January 2025

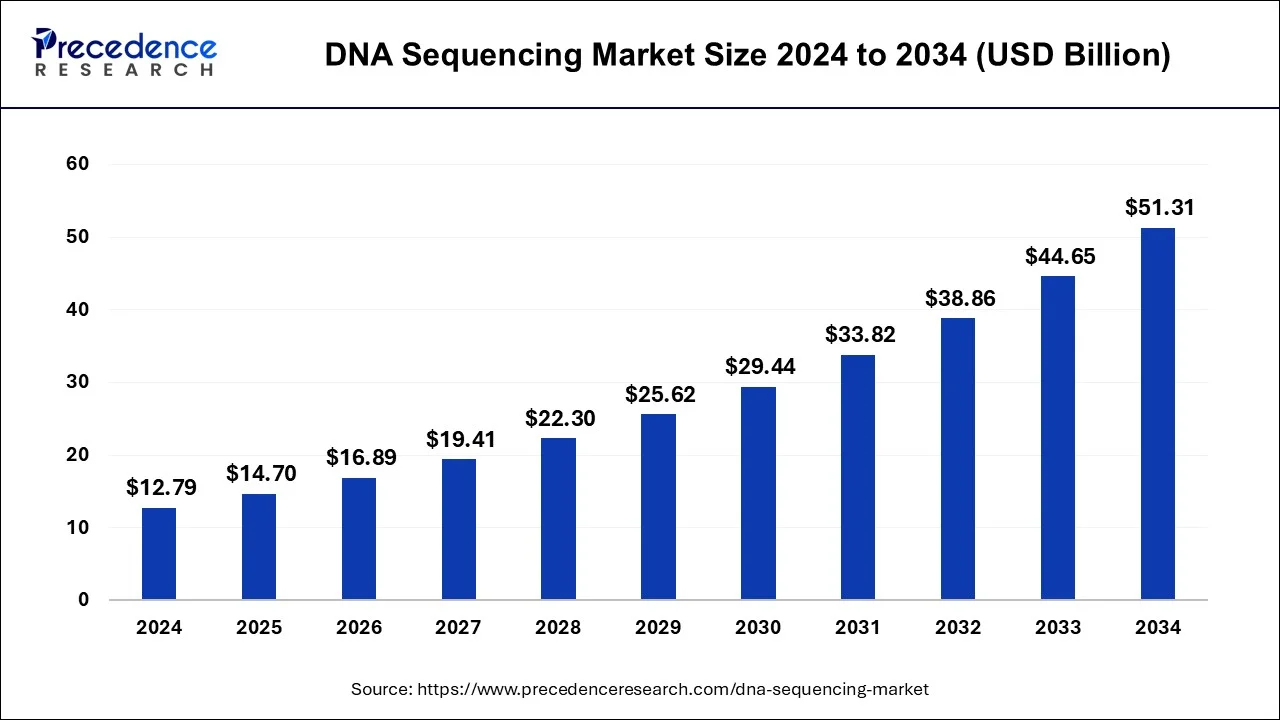

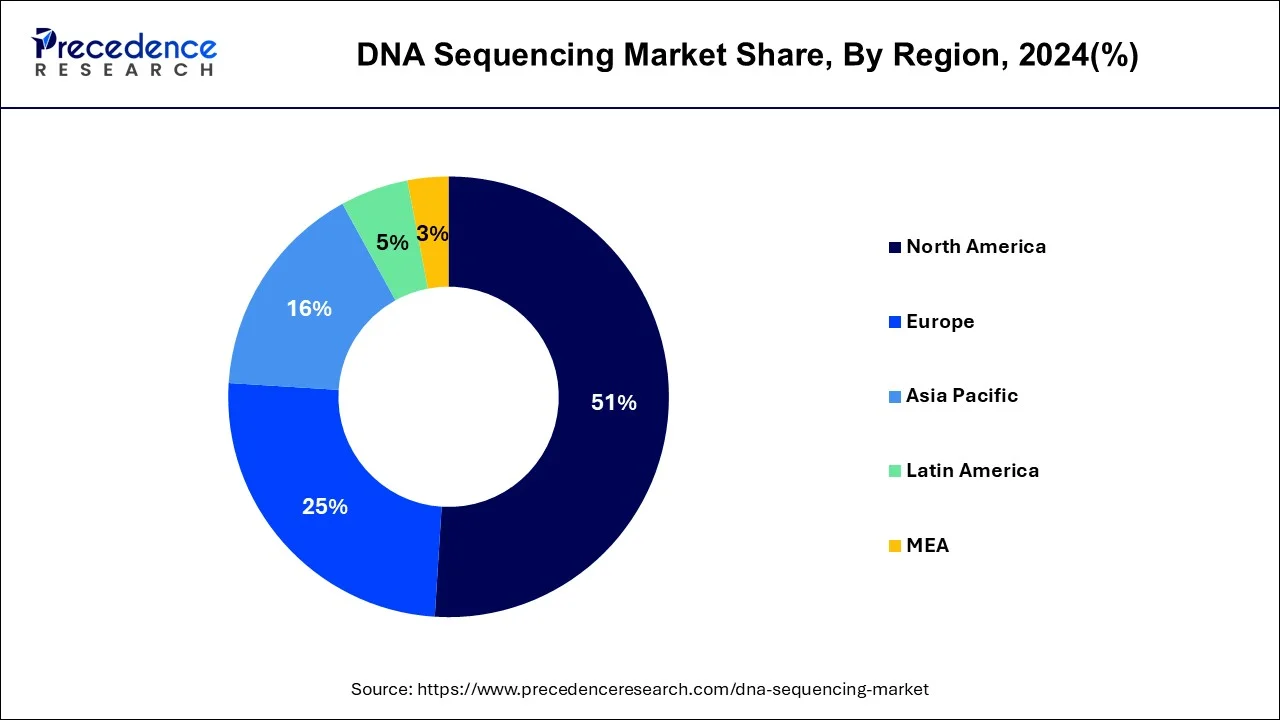

The global DNA sequencing market size is calculated at USD 14.70 billion in 2025 and is forecasted to reach around USD 51.31 billion by 2034, accelerating at a CAGR of 14.90% from 2025 to 2034. The North America DNA sequencing market size surpassed USD 6.52 billion in 2024 and is expanding at a CAGR of 14.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global DNA sequencing market size was USD 12.79 billion in 2024, accounted for USD 14.70 billion in 2025, and is expected to reach around USD 51.31 billion by 2034, expanding at a CAGR of 14.90% from 2025 to 2034.

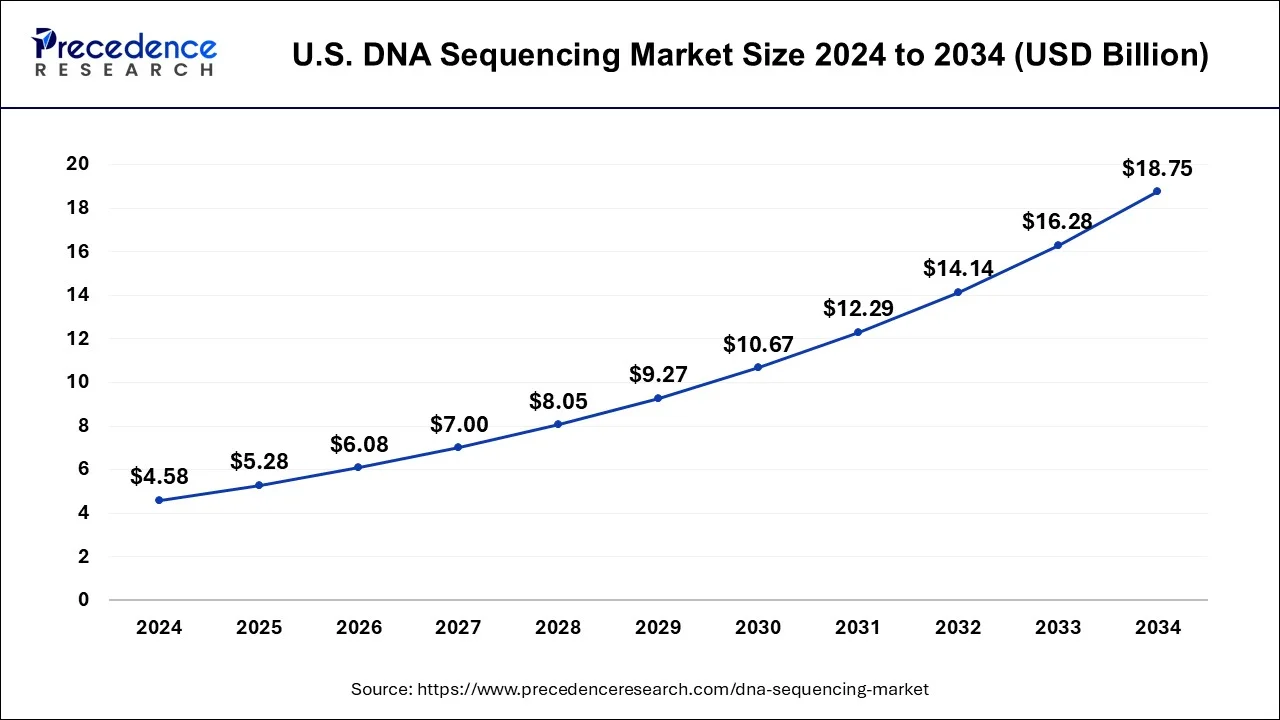

The U.S. DNA sequencing market size was estimated at USD 4.58 billion in 2024 and is predicted to be worth around USD 18.75 billion by 2034, at a CAGR of 15.14% from 2025 to 2034.

North America dominated the DNA sequencing market in 2024. North America is the leader in the DNA sequencing market due to several factors, including significant firms' ongoing technological development, strong R&D investment, and the availability of technologically advanced healthcare infrastructure. Research on cancer treatments and medication development is supported by several government programs in the U.S. and Canada. These nations are seeing rapid growth in the biotechnology sector, which is resulting in more alternatives for treatments and diagnostics.

Audacious objectives for the U.S. bioeconomy include figuring out the function of at least 80% of recently found genes and sequencing the genomes of one million microbial species in five years. The National Science Foundation in the United States has been investing in biotechnology for decades, allowing the utilization of living organisms to produce goods and services that benefit society and speeding up scientific discovery.

The Canadian government is putting great effort into reviving the country's biomanufacturing industry in order to provide Canadians with effective and safe therapies. In order to strengthen Canada's vaccination, biotechnology, pharmaceuticals, and biomanufacturing capabilities, more than $2.1 billion has been committed since March 2020. The Strategic Innovation Fund (SIF) will receive a $23 million investment from the Honourable Mary Ng, Minister of Innovation, Science and Industry, International Trade and Economic Development, to support Edesa Biotech's $61 million project.

Asia Pacific is expected to grow at the fastest rate during the forecast period. Strategic business expansion is driven by international enterprises' expanding consumer base. Furthermore, in the Asia-Pacific area, the Indian market for DNA sequencing was increasing at the fastest rate, while the Chinese market had the biggest market share.

Leveraging the power of strategic collaborations and developing capacity nationwide, the Department of Biotechnology (DBT) of the Government of India is leading the charge in fostering biotechnological innovation and entrepreneurship. One hundred fifty firms have raised around INR 4,500 Cr in follow-up funding. The nation's bioeconomy, which was valued at $137 billion in 2023, is projected to grow to $300 billion by 2030.

The fast development of DNA sequencing technology is providing scientists with the capability to generate information about genetic variation and outlines of gene expression on an unparalleled scale. The DNA sequencing technology is expected to allow scientists in achieving accurate sequencing of whole human genomes within just a few years. This technology will become a routine tool for scientists and clinicians. Numerous sequencing platforms presently in development have the potential to present greater advances in resolution and throughput. The massively parallel sequencing technologies are at present altering almost all fields of genetics, and the field of pharmacogenomics will be no exemption. The most predominant application of the new sequencing technologies in the field of pharmacogenomics is the detection of novel genetic variations that might influence drug response.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.9% |

| Market Size in 2024 | USD 12.79 billion |

| Market Size by 2034 | USD 51.31 billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, technology, Application, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The consumables segment held the largest share of the DNA sequencing market in 2024. A vast range of goods, including kits, reagents, and other supplies necessary for various sequencing technologies, are referred to as sequencing consumables when discussing DNA sequencing techniques. The need for these consumables has increased due to the continual advancements in genomics and sequencing methods. In particular, the need for specialized consumables has expanded due to the widespread use of next-generation sequencing (NGS) technology in clinical diagnosis, research, and personalized medicine. Prominent industry players provide a variety of products designed to be compatible with different sequencing systems. It is projected that as genomics plays an increasingly significant role in biomedical research and healthcare, the market for sequencing consumables will expand gradually.

The next-generation sequencing segment dominated the DNA sequencing market in 2024. In genomics research, next-generation sequencing (NGS) is a potent instrument. Millions of DNA fragments can be sequenced simultaneously by NGS, yielding comprehensive data on genome structure, genetic variants, gene activity, and behavioral changes in genes. The main goals of recent developments have been to improve data analysis, lower expenses, and sequence data more quickly and accurately. These developments have enormous potential to improve our understanding of diseases and tailored therapy by revealing fresh insights into genetics.

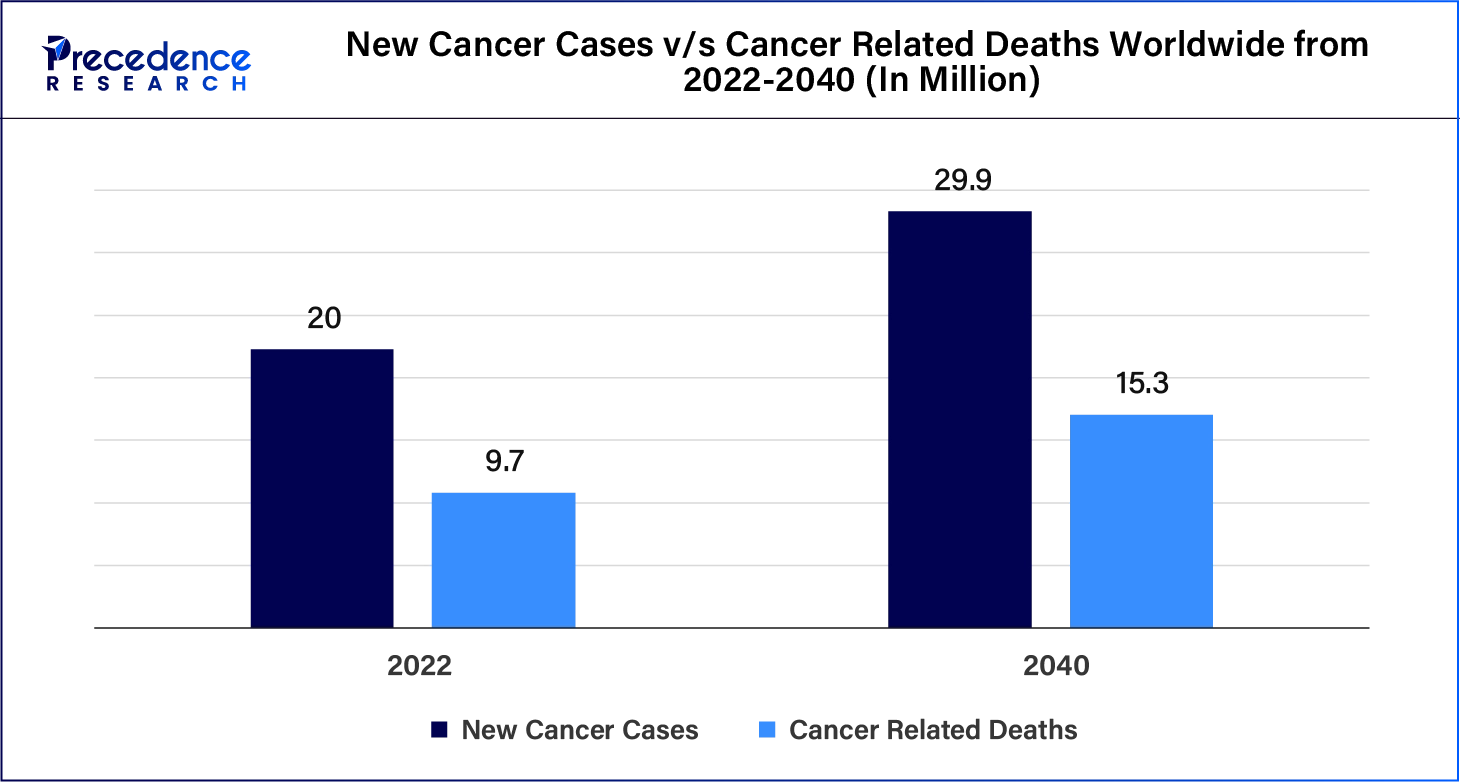

The oncology segment held the largest share of the DNA sequencing market in 2024. Sequential sequencing is also very important in the study of cancer. Thousands of tumor tissue samples are being sequenced as part of projects like The Cancer Genome Atlas in an effort to identify the specific genetic abnormalities that promote the growth of different cancer types. Researchers can also follow the evolution of a cancer's genetic makeup through sequencing. Researchers want to understand how cancer responds to treatment and may develop resistance to it by, for example, sequencing the DNA of a tumor before and after treatment.

20 million new instances of cancer and 9.7 million cancer-related deaths are expected in 2022, according to WHO projections. Five years after receiving a cancer diagnosis, an estimated 53.5 million people would still be alive. At some point in their lives, one in five people will be affected by cancer. The illness claims the lives of about 1 in 9 males and 1 in 12 women. Lung cancer is the most frequent cancer, making up 12.4% of all new cases, with 2.5 million new cases worldwide. The following in incidence order were female breast cancer (2.3 million cases, 11.6%), colon cancer (1.9 million cases, 9.6%), stomach cancer (970,000 cases, 4.9%), and prostate cancer (1.5 million cases, 7.3%).

The academic research segment dominated the DNA sequencing market in 2024. The methodical study of a research problem or scenario with the goal of finding facts to address the issue or find a solution is known as academic research. The increase of academic research is attributed to various factors, including government efforts and considerable expenditure in research and development in the field of DNA sequencing.

By Product

By Technology

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

December 2023

January 2025