January 2025

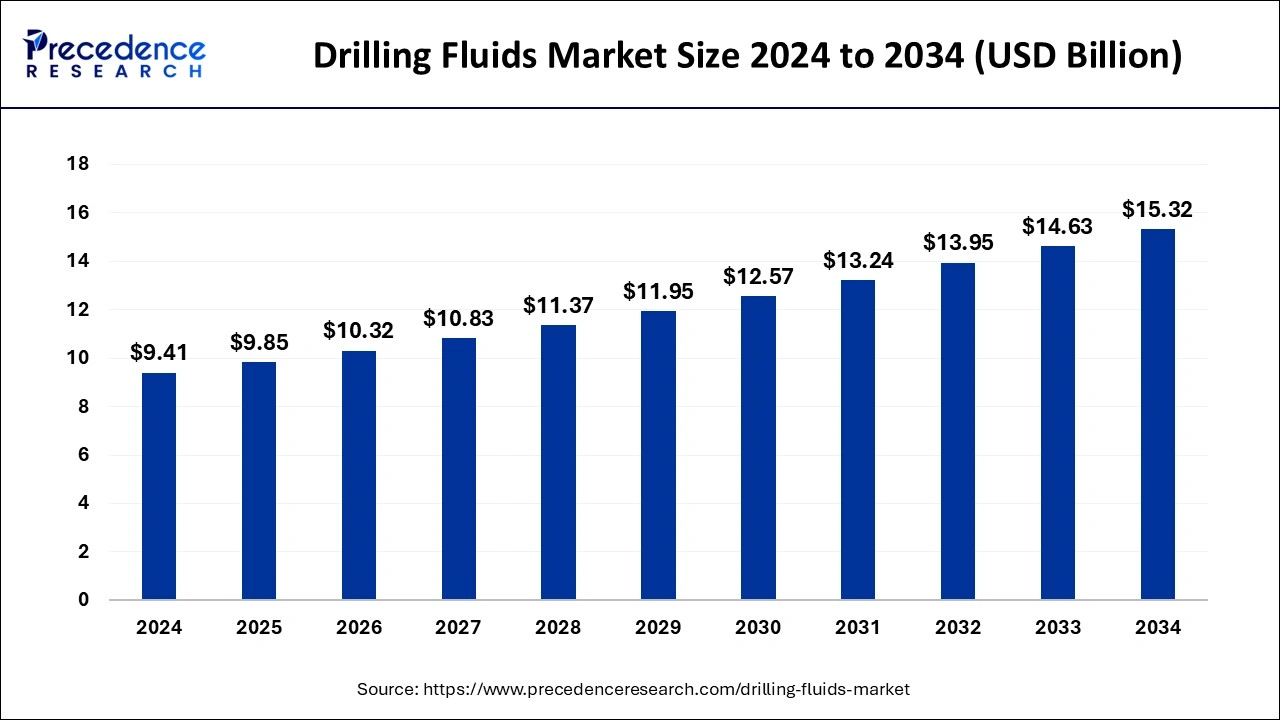

The global drilling fluids market size is calculated at USD 9.85 billion in 2025 and is projected to surpass around USD 15.32 billion by 2034, expanding at a CAGR of 5% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global drilling fluids market size accounted for USD 9.41 billion in 2024 and is expected to be worth around USD 15.32 billion by 2034, at a CAGR of 5% from 2025 to 2034.

The applications of artificial intelligence (AI) in drilling fluids can be utilised for predictive modelling, in identifying best fluid formulation for specific well conditions, optimizing the design and performance of drilling fluids by evaluating large amounts of data, in wellbore stability analysis and improvement of drilling fluids by evaluating data from lab tests and field operations thereby enhancing drilling efficiency with reduced complications.

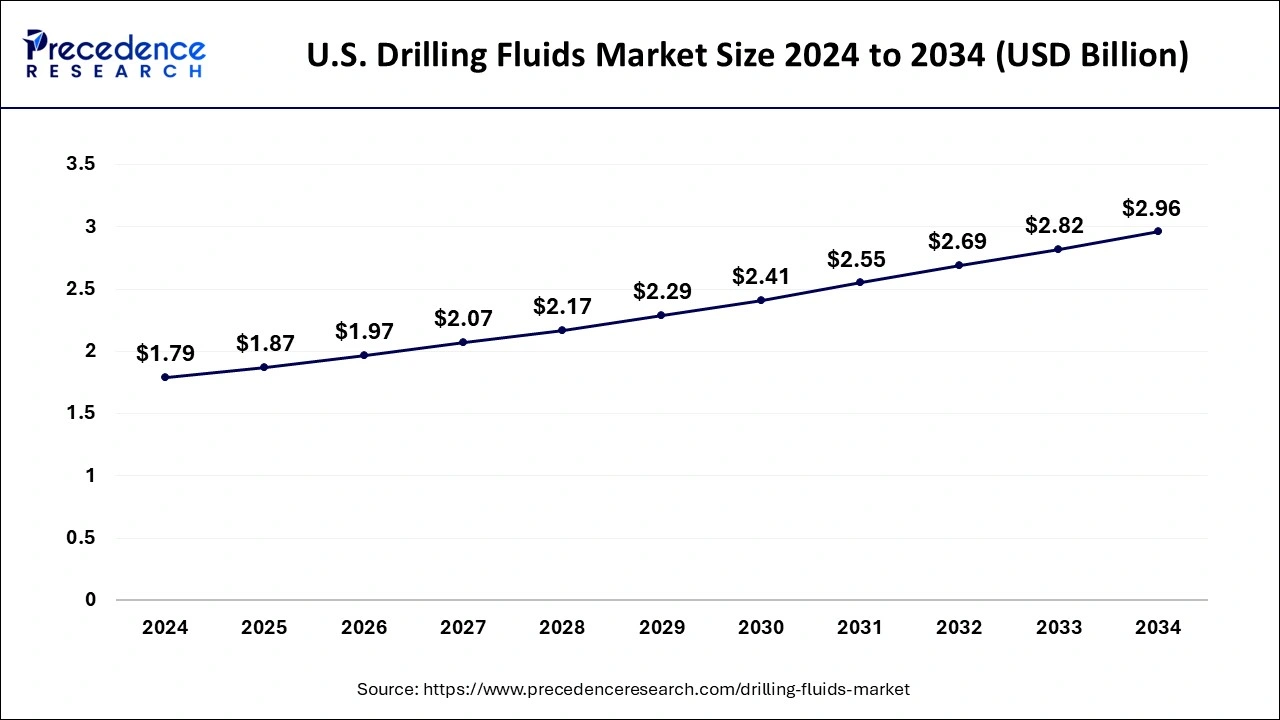

The U.S. drilling fluids market size was estimated at USD 1.79 billion in 2024 and is predicted to be worth around USD 2.96 billion by 2034, at a CAGR of 5.2% from 2025 to 2034.

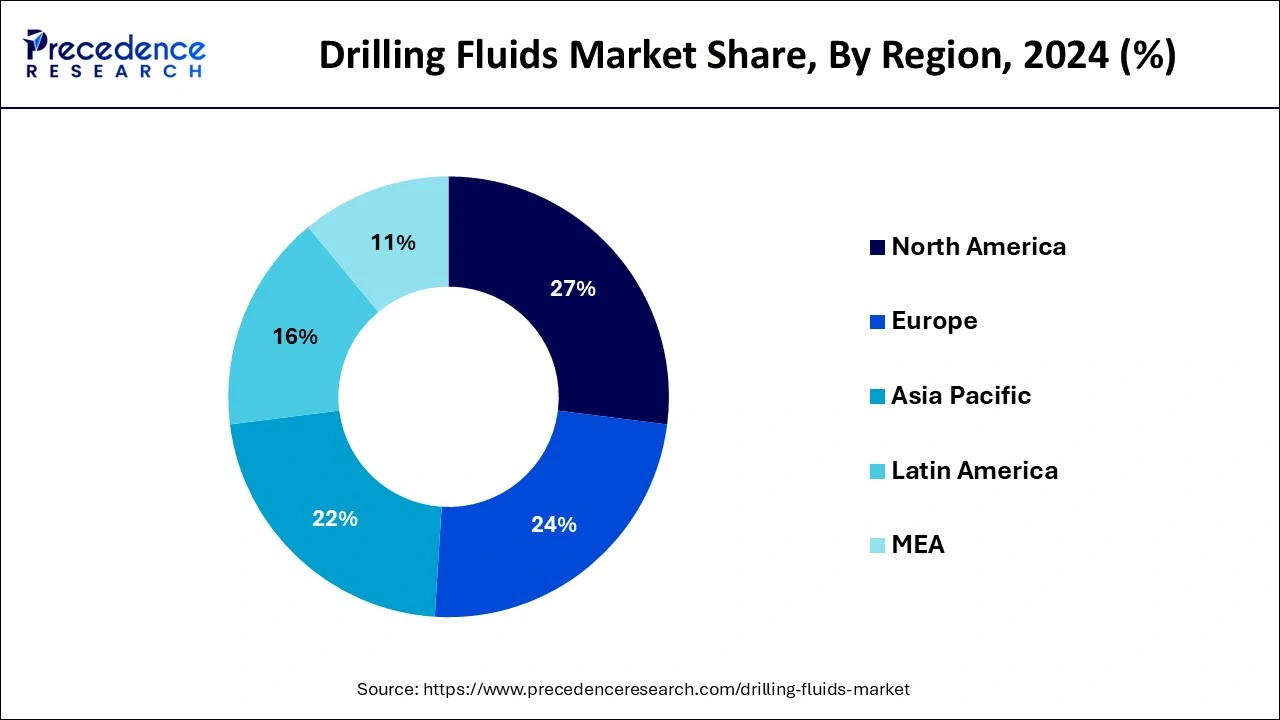

North America has held 27% revenue share in 2024. Intensifying offshore drilling movements and shale boom is motivating the attention for drilling fluids in across such regions. The escalating onshore drilling practices in the North America Middle East and Asia Pacific are propelling the awareness for drilling fluids in inland saves. Besides, neighborhood of sprawling common assets in the "Golden Triangle" (Seaward Brazil Gulf of Mexico, and seaward West Africa) is instigation great attention in the locales, which is fore seen to spur the demand for drilling fluids during next few years.

U.S. Drilling Fluids Market Trends

The U.S. drilling fluid market is expected to grow significantly. The technological innovations in drilling, increased upstream transition of oil and gas activity, rise in offshore drilling activities, demand for various processes such as borewell drilling and mineral extraction are fuelling the market growth.

Asia Pacific region is also projected to record significant progress in the drilling fluid market. This growth is attributed to intensifying exploration of oil fields from untouched reserves. For illustration, Pakistan, Australia, Brunei, Malaysia and Papua New Guinea are some of the main nations which posses sun exploited offshore oil reserves. The ultra-deepwater and deepwater drilling operations are anticipated to upsurge in the impending future, motivated by novel findings in West Africa, Latin America, and the Asia Pacific. A mainstream offshore motion is attentive in deepwater regions, including U.S., Brazil, Angola, Nigeria, Norway and Malaysia among others. Moreover, recent detections completed in developing frontline regions, like the eastern Mediterranean Sea, the East Coast of Africa, and west coast of Australia, might suggestively lift the growth of offshore reserves.

China Drilling Fluids Market Trends

| Report Highlights | Details |

| Market Size in 2024 | USD 9.41 Billion |

| Market Size in 2025 | USD 9.85 Billion |

| Market Size by 2034 | USD 15.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In 2024, onshore appeared as the prime application market segment and occupied around 70% revenue share of the total market. Cumulative amount of oil drilling operations to meet mounting energy requirements is projected to push the demand over for drilling fluids significantly. Furthermore, rising upstream expenditure to address oil production goals is anticipated to flourish the global oil and gas market, consequently motivating the need for drilling fluids.

Besides, upward demand for the harsh environments, mud in deep water, and remote sites is estimated to spur requirement for drilling fluids for offshore uses. Augmented environmental hazards related with offshore locations and maintenance expenses have insisted businesses to employ water-based or synthetic fluids for economical exploration and production undertakings.

Among different types of product segments involved in this market, water-based fluids segment appeared as major revenue contributor and garnered more than 52.3% of the market share in the year 2024. These fluids are expected to observe augmented proliferation and progress due to their cost-effectiveness and inferior environmental bearing caused by discharged mud and cuttings. The intensifying emphasis on refining the thermal and inhibitive performance of water-based systems to contend with non-aqueous fluids utilized for stimulating applications including onshore and offshore shelf activities is expected to flourish the requirement for water-based fluids during years to come.

On the other hand, synthetic-based fluids segment is projected to grow significantly with fastest CAGR due to their outstanding thermal stability, lubricity, penetration rates, borehole control, which aid in plummeting the total costs.

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025