629.0 | 2,846.5 | 3,077.7 |

| Cotton fabrics | 3,217.5 | 3,485.6 | 3,770.7 |

| Super Absorbents | 3,226.7 | 3,463.5 | 3,712.4 |

| Latex | 1,850.5 | 2,002.3 | 2,163.4 |

| Others | 1,426.1 | 1,540.9 | 1,662.6 |

The female segment dominated the disposable incontinence products market in 2024. While both sexes are affected by urine incontinence, women may experience a more significant social stigma because of cultural norms around femininity, hygiene, and self-control. Because of this, women could be more likely to look for covert and practical ways to manage their condition, like disposable incontinence products, to avoid being seen or embarrassed. As they age, women often develop specific problems with urine incontinence because of biological variables like pregnancy, menopause, childbirth, and pelvic floor abnormalities.

Because of these physiological alterations, which frequently result in weaker pelvic muscles and heightened vulnerability to urine incontinence, are the primary users of disposable incontinence devices.

The retail stores segment dominated the disposable incontinence products market in 2024. Customers can readily find various disposable incontinence products in retail establishments, offering simple access. Customers may readily purchase these products because they are usually available in pharmacies, supermarkets, and online retail. Numerous producers of disposable incontinence products make significant investments in retail store marketing and promotional campaigns. This involves well-placed product placement, marketing initiatives, and special offers that raise brand awareness and entice customers to buy their goods.

Disposable Incontinence Products Market Revenue, By Distribution Channel 2022-2024 (USD Million)

| Distribution Channel | 2022 | 2023 | 2024 |

| Retail Stores | 8,436.2 | 8,989.3 | 9,563.5 |

| E-commerce | 3,913.6 | 4,349.5 | 4,823.5 |

The 60 to 79 years segment dominated the disposable incontinence products market in 2024. Overall, life expectancy has increased due to lifestyle and medical care advances. Longer lifespans increase the likelihood that people may experience age-related health problems like incontinence, which increases the market for throwaway goods in this age range. Producers have made significant R&D investments to produce disposable incontinence products designed to meet older people's needs, aiming to make them more comfortable and effective. These goods appeal more to the 60–79 age group because of their superior absorbent materials, odor control technologies, and ergonomic designs.

The ambulatory surgical centers segment dominated the disposable incontinence products market in 2024. The growing trend of outpatient procedures has led to an increase in the popularity of ambulatory surgical facilities. These facilities provide out-of-hospital surgical procedures, such as urology and gynecological procedures, frequently using disposable incontinence devices.

Disposable Incontinence Products Market Revenue, By End-use 2022-2024 (USD Million)

| End-use | 2022 | 2023 | 2024 |

| Hospital | 4,073.4 | 4,394.7 | 4,734.8 |

| Ambulatory Surgical Centers | 1,663.6 | 1,797.4 | 1,939.4 |

| Nursing Facilities | 3,391.0 | 3,662.2 | 3,949.6 |

| Long term care centers | 2,594.7 | 2,809.5 | 3,037.8 |

| Others | 627.2 | 675.0 | 725.3 |

By Product

By Application

By Incontinence Type

By Disease

By Material

By Gender

By Age

By Distribution Channel

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

January 2025